Asahi Kasei, Mitsui, Mitsubishi Establish New Company! Sinopec, BASF Already Positioned

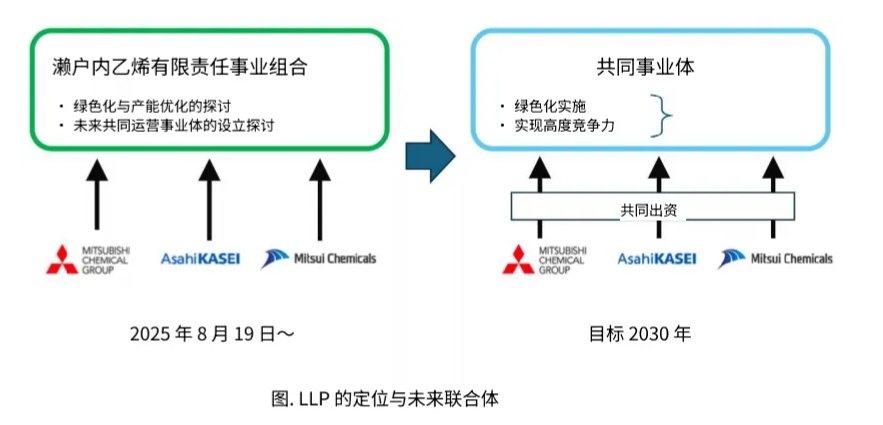

On September 1st, Asahi Kasei Corporation, Mitsui Chemicals, Inc., and Mitsubishi Chemical Corporation announced the joint establishment of a limited liability partnership, Setouchi Ethylene LLP. The three companies will focus on researching carbon reduction technologies and capacity optimization for two ethylene production facilities in western Japan, with plans to achieve a green transformation by 2030.

Ethylene decarbonization: Why are Japan's three major chemical giants joining forces?

Ethylene, as one of the largest chemical products by global output, accounts for 1.8% of global industrial carbon emissions in its production process, primarily due to the high-temperature energy consumption of steam crackers. At the same time, ethylene is a key raw material for synthesizing various plastics. Through different polymerization processes, it can give rise to basic resins such as polyethylene, polyvinyl chloride, and polystyrene, which can further be processed into high-performance engineering plastics like nylon, polycarbonate, and polyester.

As the world's third-largest ethylene producer, Japan currently has a production capacity of approximately 10 million tons per year. However, the carbon intensity (CO₂ per ton of ethylene) of its traditional processes is 20%-30% higher than the leading levels in Europe and the United States. According to plans by the Ministry of Economy, Trade and Industry (METI) of Japan, the chemical industry is required to achieve a 40% reduction in emissions by 2030.

Therefore, the stability, greenness, and efficiency optimization of ethylene production are directly related to the development quality of the downstream engineering plastics industry, and have become an important underlying logic for the joint arrangement of the three companies.

Ethylene green transition, how to layout?

As early as last year, the three companies had already begun in-depth discussions on specific measures to promote carbon neutrality in ethylene production facilities. Focusing on multiple aspects, they proposed a series of forward-looking strategies.

For example, there is a plan to gradually shift raw materials from traditional petroleum resources to biomass-based materials, while simultaneously introducing low-carbon fuels to reduce carbon emissions from the source. In addition, optimizing the production framework is a key aspect, which even includes planning for potential capacity reductions in the future to achieve more efficient resource utilization. After extensive discussions and considerations, the three companies unanimously agreed that establishing an LLP is the best way to deepen cooperation and accelerate the achievement of their goals.

In terms of technological reserves, it is reported that Asahi Kasei has developed a "lignin depolymerization technology" that can convert biomass such as paper waste into ethylene feedstock, replacing part of the petroleum-based raw materials. Pilot data shows that when the biomass proportion reaches 20%, carbon emissions can be reduced by 35%, and the cost is 15% lower than that of the traditional bioethanol route.

The difference between bio-based olefins and traditional ethylene?

From a technical perspective, bio-based ethylene has opened up a new pathway for ethylene production. It originates from renewable biomass resources, such as agricultural and forestry waste, energy crops, and industrial waste. Through a series of biological and chemical conversion processes, the organic components in these biomasses are efficiently converted into ethylene.

From the perspective of carbon emissions, taking the technological pathway of biomass → bioethanol → bio-based ethylene as an example, relevant data show that its CO2 emissions are 0.8–1.2 kg CO2 per kg of product, representing a 60% reduction in carbon emissions compared to the petrochemical route.

Therefore, the core advantages of bio-based ethylene lie in the use of renewable raw materials and low carbon emissions. At the same time, the technological and industrialization challenges of bio-based ethylene are also very apparent at present.

From a cost competition perspective, the raw material cost of bio-based ethylene accounts for 60-70% of the total cost and is subject to significant price fluctuations. The energy consumption of the process is 20-30% higher than that of the petrochemical route, and the small scale of individual units leads to poor economic efficiency.

In terms of breakthroughs in key technologies, there are bottlenecks such as high energy consumption in biomass pretreatment, fermentation conversion being limited by efficient industrial strains and enzyme preparations, high costs of separation and purification, and the need to improve catalytic selectivity.

Major companies are entering the field, and breakthroughs in bio-based ethylene are worth anticipating.

Despite numerous challenges, as one of the most important basic chemicals worldwide, bio-based ethylene has become a hot pursuit for major chemical companies under the trend of low-carbon sustainability, with companies such as Braskem, BASF, and New Energy Blue all having their own layouts.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track