U.S. Reciprocal Tariffs Officially Take Effect, Oil Prices Mark Sixth Consecutive Drop, Plastic Futures Fluctuate Narrowly, Weak Volatile Trend Expected Today

1. Overnight Crude Oil Market Dynamics

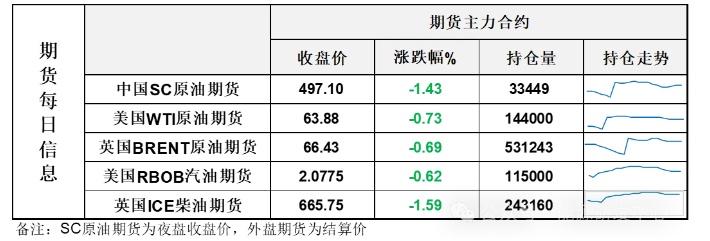

8/7: The bearish sentiment from OPEC+ production increase continues, coupled with the US sanction plans not yet causing significant concern, leading to a six-day consecutive decline in international oil prices. NYMEXCrude Oil FuturesThe September contract fell by $0.47/barrel to $63.88, a month-on-month decrease of 0.73%; ICE Brent crude oil futures October contract fell by $0.46/barrel to $66.43, a month-on-month decrease of 0.69%. China's INE crude oil futures main contract 2510 increased by 0.4 to 499.9 yuan/barrel, and fell by 6.1 to 493.8 yuan/barrel in the night session.

Future Market Outlook

Oil prices have closed lower for the sixth consecutive day, marking the first occurrence of six straight declines in half a year. During this period, there were significant intraday rebounds, but none altered the downward trend in oil prices.

2. Federal Reserve — ① Trump nominates Chairman of the White House Council of Economic AdvisersStephen Milam serves as a member of the Federal Reserve Board.The term ends on January 31, 2026. ② It is reported thatWaller has become a leading candidate for the new Fed chairman.3. U.S. Treasury Secretary Besent: The interview process for the Federal Reserve Chairman has begun. 4. Bostic: The July employment report has indeed changed the Federal Reserve's view on employment targets.

3. US-Russia Talks - ① Russian Presidential Aide: Russia and the US are preparing a meeting between the two heads of state, with the goal ofMeeting to be held next week2. Putin: The UAE is one of the appropriate places to meet with Trump and does not mind meeting Zelensky. 3. Trump comments on the Russia-US summit: Putin does not need to agree to meet Zelensky.

4. Policy of Exempting Nursery Education FeesCover all kindergarten children in the senior class.The annual childcare and education subsidy funds to be borne by the central finance will be allocated soon.

The General Administration of Customs: In July, imports and exports totaled 3.91 trillion yuan, an increase of 6.7%. Among them, exports were 2.31 trillion yuan, an increase of 8%; imports were 1.6 trillion yuan, an increase of 4.8%.

3. Plastic Market Trends

Night session chemical products show mixed gains and losses.

The plastics 2509 contract was quoted at 7,309 yuan/ton, up 0.10% from the previous trading day.

The PP2509 contract reported at 7078 yuan/ton, up 0.06% from the previous trading day.

PP2601 contract reported at 7,109 yuan/ton, down 0.03% from the previous trading day.

The PVC2509 contract is quoted at 5,014 yuan/ton, down 0.61% compared to the previous trading day.

The styrene 2509 contract is quoted at 7,300 yuan/ton, down 0.12% from the previous trading day.

4. Market Forecast for Today

PE:The price of polyethylene is expected to fluctuate slightly downward. In the short term, although there is decent cost support for polyethylene, the fundamental supply and demand pressure is increasing, intensifying market caution. Prices may fluctuate slightly downward, with a range of 5-50 yuan/ton.

PP:Polypropylene prices are expected to fluctuate mainly at the lower end, with raffia grades hovering around 7000-7050 yuan/ton. As the market lacks new supply and demand variables, it is seeking new guidance from external factors.

pvc:PVC prices are expected to decline within a narrow range, with the spot market fundamentally weak and price expectations slightly easing.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track