European TDI Soars Due To Covestro Plant Shutdown

The Dolmagen factory will halt production until October or longer.

With the restart of the Borsod Chem Zrt production facility in Kazincbarcika, Hungary, spot prices for toluene diisocyanate (TDI) in Europe have begun to decline. However, due to the ongoing shutdown of Covestro AG's TDI plant in Dormagen, Germany, which is expected to last until October or longer, prices may remain high, making it difficult for downstream polyurethane (PU) foam producers to maintain profits amid weak demand.

Image Source: Internet

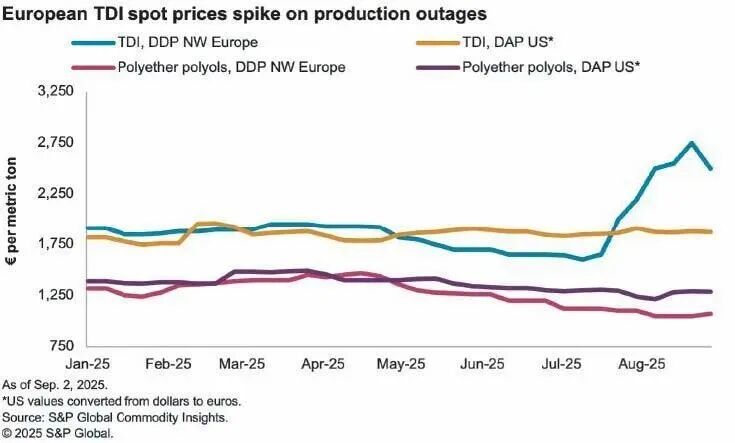

S&P Global Commodity Insights' Platts reported on August 29 that the delivered duty paid (DDP) price of TDI in Northwest Europe (NWE) was €2,500 per ton, down from €2,750 per ton on August 22, but significantly higher than the €1,600 per ton price before the spike on July 11.

On July 12, Covestro's chlor-alkali plant in Dormagen suffered serious damage due to a fire at an external substation, resulting in a sudden power outage. Chlorine production was forced to stop, and Covestro had to shut down its downstream TDI facility. On July 16, Covestro announced a force majeure status for TDI production in Dormagen, leading to a subsequent increase in prices (see chart). Markus Steilemann, the Chairman and CEO of Covestro, reported on the shutdown situation during the company's second-quarter earnings call on July 31. He stated, "The main impact is on chlorine supply, which will last for several months. Chlorine is essential for the operation of the TDI plant."

According to Commodity Insights, the Dolmagen plant has an annual capacity of 280,000 tons, accounting for more than half of Europe's total TDI capacity. BASF SE has closed its TDI plant in Ludwigshafen, Germany, with an annual capacity of 300,000 tons in 2023. Borsod Chem, a subsidiary of China's Wanhua Chemical Group, is the only remaining producer in the region, with two sets of production facilities totaling 250,000 tons per year in Kazincbarcika.

Therefore, when BorsodChem began planned maintenance in Kazincbarcika at the end of July, TDI production in Europe was consequently disrupted, further driving up prices. As of August 22, BorsodChem had successfully resumed production. Market sources told Platts that this restart, coupled with expected TDI imports from Asia in October, led to a price drop of 250 euros per ton in the week ending August 29. Nevertheless, TDI prices were still 900 euros higher than on July 11, and 608 euros above the average of 1,892 euros per ton in August 2024.

Challenging Times for Flexible Foam Manufacturers

The high prices have severely compressed the profits of PU foam producers, bringing them down to unsustainable levels, a polyol producer told Platts. He added, "The biggest problem lies with the large foam manufacturers, whose costs are very high."

TDI and polyether polyols are the main raw materials used for flexible PU foams in furniture, mattresses, carpet underlay, and automotive seats. In the first half of 2025, the price trends of these two raw materials in Europe were generally consistent, but since mid-July, TDI prices have soared while polyol prices have continued to decline (see chart).

Market sources told Platts that imports of polyols from Asia, mainly China, have added to the already surplus supply in the European market, while the influx of finished furniture from Asia has also weakened the demand for polyols. What makes matters worse is that furniture demand usually declines in the summer as consumers tend to spend more on vacations and travel rather than on home furnishings.

On August 29, Platts assessed the DDP price for conventional polyether polyols in Northwest Europe at €1,070 per ton, an increase of €20 from the previous week. This marks the first increase since April 17, when the assessed price was €1,470 per ton.

According to Commodity Insights data, the production base for polyether polyols in Europe is far more dispersed than that for TDI, with a total of 10 companies operating in 17 different plants across Europe, and a total production capacity of 2.8 million tons per year. Covestro is one of the largest producers, with an annual capacity of 675,000 tons, distributed across Dormagen, Germany; Fos-sur-Mer, France; and Antwerp, Belgium. Other major polyol producers in the region include BASF, Dow Inc., Repsol SA, and Shell Plc.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track