LyondellBasell announces expansion of 400,000 tons of propylene capacity!

Recently, LyondellBasell (LYB) announced plans to invest in expanding the propylene production capacity at its Channelview complex near Houston.

The project is scheduled to commence construction in the third quarter of 2025 and is expected to be operational by the end of 2028. The facility will produce approximately 400,000 tons of propylene annually, create 750 temporary jobs during the peak construction period, and is projected to add 25 permanent positions upon completion.

The new facility will utilize olefin metathesis technology to convert ethylene into propylene, which will then be further used in the production of polypropylene and epoxy propane. These are essential basic materials in daily life, widely applied in industries such as food packaging, medical devices, automotive components, aircraft de-icing fluids, building insulation materials, home decoration pads, and communication equipment.

Let's talk about LyondellBasell's business empire, starting with its development history.

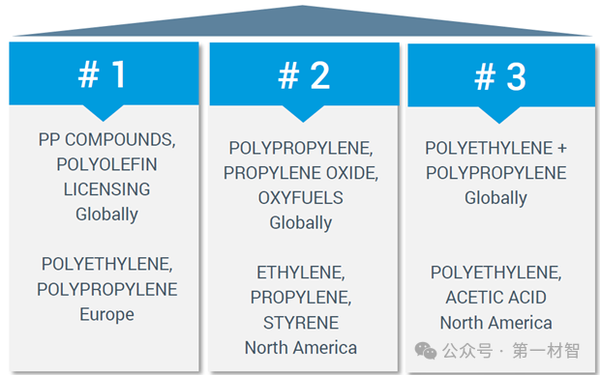

LyondellBasell's main advantageous businesses

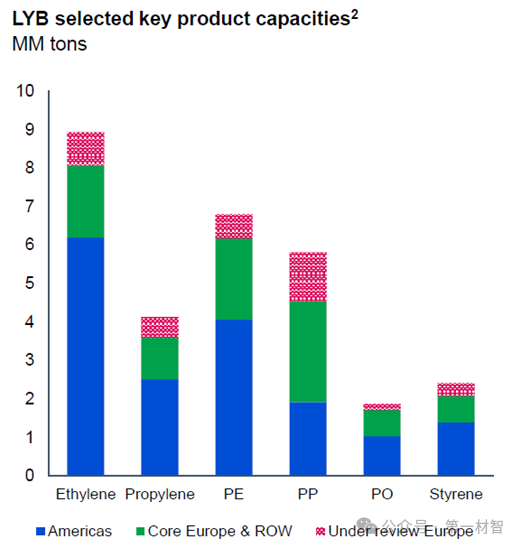

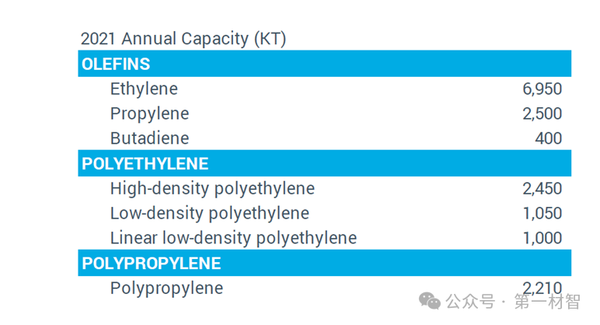

The main product capacity of Lanxess.

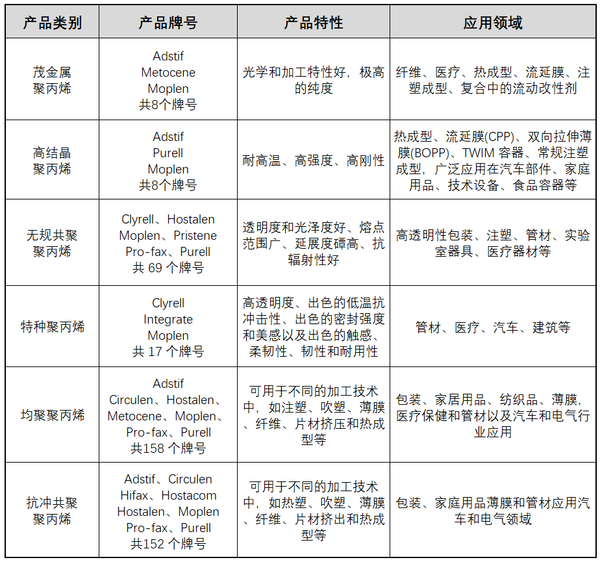

Currently, LYB's polyolefin technology licensing business and PP modification business rank first in market share globally, while its PP and PO products rank second in market share worldwide. The overall scale of its PE+PP business ranks third globally. Its core assets and production capacity mainly involve ethylene, propylene, polyethylene, polypropylene, PO, and styrene.

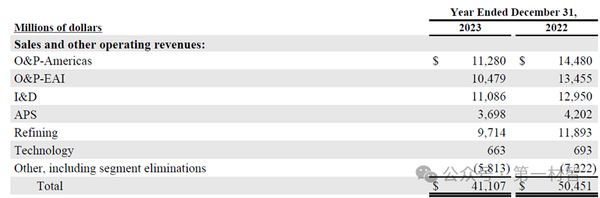

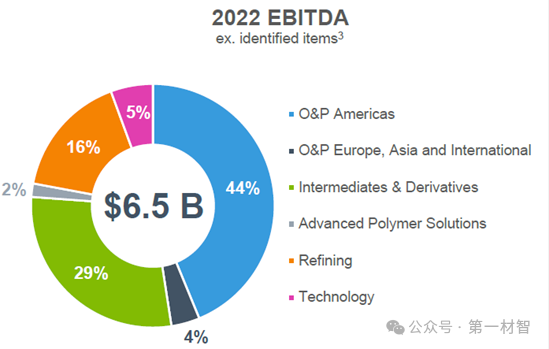

LYB's business departments mainly include:

O&P Americas (Olefins & Polyolefins - North America)

O&P Europe, Asia and International

Intermediates & Derivatives

Advanced Polymer Solutions

Refining (Oil refining)

Technology (Technology Transfer)

Table: Revenue of LYB Business Units, 2022-2023

One of the most important global players in the olefins and polyolefins business.

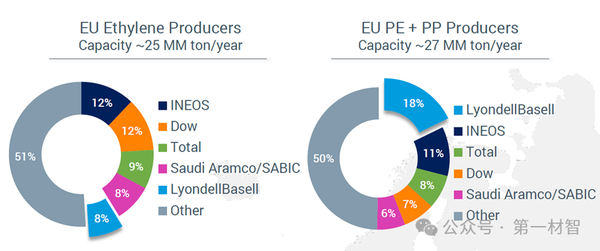

In the field of olefins and polyolefins, LYB is the largest polyolefin producer in Europe, the second-largest polyolefin producer in North America, and one of the top five olefin product producers globally.

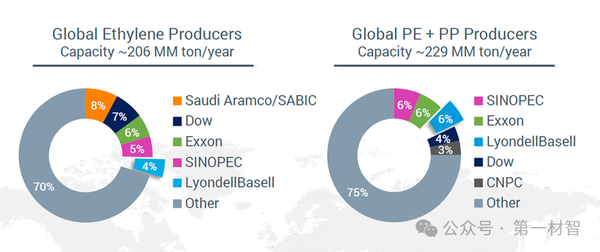

According to disclosed 2021 data, LYB is the fifth-largest ethylene producer globally, with a market share of approximately 4%, following Saudi Aramco/SABIC, Dow, Exxon, and Sinopec. When calculating the polyolefin market share based on PE+PP, LYB is the third-largest supplier globally, ranking behind only Sinopec and Exxon.

LYB's market share in the global PE and PE+PP markets, 2021

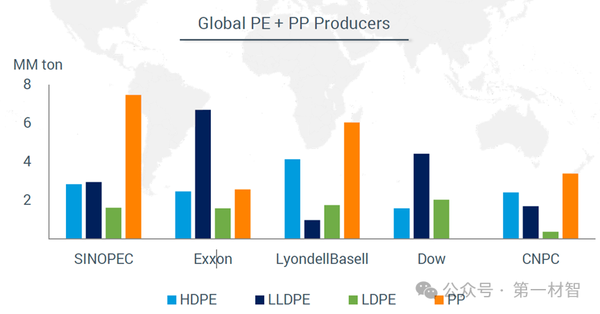

LYB and major polyolefin suppliers' polyolefin product capacity, 2021

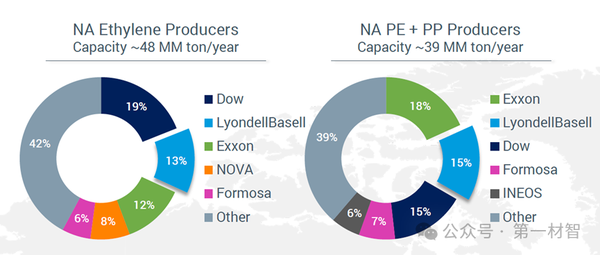

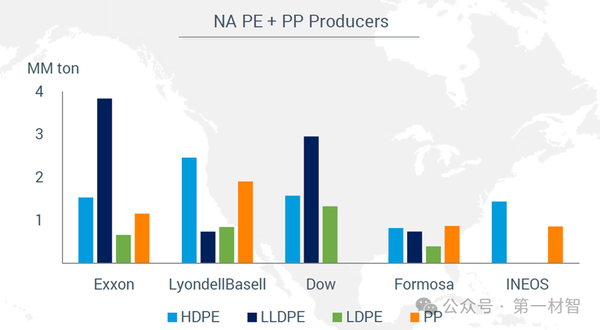

In the North American market, LYB's ethylene market share is 13%, and its PE+PP market share is 15%. LYB has 2.45 million tons of PE, 1.05 million tons of LDPE, 1 million tons of PE, and 2.21 million tons of PP in North America. The upstream includes 6.95 million tons of ethylene and 2.5 million tons of propylene.

LYB's market share of ethylene and polyolefins in North America

Table: LYB's Olefin and Polyolefin Production Capacity in North America

LYB's EBITDA contribution by business unit in 2022

From the company's EBITDA margin contribution in 2022, the olefin and polyolefin business in North America performed significantly better than other regions of the company. This is mainly attributed to the favorable economics of North American ethane cracker operations.

In Europe, LYB is the fifth-largest ethylene producer with an 8% market share and a capacity of 4.05 million tons. Its PE+PP capacity ranks first in Europe, with a market share of about 18%. The company has a production capacity of 4.05 million tons of ethylene, 2.75 million tons of propylene, 2.3 million tons of HDPE, 1.25 million tons of LDPE, 0.45 million tons of LLDPE, and 6.85 million tons of PP.

LYB's market share of ethylene and polyolefins in Europe

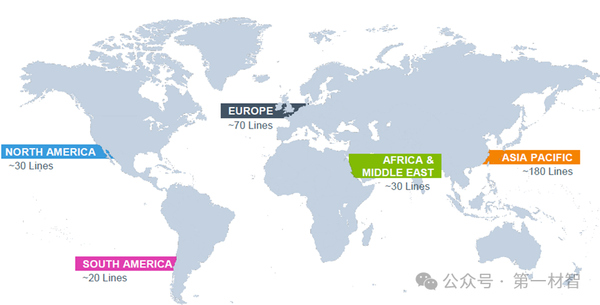

LYB's Global Distribution of Polyolefin Process Package Authorizations

LYB Polyolefin Catalyst Business Global Distribution

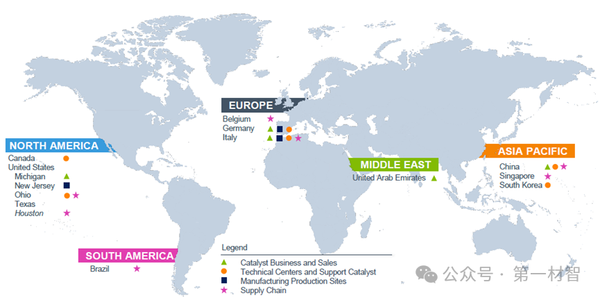

In the field of polyolefin catalysts, there are currently three production plants in New Jersey, USA, Germany, and Italy. The current global market share ranks first.

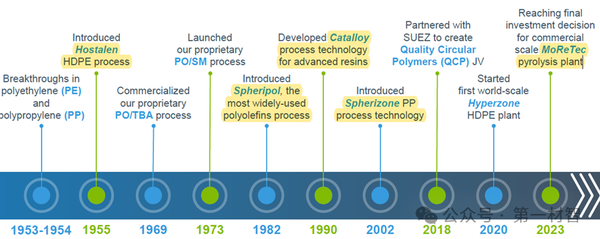

History of LYB Polyolefin Technology Development

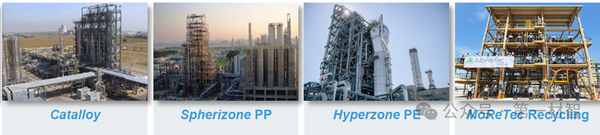

Throughout the history of LYB and its predecessors in the development of polyolefin technology, key milestones include: the start of HDPE production using the Hostalen process in 1955, the introduction of Spheripol for PP production in 1982, the use of Calalloy for producing high-end polyolefin resins in 1990, followed by the launch of Spherizone in 2002, and the introduction of the MoReTech polyolefin cracking process to the market in 2023.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track