[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

Summary: On December 5th, a summary of the prices and forecasts for general plastics and engineering plastics in the market. In terms of general plastics, the fundamentals are weak, with PE prices dropping by 5-44; some PS grades saw a slight price decrease of 50; ABS transaction focus has shifted downwards, with a decrease of 10-100, while some grades increased by 30. For engineering plastics, PC prices remain stable with some increases of 50-100; PET prices have decreased by 30; PMMA, POM, PBT, PA6, and PA66 are currently stable.

General Materials

PE: Fundamentals are weak, prices are falling.

1. Today's Summary

The instability of the Russia-Ukraine situation remains evident, coupled with the high probability that the Federal Reserve will lower interest rates again in December, leading to an increase in international oil prices. NYMEX crude oil futures contract for January is at $59.67, up $0.72 per barrel, a month-on-month increase of 1.22%; ICE Brent crude oil futures contract for February is at $63.26, up $0.59 per barrel, a month-on-month increase of 0.94%.

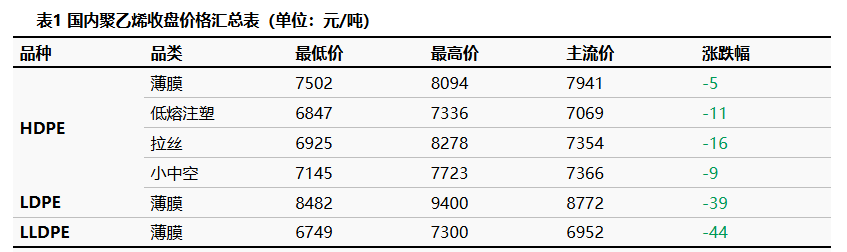

②. The price change range for the HDPE market is -16 to -5 yuan/ton, the LDPE market price is -39 yuan/ton, and the LLDPE market price is -44 yuan/ton.

2. Spot Overview

There is certain selling pressure in the weekend market, coupled with difficulty in increasing transaction volume. The fundamentals remain under pressure, leading to an expansion in the price concessions, with prices primarily declining. However, there is a slight improvement in transactions at lower prices. The price fluctuation range for HDPE in the market is -16 to 5 yuan/ton, the market price for LDPE is -39 yuan/ton, and the market price for LLDPE is -44 yuan/ton.

3. Price Forecast

In the short term, the supply side continues to increase, while terminal demand gradually weakens, so the strategy of purchasing based on actual needs will continue; there is insufficient cost support, and participants have a bearish mindset. Overall, the supply-demand imbalance is difficult to change, market confidence is lacking, and under the pressure of year-end inventory clearance, the strategy of exchanging price for volume may continue. It is expected that polyethylene market prices will primarily fluctuate downward next week.

PS: Some product grades have slightly reduced prices for sales.

1 Today's Summary

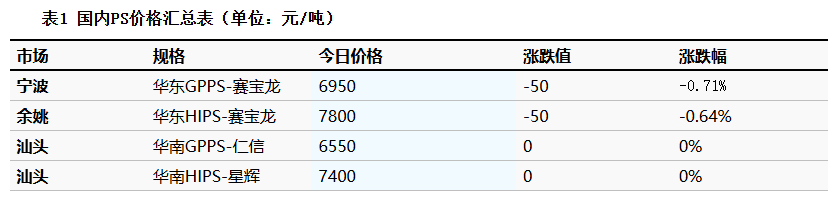

Today, the price of GPPS in East China dropped by 50 to 6,950 yuan/ton.

② 、 On Friday, the East China styrene market rose by 35 to close at 6,725 yuan/ton, South China rose by 45 to close at 6,775 yuan/ton, and Shandong rose by 15 to close at 6,530 yuan/ton.

2 Spot Overview

According to Longzhong Information, today's East China GPPS fell by 50 to 6,950 yuan/ton.The trend of spot and futures prices for raw material styrene shows differentiation, with cost support remaining relatively stable. The industry's supply is primarily focused on recovery, with an overall ample supply of goods. Some grades have slightly lowered their prices for sales. Downstream procurement is driven by basic needs, and the transaction situation is average.

3 Price Prediction

Styrene futures and spot prices show divergent trends, with general cost support. Industry supply has somewhat recovered, though some grades are in short supply, and downstream demand is for just-in-time procurement. In the short term, the PS market may struggle to follow the upward trend. It is estimated that the price of modified polystyrene in the East China market will be between 6,950-7,800 yuan/ton.

ABS: Slow Demand Follow-up, Lower Transaction Focus

1 Today's summary:

①. Today, the market price in East China remains stable; the market price in South China is declining, and market transactions are average.

②. The monthly ABS production in December is expected to increase compared to the previous month.

2 Spot Overview:

Based on the regions of Yuyao and Dongguan, the market prices in East China are declining, and the market prices in South China continue to trend downward. Today, the market transaction is poor, and petrochemical plants face significant selling pressure. Sellers have a strong intention to lower prices, and quotes continue to decline. It is expected that the domestic ABS market will narrow down next week.

3 Price Prediction:

Based on the Ningbo and Dongguan areas, prices in the East China market are declining, while prices in the South China market continue to trend downwards. Today's market transactions were sluggish, with significant sales pressure on petrochemical plants. Traders showed a strong inclination to sell at lower prices, and quotations continued to decline. It is expected that the domestic ABS market will experience a narrow decline next week.

Engineering materials

PC: East China mainly consolidates, South China operates with firm price increases.

1 Today's Summary

Thursday International crude oil Rise ICE Brent crude oil futures for February contract rose 0.59 to 63.26. USD/barrel.

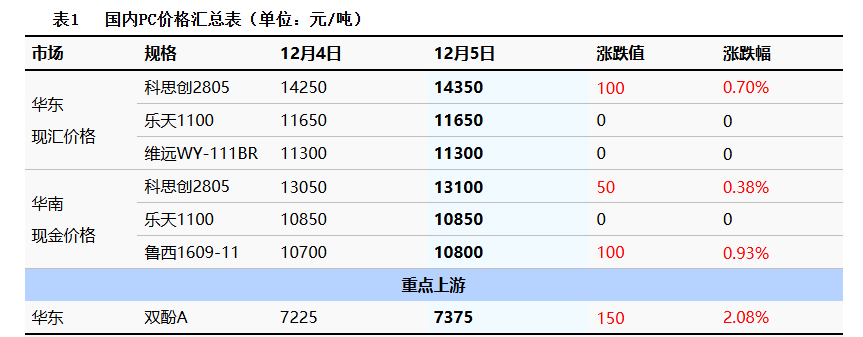

②、 The closing price of raw material Bisphenol A in the East China market is 7375. Yuan/ton, an increase of 150 yuan/ton compared to the previous period.

The Zhejiang Petrochemical PC Phase II unit has entered a phased shutdown for maintenance.

2. Spot Price

Today, the domestic PC market is observing and maintaining prices. As of the afternoon closing, the mainstream negotiation reference for low-end injection molding grade in East China is 10,750-13,050 yuan/ton, while the negotiation for mid-to-high-end grade is 14,350-14,800 yuan/ton, with the mainstream focus remaining stable compared to yesterday. Approaching the weekend, there are no new factory price adjustments from domestic PC manufacturers, and the second phase of Zhejiang Petrochemical's PC facility has entered a phased shutdown for maintenance. In the spot market, East China primarily consolidates to digest the gains, while some domestic focal points in South China are on the rise. There is minimal fluctuation in fundamental news, but the supply-side support remains favorable, with industry participants adopting a cautious and moderate stance. Price maintenance operations are conducted alongside transactions, with downstream demand generally stable and trading atmosphere quiet.

3 Price Prediction

This week, the domestic PC regional market showed alternating increases, with continued supply shortages and low social inventory being major positive factors. Looking ahead to next week, Zhejiang Petrochemical's second-phase PC facility is about to undergo full shutdown for maintenance, which will further reduce supply. Low-end sources remain scarce, providing strong price support. Other domestic PC manufacturers are also expected to maintain price support. It is anticipated that the domestic PC market will operate with a steady yet slightly strong oscillation. Attention should be paid to the recent downstream purchasing activity and the latest pricing adjustments from PC manufacturers at the beginning of the week.

PET: The market price of polyester bottle flakes has declined, and transactions have relatively improved.

1 Today's Summary

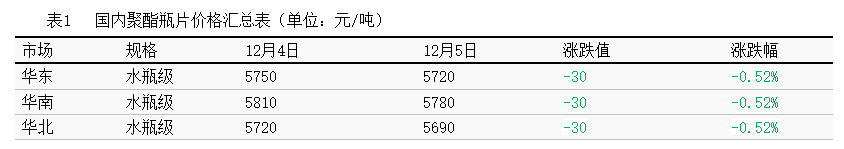

① WanKai and TaiBao decreased by 20, while other factories remained stable (unit: yuan/ton).

②. Today, the domestic polyester bottle chip capacity utilization rate is 73.05%.

2. Spot Overview

Today, the spot price of polyester bottle-grade PET in the East China region is 5720, a decrease of 30 compared to the previous working day, in line with the morning forecast.

The market atmosphere is bearish, and raw materials continue to decline. There is tight circulation of local supply, with most polyester bottle chip factories remaining stable, and some adjusting downward by 20. The market focus has noticeably shifted downwards. It is heard that December supply transactions are between 5670-5750, with some slightly higher at 5770 and slightly lower at 5640, 5650, or futures contract 2602 with a discount of 50 to a premium of 20. The basis has weakened, and brand price differences are significant. Spot and futures traders are selling well, with downstream and traders replenishing stocks. Traditional traders are experiencing light sales, and overall transactions have improved compared to yesterday. (Unit: RMB/ton)

3. Price Forecast

Downstream demand shows no signs of improvement, increasing order pressure on factories and stockholders. Coupled with the approaching year-end and the pressure on some end-users to collect payments, the restocking sentiment is poor. Additionally, with weak raw material support, the polyester bottle chip market may continue to remain sluggish.The spot price of polyester bottle-grade chips in the East China region is expected to be 5650-5750 yuan/ton.

PMMA: PMMA particles are running horizontally.

1 Today's summary

①、 Today PMMA particles The market price is stable. 。

②. Today's domestic PMMA particle utilization rate is 65%.

2 Spot Overview

Based on the East China region, today's PMMA particles closed at 12,800 yuan/ton, remaining stable compared to the previous working day, in line with morning expectations. 。 The price of raw material MMA continues to be weak, with little change in cost support. There is limited inquiry in the market, and demand has not yet improved, with most purchases being made according to need. Actual transactions are average.

3 Price Prediction

Original The center of mass is expected to fluctuate within the interval. The support from the cost side is average, and there are more low-priced offers reported by on-site traders. Demand follows up weakly. The focus of the business discussion is relatively low.

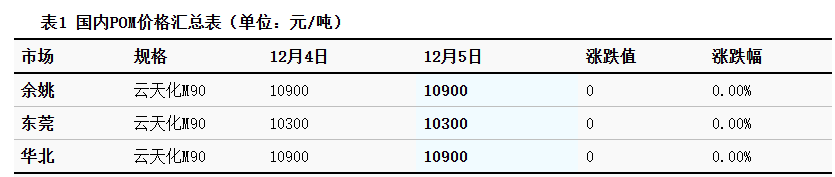

POM: Tight Spot Supply, Traders Firm on Pricing for Sales

1. Today's Summary

The Yanzhou Coal and Electricity Group Luhua Phase I POM unit will be shut down for maintenance on November 25, with a planned duration of about 15 days.

The Henan Longyu POM unit in Hebi will be shut down for maintenance on October 20, and the startup time is not yet determined.

2 Spot Overview

Based on the Yuyao region, today's price for Yuntianhua M90 is 10,900 yuan/ton, stable compared to the previous period. Today's POM market is operating steadily. Petrochemical plants have a tight supply of spot goods, and ex-factory prices are strong, with fundamental support being strong. The market has a strong pricing sentiment, and traders' quotations remain high. End users are cautiously observing, being relatively cautious in accepting high prices in the short term, negotiating on a case-by-case basis. As of closing, the domestic POM market in Yuyao is priced at 8,200-11,100 RMB/ton including tax, and the cash price in the Dongguan market is 7,700-10,400 RMB/ton.

3. Price Prediction

During the week, the inventory of POM petrochemical plants remained low, supporting the sentiment of industry players. The atmosphere for replenishing goods was intense across various locations, with manufacturers primarily focusing on controlled shipments. Market spot circulation tightened, and traders actively followed up with price increases. However, the rising procurement costs for end users led to a short-term weakening of replenishment demand, with occasional users making sporadic purchases on a case-by-case basis. Longzhong expects the domestic POM market to consolidate at a high level in the short term.

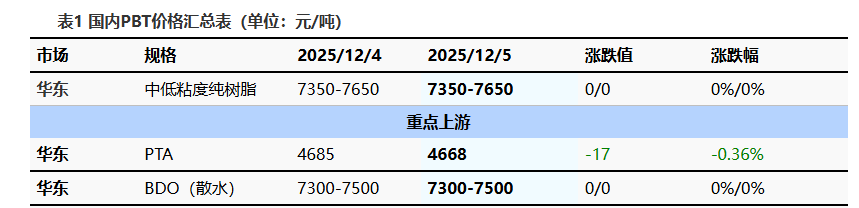

PBT: Raw material prices fluctuate slightly, PBT market is consolidating within a range.

1 Today's Summary

This week's PBT manufacturers' quotes remain basically stable.

This week's PBT equipment maintenance is minimal.

③ The current PBT production is 23,600 tons, with a capacity utilization rate of 55.45%, remaining stable compared to the previous period. This week's domestic PBT average gross profit is -624 yuan/ton, a decrease of 32 yuan/ton compared to the previous week. 。

2 Spot Overview

As a benchmark in the East China region, today's mainstream price for medium to low viscosity PBT resin is between 7350-7650 yuan/ton, remaining unchanged from the previous working day. Today, the PBT market is in a range-bound consolidation, the PTA market has seen a downward shift in focus, and the BDO market is weak and stagnant. The cost side has made slight adjustments, and there is limited guidance from the fundamentals. PBT Market Supply and demand game continues.Negotiation focus area consolidation.According to Longzhong Information's statistics, the price of low-viscosity PBT pure resin in the East China market is 7,350-7,650 RMB per ton.

3 Price Prediction

The PBT market is expected to operate weakly. On the raw material side, the supply and demand of PTA have not changed much, maintaining a slightly tight balance sheet with continuous inventory reduction. However, the terminal load continues to decline, lacking support from the demand side, and there is a lack of substantial external driving factors. The weakening of raw materials drags down the cost side, causing the PTA spot market to maintain a weak and volatile pattern in the short term. BDO's supply and demand are both expected to show a decreasing trend later, but the cost transmission is not smooth, suppressing the raw material trend. Downstream contracts follow, and real spot transactions are light. The supply side continues to have a selling mentality, making it difficult for the PBT market to have any positive stimulus, and the market focus may decline. Therefore, Longzhong expects the East China market for low and medium viscosity PBT resin to be around 7300-7600 yuan/ton next week.

PA6: Strong Cost Support, PA6 Market Firmly Operating

1 Today's Summary

①、 Sinopec's settlement price for high-end caprolactam in November 2025 is 8,900 yuan/ton (liquid premium grade, six-month acceptance, self-pickup), an increase of 320 yuan/ton compared to the settlement price in October.

②、 Sinopec has reduced the price of pure benzene at various refineries in East China and South China by 200 RMB/ton, setting the price at 5,450 RMB/ton, effective from October 21.

2 Spot Overview

Today, the nylon 6 market is running steadily. The supply of raw material caprolactam is tight, and market prices continue to rise. The cost pressure on chips is high, so polymerization companies maintain firm quotations. However, downstream replenishment sentiment is cautious, and demand is limited, resulting in generally average market transactions. In East China, regular spinning PA6 is priced at 9,650-9,950 yuan/ton in cash with short delivery, and high-speed spinning spot is priced at 9,900-10,200 yuan/ton with delivery on acceptance.

3 Price Forecast

From the cost perspective, the supply of caprolactam is tight, and market prices may continue to rise; from the supply and demand perspective, some polymer enterprises have plans to reduce production in the future, but downstream demand is limited and purchasing is cautious. Attention should be paid to the changes in the operations of polymer enterprises and the situation of downstream demand. It is expected that the PA6 market will operate steadily in the near term.

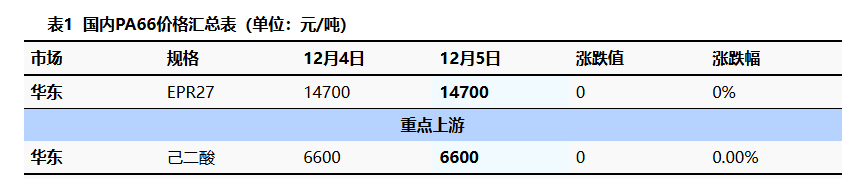

PA66: Suppliers are reluctant to sell at low prices, and the market remains firm.

1 Today's Summary

On December 4th, the instability of the Russia-Ukraine situation remains evident, coupled with the high probability that the Federal Reserve will cut interest rates again in December, leading to an increase in international oil prices. NYMEX crude oil futures for January contract rose by $0.72 to $59.67 per barrel, a week-on-week increase of 1.22%; ICE Brent crude futures for February contract rose by $0.59 to $63.26 per barrel, a week-on-week increase of 0.94%. China's INE crude oil futures for January contract increased by 2.0 to 451.3 yuan per barrel, with a night session increase of 5.2 to 456.5 yuan per barrel.

Today, the domestic PA66 capacity utilization rate is 66%, with a daily production of approximately 2650 tons. The capacity utilization rate is relatively stable, downstream demand is average, and the domestic PA66 industry has a sufficient supply of goods.

2 Spot Overview

Based on the Yuyao market in the East China region, today's EPR27 market price is referenced at 14,600-14,800 yuan/ton, remaining stable compared to the previous trading day. 。 Market spot supply is stable. Cost pressures are relatively high, while downstream maintains a steady pace of essential procurement. Suppliers are reluctant to sell at low prices, resulting in a strong market performance.

3 Price Prediction

The spot supply in the market is stable, but due to ongoing cost pressures, suppliers are reluctant to sell at low prices. Along with the deepening trend of anti-involution in the industry, the domestic PA66 market is expected to operate firmly in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Middle East Tension Spikes Global Energy Pattern, Crude Oil and Plastic Industries Face Multiple Challenges

-

[Forward-Looking Analysis] Impact of Escalating U.S.-Iran Tensions on Domestic Chemical Market

-

Middle East Tensions Escalate Sharply: How Polyolefins Respond Amid Soaring Risk Premium

-

BASF Raises Prices! Nova Chemicals Expands Recycled PE Lineup! South Korea, UAE Sign $35B Defense MOU

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!