Wanhua Chemical Expands Against the Trend! World's No. 1 in Production Capacity! What Is Wanhua Chemical Waiting For?

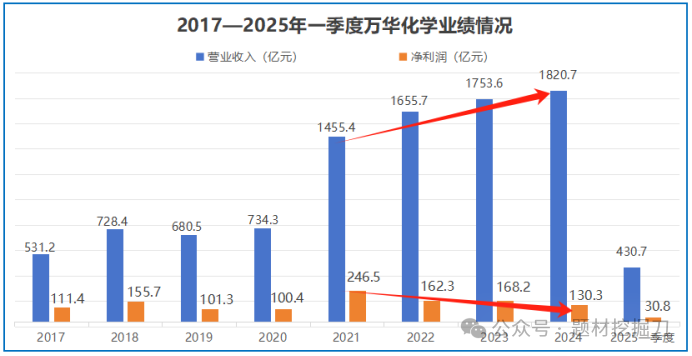

From breaking the overseas technology blockade to becoming a global chemical giant, from almost going bankrupt to earning 24.7 billion in a year, the glory of Wanhua Chemical was once a household name.

However, flowers do not remain red for a hundred days. In 2022, the company's net profit fell by 34.14% year-on-year, leading it into the predicament of "increased revenue without increased profit."

(Data source: Wind and other public information)

Net profit saw a slight rebound in 2023, but in 2024 it dropped again to 13 billion yuan, nearly half of the peak level in 2021. In the first quarter of 2025, net profit continues to decline.

The performance is poor, and the market value has fallen accordingly, dropping from a peak of about 450 billion to around 170 billion in July 2025, evaporating nearly 280 billion. People can't help but ask, what exactly is going on with Wanhua Chemical? When will its performance recover?

Even industry leaders cannot escape the cycle.

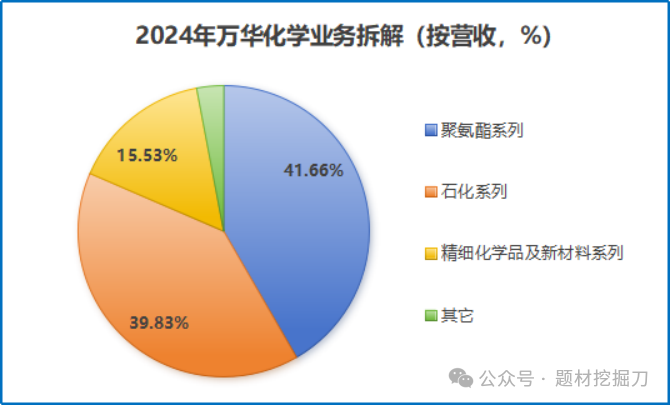

Wanhua Chemical primarily produces chemical intermediates, with its business divided into three segments: polyurethanes, petrochemicals, and fine chemicals.

(Data source: Wind and other public information)

Among them, polyurethane is the company's largest business. In 2024, it only contributed 41.66% of the revenue but accounted for 67.41% of the gross profit, becoming the pillar of profitability.

Looking again at the petrochemical business, it accounts for nearly 40% of the revenue in 2024, but its gross profit margin is only 3.52%, which is very low. It primarily serves the role of supplying raw materials, with strategic value far outweighing its profit contribution. Therefore, the polyurethane business directly affects the company’s overall profitability.

What has the company's polyurethane business experienced in the past three years?

The answer is obvious — prices are falling!

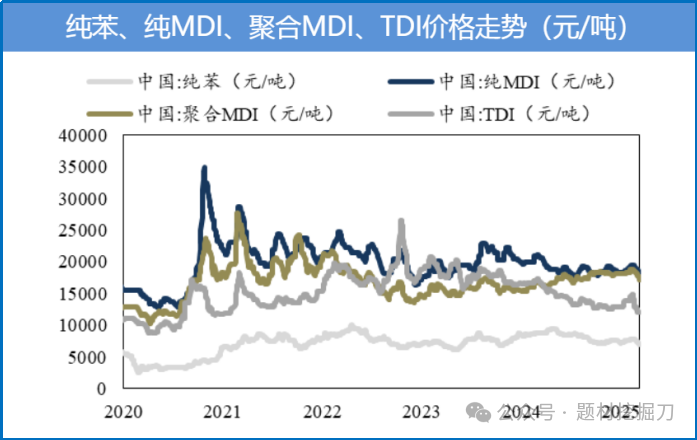

The core products of Wanhua Chemical's polyurethane business are MDI and TDI. Simply put, MDI is like a "hard glue raw material," used to produce rigid foams and high-performance elastomers, which are applied in insulation materials, industrial components, and other areas. TDI, on the other hand, is more like a "soft sponge raw material," used in fields such as furniture and automotive seating.

In recent years, the global production capacity of MDI and TDI has expanded too quickly, while the growth in traditional demand areas such as home appliances and construction has been weak. This has led to an imbalance in supply and demand, causing product prices to decline since 2022.

(Data source: Wind and other public information)

By 2024, the average market price of pure MDI has dropped to around 19,000 yuan per ton, and the average price of polymeric MDI has also decreased to around 17,000 yuan per ton, both lower than the prices above 20,000 yuan per ton in 2021.

As the world's largest supplier of MDI and TDI, Wanhua Chemical has maintained revenue growth through "compensating price with volume," but the sharp decline in core product prices has still impacted its net profit.

Moreover, the company has been expanding, which has made the profits even worse.

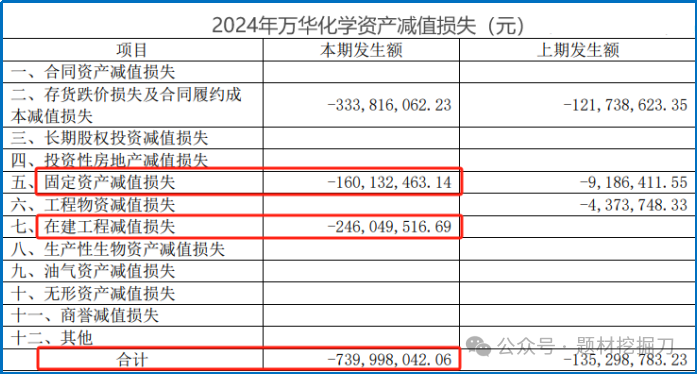

On one hand, asset impairment losses have increased significantly. Due to rapid capacity expansion in the past, Wanhua Chemical has proactively optimized its asset structure by making impairment provisions or scrapping low-efficiency projects.

In 2024, the company recognized asset impairment losses of 740 million yuan (an increase of 600 million yuan year-on-year), fixed asset write-off losses of 600 million yuan, and losses from the scrapping and cancellation of construction in progress amounting to 290 million yuan, which together reduced the total profit by 1.63 billion yuan.

(Data Source: Company Annual Report)

This kind of "cutting one's losses" adjustment, while beneficial for optimizing the asset structure, inevitably involves short-term pain.

On the other hand, after construction in progress is converted into fixed assets, depreciation costs surge. By the end of 2024, the company’s construction in progress reached 63.2 billion yuan. Once these are converted into fixed assets in the future, depreciation expenses will increase, which will have a long-term impact on profits. Moreover, this impact has already begun to emerge.

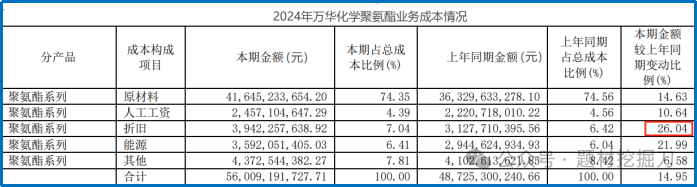

In 2024, Wanhua Chemical transferred 28.6 billion yuan worth of construction projects into fixed assets, including 18.4 billion yuan related to polyurethane business projects. This directly resulted in a 26.04% year-on-year increase in depreciation costs for this business, which is much faster than the growth rate of other costs.

(Data source: Company annual report)

Speaking of this, some may ask: why does Wanhua Chemical continue large-scale expansion even during the downturn of the chemical industry?

The answer is to prepare for the industry's future recovery.

Prepare for a rainy day, expand production against the trend.

In the chemical industry, counter-cyclical expansion is a common strategy. Simply put, it involves reserving capacity during industry downturns, so that when demand recovers, capacity can be rapidly unleashed to capture market share.

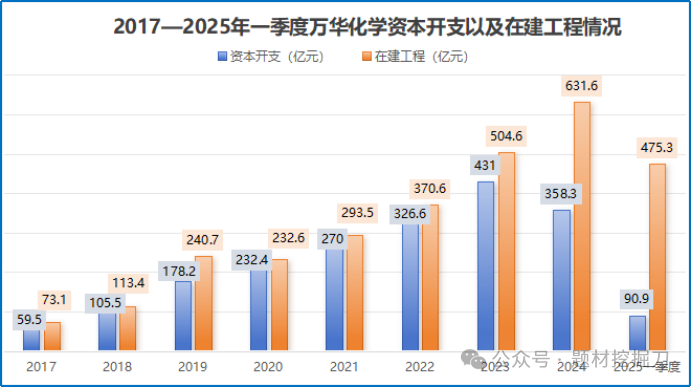

Those familiar with Wanhua Chemical know that this is not the first time the company has expanded production against the trend. From 2017 to 2019, the company's capital expenditure surged from 6 billion to 17.8 billion, and the capacity that was laid out in advance was fully utilized during the demand rebound and price increase in 2020-2021, driving the performance to reach its peak.

(Data source: Wind and other public information)

From 2022 to 2024, the company once again aggressively expanded its production capacity against the market trend. By 2024, construction in progress had reached 63.2 billion yuan, and this round of capacity expansion is also nearing its end.

What is the company’s current production capacity?

While advancing the construction of new projects, Wanhua Chemical is also continuously improving the operational efficiency of existing plants through investments in digital intelligence, thereby boosting the annual production capacity of the factories through a dual approach.

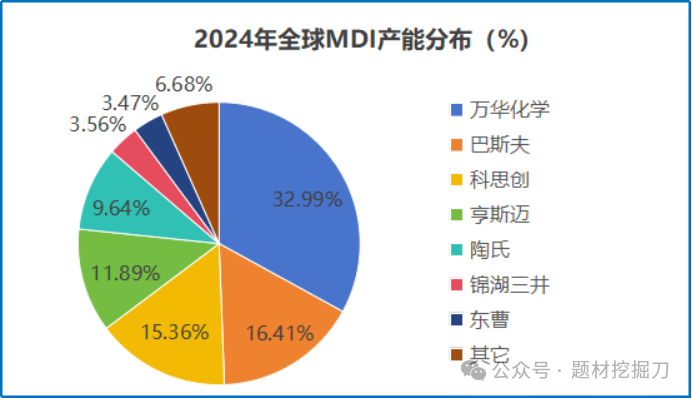

By the end of 2024, the company’s MDI production capacity will reach 3.8 million tons per year, accounting for 33% of the global market share and firmly ranking first in the world; its TDI production capacity has also increased to 1.11 million tons per year, also ranking first globally.

(Data source: Wind and other public information)

This scale advantage not only creates a cost barrier but also enhances its pricing power in the supply chain.

However, the industry concentration of MDI and TDI is already very high. Especially during the troughs of weak demand cycles, relying solely on expanding market share leaves less and less room. The key is still when the industry will recover!

Everything is ready, just waiting for demand to improve.

From the perspective of the entire industry, MDI and TDI are undergoing structural adjustments, with differing situations on the demand and supply sides.

The demand side is supported by multiple sectors such as home appliances, construction, and automotive, but it is difficult for the overall demand to be driven solely by the prosperity of a single industry. Market recovery still depends on a comprehensive rebound of the macroeconomy.

However, there has been movement on the supply side. In early 2025, chemical giants such as BASF, Wanhua Chemical, and Huntsman jointly raised their prices, which shows how much the industry hopes for a rebound in MDI and TDI prices. Furthermore, supply contraction has become the key factor driving price increases.

(Data source: wind and other public information)

In 2025, many MDI plants in Asia are either scheduled for shutdowns or experiencing unexpected shutdowns. For example, Kumho in South Korea (410,000 tons/year), Tosoh in Japan (400,000 tons/year), and BASF in South Korea all underwent concentrated maintenance in the first quarter.

In May, Wanhua Chemical also announced maintenance plans for its Fujian and Yantai industrial parks. This proactive supply contraction indeed provides support for price increases.

From the data, the change in the price spread between MDI and the raw material benzene also illustrates the issue. Despite fluctuations in the cost of benzene and other materials, the price spread between MDI and benzene has been widening since the first quarter of 2025, indicating that the increase in product prices has effectively covered the rise in costs.

The widening price spread not only reflects the improvement in the pricing power of enterprises but also indicates that, after a long period of adjustment, the industry is achieving value recovery by optimizing the supply side.

Wanhua Chemical is currently in the trough of the industry cycle, and the decline in net profit is mainly due to the drop in MDI and TDI prices as well as asset impairment.

Since 2025, the major industry players have collectively raised prices and proactively reduced supply, resulting in a continuous expansion of the MDI-benzene price spread, which may indicate that the turning point of the industry cycle is approaching. Once the industry recovers, Wanhua Chemical, with its global leading production capacity, will certainly be able to showcase its capabilities, and most of the existing problems will be resolved.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track