Nio moves closer to fourth quarter profitability

The delivery of the ten-thousand-level administrative flagship ET9 has begun, the first model of the sub-brand Yinghuochong is on the market, and the new model of the main model "5566" is launched...

The curtain on NIO's "big year for products" was fully lifted in the second quarter of this year, marking a turning point for this new energy vehicle company, which has been established for ten years, as it finally emerges from the shadows.

From April to June this year, NIO's new car deliveries rebounded significantly from 42,000 units in the previous quarter to 72,000 units. The automotive sales revenue increased by 62.4% quarter-on-quarter to 16.14 billion yuan. Meanwhile, the adjusted net loss for the second quarter narrowed from 6.28 billion yuan in the first quarter to 4.13 billion yuan, and cash reserves grew from 26 billion yuan to 27.2 billion yuan.

The improvement in various operational data and financial indicators confirms a prediction made by NIO's founder, chairman, and CEO, William Li, three months ago: NIO hit its lowest point in the first quarter of this year, and the company has already entered an upward trajectory starting from the second quarter.

In the third quarter, NIO's momentum was booming—the Li Auto L9 was launched and delivered immediately, with 10,575 units sold in the first month, making it the fastest model in NIO's history to exceed 10,000 sales. Furthermore, the newly unveiled ES8 in August achieved even better initial order results than the Li Auto L9.

With the launch of these two new models, NIO expects its third-quarter deliveries to reach 87,000 to 91,000 vehicles, and is aiming to reach 150,000 vehicles in the fourth quarter.

Since the beginning of the year, NIO has conducted a large-scale and detailed review of its organizational structure and business processes. The initial success of the Leidao L90 and the new NIO ES8 not only represents an increase in sales and an improvement in financial data for NIO but also serves as a testament to the company's organizational capabilities and systemic efficiency.

In a recent internal speech, Li Bin jokingly said that when the goal of "achieving profitability in the fourth quarter" was proposed at the beginning of the year, less than 1% of people probably believed in this goal.

With the launch of the two flagship large three-row SUVs, NIO is clearly one step closer to achieving profitability in the fourth quarter.

Start a new cycle

In the second quarter, the new "5566" (NIO's main models ET5, ET5T, ES6, EC6) and the Firefly were launched, marking the first step in NIO's rebound from its lowest point.

Firstly, the transition between the old and new models of the 5566 has been completed, and from April onwards, NIO's overall delivery volume has returned to around 24,000 units. The old model 5566 successfully completed its product cycle, and the new model 5566 has seamlessly taken over with its outstanding product strength.

Secondly, the LeDao L60 has revitalized after adjustments in organizational structure and updates in sales policy, achieving a rebound in monthly sales in May and June. This is uncommon in the automotive industry, especially in the current market where new car models are frequently launched, and rarely can a model make such a comeback.

Once again, the first model from the premium small car brand Firefly quickly gained market favor upon its launch. The introduction of the battery rental policy also contributed to the rapid increase in sales volume. In its first full month of delivery, 3,690 units were sold, and in August, this number increased to 4,346 units.

The two large three-row SUVs, Leidao L90 and the all-new ES8, built on the third-generation platform, have initiated a new cycle of rapid growth for NIO.

On the evening of July 31, the LeDao L90 began delivery. Prior to this, the flagship model, which had been in development for three years, had been in pre-launch for six months. The efficient order conversion, launch, and delivery process improvements made this car a true hit, with 10,575 units delivered in August.

The brand-new ES8 will be launched in late September, but after the product technology launch in late August, its pre-sale performance has already surpassed that of the Le Tao L90. NIO internally expects the brand-new ES8 to achieve monthly sales of over 10,000 units.

The sales performance of both the LeDao L90 and the all-new NIO ES8 exceeded the expectations of NIO's management. William Li summarized this as a result of the combination of technology roadmap, market choices, and product definition.

In terms of market selection, it has targeted a sufficiently large niche; in terms of technology path, pure electric has finally reached a turning point and can be transformed into a highly perceptible product experience; in terms of product definition, NIO has also learned from past lessons and maximized explicit value.

Apart from the technical and product maturity, starting with the LeDao L90, NIO has undergone a transformative overhaul in its sales system—from configuration design to pricing strategy, from marketing promotion to delivery pace, all iterated according to market-validated paradigms.

"On one hand, we need to raise the upper limit of our products, and on the other hand, our organizational and systematic capabilities in marketing must keep up. In this way, each product can reach its potential," Li Bin said at the media briefing following the earnings report release.

The verification of system capabilities and the enhancement of brand capabilities are also driving the market performance of other models.

While the LeDao L90 is selling well, the LeDao L60 also set a new order record for the year in August. Meanwhile, after the launch of the ES8, the attention and recognition for the new model "5566" have further increased.

Last Friday, NIO adjusted the sales policy for the new "5566" models. These models will now come standard with a 100 kWh battery pack at the same starting price, effectively offering a discount of 38,000 RMB for this configuration.

From this perspective, NIO's guidance of delivering 87,000 to 91,000 vehicles in the third quarter, with a year-over-year revenue growth of 41% to 47%, is not an exaggeration. Excluding the sales from the first two months of the third quarter, NIO needs to complete approximately 35,000 deliveries in September.

According to the fourth-quarter profit target, NIO plans to achieve an average monthly delivery of 50,000 vehicles in the last three months of this year. With the launch and delivery of the all-new ES8, this target no longer seems as unattainable as it did three months ago.

It is worth noting that due to the transition between new and old models and the adjustment of the product structure, NIO's average vehicle price slightly decreased in the second quarter, and the revenue growth was slightly less than the sales growth. However, under these circumstances, NIO's vehicle gross margin remained stable and even saw a slight increase.

This fully demonstrates that the launch and strong sales of multiple models across three brands indicate that NIO's economies of scale are further being realized.

With the increase in sales and proportion of mid-to-large models such as the Leidao L90 and the new NIO ES8, NIO's gross profit margin is expected to rise to a new level. According to the guidance provided in the earnings call, NIO's automotive gross profit margin for the fourth quarter is expected to reach 16%-17%, laying a solid foundation for achieving breakeven.

Regarding specific brands and models, Li Bin has provided a clear path: NIO at 20%-25%, ALPS at 15%, Firefly at 10%, while the flagship models ALPS L90 and the new NIO ES8 are at 20%.

A frugal NIO

While increasing sales and releasing economies of scale, NIO is also optimizing its operational mechanisms.

One of the most notable actions is the comprehensive cost reduction and efficiency improvement based on CBU (Cost-Bearing Unit).

Under the new mechanism, the expenses and costs of each business unit of NIO have become meticulously calculated. The input and output of each project will be carefully measured. In the words of Li Bin, "Save where we can, spend where we must. It's not about not spending, but about improving the efficiency of fund utilization."

This year, NIO's R&D projects have been significantly tightened and prioritized to ensure that core projects receive sufficient resources, while unnecessary and long-term investments are reduced. For instance, during a media briefing following the earnings report release, William Li candidly stated, "We'll pursue ventures like the smartphone business when we have more funds in the future."

Under the guidance of improved operational efficiency, NIO's R&D expenses in the second quarter decreased to slightly over 3 billion yuan, a reduction of 170 million yuan compared to the first quarter, and a year-on-year decrease of 210 million yuan.

For NIO, which has laid out twelve full-stack technologies for smart electric vehicles, this is not easy, and this is just the beginning.

According to Li Bin, NIO will maintain a quarterly R&D investment of 2 to 2.5 billion yuan next year. With improved efficiency, they will be able to achieve the output that previously required a quarterly investment of 3 billion yuan, ensuring long-term competitiveness while also improving NIO's financial performance.

Another major expenditure is selling, general and administrative expenses, which cover various aspects such as marketing, channels, and services.

Under the CBU mechanism, this cost has been significantly controlled, decreasing from 4.4 billion yuan in the first quarter to less than 4 billion yuan in the second quarter, even with the intensive hosting of various new product launch events in the second quarter.

This is largely attributed to the optimization of sales channels.

Last year, this expense increased significantly, mainly due to the channel expansion of LeDao. However, this year, LeDao's channel system underwent reform, and while sharing delivery centers with NIO, it also optimized the operational efficiency of its sales system.

NIO co-founder and president Qin Lihong previously introduced that when Le Tao entered the lower-tier market this year, it adopted two approaches: traditional offline stores and the "battery swap station + sales team" method, which is equivalent to a combination of "positional warfare" and "guerrilla warfare." The latter relies on battery swap stations to provide demonstrations and experiences for potential users, significantly reducing NIO's burden in terms of personnel allocation and short-term investment.

Starting from the second quarter of this year, Ledao initiated a pilot marketing team in certain regions, achieving promising results.

Li Bin also mentioned that there was a period when Le Dao's sales staff decreased by 40%, but the delivery volume increased.

Focusing on the systematic improvement of operational efficiency and execution capability, NIO has significantly optimized the systematic efficiency of its sales, service, and R&D. In the second quarter, NIO's operating loss narrowed by 23.5% quarter-on-quarter, and the adjusted net loss decreased by 34.3% from 6.28 billion yuan in the previous quarter to 4.13 billion yuan.

Based on the guidance for fourth-quarter profits, Li Bin stated that the company's overall gross margin should reach 17%-18%, the R&D expense ratio should be 6%-7%, and the sales expense ratio should be around 10%. With an estimated total revenue of 40 billion yuan, this is a sufficiently challenging level, but not unattainable.

In the third quarter, it is understood that Ledao will expand its sales teams across various counties and districts nationwide, while the NIO brand will launch pilots in several cities. It can be anticipated that this will efficiently capture the market enthusiasm and potential orders for Ledao and NIO's new cars, while also effectively controlling sales expenses within a reasonable growth pace.

At the entire company level, NIO has already integrated the relevant organizations and teams of LeDao and Firefly. Whether it's front-end development or back-end sales and service, many underlying capabilities and resource systems can be reused. As the business and teams are further integrated, the marginal increase in expenses will be effectively alleviated.

With increased vehicle sales, significant growth in gross profit, and effective cost control, NIO is expected to achieve profitability in the fourth quarter and enter a positive cycle of excellent financial performance.

At the communication meeting the day before yesterday, Li Bin told the media that the number of people in the company who believe they can be profitable in the fourth quarter is "definitely more than 1%."

"We are not encountering a crisis for the first time; in fact, we already went through one in 2019, struggled on the brink of death, then came back, followed by a moment of glory, but soon entered a new cycle. This pit is both deep and long, but coming out of it is a process of gaining a clearer understanding of ourselves and improving the organization."

Having gone through crises, one gains clearer insights, firmer determination, and greater resilience, all of which will help NIO navigate through the storm and see the sunshine again.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Chuan Jinheng Auto Safety System Jinzhou Factory Catches Fire

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

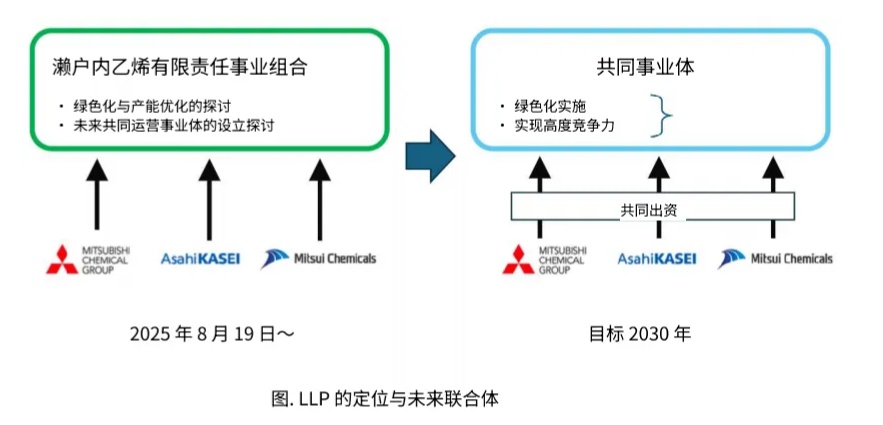

Asahi Kasei, Mitsui, Mitsubishi Establish New Company! Sinopec, BASF Already Positioned

-

Modern Dispersions To Launch PFS-Free Black Masterbatch at K Show

-

Mega Ton Project Mechanical Completion! Review of South China Large Ethylene