Wanhua chemical takes frequent actions: Completes Equity Transfer, Publicizes Two Major Projects, Establishes New Company...

Middle East "giant" buys a stake

On September 24th, the equity delivery meeting for the C3 integrated industrial chain joint venture project between Wanhua Chemical and Kuwait Petrochemical, as well as the signing ceremony for the strategic joint venture cooperation agreement for the C2 integrated industrial chain project, was held in Yantai.

Image source: Deep Sea Finance

On September 3, Wanhua Chemical announced that Kuwait Petroleum Industries Company (PIC) has invested $638 million (approximately 4.55 billion RMB) in its subsidiary Wanhua Chemical (Yantai) Petrochemical Co., Ltd., acquiring a 25% stake in the company.

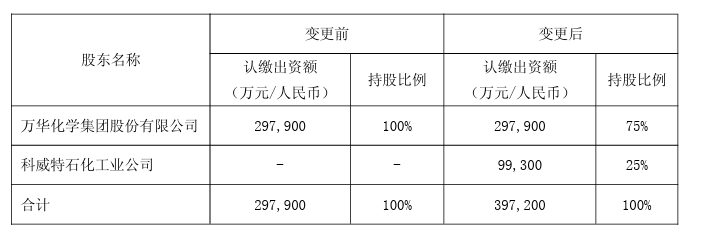

The announcement shows that PIC completed the payment on August 28, and the relevant industrial and commercial change registration was completed on September 3. After this change, the registered capital of Wanhua Chemical increased from 2.979 billion yuan to 3.972 billion yuan. In terms of equity, Wanhua Chemical holds 75% of the shares with a subscribed capital contribution of 2.979 billion yuan; Kuwait Petrochemical holds 25% of the shares with a subscribed capital contribution of 993 million yuan. Along with the adjustment of the equity structure, the senior management of Wanhua Chemical has also changed.

Wanhua Chemical stated that this cooperation aims to enhance the security of raw material supply for its petrochemical business, diversify the operational risks of the petrochemical business, accelerate the company's internationalization process, support the national "Belt and Road" initiative, and assist Kuwait Petroleum Corporation in its "oil conversion" efforts.

In March this year, the capital increase and share expansion project of Wanhua (Yantai) Petrochemical was listed on the Shandong Property Rights Exchange Center. On April 25, Wanhua Chemical and Kuwait Petrochemical officially signed a joint venture agreement. Prior to this, Kuwait Petrochemical had completed the delisting procedure at the Shandong Property Rights Exchange Center.

In 2013, Wanhua Chemical signed a long-term LPG supply agreement with Kuwait Petroleum Corporation, becoming the first Chinese company to directly participate in the allocation of Middle Eastern LPG resources. Over the years, this cooperation has ensured the stable operation of Wanhua's Yantai petrochemical facilities and has also made Wanhua Chemical the first Chinese company to have the right to recommend CP prices.

Wanhua Chemical (Yantai) Petrochemical Co., Ltd. was established in 2015 and is a wholly-owned subsidiary of Wanhua Chemical Group. Its core assets include production facilities for high value-added chemicals such as propylene oxide, tertiary butanol, acrylic acid, and butyl acrylate.

The parent company of Kuwait Petrochemical Industries Company (PIC) is Kuwait Petroleum Corporation (KPC). KPC was established in 1980 and is one of the world's major oil energy groups, responsible for the exploration, production, and sale of all hydrocarbon resources within Kuwait. Currently, its LPG (Liquefied Petroleum Gas) export volume is approximately 4.5 million tons per year, and its naphtha production is about 10 million tons per year, with operations spanning six continents. PIC is primarily responsible for the management and expansion of KPC's petrochemical business.

Two major projects announced

-

Battery-grade sulfate expansion and technological transformation project announcement

On September 23, Wanhua Chemical (Yantai) Battery Materials Technology Co., Ltd. announced the expansion and renovation project of its battery-grade sulfate facility.

The project intends to renovate the existing battery-grade sulfate facility within the existing plant area of Wanhua Chemical (Yantai) Battery Materials Technology Co., Ltd. in the Yantai Chemical Industry Park, Shandong Province. Using nickel-cobalt hydroxide, crude nickel sulfate, cobalt hydroxide, nickel and nickel-iron alloy, lithium-extracted battery black powder, and other materials as raw materials, the project aims to produce battery-grade sulfate products. Based on the capacity expansion and technical transformation in 2024, the project will optimize bottleneck processes and continue to increase production capacity. Upon completion, the project will produce 101,300 tons of nickel sulfate hexahydrate crystals, 24,000 tons of cobalt sulfate heptahydrate crystals, 9,500 tons of manganese sulfate monohydrate, 7,500 tons of crude nickel hydroxide, 50 tons of crude scandium, 250 tons of scandium oxalate, 5,700 tons of crude manganese carbonate, 7,960 tons of crude magnesium carbonate, and 1,800 tons of crude zinc carbonate. Additionally, by-products will include 5,000 tons of crude manganese dioxide, 300 tons of sponge copper, and 20,000 cubic meters of manganese chloride solution.

Wanhua Chemical (Yantai) Battery Materials Technology Co., Ltd. is an enterprise that integrates the research and development, production and operation, and comprehensive resource utilization of processes such as acid leaching of cobalt, nickel, manganese, and lithium metals, solvent extraction separation, and evaporation crystallization.

For the strategic layout of battery materials, projects have recently commenced at both the Wanhua Sichuan Base and the Wanhua Haiyang Industrial Park.

Regarding the reasons for this expansion, Wanhua stated: First, to address the difficulties in raw material supply for precursor production facilities and the high prices of certain raw materials in the market, while utilizing by-products such as hydrochloric acid, liquid alkali, and sulfuric acid produced at Wanhua's Yantai Industrial Park as chemical auxiliaries to reduce production costs. Second, to utilize Wanhua Chemical's battery-grade sulfate production technology to resolve the instability or excessive levels of magnetic substances and other indicators in market battery-grade sulfates, ensuring stable quality of the precursor products produced. Third, to recycle the lithium-depleted black powder generated from the production of precursor and cathode materials, as a raw material for this project, processing it into battery-grade sulfates. This will form a closed-loop production system for elements such as nickel, cobalt, manganese, and lithium within Wanhua Chemical's battery materials business, enhancing core technological competitiveness.

-

220,000 tons/year SEP Project Announcement

On September 17, Wanhua Chemical Group (Penglai) High Performance Materials Co., Ltd. released the draft for public comments on the Environmental Impact Report for the 220,000 tons/year SEP project.

This project plans to be located in the Wanhua Penglai Industrial Park within the Penglai Chemical Industry Park in Shandong Province. It will utilize raw materials such as styrene, butadiene, methyl methacrylate, and butyl acrylate produced by the Wanhua Yantai Industrial Park's integrated ethylene project. The project will adopt its independently developed emulsion grafting - bulk SAN blending process to produce ABS and ASA. Once completed, it will produce a total annual output of 220,000 tons, including 200,000 tons of ABS materials and 20,000 tons of ASA materials.

As of the end of 2024, China's total ABS production capacity will reach 9.165 million tons per year, but the capacity utilization rate is only 60%. Currently, the major manufacturers include Zhejiang Petrochemical (1 million tons/year), LG Yongxing (930,000 tons), Zhenjiang Chimei (850,000 tons), Ningbo Taihua (750,000 tons), Liaoning Kingfa, INEOS Styrolution, Jilin Petrochemical, LG Huizhou, Tianjin Dagu, Lijin Petrochemical, Hengli Petrochemical, among others.

Establish Yantai Wanhua Electric New Materials Co., Ltd.

Recently, Yantai Wanhua Electric New Materials Co., Ltd. was established. The company is jointly held by Wanhua Chemical, Beijing Huairou Laboratory Technology Achievement Transformation Co., Ltd., Yantai Zhongtao Investment Co., Ltd., and Orient Cable.The registered capital reaches 110 million yuan, and the business scope includes new material technology promotion services, synthetic material manufacturing (excluding hazardous chemicals), etc.

Shareholder Information, Image Source: Aiqicha

As early as 2021, the first demonstration project utilizing domestically produced nylon 12 cable material, jointly developed by Orient Cable and Wanhua Chemical, was officially connected to the grid at the Wanhua Chemical Ningbo Chlor-Alkali 110kV cable. Meanwhile, the "Wanhua Chemical-Orient Cable Joint Innovation Laboratory" was established. Wanhua Chemical has made arrangements in polymer materials for cables such as XLPE, TPU, POE, and PA12.

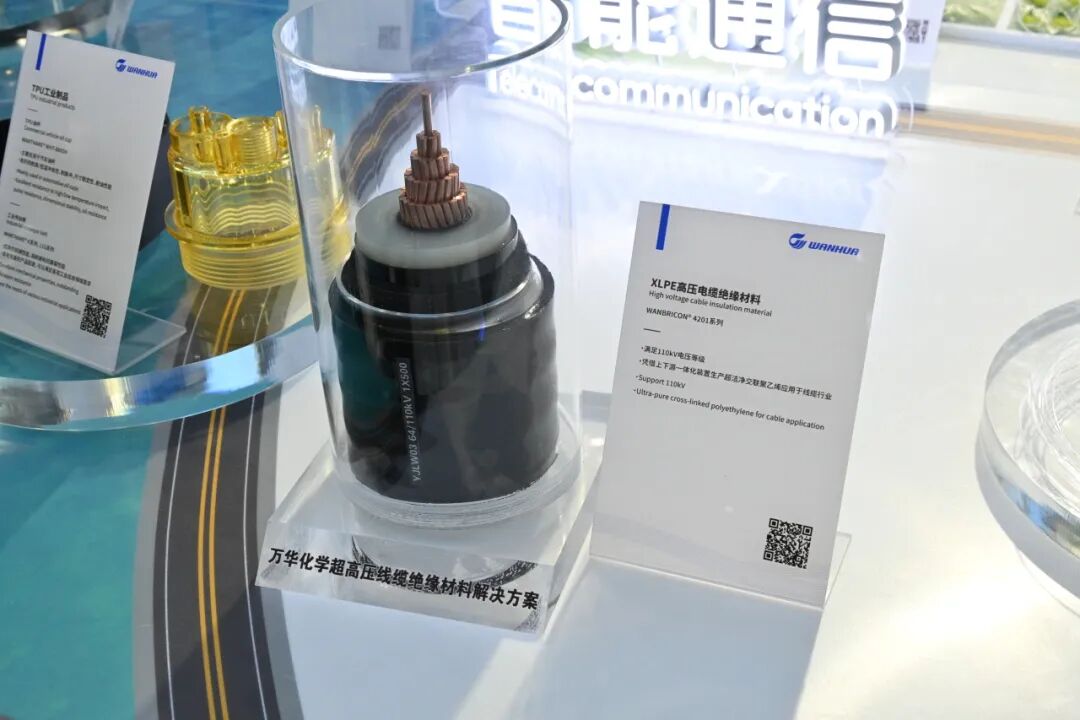

In April 2024, at the Chinaplas 2024 event, Wanhua Chemical reached a strategic cooperation with Orient Cable and TBEA to promote innovation and development in the field of high-voltage cable insulation materials (such as XLPE products). This collaboration aims to meet the rapid demand of the high-voltage cable industry driven by the rapid development of new energy vehicles and offshore wind power.

Wanhua Chemical Chinaplas 2024 showcases XLPE product applications, filmed with new chemical materials.

It is reported that at that time, Wanhua Chemical had successfully conducted pilot production of ultra-high voltage grade XLPE products.

XLPE (cross-linked polyethylene) is a type of thermosetting resin made from polyethylene cross-linking, characterized by stable chemical properties and excellent low-temperature resistance. It can resist acid and alkali corrosion and serves as a high-quality electrical insulating material, widely used in medium and high voltage transmission and distribution networks.

Currently, the core global manufacturers of this material include companies such as Dow, Borealis, Zhejiang Wanma Polymer Materials, Avient, and Solvay. In China, it is still considered a "bottleneck" new material.

In addition, in May 2022, Wanhua Chemical (Fujian) New Material Co., Ltd. and Wanma Co., Ltd.'s subsidiary, Wanma Polymer Group, jointly invested approximately 1 billion yuan to build the "Wanma-Wanhua Upstream and Downstream Integration Project," primarily aiming to construct an annual total production capacity of 600,000 tons for eco-friendly cable polymer materials.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track