Xuyang's 200,000-Ton Nylon 66 New Material Project Resubmitted for Approval

On September 1, Heze Municipal Bureau of Ecology and Environment issued an announcement regarding Yuncheng Xuyang New Materials Co., Ltd.Annual production of 200,000 tons of Nylon 66 new materials projectEnvironmental Impact Assessment Acceptance Announcement.

Yuncheng Xuyang Group is a large modern coal chemical enterprise invested and established in Yuncheng Chemical Industry Park (a provincial-level chemical industrial park) in Heze, Shandong Province. Within the Yuncheng Chemical Industry Park, Yuncheng Xuyang Group includes Yuncheng Xuyang Energy Co., Ltd., Shandong Yongzhi Chemical Co., Ltd., Shandong Hongding Chemical Co., Ltd., and Yuncheng Xuyang New Materials Co., Ltd.

The "Environmental Impact Report for the Annual Production of 200,000 Tons of Nylon 66 New Material Project by Yuncheng Xuyang Tianchen New Material Co., Ltd." was approved by the Heze Municipal Bureau of Ecology and Environment on November 10, 2023 (Approval Document No. Hehuanshen [2023] 77). The approval is as follows: Yuncheng Xuyang Tianchen New Material Co., Ltd. is located in the Yuncheng Chemical Industry Park.

The proposed project involves an investment of 2,917.66 million RMB, covering a total area of 120 mu, with a total building area of 38,090 square meters. The main constructions include production units with an annual output of 200,000 tons of nylon 66 and 100,000 tons of 1,6-hexamethylenediamine, as well as auxiliary production facilities such as waste gas and liquid incinerators, tank areas, and power distribution rooms.

Nylon 66 will have two production lines constructed, usingPolymerization process of hexamethylenediamine and adipic acidThe main equipment includes a crude salt reactor, polymerization kettle, and pre-polymerization kettle. Two production lines for hexamethylenediamine will be constructed, utilizing caprolactam ammoniation and hydrogenation processes, with key equipment including an ammoniation reactor, hydrogenation reactor, and alcohol removal tower.

Yuncheng Xuyang New Materials Co., Ltd. currently has 2 construction projects within the factory area, which have been completed but are not yet operational.

Yuncheng Xuyang New Materials Co., Ltd. is investing 6 million yuan to construct a project with an annual output of 20 tons of hexamethylenediamine catalyst, mainly building a production unit for 20 tons of hexamethylenediamine catalyst per year.

The CTH pilot project (Phase I) of Yuncheng Xuyang Tianchen New Material Co., Ltd. has been completed. The target product of the project is 6-Aminohexanenitrile (6-ACN). Currently, there are no national, industry, or corporate quality standards for 6-Aminohexanenitrile. In China, only Ningxia Ruitai Technology Co., Ltd. has a caprolactam to 6-Aminohexanenitrile production unit in operation, which is the first domestic caprolactam to hexamethylenediamine unit. Their 6-Aminohexanenitrile is used for synthesizing hexamethylenediamine.

Yuncheng Xuyang New Materials Co., Ltd. (formerly Yuncheng Xuyang Tianchen New Materials Co., Ltd.) will change its company name and legal representative on November 1, 2024.

Established in 1995, Xuyang Group's core business includes chemical operations. Starting with coking, the company has adopted a vertical integration business development model, extending into three chemical industry chains: carbon materials, aromatics, and alcohol ethers. The company's chemical operation capacity is 5.9 million tons per year, with an additional 2.88 million tons per year under construction, distributed across production parks in Xingtai, Dingzhou, Laoting, Cangzhou (Hebei), Yuncheng, Dongming (Shandong), and Hohhot (Inner Mongolia). The company is the world's largest processor of coke oven crude benzene, the second-largest processor of high-temperature coal tar globally, the largest producer of methanol from coke oven gas in China, and the largest producer of phthalic anhydride from industrial naphthalene in China.

The accelerated domestic production of adiponitrile will effectively address the shortage of upstream raw materials in the PA66 industry chain and promote the development of the downstream nylon 66 industry. Currently, more and more manufacturers are entering the nylon 66 market.

By the end of 2024, the global PA66 total production capacity reached 3.51 million tons per year, representing a 16% year-on-year increase. The industry is characterized by high concentration, with the top ten suppliers accounting for about 80% of the capacity. Among them, the top three enterprises contribute a combined 47% of the capacity. In 2024, the global production of PA66 was approximately 2.28 million tons. Based on the year-end capacity, the industry's average operating rate remained at a low level of 65%, indicating a market condition of oversupply and intense competition.

From the perspective of distribution areas, global PA66 production is mainly concentrated in Northeast Asia, North America, and Western Europe. As the world's largest producer, China has a production capacity of 1.29 million tons per year, accounting for 37% of the global total capacity.

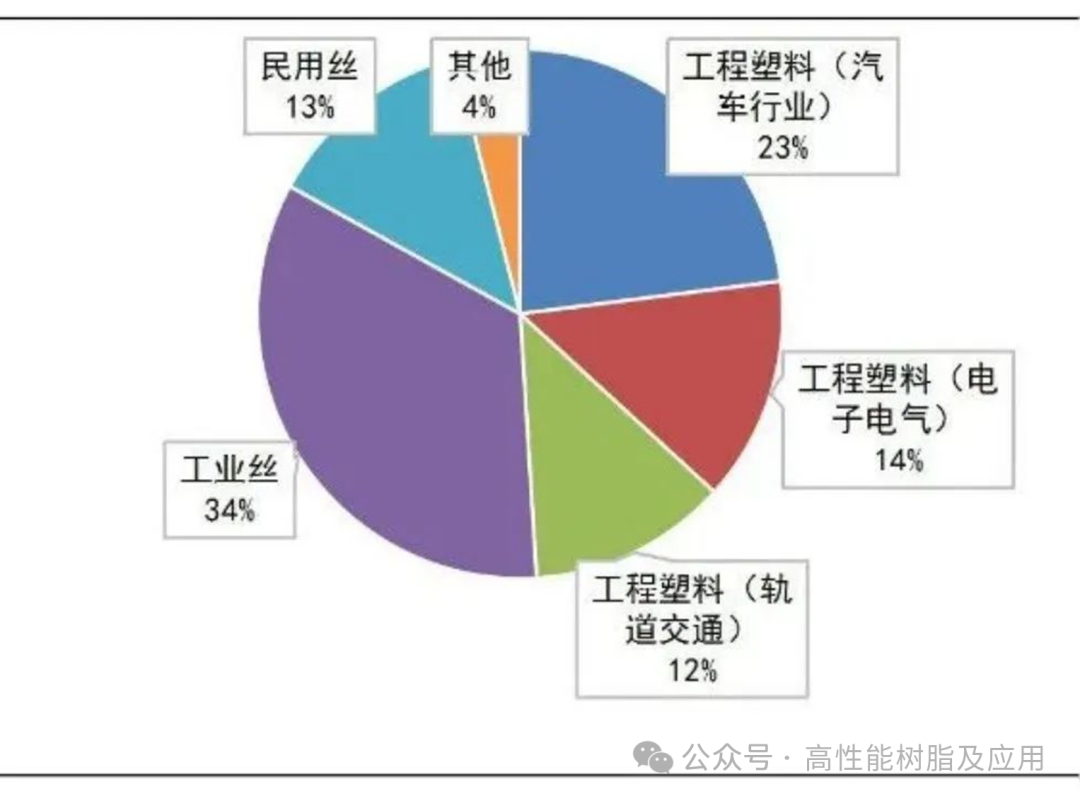

In 2024, the global consumption of PA66 is approximately 2.28 million tons, mainly used in the fields of engineering plastics, industrial yarns, and civilian yarns. Engineering plastics hold the largest share of consumption at 47%.

As of the end of 2024, China's PA66 industry capacity has surpassed 1.2 million tons per year, setting a new historical high. From 2018 to 2024, the industry has experienced a rapid growth rate of 16%, far exceeding the growth rate of large-scale chemical products, making it one of the faster-growing products in the chemical industry. There are approximately 30 companies involved in ongoing and planned Nylon 66 projects in China, with a total capacity exceeding 8.73 million tons per year. Combined with the already operational capacity, the total surpasses 10 million tons. This includes companies such as NHU, China National Chemical Tianchen Qixiang, Invista, Huafon Group, Shenma Group, and Hengli Petrochemical. It is expected that by 2025, the domestic capacity will reach around 2 to 2.5 million tons per year.

Despite the rapid expansion of production capacity, the market price of PA66 has shown a significant downward trend over the past few years, dropping from a peak of 33,000 yuan per ton to around 20,000 yuan per ton. In 2024, the theoretical profit margin of PA66 in China is expected to be only about 3.5%. This means that the profitability of the PA66 industry still faces considerable challenges.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track