Trump's Tariff Surprise: U.S.-China Trade Conflict Intensifies; PC Continues to Rise, Gains 300 Today

1. Trump’s tariff blitz, the China-US trade conflict escalates sharply! In-depth analysis of the underlying causes.

Summary:On October 10, Trump made a series of announcements, declaring a 100% tariff on Chinese goods and implementing export controls on key software, which directly triggered a plunge in the stock market and oil prices. This move countered China's export controls on rare earths and lithium batteries initiated on October 9, as well as the special port fees for ships that take effect on October 14. The deeper motivation points to the negotiations over a 24% reciprocal tariff truce that is set to expire on November 9, compounded by political pressure from a 13% year-on-year decline in soybean exports from U.S. agricultural states. Trump is attempting to seize the initiative in negotiations ahead of the APEC summit through "maximum pressure," but concerns over the volatility of his policies have exacerbated global economic uncertainty.

Event:Beijing TimeOn the evening of October 10th, around 11 PM, U.S. President Trump posted a lengthy message on social media, stating that the U.S. would impose an additional 100% tariff on Chinese goods based on the existing tariffs, and would implement export controls on "all critical software" to China. However, Trump did not specify the details of the export control policies.

:Upon the release of this article, U.S. stocks rapidly plummeted, with the three major indices collectively closing sharply lower. By the close of trading, the Dow Jones Industrial Average had fallen.1.9%, the S&P 500 index fell by 2.71%, and the Nasdaq Composite index fell by 3.56%. Among them, both the S&P 500 index and the Nasdaq recorded their largest single-day declines since April 10.At the same time.The Nasdaq China Golden Dragon Index closed down over.Alibaba and Baidu's stock prices both plummeted over 8%, while JD.com fell more than 6%. Investors are worried that trade tensions will harm global economic growth, thereby suppressing oil demand, leading to a significant drop in international oil prices. WTI crude oil futures fell 4.24%, closing at $58.90 per barrel; Brent crude oil futures dropped 3.82%, closing at $62.73 per barrel.

Fuse:

U.S. Maritime Affairs towards ChinaThe 301 investigation fee is about to be imposed, and China has deployed countermeasures. On April 17, 2025, one year after launching the "301" investigation into China's maritime, logistics, and shipbuilding industries, the Office of the United States Trade Representative (USTR) announced the fee measures.

U.S. Trade Representative's Office Annual Progressive Fee Mechanism for Chinese Manufactured Ships

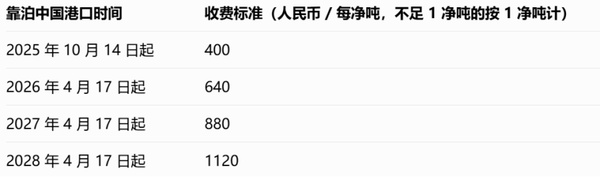

On October 10, the Ministry of Transport of China announced that, with the approval of the State Council, starting from October 14, 2025, the maritime administration at the port where American vessels are docked will be responsible for collecting special port fees for these vessels. The Ministry of Transport stated that this measure is a countermeasure against the United States.

China charges special port dues for U.S. vessels, specific charging standards.

The previous day, that is.On October 9, the Chinese Ministry of Commerce issued four announcements regarding export controls related to rare earths, lithium batteries, superhard materials, etc. This also became a key point mentioned in Trump's lengthy statement on tariffs against China.

Ministry of Commerce and General Administration of Customs AnnouncementDecision No. 55 of 2025 Announcing the Implementation of Export Controls on Items Related to Superhard Materials

Ministry of Commerce and General Administration of Customs AnnouncementAnnouncement No. 56 of 2025 on the Decision to Implement Export Controls on Certain Rare Earth Equipment and Related Raw and Auxiliary Materials.

Announcement of the Ministry of Commerce and the General Administration of CustomsDecision No. 57 of 2025 announced the implementation of export controls on certain medium and heavy rare earth-related items.

Ministry of Commerce and General Administration of Customs AnnouncementDecision No. 58 of 2025 on the Implementation of Export Control on Lithium Batteries and Artificial Graphite Anode Materials.

It should be noted that Trump inOn the night of the 10th, it was stated that there would be no meeting with our leaders during the APEC summit (October 31 - November 1). However, after half a day, at 5 a.m. Beijing time on October 11, Trump posted again, stating that starting from November 1, the U.S. would impose an additional 100% tariff on Chinese goods on top of the existing tariffs, and would implement export controls on all critical software to China. However, Trump did not specify the details of the export control policy.

The coincidence of timing has led to more speculation about the outcome of this trade conflict, as if creating bargaining chips out of thin air before the China-U.S. negotiations.

Underlying reasons:"Using war to promote peace" to solve the imminent tariff issue between China and the United States.

Review of this year's tariff war:

Trump's second term inauguration immediately resumes tariff pressure on China.On January 15, the U.S. Department of Commerce expanded restrictions on chip overseas production from 7nm to below 14nm. On January 24, an anti-dumping investigation was launched against China's low-speed passenger vehicles, involving an amount exceeding $5 billion.

The U.S. side with"Due to the 'fentanyl issue,' in February"On March 1, an additional 10% tariff was imposed on U.S. products exported to China, and on March 3, another 10% was added, bringing the total tariff rate to 20%. In response, China imposed tariffs on U.S. soybeans, automobiles, and other products, and suspended imports of certain agricultural products.

The tariff war has fully escalated. On the 2nd, the U.S. increased its "reciprocal tariffs" on China from 34% to 84%, covering core sectors such as electric vehicles and semiconductors; on April 8th, it further raised them to 125%, bringing the total tariff rate on China to 145%. China quickly responded by increasing its counter-tariffs to 125% and implementing export controls on key items such as rare earths and lithium batteries.

Geneva Economic and Trade TalksMay 2025On the 10th-11th, the U.S. side will cancel 91% of the tariffs imposed on Chinese goods, involving approximately $320 billion worth of products; simultaneously, the Chinese side will cancel 91% of the retaliatory tariffs and suspend 24% of the "reciprocal tariffs" for 90 days.

The first meeting of the London Economic and Trade Consultation MechanismJune 2025From the 9th to the 10th, the focus shifted from tariffs to specific technical details, with key discussions on rare earth export controls and market access.

Stockholm Economic and Trade TalksJuly 2025From August 28 to 29, in view of the upcoming expiration of the tariff truce period on August 12, both parties agree to extend.Truce untilIn early November, and continue to suspend the 24% reciprocal tariff.China will simultaneously suspend non-tariff countermeasures against the U.S., such as restrictions on the import of certain agricultural products.

Madrid Trade TalksSeptember 2025From the 14th to the 15th, the negotiations included TikTok operations and energy trade related to the Russia-Ukraine conflict for the first time. The Trump administration has again extended the "grace period" for ByteDance until December 16, postponing the mandate for a forced sale.

From this perspective, after the Stockholm talks, the suspension between China and the United StatesThe 24% reciprocal tariffs will expire on November 9, covering consumer and semiconductor equipment, machinery and electrical equipment, textiles, clothing and light industrial products, new energy vehicles and parts, medical devices and pharmaceuticals, as well as other key raw materials such as rare earths. Moreover, in September, due to China's countermeasures, U.S. soybean exports to China fell by 13% year-on-year, putting significant economic pressure on agricultural states. Trump urgently needs to demonstrate a stance of "protecting farmers' interests" through tough measures to appeal to midterm voters in 2026, which is the main reason for his recent actions.

Trump chose to take action at this time to create negotiating leverage before the deadline, forcing China to make concessions on key issues such as tariff extensions and technology controls.The APEC summit in South Korea at the end of October may serve as an opportunity for a meeting between the Chinese and U.S. presidents. Trump is attempting to gain a psychological advantage before the summit through the strategy of "pressure first, negotiate later."

(Author: Zhou Yongle, Senior Market Analysis Expert at Specialized Vision)

II. Today's Plastic Prices

(Source: Dayi You Su)

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track