United States Commerce Department Rules China MDI Dumping Margin Up To 512%! (Including China-US MDI Trend Changes)

Recently, the U.S. Department of Commerce announced a positive preliminary determination of anti-dumping duties on diphenylmethane diisocyanate (MDI) originating from China.

In the preliminary anti-dumping announcement, the U.S. Department of Commerce determined that the dumping margin for Chinese MDI is as high as 511.75%.From the date of the preliminary anti-dumping announcement, the U.S. Department of Commerce will instruct U.S. Customs and Border Protection (CBP) to collect temporary anti-dumping duties in the form of cash deposits based on the dumping margins of the relevant producers/exporters involved.

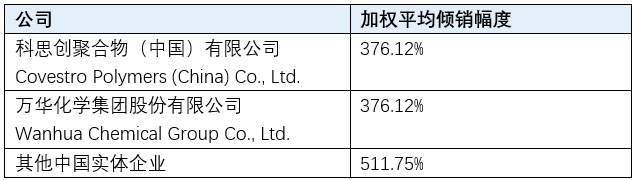

The weighted average dumping margin determined in the preliminary anti-dumping ruling is as follows:

On February 12, 2025, at the request of BASF and Dow, the U.S. Special MDI Fair Trade Alliance (referred to as the "Alliance" or "Petitioner") submitted a petition for new anti-dumping (AD) and countervailing duty (CVD) applications against imports of diphenylmethane diisocyanate (MDI) from China. At that time, the dumping margins calculated by the Petitioner were estimated to be between 305.81% and 507.13%.

On March 28, 2025, after more than a month of investigation into the allegations of China dumping MDI in the U.S. market, the U.S. International Trade Commission (USITC) determined that there was reason to continue the investigation.

On September 11, 2025, the U.S. Department of Commerce made an affirmative preliminary determination on anti-dumping regarding MDI originating from China.

The U.S. Department of Commerce will make a final anti-dumping ruling by January 23, 2026.

The product involved in the preliminary anti-dumping ruling is diphenylmethane diisocyanate (MDI), including polymeric MDI, pure MDI, and modified MDI.

MDI is a versatile chemical intermediate used in the production of various insulation materials such as rigid foam plastics; flexible foam plastics for automotive seats, bedding, and furniture; as well as in coatings, adhesives, sealants, and elastomers.

The physical forms of MDI range from low-viscosity liquids to solids. Regardless of whether the MDI has undergone a distillation process, and regardless of its acid content, reactivity, functionality, freeze stability, physical form, viscosity, grade, purity, molecular weight, or packaging, it is included within the scope of this investigation.

MDI may contain additives such as catalysts, solvents, plasticizers, antioxidants, flame retardants, colorants, pigments, diluents, thickeners, fillers, softeners, and tougheners. Mixtures of MDI with other materials, where MDI constitutes less than 40% of the total weight of the mixture, are not within the scope of this survey.

MDI can partially react with itself, polyols, or polyamines, retaining unreacted MDI components, thereby transforming it into different products that no longer contain isocyanate groups. Among these products, if the NCO content is less than 10% of the total weight, they are not within the scope of this investigation.

The scope of this investigation includes goods processed in a third country that match the above description, including mixing, diluting, introducing or removing additives, or any other processing, which, if conducted in the target country, would not remove the goods from the scope of the investigation.

The product can currently be classified under the U.S. Harmonized Tariff Schedule (HTSUS) codes 2929.10.8010 and 3909.31.0000. Related goods can also be classified under the codes 3506.91.5000, 3815.90.5000, 3824.99.2900, 3824.99.9397, 3909.50.5000, 3911.90.4500, 3920.99.5000, and 3921.13.5000.

During former President Trump's first term in the United States, MDI was already subject to the initial 301 tariffs on China (25%). In 2025, President Trump imposed so-called "reciprocal tariffs" on all Chinese imports. Although the current trade agreement between China and the United States decided to suspend the implementation of the 24% tariffs for 90 days starting from August 12, 2025, an additional 10% tariff on all Chinese imports remains in place.

This means that, in addition to the basic tariff of 6.5%, China's exports of MDI to the United States are already facing a total tariff of 41.5%. Under this tariff level, Chinese exports to North America still maintain a certain level of competitiveness compared to European sources.

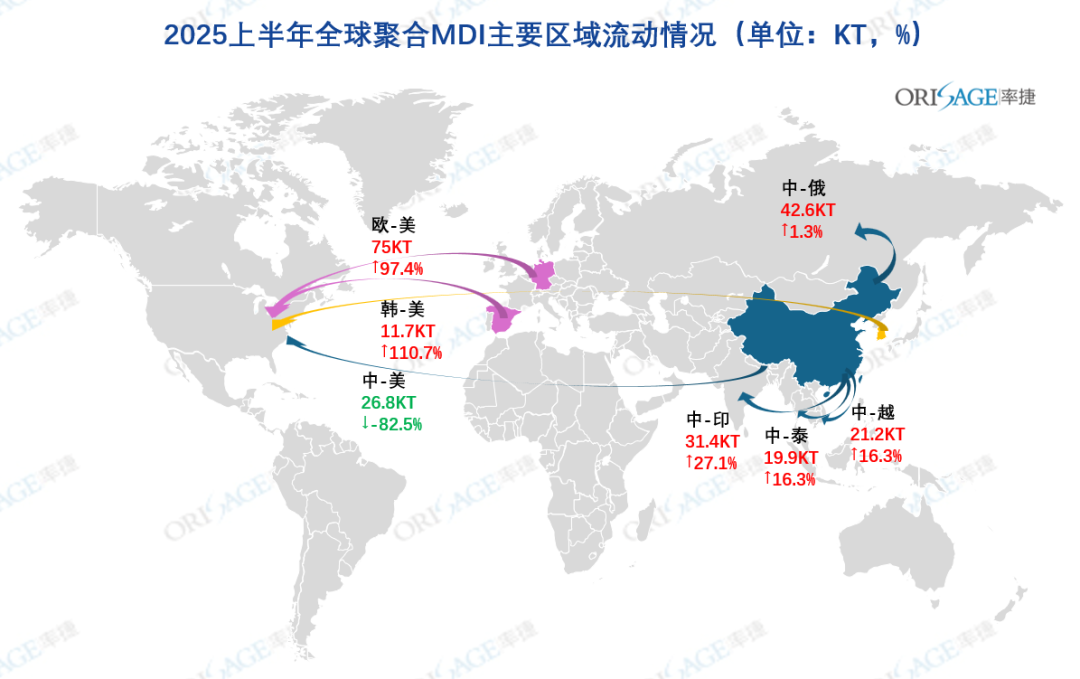

If the US Department of Commerce makes an affirmative final determination later, it is expected to have a limited impact on Chinese MDI manufacturers. Facilities in the East Asia region, such as Kumho Mitsui (610,000 tons/year) and BASF Korea (250,000 tons/year), may increase their export efforts to the US, which will lead to a tightening of supply in the Asia-Pacific foreign trade market. Wanhua Chemical's products are expected to fill the market gap in the Asia-Pacific region. Moreover, Wanhua Chemical has an MDI production capacity of 400,000 tons in Europe (BorsodChem in Hungary), which is likely to mitigate related risks by increasing exports from European facilities to the US. This may reshape MDI trade flows, but it will not change the global MDI supply pattern in recent years.

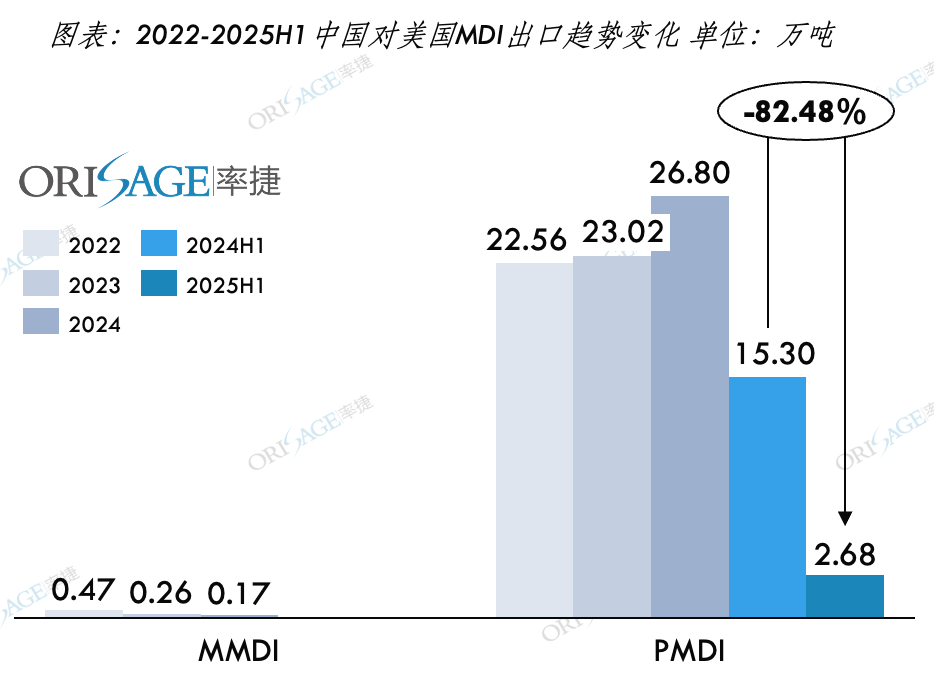

Source: Official websites of customs from various countries, compiled by Orisage Consulting.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track