Oil prices surge then retreat slightly to close higher, plastic trades in fluctuations

1. Crude Oil Market Trends

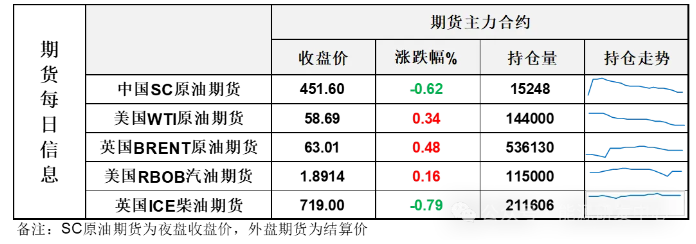

On November 13, market concerns persisted over U.S. sanctions on certain oil-producing countries, coupled with the upcoming end of the U.S. government shutdown, leading to a rise in international oil prices. NYMEX crude oil futures for the December contract rose by $0.20 per barrel to $58.69, a 0.34% increase from the previous period. ICE Brent crude oil futures for the January contract rose by $0.30 per barrel to $63.01, a 0.48% increase from the previous period. China's INE crude oil futures for the 2601 contract fell by 11.4 to 457.5 yuan per barrel, with a night session decrease of 2.8 to 454.7 yuan per barrel.

Future Market Views

After a sharp drop on Wednesday quickly released negative sentiment, oil prices rebounded and corrected on Thursday. Although oil prices failed to hold onto their intraday gains, it can still be seen that the presence of some uncertainties has left the market lacking a sustained willingness to sell off. Meanwhile, after the sharp drop, the morale of the bulls is damaged, and funds are also cautious in chasing gains. This is likely to cause oil prices to continue to fluctuate within a range. Further tracking of the extent of oversupply in the crude oil market is needed, as this is the core factor guiding oil price direction. Currently, global inventories are further accumulating, and if there continues to be an unexpectedly large buildup, oil prices are expected to continue to shift lower amid the tug-of-war. From an operational standpoint, it is recommended to continue seizing opportunities to short at highs, paying attention to timing.

Section 2: Macroeconomic Market Trends

1、Trump Signs Bill to End the Longest Government Shutdown in U.S. HistoryTrump: The government shutdown caused a $1.5 trillion loss, and it will take weeks or even months to fully assess the overall impact of the loss.

2. Kevin Hassett, Chairman of the White House Council of Economic Advisers:The upcoming employment report for October will be released soon, but it will not include the unemployment rate. The GDP for the fourth quarter is expected to decrease by 1.5% due to the government shutdown. There are not many reasons to see why interest rates won't be cut.

3. The U.S. Department of Agriculture has begun releasing data delayed due to the shutdown; the Bureau of Labor Statistics is working to determine the publication date for revised data following the government shutdown.

4、The Fed's hawks continue to send cautious signals.Daly said it is too soon to assert whether there will be a rate cut or not in December.PrematureMusalem: Open to this; Musalem: Policy is approaching neutrality, limited room for easing, need to act cautiously. Most hawkish official Hamak:The current interest rates are close to unlimited, and need to remain restrictive to curb inflation.Recently, the neutral interest rate has been rising, and the weakening of the dollar has brought it closer to its "theoretical fair value." Kashkari pointed out that he does not support a rate cut in October, and there are reasons for and against a rate cut in December.

5. RegardingHas the Dutch representative come to China to discuss the issue of Anshi Semiconductor?In response to the question, Ministry of Commerce spokesperson He Yadong stated that since the issue with Nexperia arose, China has consistently approached the situation with a responsible attitude towards the stability and security of the global semiconductor supply chain. Multiple rounds of consultations have been conducted with the Dutch side, and China has agreed to the request from the Dutch Ministry of Economic Affairs to send representatives to China for consultations. We hope the Dutch side will demonstrate a sincere willingness to cooperate with China, promptly propose substantive and constructive solutions to the problem, and take practical actions to swiftly and effectively restore the safety and stability of the global semiconductor supply chain from the source.

The Ministry of Commerce held a regular press conference. A reporter asked that it has been recently learned that China has begun designing a new rare earth export licensing system, which is expected to expedite the export process. Spokesperson He Yadong stated,The Chinese side carries out export control work on rare earth-related items in accordance with laws and regulations.。

3. Plastic Market Dynamics

Overnight oil prices surged and then fell back slightly, while plastic futures fluctuated.

The plastic 2601 contract was reported at 6,779 yuan/ton, down 0.07% from the previous trading day.

The PP2601 contract is quoted at 6,436 yuan/ton, down 0.29% from the previous trading day.

The PVC2601 contract is reported at 4567 yuan/ton, down 0.39% from the previous trading day.

The styrene 2601 contract is reported at 6336 yuan/ton, up 0.94% from the previous trading day.

4. Today's Market Forecast

PE: Overall, considering the market supply-demand dynamics, market sentiment is difficult to boost, and prices are expected to continue to decline, with a range of 30-100 yuan/ton.

PP: The polypropylene market is expected to trend weakly downward in the short term, as downstream orders are insufficient to support the large increase in supply, cost-side support is lacking, and the contradiction between supply and demand in the market will take time to ease.

PVC: The short-term PVC prices are expected to continue fluctuating weakly. Domestic supply is anticipated to increase next week, while improved demand faces pressure. The cost side continues to maintain bottom support, but industry policies and macro expectations are weak. The PVC market is expected to continue in a weak pattern.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory