Trump Signs Order! New "Reciprocal Tariffs" Range From 10% to 41%—Plastic Futures Slump, POM Rises

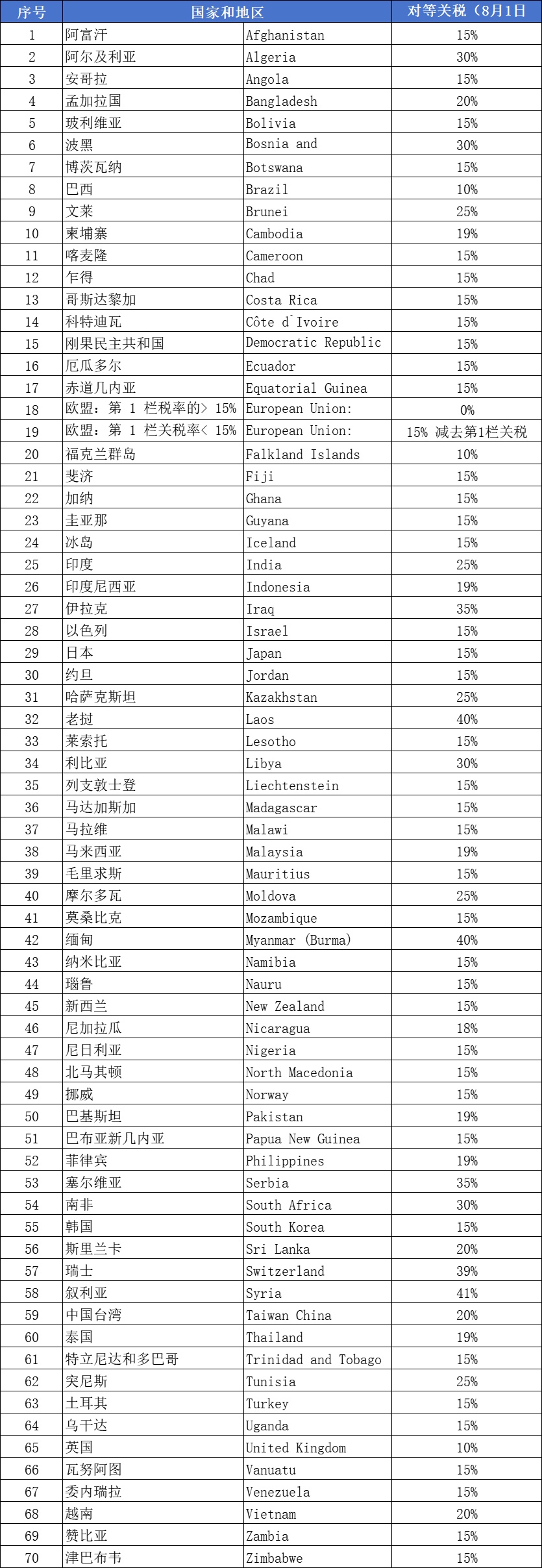

On July 31 local time, the White House website announced that U.S. President Trump signed an executive order establishing the latest "reciprocal tariff" rates for nearly 70 countries and regions, with specific rates ranging from 10% to 41%. Specific details are as follows:

According to Annex I, a 15% tariff is applied to countries such as Japan, South Korea, and New Zealand. A uniform tariff of 10% is applied to goods from countries not listed in Annex I. The executive order also stipulates that if goods are found to be rerouted through a third country to evade tariffs, a 40% rerouting tax will be imposed, and the entities will be added to an "evasion list" which is published biannually.

According to the administrative order, the highest "reciprocal tariff" rate is imposed on Syria at 41%, Myanmar and Laos at 40%; Brazil and the United Kingdom have the lowest tariff rates at 10%. The tariff rates for most countries and regions are set at 15%. The tariff rate for Vietnam is set at 20%.

The new tariffs will take effect in 7 days, officially coming into force on August 7th.This move is also to provide countries that have not reached a trade agreement with time to negotiate, so that U.S. Customs has enough time to make the necessary changes to collect the new tariffs.

Tariff Exemption: Goods that have been shipped before 00:01 AM Eastern Time on August 7, 2025, and are in their final mode of transport, and arrive in the United States by October 5, 2025, for consumption or withdrawal from warehouse for consumption, will not be subject to the additional tariffs. This allows existing orders destined for the U.S. to be exempted, meaning that as long as the goods are shipped by August 7 and arrive at a U.S. port before October 5, they qualify for the tariff exemption. The previously implemented additional tariffs (10%, excluding China) still apply.

EU Tariffs: If the tariff rate in the first column for an EU product is less than 15%, then the reciprocal tariff for that product is 15% minus the tariff in the first column. If the tariff rate in the first column for an EU product is already equal to or greater than 15%, then the reciprocal tariff for that product is zero. This essentially ensures that EU products are not subject to a tariff lower than 15%. It is important to note that the EU reciprocal tariff does not stack with the most-favored-nation rate or any other additional imposed tariffs.

Canadian Tariffs: In addition, Trump stated that he will raise tariffs on Canada from 25% to 35%, effective August 1. The White House indicated that goods that comply with the United States-Mexico-Canada Agreement (USMCA) will not be affected by the higher rates.

Latest plastic prices on August 1st

In August, the commodity futures market broadly turned green, with coking coal falling more than 5%, PP, PE, and styrene slightly declining, and PVC and PTA dropping more than 1%.

Recently, driven by the "anti-involution" sentiment and infrastructure benefits such as the Yarlung Zangbo River power station project, PVC followed leading commodities like coking coal in a unilateral rise. Unfortunately, the good times didn't last long, as it fell back shortly after gaining momentum.

The final straw that broke the market—Wanhua's 400,000 tons/year PVC and other units resume production.Directly pushing suppliers to their maximum capacity, resulting in a drop in spot prices, with a more significant decline in some areas:

Hangzhou Sanlian WuxingA decrease of 160 yuan/ton

Hangzhou Yihua Five TypesDown 160 yuan/ton

Hangzhou Yili WuxingThe price dropped by 150 RMB/ton.

Hangzhou Jintai Type 5Down 150 yuan/ton

Changzhou Zhongtai Type 5Down 120 yuan per ton

Tianjin Yili Five TypesDown 110 yuan per ton

Shanghai Tianye Five TypesDown 100 yuan/ton

……

The plastic market has almost given back all its previous gains. Currently, downstream demand is weak, and the supply side remains under high pressure, making it difficult for there to be any significant increase in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track