U.S. Treasury Secretary Threatens China: Buying Russian Oil May Lead to 500% Tariff! Styrene Falls to 5-Year Low, PVC Defies Trend to Turn Red

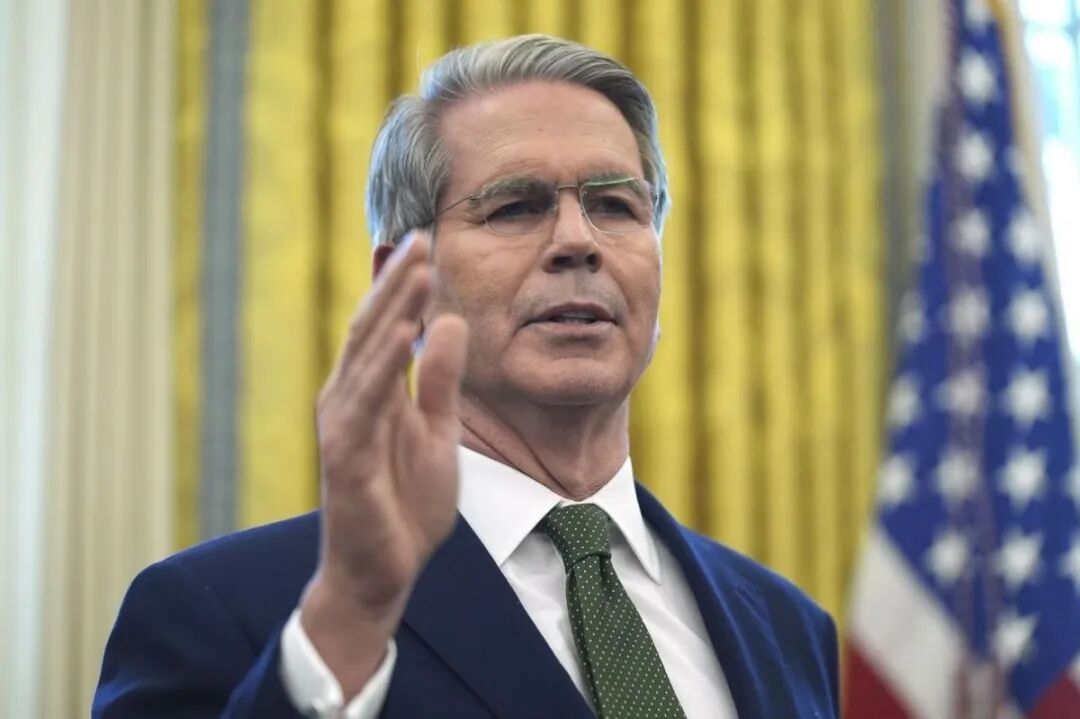

Besent said at the press conference:"85 senators are ready to grant President Trump the power to impose tariffs of up to 500% on Chinese purchases of Russian oil."

Bessent stated that Trump has instructed the U.S. ambassador to inform European allies that if European partners comply, the U.S. is prepared to impose tariffs on China for purchasing Russian oil.

This nearly brutal tariff barrier, if implemented, will completely rewrite the trade rules between China and the United States. What is more alarming is that Trump has pressured European allies through diplomatic channels to coordinate actions in an attempt to place China's energy trade under an international siege.

This brewing trade storm is pushing the world's two major economies toward the brink of a new type of confrontation.

Besent disclosed after a closed-door meeting of the Senate Finance Committee that the proposal has received bipartisan support, far exceeding the 60-vote threshold needed to pass the legislation. According to the draft, the U.S. government will have the authority to impose tariffs of 300%-500% on any Chinese entities proven to import energy from Russia, covering crude oil, natural gas, and their derivative chemical products.

More notably, Trump has instructed U.S. ambassadors in several European countries to convey a clear message to allies: If the EU implements similar sanctions simultaneously, Washington will fully support the construction of an energy trade blockade against China. Observers see this move as the White House attempting to replicate the "Russian oil price cap coalition" experience, aiming to build a new encirclement against Sino-Russian energy cooperation.

More notably, Trump has instructed U.S. ambassadors in several European countries to convey a clear message to allies: If the EU implements similar sanctions simultaneously, Washington will fully support the construction of an energy trade blockade against China. Observers see this move as the White House attempting to replicate the "Russian oil price cap coalition" experience, aiming to build a new encirclement against Sino-Russian energy cooperation.

At a White House press conference, when asked whether U.S.-China relations would escalate into a trade war, Trump declared with his signature tough tone, "We are now engaged in a trade war." This statement completely dismantled the ambiguous rhetoric of traditional diplomacy and blatantly brought the logic of Cold War-style confrontation to the forefront. Analysts point out that this move goes far beyond the realm of traditional trade friction—by cutting off the energy cooperation channel between China and Russia, the United States aims to weaken two major strategic rivals simultaneously and seize absolute dominance in the restructuring of the global energy order.

Data shows that China's crude oil imports from Russia surged by 42% year-on-year in 2023, surpassing 120 million tons. Western think tanks generally believe that Western sanctions on Russian energy have instead strengthened the energy ties between China and Russia. Now, the United States is attempting to sever this lifeline through secondary sanctions, which could trigger a reshuffling of the global energy market.

Latest Plastic Quotation on October 17

On Thursday, U.S. WTI crude oil futures closed at $56.99 per barrel, down 2.3%, marking the lowest price since February 2021, with a 19% decline over the past year. This week's decline has already surpassed the low point reached earlier this spring when Trump's series of tariff announcements sparked concerns about economic turmoil. This morning's opening continued to fall, with crude oil SC down 2.39% to 432.6 yuan/barrel, and PP, PE, and styrene futures remaining in the red, while PVC bucked the trend and turned positive. Since late September, styrene futures prices have been on a continuous downward trend, and as of yesterday's close, styrene futures prices hit a five-year low!

The instability in the market has caused the plastic spot market to show a downward trend even during the traditional peak season this year. Today, general-purpose materials and engineering materials have once again experienced a widespread decline.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track