Understanding the anshi semiconductor crisis

Currently, global automakers are facing a familiar crisis once again: car production is at risk of coming to a halt due to disruptions in the chip supply chain. Unlike the global "chip shortage" caused by the pandemic three years ago, this time, the crisis stems from a deeper, more unpredictable geopolitical confrontation.

Caught in the eye of the storm is a semiconductor supplier that was not widely known to the public—Nexperia. The chips produced by this company are not the most advanced, but they perform essential electronic control functions such as controlling car lights, vehicle body switches, and steering wheel modules; although the company's market value is less than 1% of its Dutch counterpart ASML, its importance lies in Approximately 3,000 components are produced every second. It is precisely these seemingly ordinary, but vast quantities of basic electronic components that support the stable operation of the extensive electronic systems in modern automobiles.

Nowadays, as the struggle for control over Nexperia intensifies among China, the Netherlands, and the United States, the global automotive supply chain is once again entering a period of uncertainty.

Image source: Nexperia

The "Past and Present" of Anshi Semiconductor

Anshi Semiconductor's predecessor was the Standard Products business unit of Dutch semiconductor giant NXP. In 2016, NXP decided to spin off and sell this department to complete its merger with Qualcomm.

In February 2017, two Chinese investors, Jianguang Capital and Wise Road Capital, formed a consortium to acquire the business unit for $2.75 billion and renamed it Nexperia.

At the end of 2019, China's electronics and computer equipment manufacturer Wingtech Technology acquired a controlling stake in Nexperia for $3.6 billion; a few months later, Wingtech Technology's founder Zhang Xuezheng became the CEO of Nexperia.

After being controlled by a Chinese company, the headquarters of Anshi Semiconductors remains in Nijmegen, Netherlands. The majority of the company's products (about 60%) are sold to the automotive industry, with its automotive chips widely used throughout vehicles, from lighting to electronic control units.

Although car manufacturers do not directly purchase chips from Nexperia, Milan Rosina, Principal Analyst for Power Electronics and Batteries at consultancy Yole Group, noted that the company's end customers include several European and American car manufacturers, as well as some Asian car manufacturers.

Currently, Nexperia has 12,500 employees in Europe, the United States, and China. The revenue for 2024 is approximately $2.06 billion, with a net profit of $331 million, making it an important high-quality asset for Wingtech Technology.

The crisis at Nexperia has been brewing for a long time.

Court documents show that the crisis related to Nexperia began to brew as early as the end of 2023.

At that time, the management of Nexperia had already contacted the Dutch Ministry of Economic Affairs due to operational issues related to its shareholder structure. Since Nexperia was acquired by Wingtech Technology in 2019, the company has been regarded as a "Chinese-funded enterprise" since then.

This situation prompted a series of discussions between the Dutch government and Nexperia. Both parties agreed to take several measures, including establishing a supervisory board to strengthen corporate governance. Nexperia also proposed introducing Western minority shareholders to achieve equity diversification.

However, during the process of advancing these measures, Wingtech Technology, controlled by Zhang Xuezheng, was added to the list of restricted trade entities by the United States. The Dutch side is concerned that Nexperia, a subsidiary of Wingtech Technology, may also be affected by the trade disputes between China and the United States.

In December 2024, the Dutch government once again contacted the management of Nexperia, warning the company that it must implement the previously agreed regulatory measures to ensure its "operational independence." However, Nexperia hesitated, stating that it could not provide an "unconditional guarantee" for its long-term operations in Europe.

In June 2025, amidst political turmoil in the Netherlands as the far-right Freedom Party (PVV) exited the ruling coalition, Vincent Karremans assumed the position of Dutch Minister of Economic Affairs. At the same time, the United States informed Nexperia that to avoid U.S. trade restrictions, the company's CEO, Zhang Xuezheng, would need to step down.

Due to the fact that Nexperia did not take relevant measures, in September 2025, the United States expanded its trade sanction list, including Nexperia in the "blacklist." A day later, the department led by Karremans took swift action, invoking a nearly forgotten 1952 "Material Supply Act" to take control of Nexperia on the grounds of "national security" and "serious governance deficiencies" within Nexperia, gaining the power to veto and revoke company decisions.

Meanwhile, Ruben Lichtenberg, the statutory director and Chief Legal Officer of Nexperia Holdings and Nexperia (a Dutch registered entity), supported by CFO Stefan Tilger and COO Achim Kempe, submitted an urgent request to the Enterprise Chamber of the Amsterdam Court of Appeal, seeking to initiate an investigation into the company and to take interim measures such as the removal of Zhang Xuezheng.

Multiple foreign media outlets interpret that the sudden takeover of Nexperia by the Netherlands is a response to the increasing pressure from the United States since June. However, Karremans denied that this move was coordinated with the U.S. In an interview with the Dutch TV program "Buitenhof," he stated that he had "in principle" made the decision to take over long before the U.S. issued a warning about Nexperia. "It was really a matter of racing against time because if we acted too slowly, the company could be hollowed out," he said. The core aim of this action, he claimed, is "to prevent the leakage of related technology" and "to safeguard national security."

In response to Dutch intervention, on October 4, the Chinese government imposed export controls on Nexperia's factories and subcontractors in China.

On October 7th, a Dutch court ruled to suspend Zhang Xuezheng from his positions as Executive Director of Nexperia Holding Company and Non-Executive Director of Nexperia. An independent foreign individual was appointed as a Non-Executive Director with decisive voting rights and the authority to independently represent the company. Additionally, all shares of Nexperia Holding held by Wingtech Technology's wholly-owned subsidiary, Yuxin Holdings (except for one share), are to be entrusted to an independent third party.

On October 14th, Nexperia announced that Zhang Xuezheng would no longer serve as the company's CEO, and his position would be temporarily filled by CFO Stefan Tilger.

On October 17, Nexperia (headquartered in the Netherlands) suspended the work account access of its employees in China and halted the payment of salaries to its employees in China.

The next day, Anshi China released an open letter to all employees through its official WeChat public account, clarifying two points: First, all employees should continue to follow the work instructions of Anshi China. For any other external instructions that have not been approved by Anshi China's legal representative, employees have the right to refuse to execute them. Second, all operations and employee salaries and benefits of Anshi's domestic entities remain normal. Salaries, bonuses, and other benefits will continue to be paid by Anshi China. This indicates that Anshi China is severing ties with its headquarters in the Netherlands and beginning to operate independently.

This series of changes has placed Nexperia at the center of the trilateral game between the U.S., China, and the Netherlands. For the automotive industry, this could mean another chip supply crisis. "The entire automotive industry has suddenly found itself in this shocking situation," said Sigrid de Vries, Director General of the European Automobile Manufacturers Association (ACEA). "We urgently need all relevant countries to quickly and pragmatically seek solutions."

Supply chains are tightening again, and automakers are facing a shortage of chips and materials.

For the automotive industry, which is already facing multiple challenges such as weak demand, rising costs, trade tensions, and tariff pressures, another chip crisis is undoubtedly adding insult to injury. Automotive industry associations and companies in Europe, the United States, and Japan have already issued warnings.

The European Automobile Manufacturers Association (ACEA) stated that European car manufacturers and their parts suppliers have received notifications from Nexperia that it can no longer guarantee chip deliveries. The association pointed out that Nexperia's current chip inventory can only last for a few weeks. Without these chips, European automotive parts suppliers will be unable to produce the components needed by car manufacturers, which could potentially lead to a halt in car production. Although the automotive industry has procured similar chips from other suppliers in the market, the qualification and certification of new suppliers... The construction period lasts for several months, and the risk of supply disruption cannot be completely eliminated.

A regional representative of the German union IG Metall recently stated that the industry situation is continuously deteriorating, with some auto parts suppliers having fallen into "serious trouble" and beginning to announce employee furlough plans.

The Alliance for Automotive Innovation, which represents General Motors, Toyota, Ford, Volkswagen, Hyundai, and almost all other major car companies in the U.S., also called for a prompt resolution of this matter.

The alliance's CEO, John Bozzella, stated, "If the transportation and supply of relevant automotive chips cannot be restored soon, it will disrupt automobile production in the United States and several other countries and have spillover effects on other industries. This matter is of significant impact."

The largest automotive parts supplier association in the United States, the Motor & Equipment Manufacturers Association (MEMA), recently... Due to the dispute involving Nexperia, the production at American car factories may face a "significant impact" within 2 to 4 weeks.

Not only are European and American car companies affected, but the crisis at Nexperia (Nexperia Semiconductor) has now spread to Japan. The Japan Automobile Manufacturers Association (JAMA) stated on October 23 that Japanese auto parts manufacturers have received a supply disruption warning from Nexperia. Members of the association are taking measures to mitigate the potential impact of supply disruptions. The association pointed out that Nexperia supplies critical chip components, and any shortage could have a ripple effect on Japanese car companies.

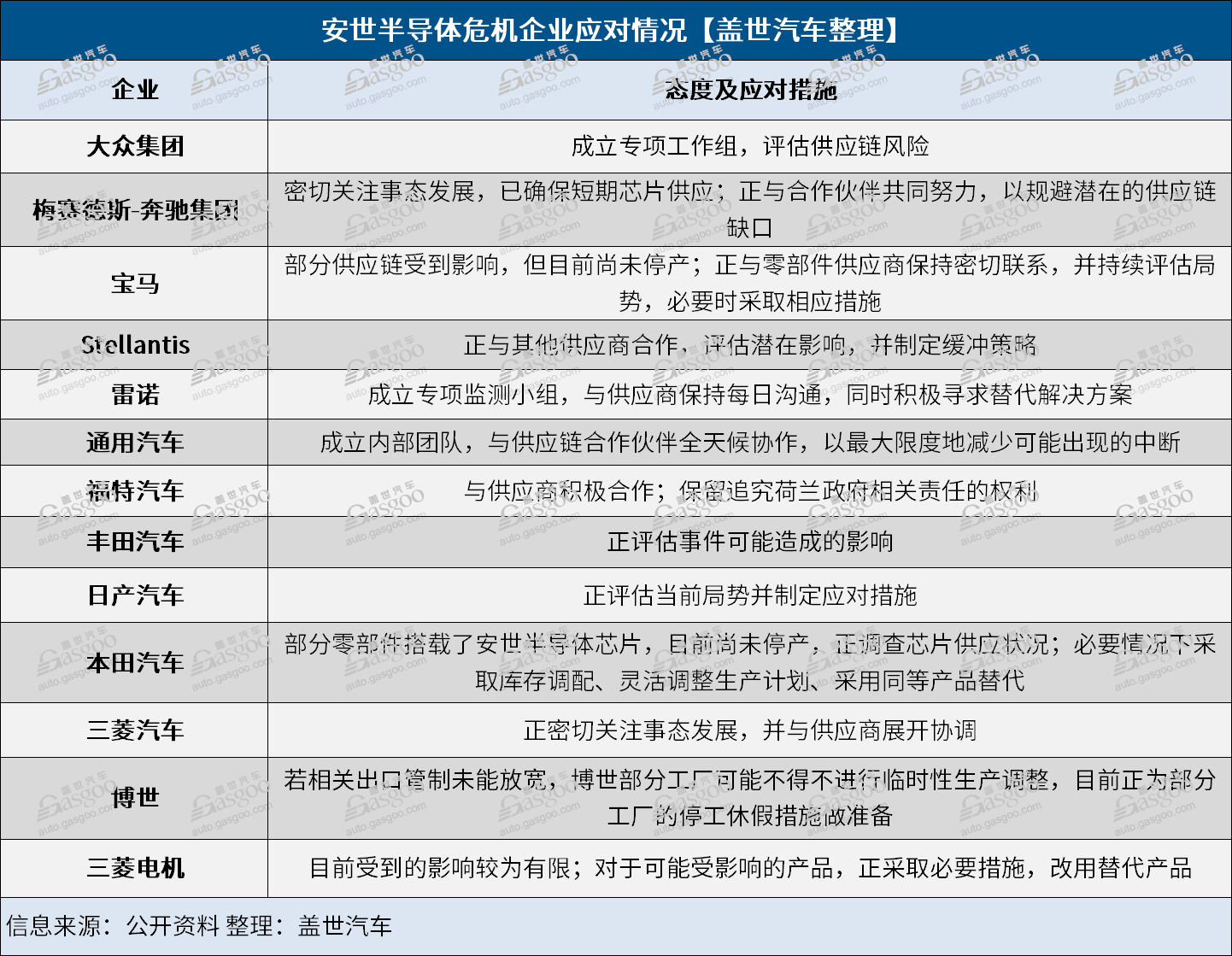

Currently, global automakers and component suppliers are closely monitoring the situation, trying to determine the extent of the impact and taking urgent measures to mitigate it.

Finding alternative suppliers? It's not that easy.

After experiencing a series of supply chain crises such as the COVID-19 pandemic, the Russia-Ukraine war, and attacks on Red Sea shipping, automakers and parts suppliers have "learned their lesson" and are enhancing supply chain resilience by diversifying procurement and establishing multiple supply channels. However, the European Automobile Manufacturers Association pointed out that despite the automotive companies' best efforts to diversify their supply chains, "the risk cannot be completely reduced to zero."

For the Nexperia crisis, it is not easy for car manufacturers to find alternative suppliers in a short period of time. Firstly, in terms of production, Nexperia produces billions of chips annually, including discrete semiconductors, diodes, transistors, and MOSFETs. It ranks third to fifth among global suppliers of similar components. Finding an alternative with such large-scale production capacity is a formidable challenge for the entire value chain.

Secondly, the chips produced by Nexperia are not cutting-edge like those from NVIDIA or Qualcomm but are inexpensive, basic mass-produced chips. These chips belong to a relatively mature technology field with lower profit margins. From a technological maturity perspective, these chips have undergone decades of improvements and have obtained stringent automotive qualification certifications, which require extremely high reliability standards. Switching to alternative suppliers means going through a lengthy certification process to re-certify components, a process that cannot be compressed into just a few days or weeks. From a profit margin perspective, as mature production lines yield lower profits, most chip manufacturers have shifted their focus to more advanced processes.

Third, the products of Nexperia are embedded with These chips are not provided as standalone components, but are soldered into complex assemblies, directly integrated into the automotive electrical structure, making it difficult for suppliers to quickly replace them.

The crucial aspect is that the lifeline of Anshi Semiconductor does not lie in its headquarters in the Netherlands, but rather in its production base located in Dongguan, China. Although Anshi has wafer factories in Germany and the UK, the packaging and testing of its chips are primarily concentrated in China. China has banned the export of automotive power chips, industrial-grade MOSFETs, and other key products from Anshi Semiconductor's Chinese base, and has simultaneously upgraded its export controls on superhard materials. The semiconductor industry chain, from lithography machines to chip manufacturing, relies heavily on the support of these critical materials.

Therefore, although in theory, companies can look for alternative suppliers, in reality, the time and cost are difficult to bear. Some European and American car companies have started trying to bypass the Dutch headquarters and place orders directly with Nexperia China to alleviate the urgent supply chain issues.

Supply Chain Security Rings Another Alarm

The complex multi-party game involving Nexperia has not yet fully settled, and the chain reaction continues to ferment.

A Dutch Ministry of Economic Affairs official stated that they are in dialogue and negotiations with the Chinese side, trying to lift China's export restrictions to avoid impacting the European industrial system. However, given the escalation of tensions between the two parties, it remains uncertain whether the negotiations can make progress. In other words, whether the current Nexperia crisis can be properly resolved depends not on the industry, but on geopolitics.

As the electrification and intelligence of vehicles continue to advance, automakers are becoming increasingly dependent on semiconductors, while the chip supply landscape is becoming more complex due to geopolitical struggles. Once the supply chain becomes politicized, the consensus on technological globalization is torn apart.

The Anshi turmoil is not just a struggle over the fate of a chip company; it also exposes another deep-seated conflict: the clash between the West and China over "supply chain security" and "industrial sovereignty." For Europe, the Dutch government's takeover of Anshi is justified as a means to "prevent the inability to access technology and products in emergencies." However, for Chinese companies, such actions are undoubtedly seen as an "erosion of economic sovereignty." When political logic overrides commercial logic, supply chain stability becomes the casualty.

From the corporate perspective, this incident is bound to accelerate the "supply chain restructuring" in the automotive industry. Automakers not only need to reassess the sourcing risks of key components but also need to establish deeper vertical integration capabilities in areas such as chips, software, and raw materials.

As the trade tensions between China and the United States continue, the global automotive industry may enter an era of more normalized supply chain pressure in the foreseeable future, highlighting the increasing importance of "supply chain security."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track