XPeng Q2 2025 Revenue Doubles, Net Loss Narrows by 62.6%

On August 19, XPeng Motors released its financial report for the second quarter of 2025 and its interim results. XPeng Motors achieved record highs in sales volume, revenue, and gross margin in the second quarter. By the end of the quarter, its cash reserves also reached a new high, and the delivery guidance for the third quarter set another record.

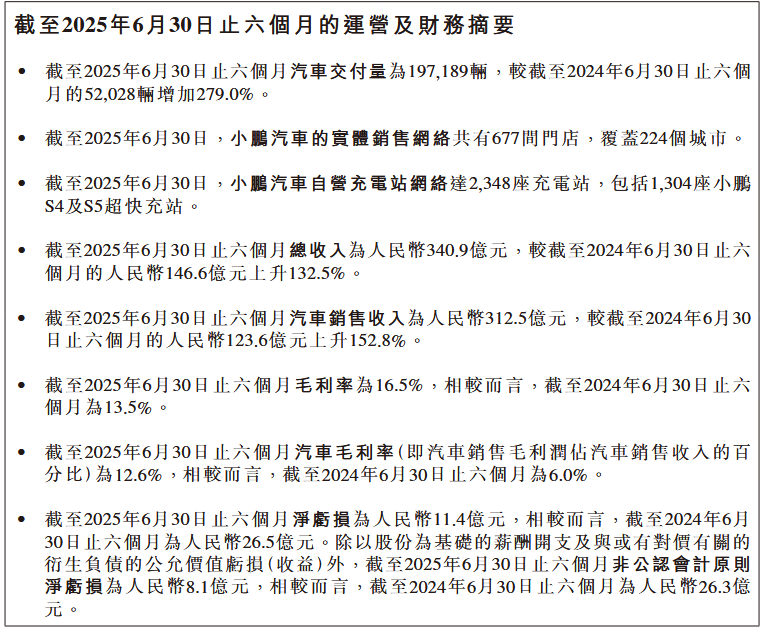

Image source: XPeng Motors financial report screenshot

Data shows that in the second quarter, XPeng Motors achieved total revenue of 18.27 billion yuan, a year-on-year increase of 125.3%. Of this, automobile sales revenue was 16.88 billion yuan, up 147.6% year-on-year; revenue from services and other sources was 1.39 billion yuan, an increase of 7.6% year-on-year.

Revenue growth is directly linked to the increase in sales volume. In the second quarter of 2025, XPeng Motors delivered 103,000 vehicles, a year-on-year increase of 241.6%; in the first half of the year, cumulative vehicle deliveries reached 197,000, a year-on-year increase of 279.0%.

The expansion of economies of scale has also led to a rebound in XPeng's profits. In the second quarter, XPeng Motors reported a net loss of 480 million yuan, compared to a net loss of 1.285 billion yuan in the same period last year, representing a year-on-year decrease of 62.6%. The gross margin reached a record high of 17.3%, up 3.3 percentage points year-on-year and 1.7 percentage points quarter-on-quarter. Specifically, the automotive gross margin was 14.3%, an increase of 7.9 percentage points compared to the same period in 2024, marking eight consecutive quarters of growth.

At present, XPeng Motors is still operating at a loss, which is partly related to the increase in its R&D investment. In the second quarter, XPeng’s R&D expenses were 2.21 billion yuan, a year-on-year increase of 50.4% and a quarter-on-quarter increase of 11.4%. Selling, general, and administrative expenses were 2.17 billion yuan, up 37.7% year-on-year and 11.4% quarter-on-quarter. Net other income was 240 million yuan, down 14.9% year-on-year and 56.4% quarter-on-quarter.

As of June 30, 2025, the company's cash and cash equivalents, restricted cash, short-term investments, and time deposits amounted to 47.57 billion yuan.

He Xiaopeng, Chairman and CEO of XPeng Motors, stated: "In the second quarter of 2025, all core business and financial indicators of XPeng Motors, including sales, revenue, gross margin, and cash on hand, reached historic highs. We have fully completed the upgrade of our new generation intelligent and electrification technology platform by 2025, creating a significant technological gap with our competitors. This will generate stronger momentum in our major product cycles and accelerate scale growth."

Looking ahead to the third quarter, XPeng Motors expects deliveries to be between 113,000 and 118,000 units, representing a year-on-year increase of 142.8% to 153.6%; total revenue is expected to be between 19.6 billion and 21 billion yuan, a year-on-year increase of 94% to 107.9%.

On August 19th, XPeng Motors' Hong Kong stock closed at HKD 77.05 per share, up 57% from HKD 49 at the beginning of the year.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track