Tdi prices soar! an overview of global tdi capacity distribution and opportunities for chinese enterprises

In July 2025, the global TDI (toluene diisocyanate) market experienced supply disruptions due to two events.

On July 12, a fire caused by electrical issues occurred at Covestro's plant in Dormagen, Germany, resulting in force majeure for the production of caustic soda, chlorine gas, and hydrochloric acid. On July 16, Covestro officially announced that due to the interruption of chlorine gas, its TDA/TDI, OTDA-based products, and polyether polyols were affected by force majeure, and that it would not be possible to fully compensate for the disruption in the short term through other plants or external purchases. This involves a TDI unit with an annual capacity of 300,000 tons (the largest single unit in Europe) as well as polyether polyol units, with the duration of the force majeure remaining uncertain.

On July 21, Wanhua Chemical announced that, in accordance with the production process characteristics of chemical enterprises and to ensure the safe and effective operation of production units, its subsidiary BorsodChem Zrt. in Hungary will begin to shut down for maintenance its integrated facilities, including MDI (400,000 tons/year) and TDI (toluene diisocyanate, 250,000 tons/year), starting from July 23, 2025. The maintenance is expected to last for approximately 30 days.

Source: Wanhua Chemical

Due to the overlap of these two significant events and multiple Chinese enterprises simultaneously entering maintenance periods, global TDI prices have responded by rising—domestically, the spot price increased by 9.22% in a single day and by 31.2% over the month, causing market sentiment to rapidly heat up.

So, what exactly is TDI? What is the current production capacity and market landscape? How do the actions of Covestro and Wanhua affect the supply and demand sides? Where are the opportunities for Chinese enterprises in the future? Suphsu Vision provides you with an overview.

TDI Global Production Capacity Distribution

First, we need to clarify what TDI is. TDI stands for toluene diisocyanate, which is an organic compound with the chemical formula C9H6N2O2. It has two isocyanate groups (–NCO) and serves as an important "adhesive" in the synthesis of polyurethane. Simply put, TDI is like a hook for Lego blocks, securely linking polyols and other components together to form a three-dimensional network structure, resulting in soft foam materials commonly found in sponges, mattresses, car seats, and sofa cushions.

Image source: Wanhua Chemical

TDI not only determines the basic performance of foam products, but also directly affects the feel, rebound, durability, and environmental indicators of the finished products. In the domestic market, Wanhua Chemical's TDI-80 has won the favor of many downstream manufacturers due to its stable quality and excellent cost-performance ratio. However, at the same time, TDI products from international giants such as BASF, Covestro, and Dow also hold a place in high-end applications.

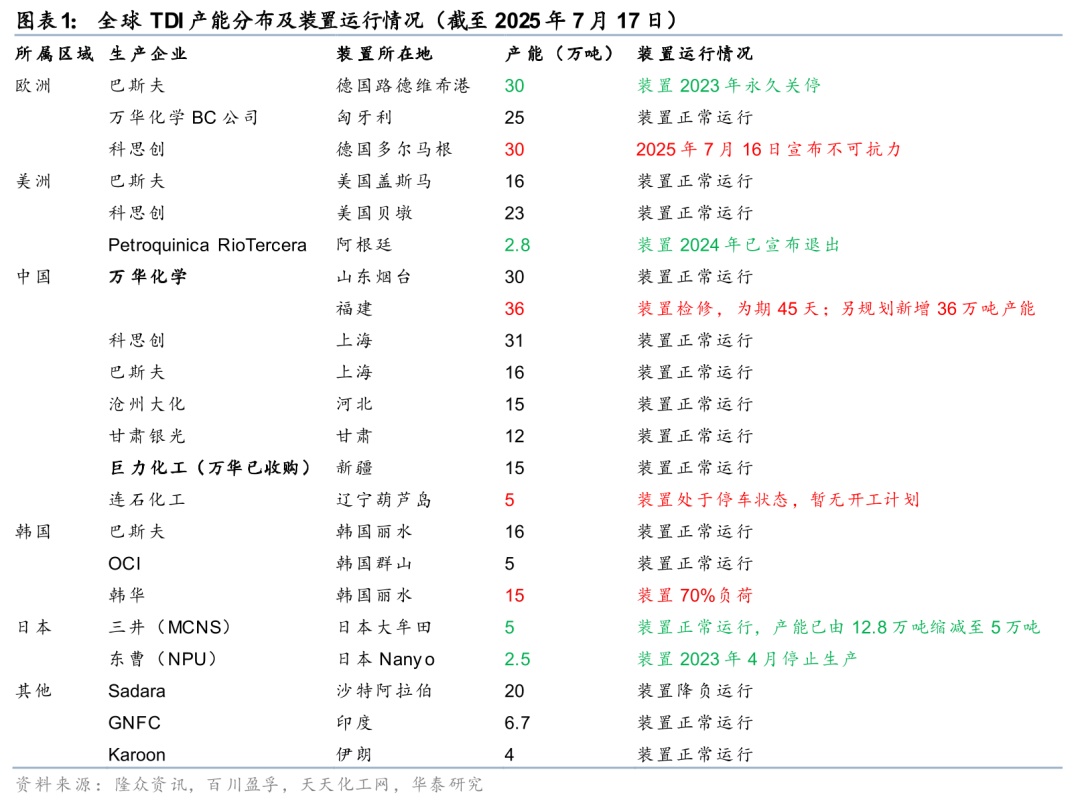

Source: Tiantian Chemical, Longzhong, Baichuan Yingfu, Huatai Research

Supply side: short-term increase, long-term capacity.

The force majeure at Covestro's German plant overlaps with Wanhua's maintenance in Hungary. Europe now has only Wanhua's Hungarian base with an annual capacity of 250,000 tons left, and after this maintenance, Europe will face a supply gap of approximately 550,000 tons in the short term. Meanwhile, the maintenance wave in China further tightens supply: Wanhua's Fujian plant with an annual capacity of 360,000 tons and Gansu Yinguang, among others, account for a total of 710,000 tons of production capacity offline (representing 43.3% of domestic capacity). This concentrated supply interruption has led to a rapid increase in TDI prices.

The recent event has accelerated the already evident trend of global TDI capacity transfer. Over the past three years, overseas giants have continually exited due to cost pressures: BASF closed its 300,000-ton/year capacity in Europe in 2023, and Mitsubishi Chemicals permanently reduced the capacity of its Dazaifu plant in Japan from 120,000 tons to 50,000 tons. In contrast, in China, Wanhua Chemical is expanding its capacity planning to 1.42 million tons/year through the acquisition of Yantai Jieli and the establishment of a new base in Fujian, while companies like Hualu Hengsheng are also increasing production. It is expected that by 2027, China's TDI capacity will account for 59% of the global total, an 18 percentage point increase compared to 2020.

The root cause lies in the disparity in energy costs—European natural gas prices are long-term 3 to 4 times higher than those in China, combined with disadvantages in labor costs, leading to a continuous decline in the competitiveness of overseas factories.

Demand side: Strong exports and new growth driven by new energy vehicles.

As the traditional peak season of "Golden September and Silver October" approaches, the demand for TDI downstream soft foam (accounting for 73%) is expected to reach a seasonal high, especially in sectors like furniture and automotive seating where there is strong stocking demand. The export market is also bright: from January to May 2025, China exported 219,000 tons of TDI, a year-on-year surge of 83%, with significant growth in emerging markets such as Vietnam and Turkey. The supply gap in Europe will temporarily rely on China's exports to fill the void, with customs data indicating that China will export 32,000 tons to Europe in 2024; this incident may double that figure.

Although architecture and furniture remain TDI's main markets (accounting for over 60% combined), the lightweight trend in new energy vehicles is bringing additional growth. The penetration rate of polyurethane composite materials in battery pack housings and seating is expected to increase, with the global demand for automotive TDI projected to grow at an annual rate of 4-5% from 2025 to 2030. Furthermore, as per capita GDP in developing countries exceeds $3,000, the consumption of soft furniture is entering an accelerated phase, with significant potential in the Indian and Southeast Asian markets.

Accelerated localization substitution! Chinese companies are competing for pricing power from capacity advantages.

Wanhua Chemical's global allocation capability has been highlighted in this event: its 300,000-ton facility in Yantai and 310,000-ton base in Shanghai can flexibly switch the export and domestic sales ratio, while the factory in Hungary serves as a bridgehead for the Central and Eastern European market. Unlike companies such as Covestro that focus on a single-region layout, Wanhua reduces logistics costs through a "China production + Europe assembly" model, shortening the delivery cycle for European customers to two weeks. Companies like Cangzhou Dahua focus on differentiated competition, with their 150,000-ton/year facility primarily supplying the high-end coatings market, achieving a gross profit margin that is 3-5 percentage points higher than the industry average.

The core barrier of TDI production lies in the safety and stability of the phosgene method. Leading companies in China have significantly reduced energy consumption through continuous research and development, with Wanhua developing a new catalyst system that improves reaction efficiency by 15%. In 2024, the CR3 will reach 68% (Wanhua, Covestro, BASF), an increase of 12 percentage points compared to 2020. This dual barrier of technology and scale makes it difficult for new entrants to replicate the cost advantages of Chinese companies.

This sudden event has amplified the global discourse power of China's TDI industry. In the short term, Chinese companies can adjust their export rhythm to achieve excess profits; in the medium to long term, they need to complete a threefold leap.

- The transition from capacity output to technology standard output, leading the international certification of green TDI processes.

- Build a regional capacity collaboration network (such as the Wanhua Hungary base) to avoid trade barriers.

- Extend into downstream high-value-added fields, such as Wanhua's layout of integrated solutions for automotive seats, transforming TDI from a commodity into customized products.

The global TDI market is "China cycle", but only by transcending the surface of price fluctuations and building competitive strength across the entire industry chain can we truly seize this historic opportunity.

Editor: Lily

Material sources: Huatai Ruisi, DT New Materials, Wanhua, Covestro, Tiantian Chemical Network

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track