The ten-year gamble of "coal-to-olefins": What Did We Win, What Did We Lose?

Over a decade ago, China experienced a fervent investment boom in "coal-to-olefins," with billions of dollars pouring into this emerging industry, seen as a breakthrough for energy security. Looking back now, what has this gamble truly brought us?

The Beginning of a High-Stakes Gamble: Why Bet on Coal-to-Olefins?

In the early 21st century, China faced a severe energy and chemical industry dilemma. As the world's factory, our demand for olefins—the fundamental raw material for industries such as plastics, synthetic rubber, and chemical fibers—soared. However, the traditional petroleum-based olefin production route posed significant risks.

At that time, China's oil dependency on foreign sources had surpassed 60% and continued to rise. International oil prices were fluctuating at high levels, reaching over $110 per barrel in 2011. Energy security alarms were frequently being raised.

At the same time, China is rich in coal resources, accounting for nearly 70% of primary energy consumption. Coal prices are relatively low, and coal chemical technology has been accumulated for a long time. Given the resource endowment of "rich in coal, poor in oil, and scarce in gas," coal-to-olefins seems to be the perfect solution.

Technological breakthroughs have further fueled this high-stakes gamble. The DMTO technology developed by the Dalian Institute of Chemical Physics at the Chinese Academy of Sciences has achieved industrial application, placing China at the forefront of the coal chemical industry worldwide. On the policy front, documents such as the "Coal Deep Processing Demonstration Project Plan" have been introduced one after another, giving the green light to industry development.

Driven by four factors—energy security, resource endowment, technological breakthroughs, and policy support—coal-to-olefins has transitioned from the laboratory to industrialization, turning a blueprint into reality.

The classic route for olefins is steam cracking of naphtha, which is akin to splitting a large "log" of crude oil through high temperature and pressure to extract useful "small sticks." This pathway is mature and efficient, but its lifeline is tightly controlled by oil-producing countries.

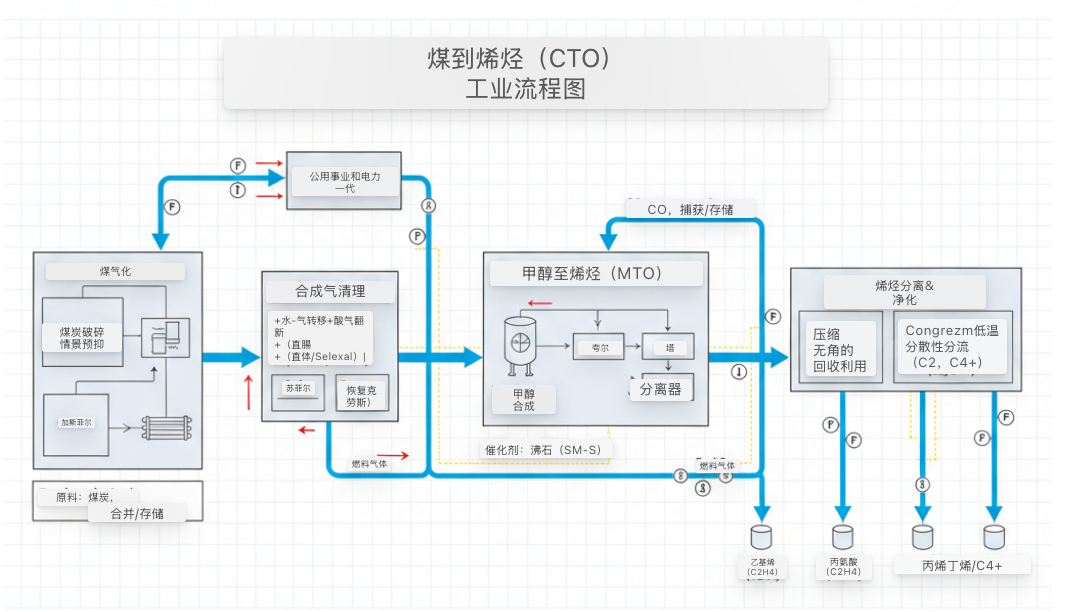

Coal-to-olefins completely overturns this logic. The starting point it chooses is China's most abundant fossil energy resource—coal. The entire process is like a precise chemical relay race.

Under high temperature and pressure, coal reacts with oxygen and steam to produce syngas (mainly composed of carbon monoxide and hydrogen). This is a crucial step in converting solid coal into gaseous chemical "building blocks," and the process is rough and energy-intensive.

Second step: Maturation.

Syngas, under the action of a catalyst, synthesizes methanol. Methanol is a platform compound; it acts like a standardized intermediate interface, connecting upstream coal with the downstream world of complex chemicals.

Third leg: transformation.

This is the most revolutionary step in the entire technology chain, namely methanol-to-olefins (MTO). Methanol vapor passes through a special molecular sieve catalyst (usually SAPO-34 zeolite), which is filled with nanoscale channels. Once methanol molecules enter these channels, they undergo complex "C-C coupling" reactions in a specific acidic environment, being precisely "tailored" and "reassembled" to ultimately produce ethylene and propylene.

Compared to traditional naphtha cracking, coal-to-olefins exhibits distinct asymmetrical characteristics in its technological pathway.

*Cost Structure: The fixed asset investment for naphtha cracking is relatively low, but its operating costs are directly tied to oil prices, causing significant fluctuations. In contrast, coal-to-olefin production requires an initial investment several times higher than the former, making it a capital-intensive endeavor. However, once established, as long as coal prices remain within a reasonable range, its operating costs become detached from high oil prices, displaying a significant cost advantage. This "oil-coal spread" is the lifeline for its survival.

Product Mix: The products of naphtha cracking are more diverse, producing not only ethylene and propylene but also a large amount of high-value chemicals such as aromatics and butadiene, forming a vast product matrix. In contrast, the MTO process is highly focused, primarily producing ethylene and propylene, with a relatively singular product spectrum.

* Resource endowment: one relies on imported oil, while the other is based on domestic coal. This is precisely the initial strategic starting point of this gamble—to find a "ballast" independent of international oil price fluctuations for China's vast chemical industry.

The Golden Age: The Glory and Contribution of Coal-to-Olefins

Between 2010 and 2016, the coal-to-olefins industry experienced a period of prominence. In regions rich in coal resources such as Inner Mongolia, Shaanxi, Ningxia, and Xinjiang, numerous coal-to-olefins projects, each with investments exceeding billions of yuan, emerged swiftly.

A typical example is the Shenhua Baotou Coal-to-Olefin Project. As the world's first successfully commercialized coal-to-olefin plant, its significance goes beyond mere economics. It has demonstrated to the world the technical and commercial viability of this non-petroleum route, greatly boosting the confidence of the entire industry. More importantly, in a traditional coal and rare earth city, it has "forged" a brand-new modern chemical industry chain, from basic polyolefins to downstream modified plastics and packaging materials, forming an endogenous industrial ecosystem.

Another example is the extension of the Yulin Energy Chemical Comprehensive Utilization Project by China Coal. It represents a higher form of coal chemical development—integration and coupling. This project is not merely about coal-to-olefins; it integrates and deeply transforms four resources: coal, oil, gas, and salt. Coal is used for the production of olefins and methanol, the associated natural gas is used for the production of ethylene, and the local rock salt resources provide raw materials for the chlor-alkali chemical industry. This "fully utilized" approach to resource use maximizes the advantages of different process routes, with significant synergistic effects, establishing a high competitive barrier. The issue it addresses is no longer just about the substitution of a single raw material, but rather a systemic issue of how to achieve optimal energy and chemical efficiency within a region.

These projects have indeed brought considerable returns.

They alleviate the dependence on imports of olefin raw materials and enhance national energy security to a certain extent.

Promoted the development of clean and efficient coal utilization technology, enhancing the added value of coal.

It has driven economic development in the western region and created a large number of job opportunities.

Developed coal chemical technology with independent intellectual property rights and formed a complete industrial chain.

Around 2014, when international oil prices remained above $100 per barrel, coal-to-olefins projects were highly profitable, with remarkable investment returns. That was indeed the golden age of coal-to-olefins.

Turning Point: Why is Coal-to-Olefins Gradually Being Phased Out?

The rapid changes in the market environment have swiftly reduced the odds of winning this gamble.

First, the sharp drop in oil prices has changed the economics.Starting in the second half of 2014, international oil prices plummeted, once falling below $30 per barrel and fluctuating between $40 and $70 per barrel for a long time. The cost of producing olefins from oil dropped significantly, while coal prices remained relatively firm due to domestic capacity reduction policies, causing the cost advantage of coal-to-olefins to vanish.

Secondly, environmental constraints are becoming increasingly stringent.Coal-to-olefins is a typical high energy consumption and high water consumption industry. Producing 1 ton of olefins requires about 6-8 tons of raw coal, approximately 20-30 tons of fresh water, and emits about 10-15 tons of carbon dioxide. Under the goals of carbon peaking and carbon neutrality, the environmental shortcomings of coal-to-olefins are becoming more apparent.

Thirdly, the U.S. shale gas revolution has caused an impact.The cost of producing olefins from ethane cracking is extremely low, and the construction of multiple new ethane cracking units in the United States has had a significant impact on the global olefins market. The production of olefins from cheap natural gas in the Middle East has also intensified market competition.

Fourth, the issue of overcapacity has become apparent.The rush of investments has led to a rapid expansion of olefin production capacity, reversing the market supply-demand relationship. Product prices have continued to decline, and industry profits have significantly shrunk.

The most crucial point is that the competitive landscape of the technological route has been established.With the maturation of new technologies such as light hydrocarbon cracking and direct crude oil-to-chemicals, as well as the clarification of future technological routes like hydrogen production from renewable energy (green hydrogen) and olefin production from carbon dioxide ("liquid sunshine"), high-carbon and high-energy-consuming coal-to-olefins is gradually losing its competitiveness.

Gains and Losses: What Have We Won, What Have We Lost?

We have won:

Valuable experience in technology autonomy—through the practice of coal-to-olefins, China has mastered world-leading coal chemical technology and cultivated a complete team for R&D, design, manufacturing, and operation.

Coal-to-olefins have indeed provided significant support for national energy security at specific historical stages as a strategic buffer for energy security.

The industrial foundation for Western development—related projects have brought comprehensive improvements in infrastructure, employment opportunities, and fiscal revenue to the Western region.

What we lost is:

Enormous investment costs—some projects incur losses due to market changes, making it difficult to recover the investment.

Excessive consumption of environmental capacity—high carbon emissions have become a heavy burden in the context of climate change.

Delay in the timing of transformation — excessive investment in coal-to-olefins may have delayed the progress of green and low-carbon transformation.

Revelations of the Future

The rise and fall of coal-to-olefins over the past decade has taught us a profound lesson.

The choice of energy technology pathways must take a long-term view and cannot rely solely on immediate comparative advantages.

Industrial policy requires foresight, and caution should be taken to prevent overheated investment driven by herd mentality.

Any energy solution must take into account economics, security, and environmental protection.

Those steel giants that once represented the glory of industry, will they become unavoidable "stranded assets" in the future, or will they be able to complete self-redemption through technological revolution and become part of a new energy and chemical system? This not only tests the wisdom of enterprises but also the strategic resolve and choices of the entire nation during the painful period of energy transition.

The next gambling session has quietly opened.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Zf asia-pacific innovation day: Multiple Cutting-Edge Technologies Launch, Leading Intelligent Electric Mobility

-

Fire at Sinopec Quanzhou Petrochemical Company: 7 Injured

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Argentina Terminates Anti-Dumping Duties on Chinese PVC Profiles! Kingfa Technology & Siemens Sign Digital and Low-Carbon Cooperation Agreement