Maximizing 4s group upwards, maximizing auto service chain downwards: Is After-Sales Entering A Fully Competitive Era?

The Chinese automotive industry is undergoing a profound change: the spotlight on new car sales is gradually dimming, while the value of after-sales services is steadily emerging.

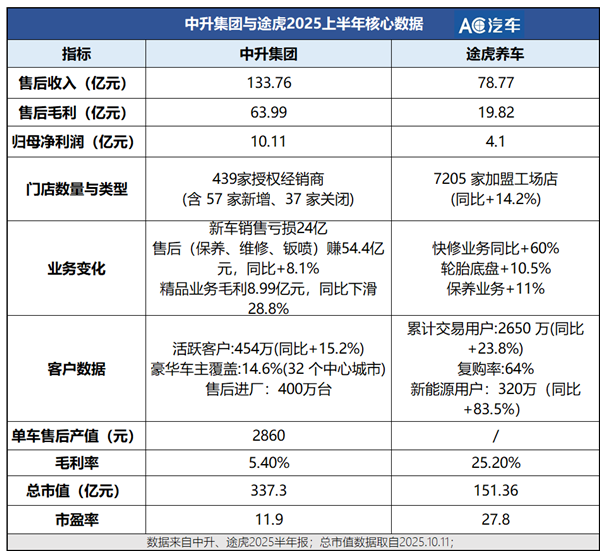

Zhongsheng and Tuhu, representing giants of traditional dealerships and independent aftermarket platforms respectively, are approaching this transformation in completely different ways.

A deep cultivation of the lifetime value of luxury car owners, a leverage to tap into a vast popular market; one seeks upward to bind with OEMs for authorized breakthroughs, while the other penetrates downward into county areas to weave a service network.

As the boundaries of traditional after-sales services become increasingly blurred and the wave of new energy accelerates its impact, a core issue becomes clearer: Under the dual challenges of industry cyclical fluctuations and structural transformations, which model is more resilient? Who can be the first to find a sustainable growth path?

To address this issue, this article will analyze the latest financial reports of two companies from three aspects: the structure of after-sales profits, market segmentation logic, and new energy deployment.

1. After-sales becomes the core of profitability, Zhongsheng relies on it for survival, Tuhu relies on it for development.

Tuhu's foundation lies in serving China's fleet of over 300 million vehicles. By integrating online platforms with offline stores, Tuhu addresses the pain points of the traditional auto repair industry, such as non-transparent pricing and inconsistent services, and continues to delve deeply into the aftermarket areas of maintenance, tires, and quick repairs.

In contrast, Zhongsheng, as a traditional dealer, still focuses its core operations on new car sales, particularly luxury fuel vehicles and the associated financial and insurance services. Its model is closely tied to the prosperity of the new car market.

The changes in the profit structure of both parties in recent years are quite intriguing.

Zhongsheng is experiencing a situation where the gross profit on new cars is shrinking while after-sales services have grown by 8%, whereas Tuhu's core business revenue continues to rise.

This points to a common trend: new car sales are transitioning from being "profit centers" to "traffic entrances," while after-sales services that maintain customer relationships are becoming the cornerstone of long-term profitability.

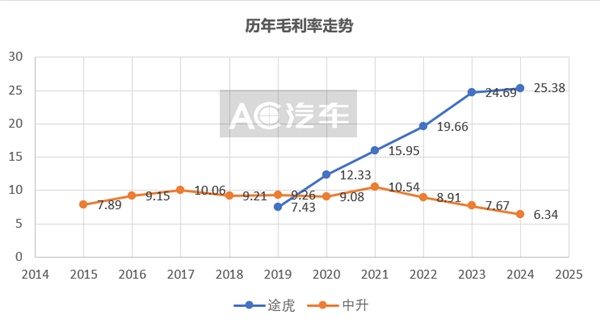

This judgment is corroborated by the trend of gross profit margins of the two companies.

Since Tuhu disclosed its data, the gross profit margin has increased from 7.4% to 25.4% in 2024, demonstrating a continuous and steady upward trend, indicating the ongoing optimization of its economies of scale and operational efficiency.

In contrast, Zhongsheng's gross profit margin exhibits a typical "inverted V" cycle, peaking around 2021 (10.5%) before declining all the way to 6.3% in 2024, profoundly reflecting the volatility associated with the traditional dealership model.

This leads to a key question: Does China's automotive aftermarket also possess similar counter-cyclical properties as the U.S. market?

During the 2009 financial crisis, U.S. automobile sales decreased by 15.36% year-over-year, while the automotive aftermarket size only declined by 1.44%.

With the increasing age of vehicles in China and a large number of vehicles going out of warranty, the independent aftermarket is set to experience structural opportunities. The robust 60% growth in Tuhu's quick repair business is a testament to this trend.

In contrast, new car sales are more directly related to the ups and downs of the macroeconomy, and their cyclical fluctuations are also more intense.

The differences in valuations in the capital market also provide supporting evidence for this.

The market gives Tuhu a higher price-to-earnings ratio (Tuhu 27.8 vs. Zhongsheng 11.9), which to some extent reflects the recognition of its business model and the anticipation of growth in the aftermarket.

Of course, these indicators are not meant to determine the superiority of either model, but rather to provide some insights to the industry: In an era where the industry shifts from acquiring new customers to managing existing ones, the ability to serve "existing customers" well may have more long-term value in transcending economic cycles than the ability to acquire "new customers."

02. The market is clearly stratified, with Tuhu winning in terms of scale and efficiency, while Zhongsheng excels in customer quality and depth.

The current automotive aftermarket is exhibiting a clear "stratified competition" pattern, with the traditional "unified" business model gradually giving way to differentiated approaches.

The growth logic of these two leading companies, Tuhu and Zhongsheng, precisely confirms this trend—they serve distinctly different customer groups with different business models and build competitive advantages in their respective fields.

The core strategy of Zhongsheng lies in "deep cultivation of high-value customers." By focusing on 32 central cities, it has implemented the largest network optimization in history—closing 37 inefficient stores while adding 57 new dealerships and 20 service centers, achieving a dense layout of an average of 15 outlets per city in key cities.

This regional deep cultivation not only improved service efficiency but also accelerated market consolidation during the industry reshuffle period. By June 2025, 46% of its stores nationwide had become the leading local dealers, with 89 of them operating exclusively, significantly enhancing local bargaining power.

More importantly, Zhongsheng successfully broke the limitation of "serving only customers who purchase cars from its own stores"—in central cities like Chengdu and Dalian, external customers accounted for 20%, 36%, and 30% of the maintenance, accident, and renewal insurance services respectively, driving the growth of its active customers to 4.54 million and achieving continuous expansion of a high-quality customer base.

In contrast, Tuhu Car Care has chosen the path of "inclusive scale." With 7,205 service shops covering 70% of high-potential counties, it has extended its services to market fringes that traditional 4S shops find difficult to reach.

This efficient operational system supports 26.5 million trading users and 13.5 million monthly active users. Through a digital platform for direct procurement, large-scale price negotiation, and an intelligent warehousing and distribution network (such as the automated warehouse in Guangzhou achieving a 2.5-fold efficiency improvement), it continuously optimizes the cost structure, ultimately converting the cost savings into price competitiveness for the mass market.

While solidifying its core businesses such as tire stabilization and maintenance, Tuhu is actively expanding into high-growth areas like quick repairs (with revenue growth exceeding 60%) and car beauty services (with self-owned products accounting for over 70%). This expansion precisely meets the comprehensive needs of car owners in lower-tier markets for professionalism, convenience, and cost-effectiveness.

These two paths essentially reflect the profound differentiation occurring in the automotive aftermarket. Zhongsheng is building a high-end moat through "regional density × customer depth," while Tuhu is expanding into the inclusive market by leveraging "network breadth × operational efficiency."

They each target the core needs of different consumer groups: one focuses on service quality and brand trust, while the other values convenience and affordability.

This division of labor is not a temporary market phenomenon, but rather an inevitable result of increased industry maturity. In the future, the automotive aftermarket is likely to maintain this multi-level, complementary and symbiotic competitive ecosystem for a long time.

New energy after-sales is a battleground; Zhongsheng continues its legacy, while Tuhu reinvents "Tuhu".

The popularization of new energy vehicles has created a complex situation of both challenges and opportunities for the dealership industry and the aftermarket. It has made the difficulties of traditional new car sales more apparent, but it also forces dealers to proactively seek change by embracing new brands and optimizing service networks to find new growth opportunities.

For the aftermarket, the impact of new energy vehicles goes beyond the decline in cyclical maintenance business for traditional fuel vehicles. More critically, the technological and authorization barriers have suddenly increased, bringing deeper challenges to practitioners.

Zhongsheng has two clear paths in its layout of the new energy sector: on one hand, it continues to partner with manufacturers, such as its collaboration with AITO—during the first half of this year, 36 Wenjie stores contributed 11,000 units in sales, directly boosting the group's overall new car gross margin by 0.6 percentage points; on the after-sales side, it targets owners of traditional luxury BBA brand new energy vehicles, offering exclusive service packages to lock in high-end customers.

On the other hand, in dealing with new energy vehicles that are out of warranty, Zhongsheng has also developed a deep cooperation with Electric Donkey, a chain specializing in three electric systems. They are expanding services in their own paint and bodywork centers through a "store-in-store" model.

Tuhu focuses on the new energy after-sales post-warranty market, creating a more comprehensive layout. It first obtains maintenance qualifications through scaling, and by mid-2025, it has received authorization from 12 battery manufacturers, preparing for the upcoming peak period of "three-electric maintenance."

Simultaneously developing an "oil and electricity dual-service" model to build a dedicated new energy product matrix centered around tires, engine oil, and beauty washing. Although the unit price of these products is lower than that of the three-electric maintenance, they have strong repurchase attributes. When users purchase them, they can also enjoy battery inspection services, which coincidentally channels customers to the three-electric maintenance business, forming a virtuous cycle.

In addition, Tuhu's network has penetrated the county-level market, where the service demand for out-of-warranty vehicles is rapidly being released, highlighting its 2C value even more.

Overall, Zhongsheng New Energy's layout continues the gene of cooperation with OEMs, attempting to integrate new elements within the existing system; Tuhu, on the other hand, seems to be building a new parallel new energy aftermarket ecosystem alongside the 4S system.

Both are in the exploratory stage of the new energy market and have not yet truly established a profitable model. Whether their investments in the new energy sector can yield the expected returns remains to be tested over time.

In Conclusion

Tuhu's successful listing demonstrates the enormous potential of platform-based service companies focusing on the stock market. In contrast, the continued pressure on new car gross margins faced by leading 4S groups like Zhongsheng reveals that the core value of traditional dealers as "middlemen" is being challenged in the wave of new energy.

This does not mean the exit of the 4S system. Zhongsheng's in-depth layout in the aftermarket—whether targeting high-net-worth car owners or focusing on users with high vehicle age—sends a clear signal to the entire aftermarket:

A battle over the "car owner's entire lifecycle" strategy is breaking the once-clear boundaries between the 4S system and independent aftersales services, as the aftermarket enters an era of full-scale competition.

In the next 3-5 years, do you have more confidence in Tuhu or Zhongsheng? Feel free to leave your opinions in the comments section.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track