Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

On December 3, 2025, Dow Chemical announced a price increase of 300 euros per ton (or equivalent local currency) on all MDI products sold in the Europe, Middle East, Africa, and India (EMEAI) region.

Since December, major global MDI manufacturers such as Dow Chemical, Wanhua Chemical, Huntsman, and other industry giants have intensively issued price adjustment announcements, with increases ranging from 200-350 yuan/ton, covering key markets in Europe, the Middle East, and Asia-Pacific.

Major companies intensively raise prices

Wanhua Chemical announced that starting from December 1, 2025, it will raise the prices of its polymer MDI and pure MDI products in Southeast Asia and South Asia by $200 per ton, or according to existing contracts. It is reported that Wanhua Chemical's distribution channels are affected by significant increases in overseas prices, increased exports, and domestic maintenance, leading to tight supply and delayed shipments. Additionally, starting from the second half of the month, supply will be further tightened.

On December 1, 2025, Hungary's BorsodChem announced a price increase of 300 euros per ton for all MDI products, effective immediately or according to pre-established contracts. This price increase is due to ongoing cost pressures.

Huntsman: Announced a price increase of 350 euros/ton for all MDI products in Europe, Africa, and the Middle East starting from December 2, or according to established contracts.

BASF: Starting from November 20, the prices of MDI series products in the South Asia region will be increased by $200 per ton, with centralized maintenance expected in December.

Covestro: The price for polymeric MDI for distribution channels is set at 14,700 RMB/ton on December 1st; for one-time price customers, it is set at 14,900 RMB/ton, which is an increase of 100 RMB/ton compared to last week.

The direct trigger of this price surge Cost pressure and supply contraction exert a dual squeeze. From the cost perspective, the long-tail effect of the European energy crisis continues to ferment. Although natural gas prices have fallen from their peak, they remain at three times the level prior to the Russia-Ukraine conflict. Coupled with the year-on-year increase in raw material prices, this has pushed up the marginal cost of MDI production. In their price adjustment statements, companies like Dow Chemical and BASF have clearly stated that the price increase is to cope with the continuous rise in energy, raw materials, and transportation costs.

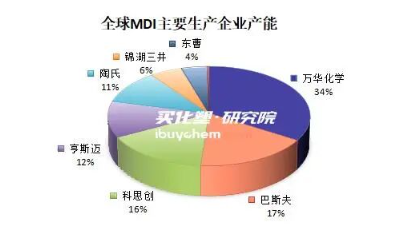

From the supply side, global MDI production capacity is highly concentrated among five major companies: Wanhua Chemical, BASF, Covestro, Huntsman, and Dow, which together hold a market share of 90%. Among them, Wanhua Chemical ranks first in the world with a production capacity of 3.8 million tons per year. Recently, supply tightness has been exacerbated by capacity damage in Europe and concentrated maintenance by Chinese companies. Huntsman's 280,000-ton facility in Rotterdam experienced an unexpected shutdown, while Wanhua's Ningbo facility entered a 55-day maintenance period. Shanghai Covestro and Chongqing BASF also initiated maintenance plans simultaneously, with a projected reduction of pure MDI output by 30% in the short term. The combination of planned maintenance and unplanned shutdowns has instantly intensified market tension. Against a backdrop of relatively stable demand, the marginal contraction of supply effects has been quickly amplified.

The structural imbalance in the global MDI market has further amplified the price increase effect. As the world's largest producer and net exporter, China's MDI industry has a capacity advantage; however, due to changes in the export environment, net export volume is expected to decline year-on-year in the first three quarters of 2025. Meanwhile, the European market is constrained by limited local capacity, and North America can only achieve self-sufficiency, making it difficult to bridge the regional supply-demand gap through transoceanic adjustments.

European chemical companies are facing a dual dilemma of rising energy costs and environmental pressures. BASF, Covestro, and other companies have generally reported pressure on their performance in the first three quarters, with Covestro experiencing a loss of 2.2 billion yuan. In response to the crisis, Huntsman has closed three downstream facilities in Europe and the Middle East, while BASF has signed long-term natural gas procurement agreements, but its international competitiveness continues to weaken.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Middle East Tension Spikes Global Energy Pattern, Crude Oil and Plastic Industries Face Multiple Challenges

-

[Forward-Looking Analysis] Impact of Escalating U.S.-Iran Tensions on Domestic Chemical Market

-

Middle East Tensions Escalate Sharply: How Polyolefins Respond Amid Soaring Risk Premium

-

BASF Raises Prices! Nova Chemicals Expands Recycled PE Lineup! South Korea, UAE Sign $35B Defense MOU

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!