Wanhua chemical: Another 200,000 Tons, Domestic Production to Exceed 10 Million Tons!

[DT New Materials]It has been learned that recently, Wanhua Chemical Group (Penglai) High Performance Materials Co., Ltd. has announced a 220,000 tons/year SEP project.

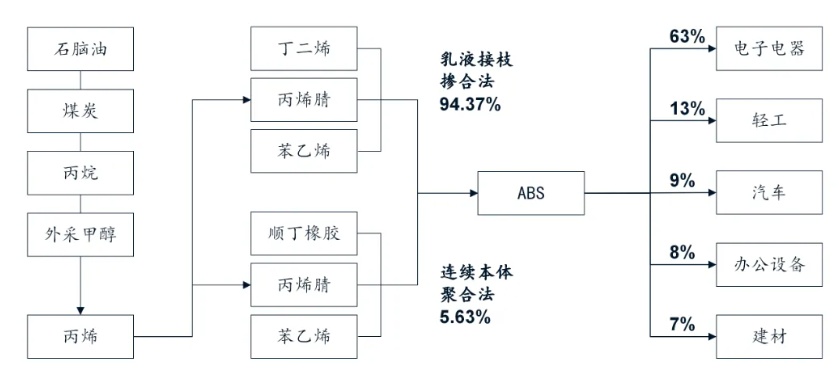

The project adopts the use ofThe ethylene integration project at Wanhua Yantai Industrial Park produces raw materials such as styrene, butadiene, methyl methacrylate, and butyl acrylate. It employs Wanhua's independently developed, proprietary emulsion grafting - bulk SAN blending technology to manufacture ABS and ASA. Once completed, it will produce general-purpose and specialty ABS materials, totaling 200,000 tons per year of ABS and 20,000 tons per year of ASA.

Wanhua hopes to alleviate the current oversupply issue of styrene by producing ABS, the product with the highest technical content, largest volume, and best economic benefits among downstream applications of styrene. This will fully utilize the cost and resource advantages of integration and increase the added value of upstream chemicals.

Image data source: Fund Changqing

The global ABS market is currently not optimistic. In Europe, due to weak demand from downstream industries such as automotive, construction, and home appliances...Overlaying geopolitical and tariff uncertaintiesThe overall ABS market is being dragged down. The U.S. ABS market is also affected by the automotive industry, with demand 5% lower than normal levels, although sectors like construction are performing reasonably well. The Asian ABS market shows relatively stable automotive demand, with toy manufacturing providing some support, but the demand for home appliances is weakening due to seasonal production cuts and the impact of trade tariffs.

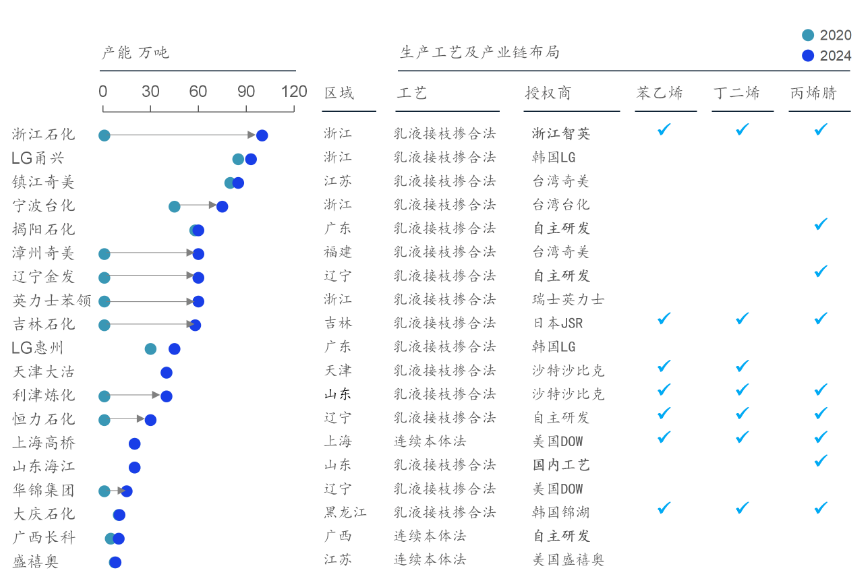

On the other hand, production capacity is still increasing. By the end of 2024, China's total ABS production capacity will reach 9.165 million tons per year, but the capacity utilization rate is only 60%.Zhejiang Petrochemical leads with an annual capacity of 1 million tons, followed by LG Yongxing (930,000 tons), Zhenjiang Chimei (850,000 tons), and Ningbo Taihua (750,000 tons). Additionally, there are Liaoning Kingfa, INEOS Styrolution, Jilin Petrochemical, LG Huizhou, Tianjin Dagu, Lijin Refining and Chemical, Hengli Petrochemical, etc.The combined production capacity of the top ten enterprises exceeds 6 million tons, accounting for 78.25% of the national total.

Since the beginning of this year, new units have been commissioned at Yulong Petrochemical, Daqing Petrochemical, Shandong Yike, Jilin Petrochemical, and others. It is expected that by the end of the year, domestic capacity will likely exceed 10 million tons!

Image data source: Fund Changqing

Multiple factors have contributed to the decline in ABS prices. The price of ABS in China has continuously dropped from $1,410/ton on January 8 to the current 9,962 yuan/ton in September, with some products falling to 9,000 yuan/ton. It is expected that in the second half of the year, product prices are likely to fall to the cost line or possibly incur losses, while the entire industry experienced an average loss of 253 yuan/ton last year and an average loss of 68 yuan/ton in 2023.

Meanwhile, the structure remains imbalanced, with general-purpose products accounting for about 80% of the ABS market and specialty products accounting for about 20%. High-end grades (such as medical-grade transparent materials and automotive weather-resistant materials) still rely on imports, necessitating the accelerated development of specialty ABS, ASA, and other such materials.Biobased ABS (biomass-derived styrene raw material) and physically recycled ABSSame varieties.

Speaking of ASAAcrylonitrile-Butadiene-Styrene CopolymerCompared to ABS(Acrylonitrile-Butadiene-Styrene Copolymer)The physical properties of structures are non-The properties are similar, but the anti-UV aging ability is greatly improved, making it a necessity in high-end fields such as new energy vehicle exteriors, photovoltaic junction boxes, outdoor building materials, 5G, and satellite communications. The market price is over 50% higher, but the polymerization cost has not increased much.

Major global ASA (Acrylonitrile Styrene Acrylate) manufacturers include BASF, INEOS Styrolution, UMG Japan, LG Chem, Kumho Petrochemical, Lotte Chemical, Sumitomo Chemical, Chimei Corporation from Taiwan, and SABIC. Earlier this year, LG Chem announced the signing of an agreement with South Korean furniture company Hanssem.The high-functional plastic ASA made from plant-based materials is used as the surface material for Hansen Kitchen Home's "e'clat" products. The world's first bio-based ASA has already been applied, and the speed is truly impressive.

In June this year, Shandong Lihuayi adopted the emulsion grafting-bulk SAN blending process technology from Technip USA, with a total investment of 2.2 billion yuan, to launch the first 100,000-ton/year ASA resin integrated production project in mainland China. With the full industry chain integration advantage of "refining-propylene/ethylbenzene-acrylonitrile/styrene/AMS-ASA," the company's ASA costs have significantly decreased. Other companies such as Shandong Yigong Material Technology, Anqiu Donghai Plastics, Zhejiang Ji'ertai, and Ruifeng Polymer are relatively smaller in scale.

Overall, the application prospects of ASA are quite promising. With giants like Wanhua Chemical, which have independent technology and raw material advantages, entering the field, it is expected to become more accessible to the general public in the future.The ASA blending methods are numerous, and the variety and models of products are extensive, resulting in significant differentiation in competition. Achieving full coverage across high, medium, and low segments, and even replacing the large ABS market, is still very challenging.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track