Top 10 Domestic Power Battery Export Volume from January to July: Two Companies Double Growth, BYD Shows Significant Increase

From January to July, the cumulative export of power batteries in China increased by 29.4% year-on-year. Companies such as BYD, SVOLT Energy, and REPT Battero exceeded the average growth rate, with SVOLT Energy and REPT Battero achieving year-on-year growth of 159.8% and 111.9%, respectively.

On August 11, the China Automotive Power Battery Industry Innovation Alliance released the latest data showing that in July, China’s total exports of power batteries and other batteries (note: “other batteries” mainly refer to energy storage batteries, including a small number of small power batteries) reached 23.2 GWh, a month-on-month decrease of 4.7% and a year-on-year increase of 35.4%, accounting for 18.3% of that month’s total sales. Among them, power batteries accounted for 63.7% of exports and other batteries accounted for 36.3%. Compared with the previous month, the proportion of other batteries increased by 1.3 percentage points.

Image source: China Automotive Power Battery Industry Innovation Alliance

From January to July, China's cumulative exports of power and other batteries reached 150.5 GWh, with a year-on-year cumulative growth of 53.1%, accounting for 19.1% of cumulative sales during the same period. The proportions of power batteries and other batteries were 64.1% and 35.9%, respectively, with the power battery proportion remaining unchanged compared to the previous month's cumulative volume.

From January to July, China's power battery exports reached 96.4 GWh.

Specifically,In terms of power batteriesIn July, China’s power battery exports reached 14.8 GWh, a month-on-month decrease of 6.7% and a year-on-year increase of 48.4%. From January to July, the cumulative export of power batteries in China was 96.4 GWh, representing a year-on-year increase of 29.4%.

In terms of the material type of power batteries, in July, China's export volume of ternary power batteries was 8.4 GWh, a month-on-month decrease of 7% and a year-on-year increase of 32.9%, accounting for 56.6% of the total. From January to July, the cumulative export volume of China's ternary power batteries was 56.4 GWh, with a cumulative year-on-year growth of 22.3% and a cumulative proportion of 58.4%.

In July, China's exports of lithium iron phosphate (LFP) power batteries amounted to 6.2 GWh, a month-on-month decrease of 7.6% and a year-on-year increase of 76.1%, accounting for 42.3% of the total. From January to July, the cumulative export volume of LFP power batteries in China was 39.4 GWh, with a cumulative year-on-year growth of 42%, accounting for 40.8% of the total.

Other aspects of batteriesIn July, China’s export volume of other batteries was 8.4 GWh, a month-on-month decrease of 0.9% and a year-on-year increase of 17.4%. From January to July, the cumulative export volume of other batteries in China reached 54.1 GWh, representing a cumulative year-on-year growth of 127.1%. Most of these other batteries are energy storage batteries, with lithium iron phosphate as the main cathode material.

Image source: China Automotive Power Battery Industry Innovation Alliance

At the corporate level, in July, China's exports of power and other batteries increased by 35.4% year-on-year. Companies such as BYD, CALB, EVE Energy, Microvast, and REPT Battero exceeded the average growth rate, with REPT Battero having the highest growth rate, increasing by 269.2% year-on-year.

From January to July, the cumulative year-on-year growth of China's power and other battery exports increased by 53.1%. Companies such as BYD, CALB, Gotion High-Tech, SVOLT Energy, and REPT exceeded the average growth rate, with REPT and SVOLT Energy achieving a year-on-year doubling of growth, with increases of 206.2% and 170%, respectively.

In July, China's power battery exports increased by 48.4% year-on-year. CATL, BYD, CALB, EVE Energy, Ruipu Lanjun, and others exceeded the average growth rate, with Ruipu Lanjun achieving the highest growth at 144.5% year-on-year.

From January to July, China's power battery exports increased by 29.4% year-on-year. Companies such as BYD, SVOLT Energy, and REPT Battero exceeded the average growth rate, with SVOLT Energy and REPT Battero achieving year-on-year growth of 159.8% and 111.9% respectively.

Overseas is the next main battlefield for China's power battery industry.

Battery Network has noted that from January to July, REPT BATTERO and SVOLT Energy have shown outstanding performance in battery exports, mainly due to an increase in orders for power and energy storage battery products, with scale effects becoming evident.

Ruipu Lanjun recently released its half-year report, showing that it sold a total of 32.4 GWh of lithium battery products in the first half of the year, a year-on-year increase of 100.2%. Among them, shipments of energy storage batteries reached 18.87 GWh, a year-on-year increase of approximately 119.3%; shipments of power batteries reached 13.53 GWh, a year-on-year increase of approximately 78.5%. In terms of sales revenue, the company's power battery product sales generated revenue of 4.027 billion yuan, a year-on-year increase of 40.9%; energy storage battery product sales generated revenue of 5.083 billion yuan, a year-on-year increase of 58.4%.

In terms of global expansion, REPT Battero has established subsidiaries in regions such as the United States, Germany, and Southeast Asia, actively exploring international markets and establishing deep cooperative relationships with leading global energy storage and new energy vehicle enterprises. At the same time, the company plans to build production plants in Southeast Asia, Europe, and South America. In January this year, the company announced its investment in the construction of a battery manufacturing base in Indonesia, with the first phase planned to have an annual production capacity of 8 GWh for power and energy storage batteries and systems, as well as battery components.

In July this year, Honeycomb Energy made another key move in expanding its overseas power battery sector. Following deliveries to Europe’s STELLANTIS and BMW MINI, Honeycomb Energy’s short-plate battery, known for its high safety, long lifespan, and fast-charging advantages, was successfully delivered to Vietnam’s VinFast, providing core power support for its Limo Green model.

In addition, Honeycomb Energy's storage products have entered the markets of multiple countries and regions in Europe, the Middle East, and the Asia-Pacific. The cumulative number of projects has exceeded 200+, spanning over 30 countries. It is expected that the cumulative sales will reach 5GWh in 2025 and 8GWh in 2026.

In addition to Ruipu Lanjun and Hive Energy, BYD's export growth is also significant. In both the "Top 10 Power and Other Battery Exports in China" and the "Top 10 Power Battery Exports in China," the company's battery exports in July increased by 96.5% year-on-year; from January to July, the exports increased by 86% year-on-year.

In terms of battery installation, in July, the total installed capacity of BYD's new energy vehicle power batteries and energy storage batteries was approximately 22.350 GWh, with a cumulative installed capacity of approximately 156.876 GWh from January to July.

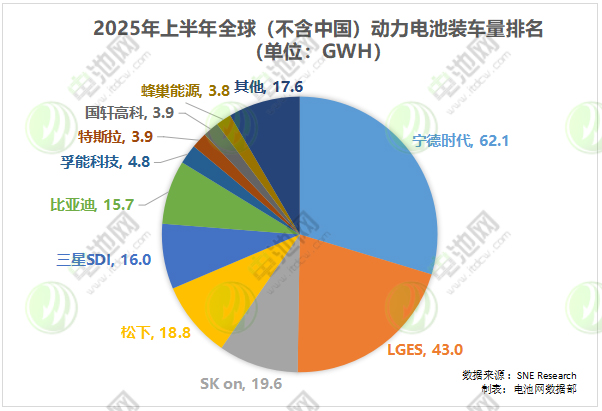

According to data released by the South Korean research institute SNE Research, the global (excluding China) installed capacity of power batteries reached 209.2 GWh in the first half of 2025, representing a year-on-year increase of 23.8%.

In the first half of the year, among the top 10 global (excluding China) companies for electric vehicle battery installations, five Chinese battery companies made the list: CATL, BYD, Farasis Energy, Gotion High-Tech, and SVOLT. The total installation volume of these five Chinese companies in the overseas electric vehicle battery market was 90.3 GWh, with a market share of 43.2%.

Dong Yang, Chairman of the China Automotive Power Battery Industry Innovation Alliance, recently stated in an article that overseas markets are the next main battlefield for China’s power battery industry. Although there are issues such as involutional competition in China’s new energy vehicles and power batteries, from the perspective of international competition, Chinese new energy vehicles and power batteries possess the strongest competitiveness. The electrification of automotive products has become an irreversible international trend. For a considerable period of time, China’s new energy vehicle and power battery industries can maintain advantages such as advanced technology, rapid innovation, and relatively low costs, giving them strong international competitiveness. The competitive advantages of China’s new energy vehicles and power batteries in the domestic market are already evident. However, the international market is the main battlefield for competition between Chinese and foreign new energy vehicles and power batteries.

Research institution EVTank also mentioned that, in addition to the continued high demand in the Chinese market, leading companies accelerating their overseas expansion has also contributed to a significant increase in lithium battery shipments. In its "White Paper on the Development of China’s Lithium-ion Battery Industry (2025)", EVTank predicts that global lithium-ion battery shipments will reach 1,899.3 GWh in 2025 and 5,127.3 GWh in 2030.

It can be seen that going overseas is becoming a key pathway for Chinese enterprises' global expansion and value chain upgrading. However, in the face of high tariff barriers, escalating trade wars, and other uncertainties, how can Chinese enterprises accelerate the upgrade from "product going global" to "industry going global" amid industry integration and global competition and cooperation?

The 12th China (Suzhou) Battery New Energy Industry International Summit (ABEC 2025 | Battery "Davos"), organized by the Zhongguancun New Battery Technology Innovation Alliance and the Battery "Davos" (ABEC) Organizing Committee, will be held in Suzhou, Jiangsu from November 11 to 13, 2025.The theme of this forum is "Seeking Innovation and Adapting to Change: Reshaping Value - The Determination and Resilience in the Reshuffling Cycle of China's Battery New Energy Industry."“Overseas Ventures Chronicle: Accelerating Industry Consolidation and Global Competition-Cooperation in Battery New Energy”Conduct in-depth discussions on hot topics mentioned above.。At that time,600+Executives from leading domestic and international enterprises, listed companies, specialized and innovative enterprises, gazelle companies, unicorns, renowned institutions, investment funds, industry associations, and government departments will attend the event for precise networking and valuable dialogues.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track