China-u.s. tariff adjustments + u.s. political and economic game escalates! oil prices slightly decline, plastic futures mostly down with some gains

I. Overnight Crude Oil Market Dynamics

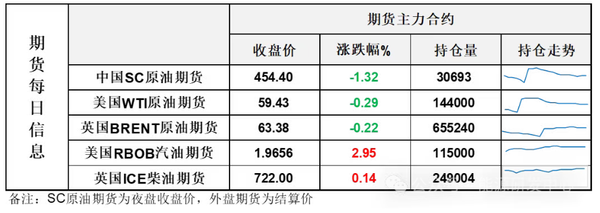

Saudi Arabia still has concerns about demand in the Asian market, coupled with the ongoing atmosphere of increased production within OPEC+, leading to a decline in international oil prices.Crude oil futuresThe December contract fell by $0.17 per barrel to $59.43, a month-on-month decrease of 0.29%. The ICE Brent futures January contract fell by $0.14 per barrel to $63.38, a month-on-month decrease of 0.22%. China's INE crude oil futures December 2025 contract fell by 1.6 to 460.5 yuan per barrel, with a night session drop of 6.1 to 454.4 yuan per barrel.

Future Market Forecast

On Thursday, after a tug-of-war, oil prices closed with a doji. During the day, there were rallies, and during the night session, there was a sharp decline due to the cooling of risk appetite in the U.S. market. The prices rebounded at the end of the session, recovering some lost ground, but ultimately closed slightly lower. While crude oil prices fell sharply, refined oil markets in Europe and the U.S. continued to rise. This is the result of a tug-of-war between multiple influencing factors. Although oil prices fluctuated significantly, the market atmosphere felt dull, with a strong sense of cautious observation, reflecting the current standoff phase in the market.

The Middle East physical market continues to weaken after Saudi Aramco announced a comprehensive reduction in the official December selling price of crude oil to Asia. The price of its flagship Arab Light crude oil has been lowered by $1.20 per barrel, narrowing its premium over the Asian benchmark oil price to $1 per barrel. This price adjustment comes as OPEC+ major oil-producing countries announced a suspension of production increases in the first quarter to address seasonal weak demand and potential supply surplus pressure. Although U.S. sanctions on Russia once caused short-term market fluctuations, the cumulative decline in London crude oil prices has approached 15% this year, with current trading prices consistently below $65 per barrel, reflecting persistent market concerns over supply and demand balance.

The disturbances, including fluctuations in geopolitical and macroeconomic sentiments, continue to keep oil prices in a complex tug-of-war below the upper resistance, with the focus gradually shifting downward. This situation has persisted for two weeks, and currently, the market still lacks the impetus to break the deadlock. While maintaining a bearish outlook, it is necessary to guard against sudden market movements caused by geopolitical and other factors. Overall, after evaluating the tug-of-war in oil prices, it is still highly probable that the focus of oil prices will be under downward pressure within the year. It is recommended to focus on seizing opportunities to short at highs, and pay attention to timing.

II. Macroeconomic Dynamics

The U.S. Supreme Court opens hearings on the tariff case.Conservative Chief Justice and others questioned the reasonableness of tariffs, reducing the probability of Trump's victory. Bessent remains optimistic about winning the case.

2、In October, the ADP employment in the United States increased by 42,000 people.In July 2025, the largest increase exceeded the market expectation of 28,000 people. The US ISM Non-Manufacturing PMI for October recorded 52.4, marking a new high since February 2025.

The Democratic Party easily defeated the Republican candidates, winning the gubernatorial elections in Virginia and New Jersey.Trump blames election loss on government shutdown, calls for an end to "prolonged debate", claims the stock market will hit new highs again, and expects third-quarter GDP growth of 4.2% or higher.。

Two Democratic leaders sent a letter to Trump seeking face-to-face negotiations, but Trump insisted on not negotiating with them until the Democrats vote to reopen the government. Due to the shutdown, the capacity of 40 major airports across the United States will be reduced by 10%.

Putin:If the US resumes nuclear testing, Russia will take equivalent countermeasures.Chief of the General Staff of the Russian Armed Forces Gerasimov: Washington is planning to conduct a nuclear test, and Russia must immediately prepare for a nuclear test.

The Customs Tariff Commission of the State Council: Adjust the tariff measures on imported goods originating from the United States and cease implementing additional tariffs on certain imported goods originating from the United States.

7. The spokesperson of the Ministry of Commerce answers reporters' questions on the adjustment of the Unreliable Entity List measures and on the adjustment of the Export Control List measures.

The Ministry of Commerce: Cease the implementation of anti-circumvention measures on imported certain cutoff wavelength shifted single-mode optical fibers originating from the United States.

9. The EU will investigate the sale of nickel mines by a British mining giant to a Chinese company, Foreign Ministry: We hope the parties concerned can uphold their commitments to openness.

3. Early Morning Dynamics of the Plastic Market

After a tug-of-war, oil prices closed with a long star candlestick, and in the battle between bulls and bears, the center of gravity of oil prices gradually shifted downward! Overnight, the main contracts of domestic plastic futures mostly fell rather than rose.

The plastic 2601 contract is quoted at 6898 yuan/ton, a decrease of 0.20% compared to the previous trading day.

PP2601 contract reported at 6576 yuan/ton, down 0.41% from the previous trading day.

PVC2601 contract reported 4685 yuan/ton, up 0.06% compared to the previous trading day.

Styrene contract 2512 was quoted at 6437 yuan/ton, down 0.71% compared to the previous trading day.

IV. Market Forecast

PE: The current PE market lacks effective macro-level positive factors, combined with the ongoing concerns about weak terminal demand. Traders are generally adopting a strategy of offering discounts to accelerate inventory turnover and alleviate sales pressure, resulting in a generally subdued trading atmosphere and insufficient transaction activity. Although market sentiment has slightly eased compared to earlier periods, the weak performance on the demand side has not seen substantial improvement, and market expectations remain cautious, making it difficult to see a fundamental change. Downstream enterprises mostly hold a "buy on dips" mentality, preferring to find low-priced resources to make transactions, with purchasing behavior mainly driven by immediate needs and lacking motivation for proactive restocking. The strength of demand continues to be limited. On the supply side, the operation of PE units in the market remains stable, with neither large-scale maintenance leading to supply contraction nor concentrated resumption causing a surge in new production, keeping the supply pattern relatively stable. However, against the backdrop of weak demand, the mismatch between supply and demand has not been alleviated. In the short term, the core contradictions of missing macro positives and weak demand are difficult to quickly resolve, and the pace of traders offering discounts may continue, with the pattern of downstream immediate need purchases still dominating the market. Coupled with the stability of supply brought by steady unit operations, the market lacks the core momentum to push prices upward. It is expected that the polyethylene market will continue to show a weak consolidation trend in the short term. If there is no unexpected improvement in demand, the market may maintain a low-level consolidation pattern, with little chance of a significant boost in trading atmosphere.

The current polypropylene (PP) market is influenced by multiple intertwined factors. Although the continuation of U.S. sanctions policies against oil-producing countries and geopolitical uncertainties provide some potential support on the cost side, the positive impact is limited and insufficient to offset the pressure from core bearish factors. On one hand, OPEC+'s insistence on increasing production has led to a global oversupply of crude oil, weakening the support logic on the cost side. On the other hand, the sluggish global economic recovery is dragging down end-user demand, with downstream companies only maintaining necessary procurement and showing low willingness to restock. Coupled with the fact that stocking for Double 11 is below expectations, demand remains unable to form a substantial boost. Meanwhile, the high accumulation of spot inventories further exacerbates market selling pressure, and the supply-demand imbalance continues to be prominent. Additionally, the restart of the Guangdong Petrochemical PP plant today will increase market supply. The fluctuating downward trend in the futures market has triggered a follow-up decline sentiment in the spot market, and the overall market sentiment is pessimistic. Overall, in the short term, the polypropylene market is expected to remain in a bearish-dominated weak pattern. The core contradiction of supply-demand imbalance has not been fundamentally resolved, coupled with the drag from the futures market, it is likely to continue its fluctuating downward trend until substantial progress in inventory digestion or an unexpected improvement in demand occurs.

PVC: Regarding the fundamentals of PVC, the operating rate of the PVC industry has increased, leading to a further rise in supply, and there is an expectation of a further increase in social inventory. Demand remains based on rigid needs, and the supply-demand imbalance is becoming more severe in the fourth quarter. On the international front, oil prices continue to decline as the latest inventory report shows a significant increase in U.S. crude oil inventories. However, the risk of supply disruptions due to Ukraine's attacks and U.S. sanctions potentially affecting Russian oil supply has limited further declines in oil prices. The overall market's risk-averse sentiment has led investors to exit the energy market. Asian stock markets have plummeted, and market volatility has reached its highest level since April. Overall, considering both internal and external weak factors, it is expected that in the short term, PVC spot market prices will continue to undergo narrow adjustments at low levels.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory