Why Don't China's Auto Workers Have Money?

Happiness is like a butterfly; the more you chase it, the farther it flies.

Before he had a chance to verify whether this sentence was actually from Nathaniel Hawthorne, 26-year-old Fang Qi (a pseudonym) let out a deep sigh. He was pondering whether his dream of buying a car had come closer or drifted even further away.

"The price of the Model 3 Long Range Rear-Wheel Drive version has been reduced from 269,500 yuan to 259,500 yuan, a decrease of 10,000 yuan," announced Tesla China's official website. It stands to reason that Fang Qi, who has long yearned for the Model 3, should be overjoyed with the price reduction.

However, he himself is also a car salesman. "All the cars are being sold at a big discount, commissions are becoming harder to earn, and last month I only received the base salary. The car prices are dropping slower than my salary, so how can I afford to buy one?"

So we could only watch him sit down silently, close the "Order Now" page of the Tesla app, and instead open Lianjia, trying to choose a relatively cheaper rental between Lanting Yayuan and Ping'an Pinglu Community.

"Putting a brake on the price war" has already become the national stance, but the numbers indicate that the "brake is not complete."

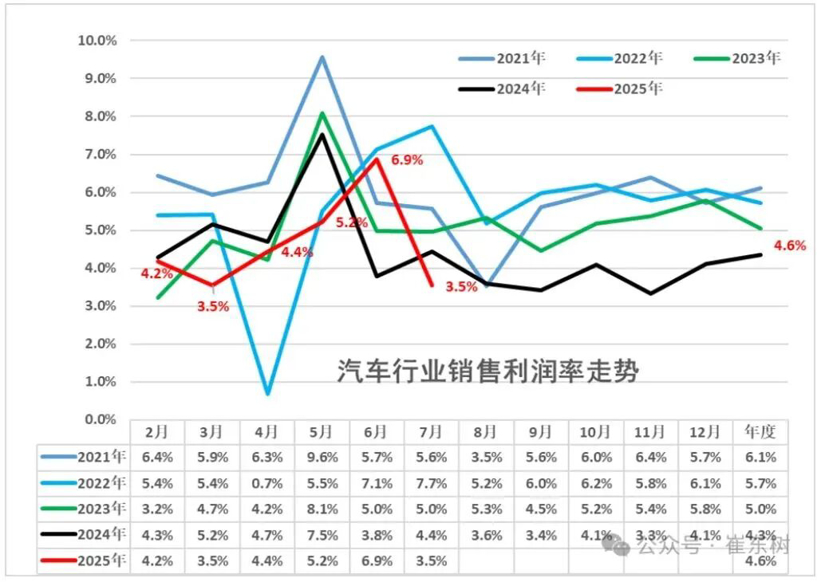

In July 2025, the profit margin of the automobile industry was 3.5%, reaching a recent low. Meanwhile, the extent of price reductions in the auto industry in July increased compared to June, even though it slowed down relative to July of last year.

Bloomberg published an article titled "Chinese Automakers Largely Ignore National Call to End Fierce Price War." Although we don't have the time to consider whether this tone is sarcastic or purely a rational observation, the pain from the price war's internal competition has indeed not yet dissipated.

"The golden age of the automotive industry is over," many veterans lament. From the golden opportunities for automotive companies' development to the tales of media receiving tens of thousands of yuan in travel expenses at a car show, these have gradually transformed into anecdotes and stories.

For the general public, they may not be car manufacturers or automotive media, but each of them could be someone like Fang Qi—car prices have indeed dropped, yet the dream has become more distant.

The stock market has risen, but the car market continues to decline.

Is the car market in July rising or falling?

According to narrow-sense passenger vehicle retail sales, there was a year-on-year increase of 6.3% to 1.826 million units.

Mr. He shook his head, "The concept of the car market shouldn't only be about sales. Think about the stock market—recently, the A-shares have been doing quite well. People never measure the stock market by trading volume, but rather by price. Although the car market focuses on scale, it should also consider price."

Based on this line of thinking, the car market in July would be hard to grow.

From the end of May, when the China Association of Automobile Manufacturers issued an initiative opposing price cuts and advocating for order maintenance, to the State Council Executive Meeting in July proposing enhanced cost investigations, price monitoring, and control over car companies’ payment terms, these all underscore the government's stance—the price war and excessive competition in the car market need to be put on the brakes.

Some brands indeed once drove a wave of "car price recovery," but overall, the price reduction for cars in July showed no significant signs of slowing down, only a slight easing.

This contradiction has even attracted the attention of overseas media.

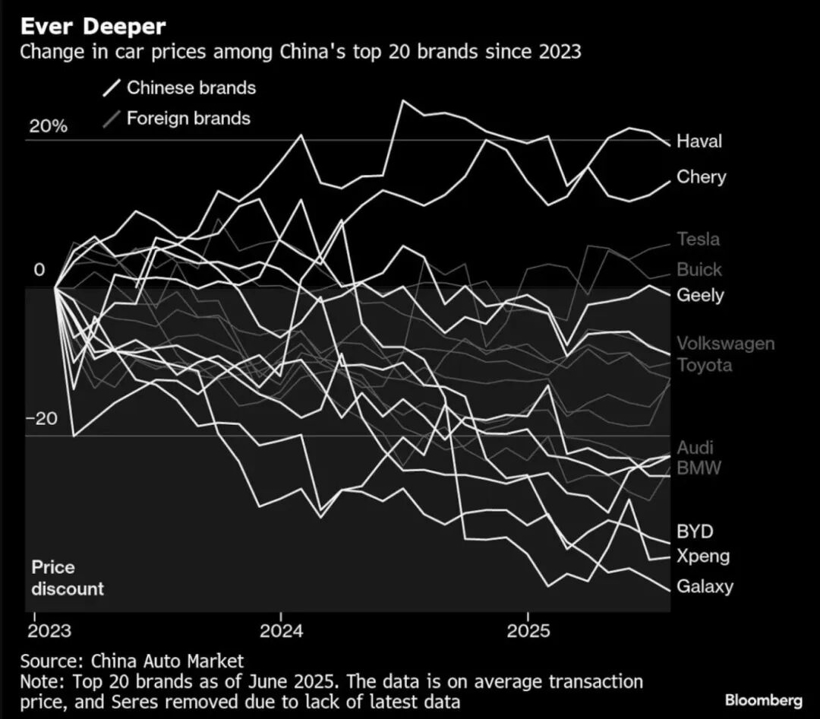

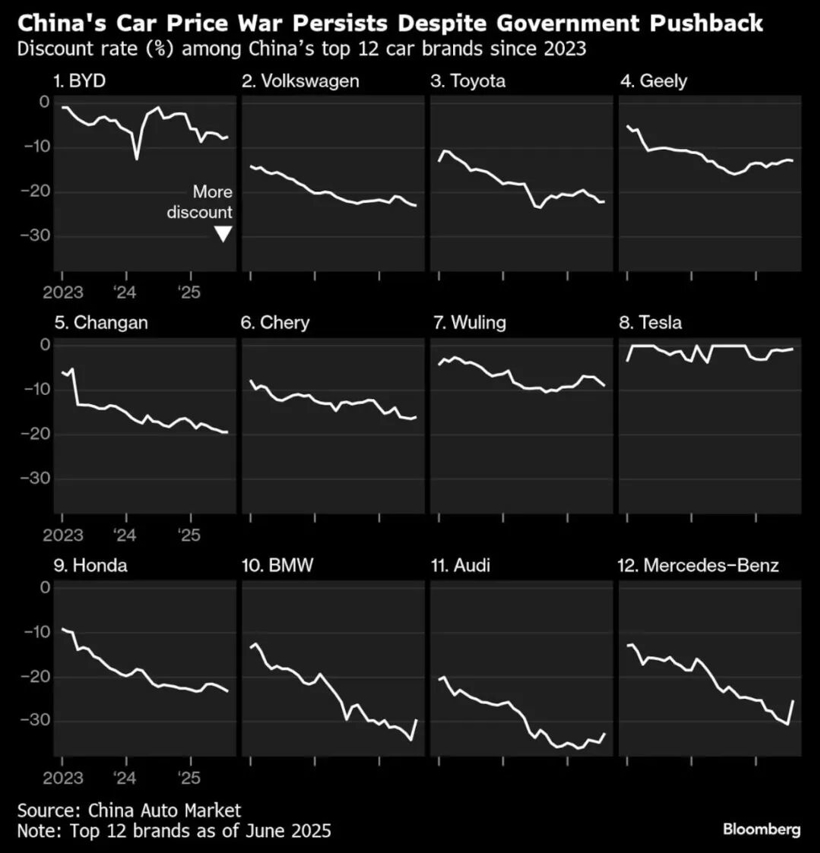

Bloomberg displays a line chart showing that until June 2025, brands such as Haval, Geely, and BYD maintain high discount levels.

China’s campaign to eliminate the fierce electric vehicle price war seems to have had limited effect. Among the top 20 car brands in the Chinese market, they have either maintained their discounts, increased discounts in July, or only slightly reduced them. As Bloomberg wrote, “Since automakers are still struggling with overcapacity and weak consumer confidence, seven brands are still offering even bigger discounts.”

As BYD, positioned in the middle of the involution vortex, the discount rate is actually recovering. According to Bloomberg data, the discount rate was 7.9% in June and 7.5% in July, but the improvement was not significant.

Domestic institutional statistics are more comprehensive and accurate.

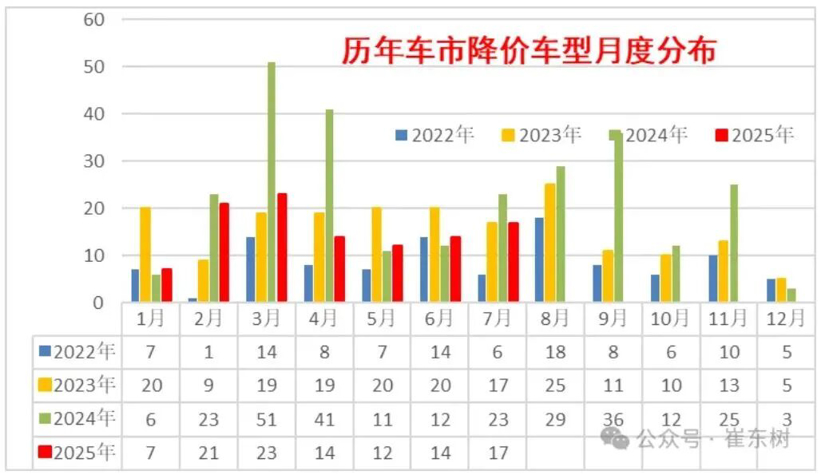

According to the table from Cui Dongshu, Secretary-General of the China Passenger Car Association, 17 car models will have price cuts in July 2025. Although the number is less than that in February-March this year and the same period in July last year, it is already higher than that in April-June.

Although it is generally believed that new energy vehicles have larger price reductions, gasoline vehicles also saw price cuts in July: among the 17 models with price reductions, 7 were gasoline vehicles, 2 more than the 5 in June 2025; there were 0 hybrid gasoline vehicles; 2 plug-in hybrid vehicles, the same as last month; 1 extended-range vehicle, unchanged from last month; and 7 pure electric vehicles, 1 more than the 6 last month.

Chart | Number of Car Models with Price Reductions by Month

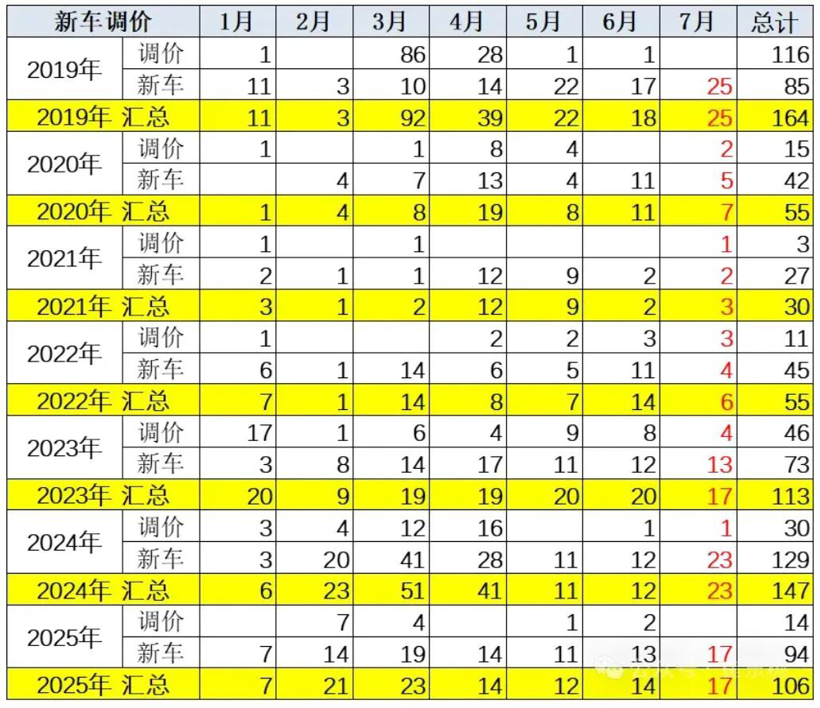

However, based on the cumulative number of discounted models from January to July, the number of discounted models in 2025 is decreasing, especially as fuel vehicles largely stop reducing prices, which has become a source of profit for many car companies.

According to statistics, the number of car models with price reductions from January to July was around 50 models from 2020 to 2022. This number increased to 113 models from January to July in 2023, further rose to 147 models in the same period in 2024, and then narrowed to 106 models from January to July in 2025.

Graph | Total Number of Price-Reduced Car Models Over the Years

Conventional fuel vehicles saw price reductions in 28 models, 21 fewer than the same period last year, making this the key factor affecting the total number. From January to July 2025, hybrid fuel vehicles saw price reductions in 3 models, 7 fewer than the same period. From January to July 2025, plug-in hybrid vehicles saw price reductions in 20 models, 5 fewer than the same period. From January to July 2025, extended-range vehicles saw price reductions in 9 models, remaining the same as the same period. From January to July 2025, pure electric vehicles saw price reductions in 46 models, 8 fewer than the same period.

Research data from Fulan Automotive CAM shows that discount rates for models such as BYD Qin PLUS range from approximately 9.6% to 12.5%, while the discount rate for the Landu Dreamer ranges from 4.7% to 15.2%.

There is also news indicating that, in addition to these statistics on direct discounts, for products like the Xiaomi SU7 where the discount rate is recorded as 0, after combining national subsidies and interest-free incentives, a discount of 42,000 to 46,000 yuan can be enjoyed, reducing the actual price of the standard version to 178,300 yuan.

Price wars severely impact automakers

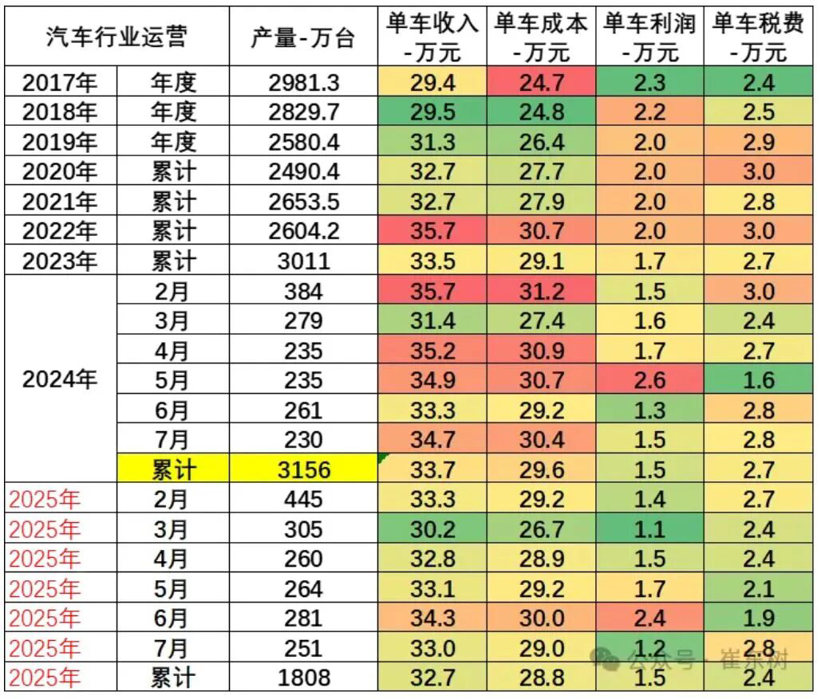

The least profitable years for China's automobile industry have arrived.

According to data from the China Passenger Car Association, the automotive industry's revenue in July was 827.5 billion yuan, up 5% year-on-year; costs were 727.6 billion yuan, up 5%; profits were 29.3 billion yuan, down 17% year-on-year. The automotive industry's profit margin was 3.5%, showing a significant decline compared to June, and also down from 4.4% in July of last year.

Graph | Monthly Profit Levels

A profit margin of 3.5% is at what level? This year, only February matched this level, and in recent years, there have been only four months with a margin below or equal to this level.

In a longitudinal comparison, it is important to note that the profit of China's automotive industry in 2024 is considered "not strong," yet the sales profit margin still reached 4.3%. From 2021 to 2023, the profit margins of the automotive industry were 6.1%, 5.7%, and 5.0%, respectively.

In a horizontal comparison, from January to July 2025, the automobile industry's revenue was 5,919.3 billion yuan, an 8% year-on-year increase; costs were 5,205.6 billion yuan, up 8%; profits were 273.7 billion yuan, a 0.9% year-on-year increase; the automobile industry's profit margin was 4.6%, while the profit margin of downstream industrial enterprises was 5.9%.

Compared with the global industry, in the first quarter of this fiscal year (April to June 2025), Toyota's revenue increased by 3.5% year-on-year to 12.25 trillion yen, operating profit decreased by 11% to 1.17 trillion yen, and net profit plunged by 37% to 841.4 billion yen. This results in an operating profit margin of 9.5%. Although this is lower than the 11.1% in the same period last year, it is significantly higher than the 4.6% profit margin of the Chinese automobile industry.

"For Chinese automakers, it naturally means not being able to make money, so they are leaving one after another."

News of whole vehicle companies undergoing bankruptcy and restructuring seems to tell a similar story almost every year: WM Motor in 2023, HiPhi in 2024, Nezha Automobile in 2025... not to mention the already consolidated traditional fuel vehicle companies like Lifan and Changfeng.

The sales channel, known as the "blood vessel" of the automotive industry, is also under immense pressure.

According to statistics from the circulation sector, in the first half of this year, over 1,200 4S dealerships were on the brink of closure, and only 27.5% of them met their sales targets, with more than 70% of dealers deeply mired in the struggle to meet their goals. Last year, over 4,400 4S dealerships nationwide went offline, equivalent to 12 stores disappearing every day. The industry's loss ratio exceeded 50%, and the scale of 4S dealerships experienced its first negative growth since 2021.

The roots of the industry chain—the suppliers—are also complaining.

"The payment terms from vehicle manufacturers are getting longer and longer. Even though the government has set a 60-day limit, there are still loopholes to exploit," complained a friend who works for a large supplier. "But companies as big as ours are relatively better off; many small suppliers in East and South China have already shut down."

Thus, inverted yield curve phenomena also appeared one after another.

Fuel vehicles, once regarded as a symbol of backwardness, have actually become the main profit drivers for many car companies. For example, after SAIC-GM gave up pursuing sales volume, it focused on the Buick GL8, which in turn improved its profit situation.

Joint venture brands and traditional luxury brands, which are often seen as slow in technological advancement, have instead taken the lead in slowing down price reductions, either for subjective or objective reasons. According to statistics, the average selling prices of Mercedes-Benz, BMW, and Audi all rebounded in July. On one hand, this is related to the demand for maintaining brand value; on the other hand, it is due to adjustments in the financial sector by the government, with the resulting costs being passed on to terminal prices.

Involution: Black and White Sides

"In the automotive industry, many of our numbers look good, so why is life still so tough?" a colleague from the industry asked.

"Because of the big price cuts, car companies have no profit, and consequently, suppliers, subcontractors, and media all see their incomes decline." I thought to myself, you are asking a question you already know the answer to.

"Why do cars have to be drastically reduced in price?" he kept asking.

Due to the global and domestic economic downturn and weak consumer purchasing power, in order to maintain the scale and liquidity of the automotive industry, it is necessary to reduce prices to match consumer affordability.

"Why should the automotive industry be the one to bear this?" This grievance is not his alone.

"Because real estate is no longer effective, automobiles are the only lever that can drive a large number of upstream and downstream industries." My view remains the same as always.

"Why are the global and domestic economies declining?" My friend simply insisted on getting to the bottom of the matter.

“Humanity has developed at a slow pace for a long time; the rapid development in the decades after the war is an exception—it's just that we've gotten used to it now.”

Human development is inseparable from technological revolutions, whether in terms of the economy or cognition.

The current technological revolution at the societal level has encountered a bottleneck. The extent of human capability depends on the magnitude of energy control, as well as efficiency and precision. So far, there have been only two true energy revolutions, both linked to industrial revolutions. The first was the steam engine-chemical energy revolution, and the second was the electrical energy revolution.

The controllable output of electrical energy in a single instance, as well as its control precision, is much higher than that of chemical energy. As for the third industrial revolution brought about by computers and intelligence, it essentially optimized the efficiency of energy and information control. For nuclear energy to become the third energy revolution, breakthroughs in controllable nuclear fusion are still needed.

Without realizing an energy revolution, how can we expect the entire society to make great strides forward? How can people's living standards improve rapidly day by day? It should be noted that the over-expectation of growth in recent years has precisely caused a backlash effect.

Understanding this truth makes it easy to comprehend why "our lives are so hard right now."

The essence of the price war and internal competition lies in the fact that, when the overall macroeconomic situation is declining and only the automotive industry is holding up, prices are forced to drop in order to maintain overall business liquidity and scale, thereby preserving jobs and operational vitality. This price adjustment aligns with consumers’ weakened purchasing power and lack of confidence in spending.

The other side of "involution" is called "competition"; together, the two forge a double-edged sword.

A single sword enables Chinese cars to change lanes and overtake, as electrification and intelligence drive the rapid rise of Chinese automobiles, enough to stand proudly among the century-old global automotive giants.

A single sword puts pressure on China's automotive industry, causing intense internal competition and leaving wounds bleeding profusely at every stage, with pain reaching the bone.

Chinese auto industry professionals, why are you short of money? Fierce internal competition is only a simple answer. Trying to catch up with a century of Western accumulation in just ten years, exchanging space for time, you will naturally find that the shortcut is full of thorns, and your feet, running at full speed, are already covered in scars.

We cannot avoid catching up and competing, but we should also give people in the automotive industry a chance to catch their breath.

Last year, the China Association of Automobile Manufacturers opposed "malicious price cuts," which drew widespread mockery from consumers. After all, at that time, most end consumers just wanted to enjoy the benefits of buying cars at lower prices. However, as more people became employed in the automotive industry and more families were connected to automotive workers, the bloodshed of this intense competition increasingly spread to thousands of households.

This year, the China Association of Automobile Manufacturers' "anti-involution" campaign has no longer been met with any abusive voices.

Ultimately, the landscape of the automotive industry is expanding, and the empathy among people in the automotive sector is broadening. But as for the pace of competition in the automotive industry, when will it become more rational and more composed?

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track