[eva daily review] market continues weak performance

1 Today's Summary

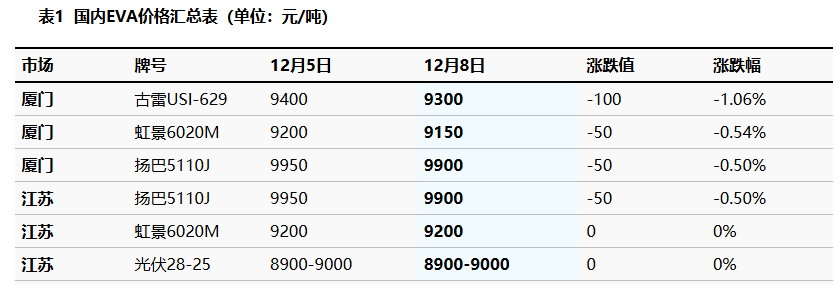

①. This week's EVA petrochemical ex-factory price continues to decrease.

② This week, EVA petrochemical units: Yangzi Petrochemical is undergoing shutdown maintenance, Zhonghua Quanzhou is undergoing major overhaul; Zhejiang Petrochemical and Lianhong's new units are in the process of commissioning.

Today, the domestic EVA market continues to operate weakly.Lack of confidence among industry players.The ex-factory prices of petrochemical products continue to decrease. Downstream demand is following up slowly, and the holders.Trade with caution , The actual trading center has moved lower. Mainstream prices: soft material is referenced at 9100-9700 yuan/ton, hard material is referenced at 9000-9900 yuan/ton.

|

Figure 1 Domestic EVA Price Trend Chart (Yuan/Ton) |

Figure 2 Domestic EVA Price Trend Chart by Category (Yuan/Ton) |

![[EVA日评]:市场延续疲弱运行(20251208)](https://oss.plastmatch.com/zx/image/333dfa5c77a74310af7b01330cc68c4a.png) |

![[EVA日评]:市场延续疲弱运行(20251208)](https://oss.plastmatch.com/zx/image/be255b253671460b9ac6e21fc0d6ffb8.png) |

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

3 Production Dynamics

Domestic EVA petrochemical facilities: Sinochem Quanzhou will shut down for maintenance on November 28; Jiangsu Sierbang facility is producing photovoltaic materials in tubular reactors and UE28150 in kettle reactors; Jiangsu Hongjing PV1 line is producing photovoltaic materials, PV2 line is switching to produce hard material V5120J, PV3 line is producing 6020M; Ningxia Baofeng is producing hard material 1803; Yan'an Yulin is producing photovoltaic material V2825Y; Tianli Gaoxin is producing photovoltaic materials; Zhejiang Petrochemical is producing photovoltaic materials; Gulei Petrochemical is producing USI-2806.All three EVA units at Yanshan have been shut down. 。

Upcoming facilities to be commissioned: Zhejiang Petrochemical 300,000 tons/year and Lianhong Green 20.Starting operations on December 5 with an annual capacity of 10,000 tons.

In addition, the main soft material prices in the South China market range from 9,100 to 9,700 RMB per ton, and the domestic EVA industry's profit margin is around 950 RMB per ton.

|

Figure 3: Trend Chart of Domestic EVA Capacity Utilization Rate |

Figure 4: Comparison of Domestic EVA Profit and Price (Yuan/Ton) |

![[EVA日评]:市场延续疲弱运行(20251208)](https://oss.plastmatch.com/zx/image/99f1d67b6b4146eebfebee2187f8eca7.png) |

![[EVA日评]:市场延续疲弱运行(20251208)](https://oss.plastmatch.com/zx/image/ad02883e4a9f47eea99c7a0b98170629.png) |

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

4 Price Forecast

In the short term, the domestic EVA market is weak and difficult to revive, and market confidence is lacking.The news of new production capacity being put into operation is impacting overall market confidence.Downstream end-user demand is insufficient.The market primarily focuses on futures delivery in the early stage, making it difficult for the spot transaction center to recover. The EVA market is expected to change in the near future. Weak operation 。

5 Related Product Information

1 Ethylene: On December 5th, CFR Northeast Asia was $745/ton, up $5/ton, and CFR Southeast Asia was $725/ton, up $5/ton. Sinopec Chemical Sales East China Branch has lowered the price of ethylene by 50 yuan/ton to 6150 yuan/ton, and Jinshan Union Trade has synchronized the ethylene price to 6150 yuan/ton.

2 Vinyl acetate The mainstream discussion for vinyl acetate in the East China market is 5600-5700 yuan/ton, Jiangsu. Petrochemical prices are between 5600-5700 yuan per ton. Holders are reluctant to sell at low prices, and the price focus continues to be on the high end.

6 Data Calendar

Table 2 Overview of Domestic EVA Data (Unit: 10,000 Tons)

|

Data |

Release Date |

Data |

The trend for this period is expected |

|

EVA Capacity utilization rate |

Thursday 16:00PM |

91.58% |

↑ |

|

EVA Weekly production |

Thursday 4:00 PM |

6.37 |

↑ |

|

Data source: Longzhong Information Note: 1. "↓↑" is considered a significant fluctuation, highlighting data dimensions where the change exceeds 3%. 2. ↗↘ are considered narrow fluctuations, highlighting data with a rise or fall within the range of 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory