UK Pharmaceutical Investment Plummets, Threatening Global Leadership

According to a recent report from the Association of the British Pharmaceutical Industry (ABPI), the UK life sciences sector is at risk of losing its world-leading status due to a continuous flow of investment to other countries.

The ABPI, in its latest report titled "Creating the Conditions for Investment and Growth," detailed a significant decline in foreign direct investment (FDI) and R&D funding. The report indicates that this means the UK is lagging in the global investment competition, which will have significant economic implications.

The pharmaceutical industry is crucial to the UK government's long-term life sciences development plan, contributing £17.6 billion in direct Gross Value Added (GVA) to the economy each year. However, the ABPI calls on the government and pharmaceutical companies to reach a consensus on factors affecting investment. For a long time, differing views on this matter have created uncertainty in the UK's life sciences sector.

Dr. Richard Torbett, CEO of ABPI, stated in the report's foreword: "In an ever-changing and competitive international environment, ensuring a shared understanding between the industry and government on the factors influencing investment has never been more important than it is today."

Image source: Internet

Decline in investment data

The ABPI's investment report is based on an analysis of the competitiveness framework between the UK and 12 benchmark countries, including Belgium, Canada, China, France, Germany, Ireland, Italy, Japan, Singapore, Spain, Switzerland, and the United States.

Foreign direct investment in the UK's life sciences sector fell by 58%, from £1.9 billion in 2021 to £795 million in 2023.

The UK's ranking in life sciences FDI among benchmark countries dropped from second place in 2021 to seventh place in 2023.

R&D investment was also affected, decreasing by nearly £100 million to £8.7 billion in 2023. ABPI analysis shows that if the UK kept pace with the global trend, an additional £1.3 billion in R&D investment could be obtained in 2023 alone.

The report points out that the UK has fallen behind for many years in the global growth trend, while the competition for globally mobile investment among countries is exceptionally intense.

Investment sources are obstructed.

The report points out that some sources of investment are drying up.

The UK has the highest rebate rate among its peer countries using related policies. Under pressure from US President Trump for the UK and the EU to purchase more American drugs and with tariff pressures, the rebate rate is expected to reach 22.9% by 2025, bringing the issue to a "critical point." The report states that this high rebate rate increasingly excludes the UK from consideration for pharmaceutical investments.

The clinical trial environment is also weakening, directly affecting the pipeline for innovative drug approvals. The preparation time for clinical trials in the UK is longer than in Spain, France, and Germany. Prime Minister Keir Starmer has pledged to reduce the average setup time for trials to 150 days, but the ABPI states that systemic reforms are still needed to attract investment.

Despite this, the UK still ranks first in Europe for cell and gene therapy trials, but not all therapies can enter the NHS due to reimbursement issues.

Pharmaceutical companies divest and relocate.

A few hours before the report was released, the large American pharmaceutical company MSD (Merck) announced the cancellation of its £1 billion expansion plan in the UK. The company will also withdraw from its London laboratory, stating that the move is due to the challenging investment environment in the UK life sciences sector and successive governments' undervaluation of pharmaceuticals.

AstraZeneca, one of the largest companies in the UK by market capitalization and an important pillar of the national pharmaceutical industry, has planned to invest $50 billion in the United States by 2030. In January, the company also canceled a £450 million vaccine manufacturing project in Liverpool due to a breakdown in negotiations over government funding support. In July, AstraZeneca CEO Pascal Soriot stated that the company is even considering relocating its listing to the United States, highlighting the severe situation in the UK's life sciences sector.

Torbett commented, "The government's goal is to make the UK Europe's leading life sciences hub by 2030, while improving health outcomes and building an NHS fit for the future. To achieve this goal, we must double down on the UK's strengths, urgently address systemic weaknesses, and seize the areas of unrealized potential."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Chuan Jinheng Auto Safety System Jinzhou Factory Catches Fire

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

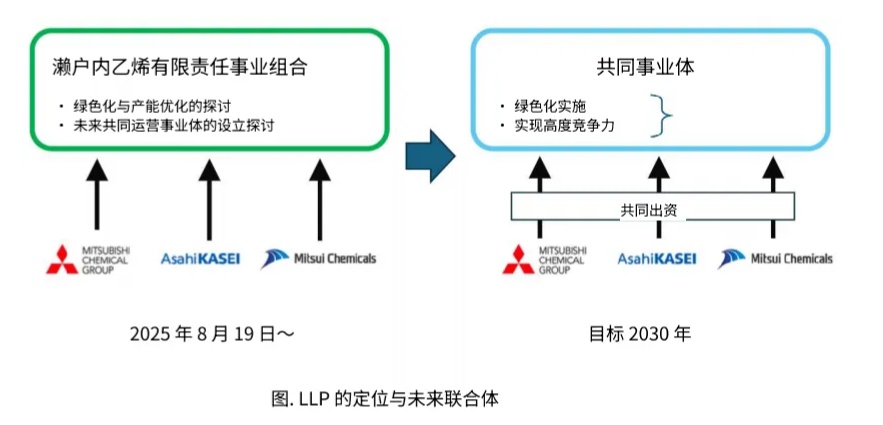

Asahi Kasei, Mitsui, Mitsubishi Establish New Company! Sinopec, BASF Already Positioned

-

Modern Dispersions To Launch PFS-Free Black Masterbatch at K Show

-

Mega Ton Project Mechanical Completion! Review of South China Large Ethylene