"xpeng, nio, and li auto break price floor"

To survive is the primary task, and lowering prices is just the first step to survive.

In the past decade, "NIO, XPeng, and Li Auto" have consistently been the "trendsetters" in the Chinese automotive market and have truly reaped the benefits of the transition to electrification.

Recently, all three have entered a critical product launch cycle and have coincidentally adopted the same strategy—price reduction.

NIO's Le Tao, after most consumers choose the BaaS battery rental plan, the actual price of the L60 has fallen to the 150,000 yuan range. Even for its flagship large model L90, the price is basically just over 200,000 yuan, demonstrating a strong value for money.

If Le Tao is the essential volume driver under NIO, then the models of NIO's main brand, especially after the pre-sale of the third-generation ES8, have seen a price drop ranging from over 80,000 to over 200,000 compared to the old models. With the BaaS battery rental plan, the ES8 has become a model starting at over 300,000 yuan. This high-end brand, which once benchmarked against BBA and whose founder William Li repeatedly emphasized would not lower prices, has completely torn off the "no price reduction" label.

Certainly, here's the translation: "Isn't it the case with ideals as well? After the initial failure of the i8 launch, the company quickly lowered the price of the i8, reducing it directly to 339,800 yuan. As a member of the ideal's 8 series, the i8's price is clearly lower than that of the L8. It is indeed surprising that an electric car of the same level is priced lower than a range-extended car, which challenges the previous perception of the ideal's pricing system."

The upcoming Li Auto i6 is bound to learn from the pricing lessons of the i8. To counter AITO's erosion of Li Auto's market share in the extended range market and to salvage the current poor delivery figures, the price of the i6 is likely to be lower than that of the L6, completely breaking through the lowest price of Li Auto's existing models.

Xpeng naturally goes without saying, as it was the first emerging force to initiate a price reduction. In the past, Xpeng was generally perceived as having an average price above 200,000 yuan, but with the launch of the MONA M03, it directly dropped to the 110,000-140,000 yuan level, becoming the core support for Xpeng Motors' sales. Including the new generation P7, its starting price is as low as 219,800 yuan, which is equivalent to the configuration level of nearly 300,000 yuan in the past.

The leading trio of new forces collectively turning to low prices is not an "active concession," but rather a helpless move as market competition enters a "life or death stage." When price cuts become the most direct and effective means of breaking the deadlock, the "price bottom line" of the new forces ultimately succumbs to the "pressure of survival."

"Three consecutive price cuts by NIO, XPeng, and Li Auto"

Let's first turn our attention back to July 29th, when the Li Auto i8 first unveiled its mystery.

This pure electric six-seater SUV is supposed to shoulder the heavy responsibility of pioneering a new path for this emerging car manufacturer. However, judging from the market feedback after its launch, the outlook is not promising. The fundamental reason behind this is the pervasive sense of ambivalence, whether it be in pricing or SKU segmentation.

Fortunately, a week later, Ideal came to its senses and made amends.

The i8 completely eliminates the Pro version, making the Max version the standard configuration, and adjusts the price from 349,800 yuan to 339,800 yuan. At the same time, a platinum sound system worth 10,000 yuan is provided as a gift, and a rear cabin entertainment screen set worth 10,000 yuan is offered as an option.

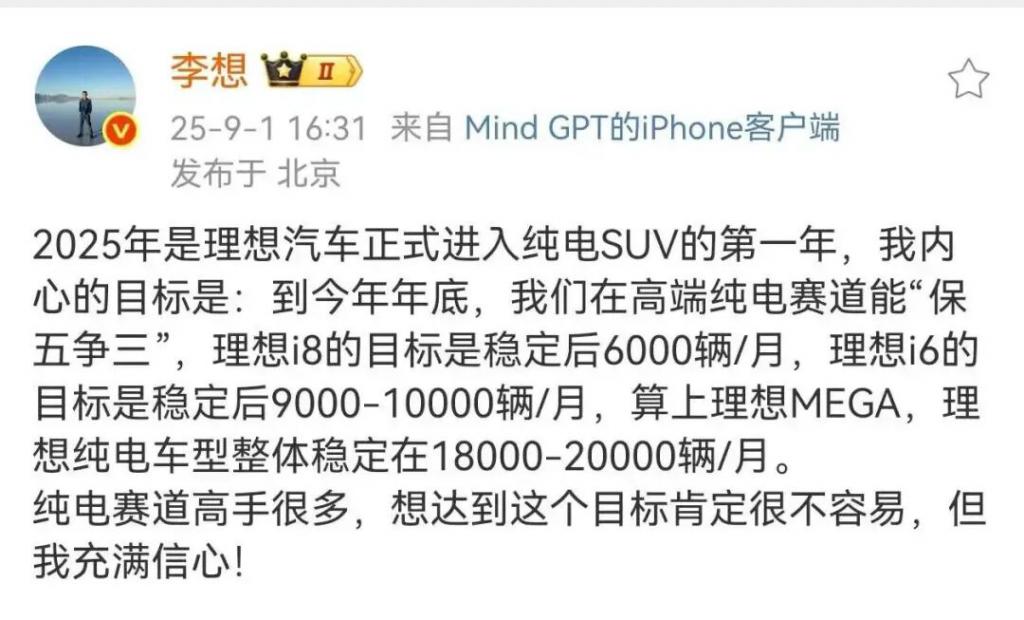

With the occurrence of major adjustments, Li Xiang, as the helmsman, offered his reflections.

"We deeply feel the affection of a large number of users for high-end configurations, but the most common complaint is that the model versions are somewhat complex and difficult to choose from, and some high-end configurations are not supported for optional selection. Previously, the i8 continued the version configuration characteristics of the L8, which shows we were stuck in a mindset of inertia."

The surface meaning of these few dozen words is not difficult to understand. Looking deeper, there is actually an undercurrent belonging to this new force in car manufacturing.

Starting with the i8, the ideal entire pricing system may be overhauled and reshaped. For instance, the i6 coming this month can already be expected to continue the "full configuration + fierce competition" strategy. Next year, during the generational switch window, the entire L series is likely to reposition several SUVs.

Coincidentally, a similar scenario was also played out with XPeng. On August 27th, not long ago, the all-new generation P7 was officially launched.

All models are equipped with three Turing chips, dual-chamber air suspension, and a 5C ultra-fast charging battery, undoubtedly making everyone strongly feel the full sincerity of this brand's "flagship" pure electric sports sedan.

Unexpectedly, the new generation P7 series is priced at only 219,800 to 259,800 yuan. Facing the fiercely competitive Chinese car market, XPeng has shown its utmost determination to boost sales.

However, in essence, it also reveals a sense of helplessness.

Years ago, the top version of the first-generation P7 was once sold for over 400,000 yuan. Consequently, looking at other currently available products from this new car-making force, from the G6 to the G9, they have also seen significant official price reductions following the launch of new models.

Not to mention the core MONA M03, which currently supports Xiaopeng's sales, its price has already entered the price range of value-for-money brands like BYD, Geely, and Leapmotor. As a friend of mine put it, "Due to various reasons, Xiaopeng's main sales range has now retreated to below 250,000 yuan or even 200,000 yuan, gradually becoming a mainstream mass-market brand."

The reality is somewhat heart-wrenching. But to stay at the table and retain the qualification for the final competition, the restructuring of the pricing system is unavoidable.

In contrast, NIO is currently in a similar situation.

On August 29th, at the Chengdu Auto Show Media Day, it was initially thought that this new car-making force would just make a brief appearance. However, it unexpectedly announced, risking backlash from existing car owners, that all models on sale from the NT2 platform will now come standard with a 100 kWh long-range battery pack, without any increase in price.

The above means a disguised official price reduction of 38,000 yuan.

Certainly, from NIO's perspective, implementing this policy is imminent. As for the real "catalyst" behind it, we have to go back to August 21st, when the all-new ES8, born on the NT3 platform, was officially announced for pre-sale starting at just 416,800 yuan. With the BaaS (Battery as a Service) car-battery separation scheme, the price further drops to 308,800 yuan.

At that time, a storm concerning the restructuring of the entire product line's pricing system was gradually unfolding.

If all goes as planned, the final offensive for the all-new ES8 at this month's NIO Day will undoubtedly be even more intense. After all, to achieve the company's goal of profitability in the fourth quarter, this pure electric large three-row SUV must sell exceptionally well while also playing the role of a profit-generating vehicle.

The price war of the new forces has just begun.

Last week, I had the privilege of having a face-to-face conversation with Li Bin, during which he provided an explanation on the topic.

The all-new ES8 is an anchor model. In fact, the first-generation ES8 was also an anchor model, as it had the highest sales and the best gross profit at the time. The second-generation ES8 deviated from this anchor, pushing the total cost in various aspects to over 500,000 yuan. Now, the all-new ES8 has once again become an anchor model, and in the future, the pricing and technical platform of all products will be repositioned based on this anchor model, that's for sure. This is also one of the reasons why we recently made the 100 kWh battery a standard feature.

In the author's view, similar to the situation faced by competitors Li Auto and XPeng, such a choice is also filled with a sense of having to compromise with the broader environment.

Last week, NIO was criticized by car owners and public opinion for "NIO's price cuts disregarding the feelings of old car owners." However, NIO's response was: if they do not choose to lower prices across the board this year, they will face a dead end. In the face of the test between harming the interests of old car owners and survival, NIO resolutely chose the latter.

On the contrary, recognizing and positioning oneself in the new place within the Chinese automotive market will resolve many difficulties.

Seeing this, after explaining the recent actions of "Wei Xiaoli," don't you think it's very appropriate to describe their situation at the beginning as "forced to restart"? The reshaping of the pricing system is ultimately a result of extreme internal competition.

The collective breaking of price floors by NIO, XPeng, and Li Auto is not a "strategic transformation," but rather an inevitable choice as market competition enters a "life or death stage," driven by the combined pressures of "peaking growth, competitor encirclement, and profit pressure." Furthermore, the current "Matthew Effect" in the Chinese automotive market has reached an unprecedented level.

For example, at this year's Chengdu Auto Show, when you see the "Five Realms" lineup under Hongmeng Intelligent Mobility, ranging from hundreds of thousands to over a million yuan, it can dominate the market. For instance, when Lei Jun merely presented the SU7 and YU7 cards, he could easily secure hundreds of thousands of major orders, with terminals completely in short supply. Furthermore, despite the skepticism around the Model Y L, it can still achieve high sales thanks to Tesla's aura...

Although reluctant to admit it, industry resources are still concentrating towards the leading frontrunners.

For players like "Weixiaoli," even though they have been deeply involved in the industry for over 10 years and seem to have established a certain moat, they still have to accept the outcome that "everything is in vain" when faced with a dimensionality reduction attack.

The same principle applies: "When the giants enter the arena, it's terrifying." When Huawei and Xiaomi enter the market with their strong brand appeal, when BYD and Geely confront the new energy sector with extreme scalability and technological reserves, and when traditional joint venture brands make a comeback with their deep financial resources, the pressure left for the new forces can be described as wave after wave.

In order to counter their relentless onslaught, relatively weaker brands can only make significant adjustments to their original strategic layouts, using "price wars" to avoid direct confrontation, fight fire with fire, and seek self-preservation.

The original price positioning of Weixiaoli, set at two to three hundred thousand yuan, is driven by the dual forces of emerging trends and new energy, and its product strength and user insights are indeed ahead. By lowering the price, it is bound to achieve a good harvest. However, this may just be the last move by the new forces.

After all, although price cuts can quickly boost sales, for companies like NIO, XPeng, and Li Auto, it is a "double-edged sword" that may trigger a series of chain reactions. In particular, the relatively high-end price positioning may be diluted by lower prices, leading to a loss of user trust due to the impact on the resale value for existing car owners. Whether exchanging price for volume can truly alleviate the pressure on profitability remains a question...

From the Ideal i8, to the new generation XPeng P7, and then to the all-new NIO ES8, all are undoubtedly using their actions to illustrate the stark reality of "giving up illusions and recognizing reality." In the future, the competition among new forces will be more brutal: prices will further decrease, technology will iterate faster, and users will be more discerning. The price cuts by Li Auto, XPeng, and NIO are not the "end," but the "beginning." From Li Xiang to He Xiaopeng to Li Bin, the mindset of these three leaders is no longer about "struggling with whether to cut prices," but about "how to live better after the price cuts."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track