Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

On October 29, 2025, the Mexican Senate officially approved President Claudia Sheinbaum's 2026 budget revenue proposal, which is part of Sheinbaum's "Plan México." This plan aims to boost domestic production, reduce import dependence, and enhance economic sovereignty.

The proposal was submitted to the House of Representatives in September and was smoothly passed due to the majority seats held by the ruling party Morena and its allies in Congress.

Tariff reform is a core component of the proposed amendment, which modifies the General Import and Export Tax Law to impose temporary tariffs on imported goods from non-free trade agreement (FTA) countries, such as China. It is expected to generate approximately 70 billion pesos (about 3.76 billion USD) in revenue each year.

⚠️ Coverage: Involves 1,371 tariff codes, accounting for 16.8% of all tariff codes in Mexico. Mainly targets over 1,400 products, focusing on key industries to reduce the trade deficit with Asia, especially China.

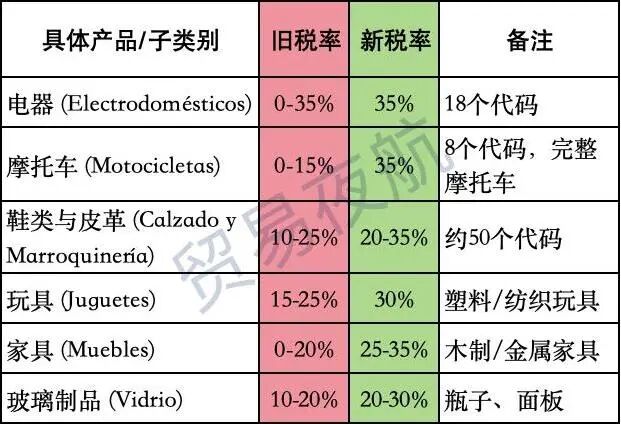

⚠️ Products and Industries: Tariffs mainly target industries such as automobiles, textiles, plastics, steel, clothing, toys, footwear, furniture, paper, and glass.

⚠️ New tax rates: 10%, 20%, 25%, 30%, 35%, and 50% vary depending on the product and country.

⚠️ Applicable countries: Suitable for non-FTA countries such as China, Southeast Asian countries, South Korea, India, Russia, Turkey, etc. (Mexico has FTA with about 50 countries).

⚠️ Tariff validity period: The additional tariffs are effective until December 31, 2026, and may be extended.

⚠️ Objective: Protect local industries (such as automotive and textiles), increase local content ratio to over 50%, attract foreign investment, support SME financing, and provide leverage for the 2026 USMCA (United States-Mexico-Canada Agreement) review negotiations (prevent Chinese goods from being transshipped through Mexico).

The following is based on the initiative and analysis report submitted to the Mexican Congress, applicable to import tariffs for non-FTA countries (such as China), with the tariff rates temporarily effective until the end of 2026.

Overall Tax Rate Structure:

🚨 10-15%: For raw materials/simple intermediates

🚨 20-35%: For intermediate components/semi-finished products

🚨 35-50%: Targeting finished/high-value products

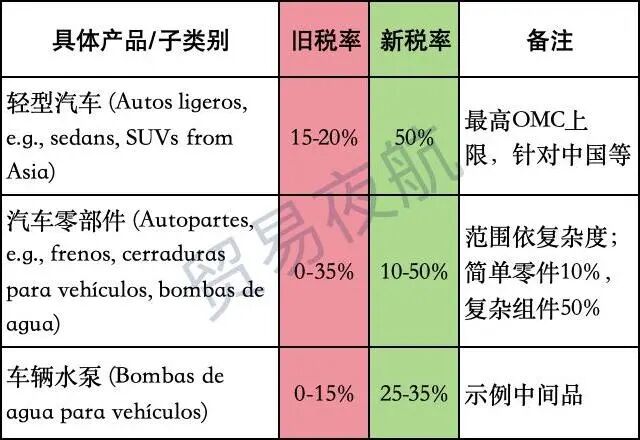

The following are the latest tax rates for specific products:

1. Automotive Industry

Affected: 154 tariff codes (141 auto parts + 13 light vehicles).

Objective: Protect the domestic automotive chain to address the trade deficit with China.

2. Steel and Metal Industry (Siderurgy and Aluminum)

Impact: 248 tariff codes.

Purpose: Anti-dumping protection.

Textile and Clothing Industry

Impact: 308 tariff codes (Chapters 61-63).

Objective: Enhance local textile content.

4. Plastic and Chemical Industry (Plastic)

Impact: Approximately 100 tariff codes.

Objective: Reduce dependency on plastic imports.

5. Products from Other Industries

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Brazil Imposes Five-Year Anti-Dumping Duty of Up to $1,267.74 Per Ton on Titanium Dioxide From China

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

MOFCOM Spokesperson Answers Questions from Reporters on China-U.S. Kuala Lumpur Trade Consultations Joint Arrangement

-

"Golden October" Weak, Polyethylene Prices Hit New Low of the Year in October

-

Kingfa Sci & Tech Q3 Net Profit Attributable to Shareholders Rises 58.0% YoY to 479 Million Yuan