Joint Venture Brands Doing Poorly in Smart Technology Is a Prejudice

Technological catch-up is only the first step; changing consumer perception requires more time and greater effort.

In recent years, the new energy vehicle industry has experienced rapid growth in the Chinese market, with the market share of new energy vehicles continuously rising to around 50%. During this period, many domestic brands have achieved overtaking on a curve through strong performance in the new energy market.

In contrast to the strong performance of many domestic brands, the transition to new energy vehicles by many joint venture brands has not been smooth. Both their brand presence and product sales have been less than satisfactory. A very important reason for this is that the level of intelligence and intelligent driving assistance systems in their new energy vehicles cannot match those of domestic brands. These product features are precisely what Chinese consumers are keen to pursue.

As the new car-making forces discuss topics such as intelligent cockpits and advanced driver-assistance systems, many joint venture brands still focus their promotional efforts on chassis tuning and engine performance. Coupled with their global integrated development model, which struggles to quickly adapt to the unique demands of the Chinese market, the differing consumer needs for automotive products, and inefficient decision-making mechanisms, the joint venture camp has almost collectively been labeled as "behind in intelligence."

However, after reflecting on the pain, the joint venture brand has decided to embrace Chinese consumers.

Faced with shortcomings in intelligence, they have all embarked on a diversified technological breakthrough in their own ways—some choose to collaborate with Chinese companies to develop new vehicles; some opt to directly adopt advanced technologies from Chinese firms; and others take a longer but steadier path of independent research and development. All roads ultimately lead to winning the hearts of Chinese consumers.

After several years of accumulation, the joint venture camp, eager to shake off the label of "backward in intelligence," is striving to have its true capabilities reassessed through the launch of one new model after another. The title of the article perfectly encapsulates this phenomenon.

Joint venture brands are eager to prove themselves.

"It's a prejudice that joint venture brands do not excel in smart technology."

At the unveiling event of the first model in the Buick Zijing series, the Zijing L7, on September 15, Xue Haitao, Deputy General Manager of SAIC-GM, stated this. In his view, the level of intelligence in joint venture brands has significantly improved, and it's time to shed the label of being not intelligent enough. Furthermore, Buick has reached the top tier of the industry in smart electric experiences.

Xue Haitao's courage comes from the Buick Zhijing, this mid-to-large-sized extended-range sedan.

As the first flagship sedan of Buick's high-end new energy sub-brand "Zhi Jing," the Zhi Jing L7 is backed by Buick's brand heritage and billions in resource investment. The new car is built on the so-called million-level "Xiaoyao" architecture, adopts "Zhenlong" range extension technology, is equipped with the "Xiaoyao Intelligent Driving" assistance system, the Momenta R6 Flywheel large model, as well as Qualcomm's latest-generation SA8775P chip, among a series of product highlights that together deliver an upgraded product experience, especially in terms of intelligent electric capabilities.

From architecture to the range-extending technology route, from the assisted driving system to the latest generation of chips... With these integrated product points, the ultimate experience and terminal performance of the Buick L7 are matters for later discussion. Just by looking at these product points that indicate industry hotspots, it is easy to see that Buick and even SAIC-GM are making a decisive transformation.

Take extended-range electric vehicles as an example. Although the market performance of extended-range EVs has not been very optimistic this year, there are still many car companies continuously launching new models, including traditional brands, emerging forces, and cross-sector car manufacturers, without exception. As for intelligent driving assistance, it goes without saying that it is an investment option that all competitive car companies cannot avoid, and it is a purchase factor that Chinese consumers pay great attention to. This is also an important reason why Huawei's ADS solution and Momenta's solution have risen successively in recent years.

Whether it is Buick or other joint venture brands, they have been continuously paying the price for the "lack of attention" from a few years ago.

Zhijing L7, or the series of technologies and strategies built around Zhijing L7, is the way SAIC-GM buys in. Other joint venture brands also have their own technical breakthroughs.

Collaborating with technology companies is undoubtedly the fastest solution. For example, the Volkswagen Group and XPeng Motors are working together to jointly develop electronic and electrical architectures, which will be integrated into Volkswagen's electric vehicle platforms in China. These architectures will also be deployed on Volkswagen's fuel and plug-in hybrid vehicle platforms in the Chinese market. The strategic technological collaboration between both parties will expand into broader markets.

At the same time, establishing local R&D teams represents another approach. For example, SAIC-GM’s Pan Asia Technical Automotive Center is a typical case dedicated to the localization of intelligent connected vehicle technologies; similarly, Volkswagen has invested 1 billion euros to set up a digital sales center in Anhui.

Some brands choose to acquire technology companies to address their own shortcomings. For example, Stellantis Group invested 1.5 billion euros to acquire approximately 20% equity in Leapmotor to gain its intelligent technology; Hyundai Motor acquired Boston Dynamics to strengthen its robotics technology reserves.

These layouts demonstrate that joint venture brands are responding to the challenges of smart technology in the Chinese market in a more flexible manner, no longer adhering strictly to the traditional model of complete independent research and development.

After a period of "refinement," the once cumbersome car interface, sluggish voice recognition, and erratic lane-keeping — technologies that many Chinese consumers once scoffed at — are disappearing. They are being replaced by models with more advanced technologies and improved experiences.

Can "bias" be broken?

So, how is the intelligent level of the latest joint venture new energy vehicles verified in terms of capability?

To assess the intelligent electric capabilities of joint-venture new energy vehicles, we cannot do without traditional joint-venture giants like Volkswagen, General Motors, and Toyota. So, what are their latest achievements in new energy vehicles, and how do they perform?

The Volkswagen ID.7 is equipped with the latest ID.OS 2.0 infotainment system, which marks a significant improvement compared to the earlier ID series. The voice recognition response speed has greatly increased, the interface interaction is more intuitive, and it supports multi-scene gesture control functions. Compared to a few years ago when Volkswagen faced system challenges that delayed launches, these advancements are truly impressive.

The newly unveiled Buick Zijing L7 is equipped with Momenta's R6 Flywheel Large Model Assisted Driving System, which has currently achieved urban navigation assisted driving capabilities, performing close to the level of mainstream emerging forces in cities like Shanghai. Meanwhile, this system continually optimizes its algorithms and user experience through a data-driven flywheel evolution.

Additionally, the Toyota bZ4X is equipped with the T-Pilot intelligent driving assistance system, which has accumulated over 10 billion kilometers of safe driving data worldwide, giving it a unique advantage in terms of reliability. The Ford Mustang Mach-E uses the BlueCruise active driving assistance system, which scored higher than Tesla Autopilot in evaluations by Consumer Reports in the United States, demonstrating the deep expertise of traditional automakers in the field of autonomous driving.

Despite making significant progress, joint venture brands still face numerous challenges on the path to intelligence.

The primary issue is the ongoing conflict between global strategy and local demands. Multinational car companies need to balance the consistency of global products with the specific needs of the Chinese market, which often results in domestic models having less advanced intelligent configurations compared to overseas versions. Meanwhile, the disadvantages in data accumulation and algorithm iteration cannot be ignored. Intelligent systems require extensive data for training, but joint venture brands have a limited number of intelligent vehicles in the Chinese market, making it difficult for the data flywheel to turn quickly.

Additionally, issues such as organizational structure and cultural conflicts, as well as cost control pressures, are unavoidable topics that need to be addressed.

However, technological catch-up is only the first step; changing consumer perception requires more time and effort.

Data shows that most consumers still believe that domestic brands lead joint venture brands in terms of intelligence, and this cognitive inertia is difficult to completely reverse in the short term.

Joint venture brands need to strengthen technology dissemination and experiential marketing, allowing consumers to personally experience their advancements in intelligence. Xue Haitao, Deputy General Manager of SAIC-GM, bluntly stated at the unveiling event of the Buick Zijing L7, "It's a prejudice to say that joint venture brands can't do well in intelligence," which is precisely a manifestation of these dissemination efforts.

At the same time, establishing a differentiated advantage is also crucial. Joint venture brands should not blindly follow the technological paths of new forces but should leverage their strengths in safety, reliability, and quality control to create a unique smart label. As the prices of new energy vehicles from joint venture brands become more practical, more consumers are willing to give their products a chance, allowing for an objective assessment of their level of intelligence.

Overall, the competition in intelligence is not a sprint but a marathon. Joint venture brands, with their global R&D resources, supply chain advantages, and manufacturing experience, still have the opportunity to secure a position in the long-term competition.

In the future, the intelligent sector will undoubtedly exhibit a pattern of diverse competition, each with its own unique characteristics. Both independent and joint venture brands will collectively drive the industry forward through technological innovation. As for now, joint venture new energy vehicles are still in the process of catching up.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Chuan Jinheng Auto Safety System Jinzhou Factory Catches Fire

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

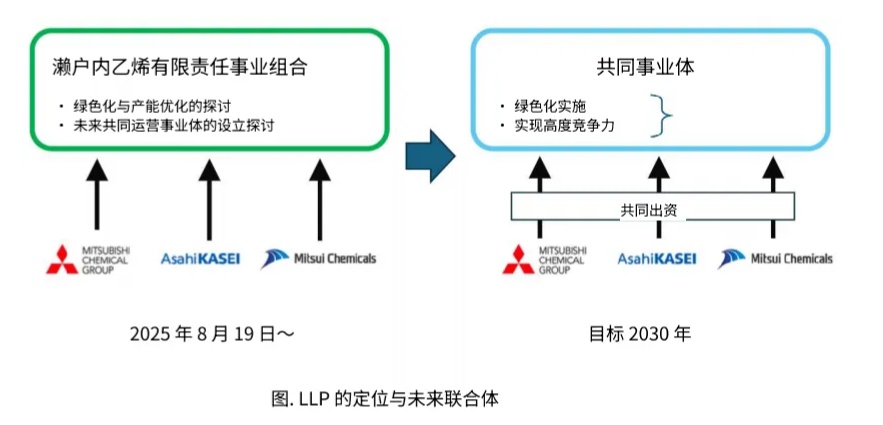

Asahi Kasei, Mitsui, Mitsubishi Establish New Company! Sinopec, BASF Already Positioned

-

Modern Dispersions To Launch PFS-Free Black Masterbatch at K Show

-

Mega Ton Project Mechanical Completion! Review of South China Large Ethylene