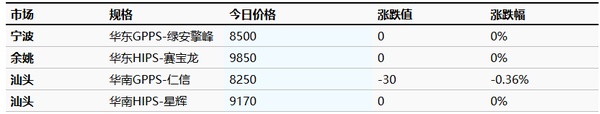

Raw material styrene rebounded slightly after stopping its decline, and the cost negative factors have eased somewhat. However, considering the high supply and shipping pressure, demand is below expectations, and in the short term, the PS market may see low-price sales with limited price fluctuations. It is expected that the transparent modified benzene in the East China market will be 8500-10300 yuan/ton.

[Today's Plastics Market] Partial Gains! PP and PVC fluctuate upwards, while PE and ABS continue to fall, with the highest drop being 100

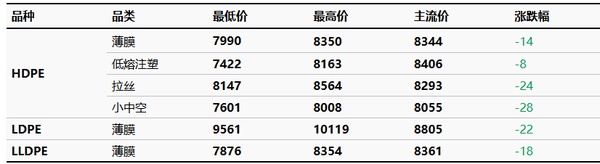

Summary: On March 24, the prices and forecasts for general-purpose plastics and engineering plastics are summarized! General-purpose plastics show mixed increases and decreases, with limited improvement in supply and demand. The price of polyethylene has decreased by 8-28; the PP and PVC markets have risen, with the highest increase being 90; the PS market is stable with some small decreases of 30; ABS continues to decline by 10-100; the EVA market shows weak stability and fluctuation. Most engineering plastics remain stable, with some PC decreasing by 50; PA6 and PA66 are in a weak consolidation; PET, PBT, POM, and PMMA are in a stalemate operation.

general material

PE:Supply and demand improvement is limited, polyethylene prices fall

3, price prediction

In the short term, in terms of cost, the relatively firm crude oil prices provide some support to PE costs; in terms of supply, some enterprises are undergoing maintenance in the short term, which has somewhat alleviated market supply pressure; in terms of demand, although the overall downstream operation of PE has improved, the follow-up in demand is limited, mainly focusing on replenishing inventory based on rigid demand. Overall, the improvement in supply and demand is not significant, and it is expected that polyethylene prices will mainly fluctuate within a narrow range tomorrow.

PP:Cost-end benefits support boosting the polypropylene market center to shift upwards

3, price prediction

Demand-side weakness continues, with additional overseas tariffs leading to a reduction in export orders for manufactured goods. Supply-side expectations for recent increases remain unchanged, and future market valuation expectations are weak. Frequent short-term maintenance and rising costs at the cost end are beneficial to market sentiment, as merchants who have been building a bottom at low prices for a long time are testing higher offers to verify transactions. Recently, the market has been vying for territory between supply and demand and costs, and it is expected that the short-term polypropylene market will revolve around 7300-7430 yuan/ton to verify transactions. Special attention should be paid to the impact of tariff adjustments on downstream product exports, as well as the status of inventory along the industrial chain and demand-side variables.

PVC:PVC price increases slowly, trading atmosphere turns weak

3.price forecasttest

Recent macro policy expectations have boosted and upstream black sector benefits have pushed up PVC intraday prices; the basic supply and demand situation remains at an impasse, with concentrated maintenance seasons in the future, supply is expected to slow down, terminal demand mainly remains stable, spot prices follow the market trend and rise; costs are mainly stable in the short term, market expectations are still mainly affected by market fluctuations, there is insufficient support for continuous price increases in the spot market, and the cash price of the five-type calcium carbide method in the East China PVC market is seen in the range of 4900-5050 yuan/ton.

PS:Market stabilizes with some minor declines, transactions slightly better at lower levels

3, price prediction

ABS:Market transactions are very weak, and prices continue to decline.

1today's summary

Today, the market prices in South China continue to fall, and the market prices in East China continue to decline.

②、The monthly production of ABS in March is expected to rise.

2spot overview

Table 1 Domestic ABS Price Summary (Unit: Yuan/Ton)

With Yuyao and Dongguan regions as the benchmark, market prices have declined.Today, the market prices in Dongguan and Yuyao continue to decline, with terminal demand recovering slowly, and the market is filled with negative factors, leading to a continued drop in prices.

3、price prediction

Today, the market prices in South China have partially declined, and the market prices in East China have also decreased. The overall transaction volume is weak, traders are having difficulty selling goods, and there is a significant increase in supply. It is expected that the domestic ABS market prices will continue to maintain a downward trend tomorrow.

EVA:EVA market price fluctuates narrowly

1、spot overview

Table 1 Domestic EVA Price Summary (Unit: Yuan/Ton)

Today's EVA market price fluctuates narrowly, with a weak trading atmosphere. Traders have low spot inventory, but under the backdrop of differing views on future prospects, some merchants are pre-selling futures, which constrains spot prices. Meanwhile, end-user enterprises' intention to stock up has decreased, mostly sticking to replenishing based on rigid demand, with actual transaction prices focusing on negotiation.

3.price prediction

Combining the analysis of driving factors, it is expected that the EVA price may undergo a high-level consolidation in the near future. The specific reasons are as follows:

supplyThe tight market supply situation has slightly eased, with some merchants pre-selling futures, which constrains the spot price.

requirements: input format:Downstream enterprises have a rigid demand for restocking, but the intention to stockpile is not high, showing some resistance to high-priced sources.

upstreamOn Friday (March 21), the May 2025 futures contract for West Texas Intermediate light crude oil on the New York Mercantile Exchange settled at $68.28 per barrel, up $0.21 from the previous trading day, an increase of 0.31%, with a trading range of $67.65 to $68.65; the May 2025 futures contract for Brent crude oil on the Intercontinental Exchange in London settled at $72.16 per barrel, up $0.16 from the previous trading day, an increase of 0.22%, with a trading range of $71.51 to $72.51.

engineering material

PC:Message support is limited, market remains weak and fluctuates

①、Last Friday, international crude oil rose, ICE Brent futures May contract up 0.16 USD per barrel to 72.16.

②、The closing price of raw material bisphenol A in the East China market was 8975 yuan/ton, a decrease of 75 yuan/ton from the previous period.

③、PC factory temporarily stabilizes operations, spot market weakly consolidates.

2spot overview

Table 1 Domestic PC Price Summary (Unit: Yuan/Ton)

Today, the domestic PC market is operating with low and weak fluctuations. As of the afternoon close, the main negotiation reference for low-end injection molding grade materials in East China is 12,000-15,300 yuan/ton, while for mid-to-high-end materials it is 15,200-16,400 yuan/ton, with some falling by 50 yuan/ton compared to Friday. At the beginning of the week, the latest ex-factory prices from some domestic PC manufacturers remained stable, with a few adjusting downward by 150 yuan/ton; looking at the spot market, both East China and South China continue to show a weak consolidation pattern, with no significant improvement in fundamentals, slow spot trading, cautious and hard-to-lift market sentiment, some selling focuses continue to shift downward, poor new orders from downstream, very few inquiries and purchases in the market, and difficulty in increasing trading volume.

3. price prediction

Currently, the overall performance of the domestic PC market remains weak, with an unusually long decline in market conditions, significantly impacting market sentiment. Despite some PC facilities planning to reduce production or undergo maintenance in April, there has been no boost to the market as of yet. With the industry continuing to face high supply and low demand in the short term, it is expected that the domestic PC market will mainly operate at a low level with weak consolidation, focusing on the actual reduction in supply and the digestion of social inventory.

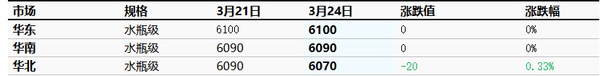

PET:Polyester chip market remains in a stalemate

1today's summary

①、Wan Kai, Hanjiang, Yizheng decreased by 30, China Resources decreased by 60, other factories stable (unit: yuan/ton)

②、Today, the domestic polyester bottle chip capacity utilization rate is 71.12%.

2spot overview

Table 1 Domestic Polyester Chip Price Summary (Unit: Yuan/Ton)

With East China as the benchmark, today's polyester bottle chip water bottle grade spot price closed at 6100 yuan/ton, stable compared to the previous working day, in line with early expectations.

Weekend oil prices slightly increased, but raw materials fluctuated, polyester bottle chip factory prices mostly decreased by 30, market focus was on consolidation, March-April goods traded at 6060-6150, mainly lower-priced goods; basis strengthened, contract 2505 at par. Cargo holders mainly sold, downstream buyers replenished stocks as needed, transactions were sporadic.

3、price prediction

As the end of the month approaches, some inventory holders face pressure to sell. With expectations of increased supply, the polyester chip market is under growing pressure. Traders and end-users are not keen on stockpiling, and downstream buyers are only replenishing as needed, leading to a continuously weak trading atmosphere. Additionally, with the raw materials performing mediocrely, the polyester chip market may lack upward momentum. It is expected that the spot price for water bottle-grade polyester chips will move within the range of 6050-6130 tomorrow.

POM:Insufficient demand follow-up, POM market weak and steady with a wait-and-see attitude

3、price prediction

At the beginning of the week, the shipment situation in various regions did not improve, and the inventory pressure on petrochemical plants continued to increase. The short-term POM fundamentals lack support, and the market's pessimistic sentiment has intensified. Traders' operating mentality is poor, and there is still room for negotiation in the main quotations. Terminal orders are weak, and the buying and selling atmosphere will be difficult to be optimistic. It is expected that the short-term domestic POM market will fluctuate weakly.

PBT:PBT market supply and demand game continues

1today's summary

PBT manufacturer's quotations are stable.

②This week, the PBT plant is operating normally.

③This week, China's PBT industry production reached 21,175 tons, with an industry capacity utilization rate of 49.85%, remaining flat from last week. This week, the average gross profit of domestic PBT was -401 yuan/ton, a decrease of 27 yuan/ton compared to last week.

2spot overview

Table 1 Domestic PBT Price Summary (Unit: Yuan/Ton)

in order toEast China region as the benchmark, today's mainstream price for medium to low viscosity PBT resin is 7900-8200 yuan/ton,unchanged from yesterday。Today, the PBT market is in a wait-and-see mode, the PTA market is operating weakly, and the BDO market is in a weak stalemate. The cost support is relatively weak, and the PBT market sentiment is bearish. There is a psychological game between supply and demand sides within the market, leading to a wait-and-see attitude. According to statistics, in the East China market, the price of low to medium viscosity PBT pure resin is 7900-8200 yuan/ton.

3, price prediction

It is expected that the PBT market will fluctuate within a range. In terms of cost, the PTA balance sheet maintains an expectation of inventory reduction, with no significant supply and demand contradictions, and the overall valuation is relatively low. However, there are many unstable external factors, commodities lack sustained driving force, and downstream operations are cautious, leading to a continued volatile pattern in the short-term domestic PTA spot market; at the beginning of the new BDO trading cycle, the market continues to adopt a wait-and-see attitude, with actual terminal demand remaining weak and price negotiations upon entry, and holding manufacturers having moderate confidence in the future market, with mainstream offers stable, and real transactions negotiated according to the market, with the market center showing a weak fluctuation. The cost support is average, and the PBT market mostly adopts a wait-and-see attitude, lacking clear bullish or bearish drivers, with the market center fluctuating within a range, thus it is expected that tomorrow's East China market for medium and low viscosity PBT resin will be in the range of 7900-8200 yuan/ton.

PA6:The transaction atmosphere slightly improved, and the PA6 market is consolidating its operations.

1today's summary

①、The weekly settlement price of Sinopec's caprolactam is 10,380 yuan/ton (six-month acceptance interest-free), a decrease of 340 yuan/ton from last week.

②, Sinopec's pure benzene prices in East China and South China have been reduced by 100 yuan/ton, to be implemented at 6950 yuan/ton, effective from March 18.

2spot overview

Table 1 Domestic Polyamide 6 Price Summary (Unit: Yuan/Ton)

Today, the polyamide 6 chip market has stopped falling. The price of caprolactam, the raw material, continues to decline. However, as chips are currently being sold at a loss, polymer companies are not keen on lowering prices further. Some chip prices have risen slightly, but overall downstream demand is limited, with purchases made selectively based on need and at lower prices. Transactions for some lower-priced chips have improved. In East China, the cash price for conventional spinning regular PA6 chips is 10,300-10,600 yuan/ton (short delivery), while the spot price for high-speed spinning is 11,300-11,800 yuan/ton (delivery against acceptance). In Chaohu, the self-pickup cash price is 9,600-9,700 yuan/ton.

3、price prediction

From the cost perspective, the caprolactam market is low or may continue to be in a low consolidation, with attention to the maintenance and load reduction of subsequent raw material enterprises; from the supply and demand perspective, polymer enterprises maintain high operating rates, some enterprises undergo maintenance and load reduction to alleviate inventory pressure, but downstream buyers are cautious in choosing to replenish stocks at lower prices. It is expected that the recent nylon 6 market will consolidate, and close attention should be paid to downstream demand and manufacturer price adjustment dynamics.

PMMA:inquiry limited light operation

Today's summary

Today's factory quotes are stable.

②、Today, the domestic PMMA particle utilization rate is 64%.

2spot overview

Table 1 Summary of Domestic PMMA Particle Prices (Unit: Yuan/Ton)

Taking East China as the benchmark, PMMA particles closed at 17,000 yuan/ton today, unchanged from yesterday, in line with early expectations.Today, the PMMA particle market maintains a stable transition trend, with no significant news. At the beginning of the week, the market is in a wait-and-see mode, with insufficient inquiries heard. There is only a small amount of downstream rigid demand buying, and the overall atmosphere is light. In the short term, the market situation will remain as it is.

3, price prediction

The short-term PMMA particle market is operating in a lukewarm manner, with the fundamentals remaining stable. The buying atmosphere within the market is somewhat stagnant, and downstream purchasing enthusiasm is insufficient, with most purchases being made on a need basis, making it difficult for negotiations to increase in volume. In summary, under the continuous game between upstream and downstream, it is expected that the short-term PMMA particle market price will have a higher probability of remaining stable. Actual transaction volumes need to be followed up, and continued attention should be paid to the dynamics of offers and bids.

PA66downstream cautious about high-price procurement market weak consolidation

3, price prediction

Demand side has not shown a significant recovery, and the high prices of aggregated companies' products are not selling well, leading to a gradual accumulation of inventory in the industry. Meanwhile, aggregated companies still face cost pressures. It is expected that the domestic PA66 will remain weak in the short term. Specifically, attention should be paid to the price guidance for Invista's hexamethylenediamine.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track