Top 10 Most Popular Car Models in the First-Tier Cities of Beijing, Shanghai, Guangzhou, and Shenzhen in the First Half of the Year

The Top 10 Most Popular Car Models in the First Half of 2025 in Beijing, Shanghai, Guangzhou, and Shenzhen Have Been Released.

In the four major first-tier cities, new energy vehicles have become the absolute market mainstream, dominating the rankings in each city. Intelligence and a sense of technology have become important considerations for consumers when purchasing cars.

In the Beijing market, the Tesla Model Y stands out, while several BYD models perform impressively. In the Shanghai market, the Tesla Model Y continues to lead, with emerging models like the Xiaomi SU7 making a strong entry. In the Guangzhou market, the Xiaomi SU7 takes the lead, and traditional fuel vehicles still hold a place. In the Shenzhen market, the Xiaomi SU7 leads in sales, and BYD, leveraging its local advantage, has several models making the list.

Although the four major cities each have their own focus, they collectively outline a diverse pattern and trend direction of automobile consumption in first-tier cities.

▍Shenzhen: Vehicles priced between 200,000 and 300,000 yuan have the highest sales proportion.

In the first half of this year, new energy vehicles occupied all positions in the top 10 most popular models among consumers in Shenzhen. The Xiaomi SU7 topped the list with sales of 7,551 units, becoming the most popular model among consumers in Shenzhen.

Tesla’s two models, the Model Y (5,592 units) and Model 3 (3,704 units), ranked second and third, respectively. As a first-tier city, consumers in Shenzhen place a high value on technological sophistication and brand added value. Tesla, with its global brand image and technological innovation capabilities, has precisely met these needs. However, judging from the sales gap between the two models, SUVs are more favored in the Shenzhen market.

BYD has four models entering the list: Song PLUS (3,457 units), Song L (2,988 units), Seal 06 (2,961 units), and Song Pro (2,838 units), with total sales accounting for nearly 40% of the top 10. From the hybrid models of the Song series to the pure electric Seal 06, BYD covers the mainstream consumer price range from 150,000 to 300,000 yuan through technology penetration and price gradient settings.

The inclusion of the XPeng M03 (2,969 units) and the AITO M9 (2,855 units) represents the differentiated competition among new energy brands in the smart vehicle sector. As the only range-extended model on the list, the Li Auto L6 (2,608 units) demonstrates the market demand for products with "no range anxiety."

In terms of price range, the 200,000 to 300,000 RMB segment accounts for the highest sales proportion at 42%, with models like Xiaomi SU7 and Tesla Model Y performing strongly in this range; the 150,000 to 200,000 RMB segment is dominated by multiple BYD models, accounting for 33%, demonstrating BYD's dominance in the mid-range market; sales proportions for the under 150,000 RMB and over 300,000 RMB segments are relatively small, at 15% and 10% respectively.

▍Beijing: Models in the 150,000-250,000 price range have the highest sales proportion.

Among the top 10 most popular car models in Beijing in the first half of the year, new energy vehicles dominated, with only one traditional fuel car, the Camry, making the list. The Tesla Model Y took the lead with sales of 10,293 units, becoming the preferred choice of consumers in Beijing.

Another Tesla model, the Model 3 (3,418 units), also made it to the list, occupying two spots on the list alongside the Model Y.

BYD has four models ranked in the TOP10: Qin PLUS (5,512 units), Qin L (4,038 units), Song PLUS (2,938 units), and Seagull 05 (2,563 units). The combined sales of these four models account for more than half of the TOP10. From the Qin series to the Song series and then to the Seagull 05, they cover the consumer price range from 100,000 to 250,000 yuan.

The inclusion of the Zhijie R7 (2,574 units) and Xiaomi SU7 (4,534 units) reflects the competitive advantages of new forces and crossover brands in the field of intelligent technology. Their performance indicates that in the increasingly fierce competition of the new energy vehicle market, intelligence has become a key factor for brands to gain market share.

The inclusion of the Alpha T5 (2,478 units) on the list demonstrates the efforts of traditional car manufacturers in the transition to new energy vehicles. With its solid vehicle quality and reasonable pricing, it has secured a place in the market.

The Camry (3,065 units) is the only traditional fuel vehicle on the list, and its sales demonstrate that there is still demand for conventional fuel cars among some consumers. For those who are accustomed to the driving experience of fuel vehicles or have concerns about charging and range of new energy vehicles, mature and highly reliable fuel cars like the Camry remain their choice.

In terms of price range, models priced between 150,000 and 250,000 yuan account for the highest sales proportion at 48%. Several BYD models and the Alfa T5 mainly focus on this range. The 250,000 to 350,000 yuan segment is dominated by two Tesla models and the Xiaomi SU7, accounting for 32%, reflecting strong demand for mid-to-high-end new energy vehicles in the Beijing market. Sales proportions for models below 150,000 yuan and above 350,000 yuan are relatively small, at 12% and 8% respectively.

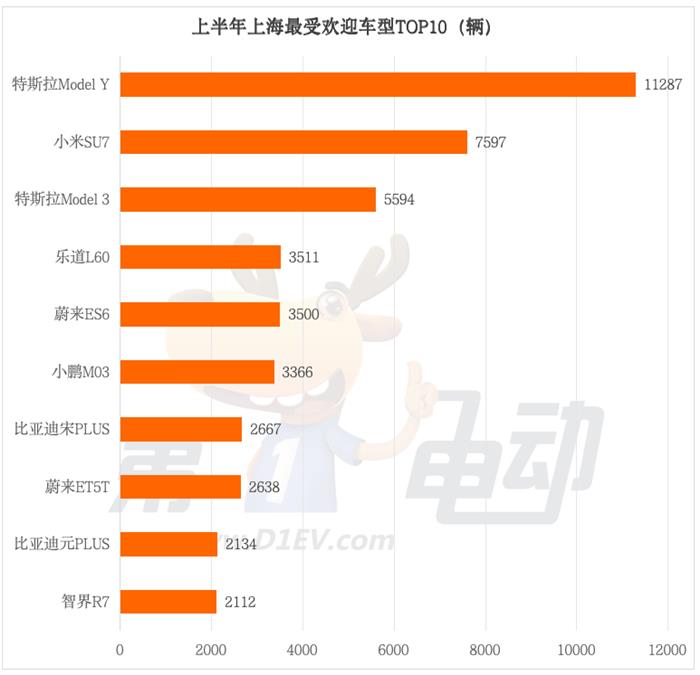

▍Shanghai: Tesla is the biggest winner

Tesla is undoubtedly the biggest winner among the best-selling models in Shanghai, with its Model Y and Model 3 ranking first and third respectively. The combined sales of these two models reached 16,881 units, far surpassing the total sales of any other single brand.

As a newcomer in the automotive industry, Xiaomi's first model, the SU7, achieved impressive results by ranking second with sales of 7,597 units.

NIO has two models on the list, the ES6 and ET5T, ranking fifth and eighth respectively, with a total sales of 6,138 units. As a representative of high-end new energy brands, NIO has established a firm foothold in Shanghai's high-end consumer market. Its battery swapping technology and premium service are important factors attracting consumers.

BYD also has two models on the list, with the Song PLUS and Yuan PLUS ranking seventh and ninth respectively, totaling 4,801 units sold. XPeng and Zhijie each have one model in the top ten, namely the XPeng M03 and Zhijie R7, with sales of 3,366 and 2,112 units respectively. Their competition in intelligent driving and technological features is also very intense.

As a relatively niche brand, LeDao's L60 ranked fourth with sales of 3,511 units, making it a dark horse. This indicates that its precise market positioning and product strategy have achieved certain results.

In terms of price range, models in the 150,000 to 250,000 RMB range have a relatively high market share in Shanghai, accounting for about 45%. BYD's Song PLUS, Yuan PLUS, as well as Xiaopeng's M03 and Leodo's L60, are mainly focused on this range. Models in this price range typically offer high cost-effectiveness and can meet the car purchasing needs of most ordinary consumers.

In the 250,000-350,000 RMB price range, models such as Tesla Model Y, Model 3, Xiaomi SU7, and NIO ES6 are the main choices, accounting for about 30% of sales. Vehicles in this range are mainly targeted at mid-to-high-end consumers, who have higher demands for brand, quality, and technological features. Sales in the below 150,000 RMB and above 350,000 RMB ranges are relatively small, accounting for approximately 15% and 10% respectively.

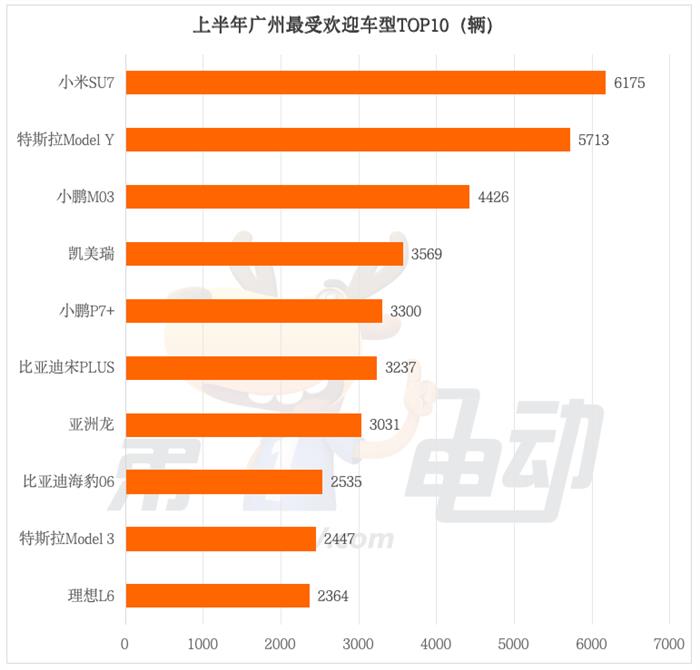

▍Guangzhou: Fuel vehicles still have a place.

Xiaomi SU7 topped the list of the top 10 best-selling models in Guangzhou in the first half of the year, with sales of 6,175 units. Tesla Model Y followed closely with sales of 5,713 units. As a popular model under Tesla, the Model Y also has a stable customer base in the Guangzhou market.

Xpeng has two models on the list: the Xpeng M03, with sales of 4,426 units, and the Xpeng P7+, with sales of 3,300 units. With a total sales volume of 7,726 units, as a local new energy vehicle brand in Guangzhou, Xpeng Motors enjoys a natural advantage in the local market.

Traditional fuel vehicles still perform well in the Guangzhou market. The Camry made the list with sales of 3,569 units, and the Avalon also ranked in the top ten with sales of 3,031 units. When purchasing cars, Guangzhou consumers not only pay attention to the technological features of the vehicles but also highly value their practicality and durability, which is where the Camry and Avalon meet consumer needs.

BYD has two models in the TOP 10, with the BYD Song PLUS selling 3,237 units and the BYD Seal 06 selling 2,535 units.

In terms of price range, models in the 150,000–250,000 yuan range account for a large proportion of sales in the Guangzhou market. Models such as the XPeng M03, BYD Song PLUS, and BYD Seal 06 are mainly concentrated in this range. The 250,000–350,000 yuan range also holds a good market share, with models like the Xiaomi SU7, Tesla Model Y, Tesla Model 3, and Li Auto L6 performing strongly in this segment.

▍Written at the end

Overall, the Xiaomi SU7 is favored by consumers in Shenzhen and Guangzhou, while consumers in Beijing and Shanghai have a strong preference for the Tesla Model Y.

From the perspective of the brand, Tesla has performed well in all four cities. The Model Y ranks among the top sales in Beijing, Shanghai, Guangzhou, and Shenzhen, while the Model 3 also has a certain level of sales in each city. This indicates that the Tesla brand has a strong influence and its products receive widespread attention.

BYD has multiple models that have made it to the rankings in various cities, such as BYD Qin PLUS and BYD Song PLUS, showcasing the advantages of BYD's model lineup and the brand's broad user base in major cities. The Xiaomi SU7 has high sales in Shenzhen, Shanghai, and Guangzhou, and has also entered the top three in Beijing. As a new power brand, its market performance is remarkable.

From the perspective of vehicle models, SUVs remain a popular choice among consumers in various cities, such as the Tesla Model Y, BYD Song PLUS, and NIO ES6. At the same time, sedans also have a certain market share, including the BYD Qin L, Tesla Model 3, and XPeng P7+, with features like better handling and fuel efficiency attracting some consumers.

From the perspective of cities, Tesla Model Y's sales in the Beijing market far exceed those of other models, with a clear leading advantage. Traditional fuel vehicles such as the Camry also have certain sales, indicating that Beijing consumers have demand for both high-end new energy vehicles and traditional fuel cars.

The market competition in Shanghai is quite intense, with both the Tesla Model Y and Xiaomi SU7 achieving high sales. Moreover, there are several new energy vehicles on the ranking list, reflecting Shanghai consumers' high acceptance of new energy vehicles and the diversity of the market.

In the Guangzhou market, apart from Xiaomi SU7 taking the top spot, local brand GAC Aion's models did not make the list, while brands like XPeng achieved certain sales. This differs slightly from Guangzhou's previous strong performance by local brands. In the first half of this year, Japanese fuel vehicles such as the Camry still appeared on the list, indicating a preference for Japanese cars in the Guangzhou market.

In the Shenzhen market, Xiaomi SU7 leads in sales, with two Tesla models also ranking among the top. At the same time, BYD performs well in its home base, with four of its models on the list, far surpassing other cities.

From an overall perspective, the high-end market in the four first-tier cities of Beijing, Shanghai, Guangzhou, and Shenzhen is dominated by brands such as Tesla and Xiaomi. The mid-range market is primarily led by BYD, while new emerging brands are breaking through by focusing on intelligent niche scenarios. Traditional fuel vehicles still have a certain market space among specific consumer groups.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track