[Today's Plastics Market] Weak Trading! ABS Falls Up to 200, PE/PP/PS/PET Narrowly Retreat

Summary: On September 12, the prices and forecasts for general-purpose and engineering plastics in the market were summarized. For general-purpose plastics, the market was weak and declining. PE and PP saw a narrow decline of 1-38; PS slightly fell by 30-40; ABS continued to decline, with some decreases of 40-200; PVC and EVA were operating within a range. In terms of engineering plastics, PC was quiet with some slight increases of 50; the PET market declined, with some decreases of 30-60, while PBT, POM, PMMA, and PA remained stable and dull.

General materials

PE: Market confidence is insufficient, primarily focusing on reducing inventory through discounts.

1. Today's Summary

The market is concerned about the risk of long-term oversupply, coupled with weakening demand in the United States, leading to a decline in international oil prices. NYMEX crude oil futures for the October contract fell by $1.30 per barrel to $62.37, a decrease of 2.04% compared to the previous period; ICE Brent crude futures for the November contract fell by $1.12 per barrel to $66.37, a decrease of 1.66% compared to the previous period.

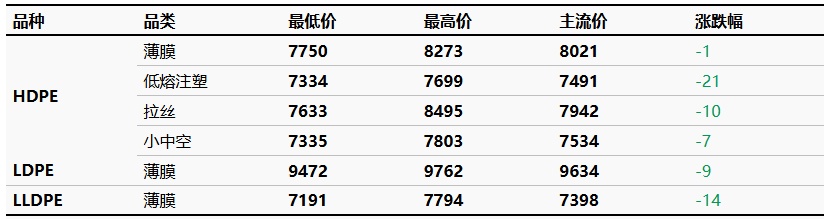

The price change range for the HDPE market is -21 to -1 yuan/ton, the LDPE market price is -9 yuan/ton, and the LLDPE market price is -14 yuan/ton.

2. Spot Overview

Cost-side support continues to strengthen, and short-term downstream restocking maintains just-in-demand levels, with little room for further improvement. Market participants’ previously bullish sentiment is gradually weakening, leading to price concessions to facilitate sales. Polyethylene prices have declined within a narrow range, and transactions have somewhat improved. The price change range for the HDPE market is -4 to 4 yuan/ton, the LDPE market price is -3 yuan/ton, and the LLDPE market price is -2 yuan/ton.

3. Price Prediction

In the short term, Enterprise The number of equipment shutdowns has increased, but supply remains at a relatively high level, resulting in ample market spot availability and certain pressure on supply. There is an expectation of increased downstream operating rates and pre-holiday stocking behavior, with orders expected to improve, considering the overall anticipated increase in imports. Therefore, the polyethylene market is expected to mainly see a narrow upward trend next week. 。

PP: Weak demand performance, polypropylene market downturn and weakness

1 Today's summary

Sinopec Central China PP partial pricing adjustments: Changling MN70 down by 50, 200A down by 50, Sino-Korean 8003/7227/9923 down by 50, 8009 down by 100, Changling F03G down by 30, Jingmen Y26 down by 100, F03D down by 50, Jingmen powder material down by 50 yuan/ton.

Today, the domestic polypropylene shutdown impact volume increased by 2.46% to 20.61%. The domestic PP facilities experiencing shutdowns today include Dalian Hengli STPP, Jincheng Petrochemical Line 1, and Zhongjing Petrochemical Phase 1 Line 2 PP facilities. The daily production proportion of filament decreased by 3.96% to 21.92%.

③、 During this period (20250829-0904), the supply-demand balance remained in a supply-surplus pattern, with the supply-demand gap staying positive and expanding compared to the previous period, exerting a bearish influence on market sentiment. In the next period, the oversupply situation will persist, but the supply-demand gap is expected to narrow. As a result, the impact on prices is expected to remain somewhat bearish. 。

2 Spot Overview

Table 1 Domestic Polypropylene Price Summary (Unit: RMB/ton)

Based on the East China region, today's polypropylene raffia closed at 6,820 RMB/ton, down 27 RMB/ton from yesterday, in line with this morning's expectations. Morning Futures opened lower and fluctuated, while the spot market's focus slightly declined. Currently, there are more temporary shutdowns of polypropylene facilities, but the spot market is still constrained by inventory pressure, with producers and traders actively reducing prices to clear inventory. In the future, as more facilities undergo maintenance and low-priced resources in the market are depleted, the price focus is expected to rebound. As of midday, the mainstream price of raffia in East China is between 6,730-6,950 yuan/ton. 。

3 Price Prediction

Today, multiple units of Jincheng Petrochemical, Hengli Petrochemical, and Zhongjing Petrochemical underwent maintenance, causing the shutdown impact to rise to 20.61%. The estimated maintenance loss for next week is expected to increase, providing some support on the supply side. On the demand side, downstream operating rates have improved, but the traditional peak season has not been observed, and there is insufficient follow-up for new downstream orders. The purchasing enthusiasm is not high, with most maintaining just-in-time replenishment. It is expected that the polypropylene market may... Continues to weakly consolidate.

PS: Cost support is slightly weak, and the market closed slightly lower.

1 Today's Summary

Today, the GPPS price in East China dropped by 40 RMB/ton to 7,560 RMB/ton.

② 、 On Friday, the East China styrene market fell by 55 yuan to close at 7,070 yuan/ton, South China fell by 60 yuan to close at 7,125 yuan/ton, and Shandong fell by 10 yuan to close at 6,915 yuan/ton.

2 The Spot Overview

Table 1 Summary of Domestic PS Prices (Unit: RMB/ton)

According to Longzhong Information, today in East China, GPPS fell by 40 yuan/ton, closing at 7560 yuan/ton.The raw material styrene is fluctuating slightly weaker, leading to reduced cost support, and there is an increase in market operations involving slight price reductions for selling. The industry supply is relaxed, and downstream just-in-need purchases are resulting in slightly lower actual transaction negotiations.

3、Price Prediction

Raw material styrene has slightly declined, with a loose supply in the industry and downstream purchasing driven by low-level demand. The PS market may remain weak and fluctuate within a narrow range in the short term. It is expected that the modified benzene price in the East China market will be around 7500-8500 RMB/ton.

PVC: PVC range adjustment with gradual supply and demand increase

1. Today's Summary

Domestic PVC manufacturers' ex-factory prices have fluctuated individually, increasing or decreasing by about 20 yuan/ton.

The Zhenyang unit has not yet resumed operation, and the Jinchuan and Beiyuan units are under maintenance.

③ Jia Jiaxingcheng and Yaowang Yue conduct internal test runs, and Bohai Chemical Development's new unit is expected to ramp up to full production by the end of the month.

2 Spot Market Overview

Table 1 Summary of Domestic PVC Spot Prices (Yuan/Ton)

Based on the East China Changzhou market, the current cash warehouse delivery price for carbide-based Type V in the East China region is 4,680 yuan/ton, remaining stable compared to the previous trading day. 。

The domestic PVC spot market remains in a small range of fluctuations, with poor macroeconomic expectations. The fundamentals show a steady increase in supply, while domestic demand is improving during the peak season. Spot trades in foreign trade are the main focus, and industry inventory is gradually increasing. The cost support for the PVC industry remains strong at the bottom, and spot prices are fluctuating weakly. In East China, the ex-factory price for calcium carbide method is 4640-4780 yuan/ton, while for ethylene method it is 4800-5000 yuan/ton.

3. Price Forecast

Domestic PVC production enterprises are expected to increase maintenance scale month-on-month, but with the anticipated commissioning of new production capacity, market supply remains high. Pre-holiday stocking before the National Day holiday in China is expected to unfold next week, while foreign trade faces uncertainty due to policy influences, with a focus on delivery of goods. Industry inventory accumulation is expected to continue slowing down. The prices of upstream raw materials remain strong, providing robust cost support. Considering the anticipated macro market sentiment before the holiday, market support is relatively strong. Next week, PVC spot prices are expected to fluctuate within a range, with the East China region's calcium carbide method Type 5 expected to be priced at 4,650-4,800 RMB/ton for cash and carry.

ABS: Today's market trading is weak, and prices continue to decline this week.

1 Today's Summary:

Today, prices in the East China market have declined; in the South China market, prices have slightly dropped in certain areas, and market transactions are generally average.

In September, the monthly production of ABS is expected to decrease slightly on a month-on-month basis.

2 Spot Overview

Table 1 Summary of Domestic ABS Prices (Unit: RMB/ton)

Using Yuyao and Dongguan as benchmarks, prices in the East China market are declining, and prices in the South China market are also declining. Today's market transactions remain driven by rigid demand. The domestic market is filled with negative factors, and market sentiment is generally moderate. Traders are offering discounts to clear inventory. It is expected that next week domestic ABS market prices will continue a downward trend.

3 Price prediction:

Taking Yuyao and Dongguan as benchmarks, the market prices in East China are adjusting within a narrow range, while the market prices in South China are declining. Today’s market transactions are mainly driven by rigid demand, with traders continuing to offer discounts to facilitate sales. ABS prices are expected to maintain a weak downward trend next week.

EVA: Downstream foaming resists high prices, resulting in average transactions.

1 Today's Summary

This week, the ex-factory price of EVA petrochemicals continued to rise, and the auction source prices were significantly increased.

②. This week, most EVA petrochemical units have been operating steadily, with Baofeng shutting down for maintenance on the evening of the 8th.

2. Spot price

Table 1 Domestic EVA Price Summary (Unit: Yuan/Ton)

The domestic EVA market quotations remained stable and consolidated today. Approaching the weekend, there were no significant changes in market supply and demand. Mainstream agents’ spot goods remained relatively tight with firm quotations, but downstream foam factories resisted high-priced sources, mainly focusing on digesting previous raw material inventories. High-priced transactions faced obstacles, and sales of early-stage inventory raw materials increased. 。 Mainstream prices: soft material is quoted at 11,300-11,600 RMB/ton, and hard material is quoted at 10,800-11,400 RMB/ton.

3 Price Prediction

Next week, driven by a strong supply-demand dynamic, the demand for photovoltaic orders downstream is expected to remain strong, leading to robust price adjustments by EVA manufacturers. However, the rate of increase is expected to slow down. The foam market continues to follow passively, and high-price transactions in the market may also slow down. Under the strong influence of supply and demand, the market is expected to rise easily but fall with difficulty, with prices anticipated to mainly consolidate at high levels.

Engineering materials

PC: Market is quiet and consolidating.

1 Today's summary

Thursday International crude oil Downward , ICE Brent Crude Oil Futures November contract at 66.37, down 1.30 USD per barrel.

②、 The closing price of raw material bisphenol A in the East China market is 8,200 yuan. Yuan/ton, unchanged month-on-month.

③. As the weekend approaches, there are no new ex-factory price adjustments from domestic PC factories.

2 Spot Market Overview

Table 1 Domestic PC Price Summary (Unit: Yuan/Ton)

The domestic PC market in China remained stable with narrow fluctuations today. By the close of the afternoon session, mainstream negotiation references for East China injection molding grade low-end materials were between 9,700-13,450 RMB/ton, and for mid-to-high-end materials, between 13,850-15,000 RMB/ton, with the overall focus remaining roughly stable compared to the previous day. Approaching the weekend, there were no new ex-factory price adjustments from domestic PC factories. In the spot market, both East China and South China were mainly stable with narrow fluctuations at low levels. The raw material side has stabilized after previous increases, and there are no substantial positive factors in the industry's supply and demand. Market participants remain cautious and hesitant, with a wait-and-see approach to shipping operations, while downstream demand remains moderate, leading to a subdued trading atmosphere.

3 Price Prediction

Approaching the weekend, the domestic PC market is experiencing a quiet and steady adjustment. Raw material prices have stopped rising and stabilized for the time being, but given the recent significant increases, cost support for PCs remains. Market sentiment is cautious and moderate, with mainstream players continuing to maintain firm pricing. However, considering the persistent intense supply and demand conflicts in the industry, there is a lack of momentum to drive price increases. It is expected that in the short term, the market will remain in a stalemate with narrow-range fluctuations.

PET: Polyester bottle chip market declines

1 Today's Summary

Factory prices are mostly stable, with occasional adjustments. Unit: yuan/ton

The domestic polyester bottle chip capacity utilization rate is at 71.82% today.

2 Spot Overview

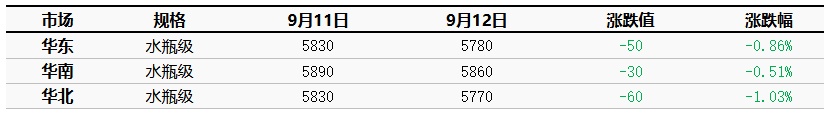

Table 1: Domestic Polyester Bottle Chip Price Summary (Unit: RMB/ton)

Based on the East China market, today's spot price for polyester bottle-grade chips closed at 5,780 yuan, down 50 yuan from the previous working day, in line with the morning forecast.

Crude oil dragged down costs, leading polyester bottle chip factories to mostly lower their quotes by 50, with some remaining stable. The market focus consequently shifted downward. September-October offers were quoted between 5770-5970, with September-October contracts offered at 11 discount 30 to premium 20, compared to a higher 11 premium 60-70; inquiries were at 5750-5780, with contracts at 11 discount 20-30, compared to a higher 5820-5850. Unit: RMB/ton.

3. Price Forecast

Supply reduction expectations are supporting the market trend; however, demand has weakened slightly. In addition, after a recent narrow recovery in processing fees, there is no significant bullish support. It is expected that polyester bottle chips may fluctuate weakly with costs tomorrow. The spot price of polyester bottle-grade chips in East China is expected to range between 5,750-5,900 yuan/ton.

PBT: Fundamentals remain largely unchanged, and the PBT market operates steadily.

1 Today's Summary

The PBT manufacturers' quotations remained stable overall this week.

This week, there are fewer PBT unit maintenance activities.

③ The PBT production for this period is 23,800 tons, with a capacity utilization rate of 56.11%.The domestic average gross profit of PBT this week is -307 yuan/ton, an increase of 72 yuan/ton compared to the previous period. 。

2 Spot Market Overview

Table 1 Summary of Domestic PBT Prices (Unit: Yuan/Ton)

Based on the East China region, the mainstream price of medium and low viscosity PBT resin today is between 7650-7900 yuan/ton, remaining stable compared to the previous working day. Today, the PBT market remains stable, while the PTA market is declining, and the BDO market is undergoing slight adjustments. The raw material aspect is experiencing minor fluctuations, having limited impact on the PBT market. Approaching the weekend, a wait-and-see attitude continues within the market. According to Longzhong Information, the price of low to medium viscosity PBT pure resin in the East China market is 7,650-7,900 yuan/ton.

3 Price Prediction

The PBT market is expected to remain in a stalemate. The low PTA processing fees in the raw material sector may affect the pace of enterprise restarts and the commissioning of new units. However, the overall commodity trend is weak, with sluggish raw material performance and gradually retreating costs. In the short term, the PTA spot market is expected to continue its weak pattern. There are no significant fluctuations in BDO supply and demand, and with the settlement cycle approaching, market participants remain cautious. Supply-side support remains weak, downstream demand is just meeting needs, and negotiations continue to be competitive, resulting in a weak and stalemated market. PBT market demand is expected to increase slowly but provides limited support to the market. The market focus is anticipated to fluctuate within a range, and the PBT short-term market may continue to consolidate. Therefore, Longzhong expects the East China market price for medium to low viscosity PBT resin to be around 7,650-7,900 RMB/ton tomorrow.

POM: Market transactions are slow, actual negotiations ongoing.

1. Today's Summary

The Xinjiang Xinlianxin POM unit is scheduled for maintenance shutdown on September 4th, planned to last approximately 21 days.

② Tianjin Bohua POM unit was shut down for maintenance on July 7, and the restart time is undetermined.

2 Current Spot Overview

Table 1 Domestic POM Price Summary (Unit: RMB/ton)

Based on the Yuyao region, today's Yun Tianhua M90 is priced at 10,800 yuan/ton, stable compared to the last period. Today, the POM market remained stable, with slow spot circulation. Traders continue to face pressure in offloading goods, and there is still room for negotiation in market quotations, with a range of 50-100 RMB/ton. As of the close, the domestic POM prices in Yuyao market, including tax, ranged from 8,100 to 11,100 RMB/ton, while the cash prices in Dongguan market ranged from 7,300 to 10,400 RMB/ton.

3. Price Prediction

Due to maintenance factors this week, the inventory at the petrochemical plant is growing slowly, and the support from the supply side is limited. However, the market's sales situation continues to be weak, with a lack of follow-up on terminal orders and poor purchasing enthusiasm from downstream users. Additionally, the pressure from low-priced imported materials has increased, resulting in significant selling pressure for traders, and mainstream grades continue to negotiate for sales.Longzhong predicts that in the short term, the domestic POM market will remain generally stable with slight declines.

PMMA: Stable operation of PMMA particles

1 Today's Summary

①、 Today, the PMMA resin market is running steadily and quietly.

Today, the domestic PMMA particle utilization rate remains at 62%.

2 Spot Market Overview

Table 1 Summary of Domestic PMMA Particle Prices (Unit: RMB/ton)

Based on the East China region, today's PMMA particles closed at 12,800 yuan/ton, stable compared to the previous working day, in line with morning expectations. 。 The domestic PMMA particle market is operating steadily. There are not many changes in the market fundamentals, with suppliers maintaining stable quotations. Low-priced supplies are rarely seen, and holders are selling according to market conditions. A small number of end users are inquiring in the market, but overall transaction volumes are limited, and many industry participants are waiting for the situation to become clearer.

3 Price Forecast

The support from the raw material side for MMA is limited, and PMMA particle producers continue to adopt a wait-and-see attitude, with prices remaining stable. Buying interest remains weak, and inquiries are few. Looking ahead, there is little new information available, and the market is expected to continue its fluctuating trend, with some holders possibly adopting a bearish stance and making narrow concessions.

PA6: Cost and Demand Game PA6 Market Organization and Operation

1 Today's Summary

①、 The weekly settlement price of Sinopec caprolactam this week is 9,120 RMB/ton (six-month interest-free acceptance).

②、 Sinopec has reduced the price of pure benzene by 100 RMB/ton at refineries in East and South China, setting the new price at 5900 RMB/ton, effective from September 4th.

2 Spot Market Overview

Table 1 Summary of Domestic Polyamide 6 Prices (Unit: RMB/ton)

Today, the nylon 6 market is operating steadily. The raw material market negotiations have slightly declined, with sliced product profits at a loss and cost pressures relatively high. However, downstream enterprises are gradually adopting a cautious purchasing attitude. Polymer companies are maintaining stable quotes for the time being, with actual transactions being negotiated. The regular spinning of East PA6 is priced at 9,200-9,500 RMB/ton with short-term cash delivery, and high-speed spinning spot is at 9,600-9,900 RMB/ton with acceptance delivery. The price for self-pickup in Chaohu is 8,550-8,650 RMB/ton in cash.

3 Price Prediction

From a cost perspective, the supply of caprolactam may recover and market negotiations may trend lower, but cost pressure from losses in chip production profits still exists. On the supply and demand side, with Guangxi Hengyi and Yuehua New Materials starting production, supply is expected to increase. However, downstream buyers are becoming more cautious and mainly replenish inventories as needed at lower prices. Therefore, the PA6 market is expected to see slight adjustments in the near term.

PA66: Average demand; the market is operating in a consolidation phase.

1 Today's Summary

① On September 11: Market concerns over long-term oversupply risks, coupled with weakening demand in the United States, led to a decline in international oil prices. The NYMEX crude oil futures October contract closed at $62.37 per barrel, down $1.30, or -2.04% from the previous day; the ICE Brent crude futures November contract closed at $66.37 per barrel, down $1.12, or -1.66% from the previous day. China's INE crude oil futures September 2510 contract rose by 3.7 to 489.4 yuan per barrel, but fell by 7.1 to 481.6 yuan per barrel in the night session.

Today, the domestic PA66 capacity utilization rate is 60%, with a daily output of approximately 2,350 tons. Under cost and demand pressures, the capacity utilization rate of domestic PA66 enterprises remains stable; however, downstream demand is generally weak, and the supply of PA66 in the domestic market is sufficient.

2 Spot Overview

Table 1 Summary of Domestic PA66 Prices (Unit: RMB/ton)

Based on the Yuyao market in East China, today's market price for EPR27 is quoted at 15,000-15,200 RMB/ton, stable compared to yesterday's price. 。 The raw materials adipic acid and hexamethylenediamine are operating in a fluctuating manner, with stable cost support. Downstream procurement is based on demand, and the overall industry sentiment is cautious. The market has sufficient spot supply and is experiencing fluctuations.

3 Price Prediction

The cost pressure is relatively high; however, the market supply of goods is sufficient, and demand performance is weak. The industry sentiment is cautious, and it is expected that the domestic PA66 market will remain in a stalemate and consolidate in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track