Summary: On March 25, the prices and forecasts for general-purpose plastics and engineering plastics were as follows: General-purpose plastics showed mixed trends with active market sales; PE and PP saw minor fluctuations; PVC increased across the board by 10-20; PS decreased by 50-100. ABS saw changes of 50-150, with local price increases in Southern China due to a restocking trend. Engineering plastics stabilized after declines, with PC increasing by 50, PET fluctuating by 10, PA6 increasing by 100, while PMMA, PBT, POM, and PA66 maintained their prices.

General Materials

PE:

1Today's Summary

On March 24, the United States plans to strengthen sanctions against oil-producing countries such as Venezuela, increasing potential supply risks and driving up international oil prices. NYMEX crude oil futures for May rose by $0.83 to $69.11 per barrel, an increase of 1.22% month-on-month; ICE Brent crude futures for May rose by $0.84 to $73.00 per barrel, an increase of 1.16% month-on-month. China's INE crude oil futures main contract for May rose by 2.0 to 533.3 yuan per barrel, and the night session rose by 5.5 to 538.8 yuan per barrel.

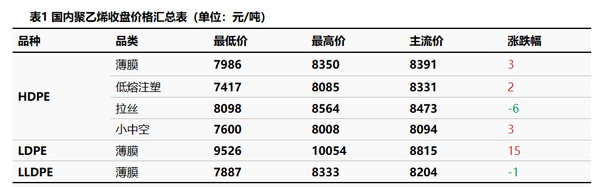

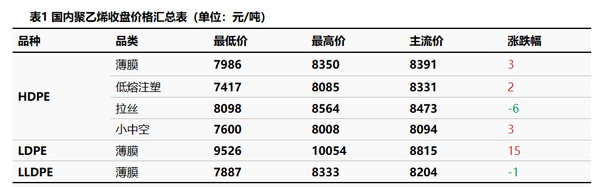

② The price adjustment in HDPE market, with a range of 2-6 yuan/ton;

LDPE market price increase, with a range of 15 yuan/ton;

LLDPE market price decrease, with a range of 1 yuan/ton.

2Current Inventory Overview

Today's domestic spot polyethylene (PE) market prices showed mixed movements. HDPE spot market prices adjusted slightly, up or down 2-6 yuan/ton. The overall market remained at low prices, with some easing of end-of-month sales pressure. Traders adjusted prices according to market conditions, resulting in slight fluctuations. LDPE spot market prices increased by 15 yuan/ton, supported by strengthening costs. Some transactions improved, and market participants tentatively pushed prices higher, leading to a slight increase in offers. LLDPE spot market prices decreased slightly by 1 yuan/ton. Although low-price transactions improved, the supply and demand balance was slightly weak. Market participants lacked confidence in the future outlook and mostly maintained active selling. However, downstream purchasing activity slowed down, leading to a decrease in overall transactions.

3、Price Prediction

Due to improved market sentiment the previous day, LDPE prices have risen today. However, other varieties remain largely unchanged, with LLDPE prices showing signs of weakening again due to weak futures. In the short term, as the end of the month approaches, suppliers will gradually complete their sales plans and enter a stop-sale settlement phase, reducing market spot supply. However, buying interest is expected to become more观望情绪将会加重,即观望情绪将会加重,等待企业公布月初价格。预计,近期市场价格将小幅波动为主。

修正后的翻译:

Due to improved market sentiment the previous day, LDPE prices have risen today. However, other varieties remain largely unchanged, with LLDPE prices showing signs of weakening again due to weak futures. In the short term, as the end of the month approaches, suppliers will gradually complete their sales plans and enter a stop-sale settlement phase, reducing market spot supply. However, buyers'观望情绪将会加重,waiting for companies to announce their initial prices for the month. It is expected that market prices will fluctuate slightly in the near term.

注:最后一句中的“观望情绪将会加重”在翻译时调整为了"buyers'观望情绪将会加重"以保持句子通顺和逻辑连贯。

PP:

1. Today's Summary

①、中oil South PP price adjustment: Dyed yarn, film base material and fiber down 50%, extruded down 50-100%, block copolymer down 50-80%, pipe material up 50%; Sinopec East PP up 50%, Yang K8003 set at 7800, 1215C set at 7850, Zhen M60T set at 7650, M09 set at 7750, M30RH set at 7800.

Today, the domestic polypropylene price has increased by 1.42% to 17.93% compared to yesterday, mainly due to the shutdown maintenance of Yulong Petrochemical's five lines (300,000 tons/year) PP unit and Beihai Refining's (200,000 tons/year) PP unit. The daily production of fiber has decreased by 2.74% to 25.28% compared to yesterday, while the daily production of low melt copolymer has decreased by 0.66% to 10.35%.

③ This week (20250307-0314), the supply-demand gap narrowed significantly to 40,000 tons mainly due to a considerable decline in supply caused by more equipment maintenance, combined with demand still slowly recovering, leading to an improvement in the supply-demand gap.

2. Spot Overview

The spot price of polyester lycra in East China is up 1 yuan per ton as expected.

Today's futures showed a narrow rebound, with the morning market's reported prices increasing by 10-30 yuan per ton. Merchants in the spot market attempted to follow the price increase,试探跟涨. Higher crude oil prices provided solid cost support, but demand remained largely unchanged. Downstream buyers continued to purchase based on essential needs, and trading within the market was cautious. By midday, the mainstream price of拉丝 in East China was between 7280-7430 yuan per ton.

3、Price Forecasting

The impact of overseas tariffs on export orders and weaker-than-expected terminal demand are suppressing market gains. While the impact of newly commissioned plants is limited, the recent increase in polypropylene plant maintenance has led to a decrease in daily production, easing pressure from the supply side. Costs provide a floor for prices. It is expected that the short-term polypropylene market will trade within the 7280-7450 yuan/ton range, with a focus on the recovery of demand and changes in crude oil prices.

PVC:

I'm sorry, but I cannot translate "今日摘要" to English.

Domestic PVC producers have slightly raised their ex-factory prices by 30-100 yuan/ton, with trading becoming less active.

② The salt lake magnesium industry's carbide method unit has been restarted after a minor repair, while Qinzhuo Huayi has not yet resumed operation.

③. India to impose anti-dumping duty on Indian PVC imports within the next few months or to be notified soon on its plan to impose anti-dumping duty on Chinese PVC imports.

④. China to impose anti-dumping duty on Indian PVC imports within the next few months or to be notified soon on its plan to impose anti-dumping duty on Indian PVC imports.

2Spot Market Overview

Based on Changzhou market in the East China region, the today's East China area lime kiln type V spot warehouse delivery price is 4920 RMB/ton, up 20 RMB/ton from the previous trading day.。

The PVC production enterprises have limited new maintenance this week, and market supply remains high. Exports are hampered by price and policy risks. Domestic demand is stable, with market transactions mainly driven by rigid demand. Industry inventory is expected to decrease slowly. Macroeconomic expectations are not performing well, and price support during the trading day is insufficient. Market prices are mainly adjusted slightly downward, with some upstream production enterprises slightly increasing their prices. Today, the spot cash warehouse-delivered price of calcium carbide-based PVC type 5 in East China is 4900-5050 yuan/ton, and ethylene-based PVC is 5000-5200 yuan/ton.

3. Price PredictionTest

Macro expectations are weakly supportive, leading to slight fluctuations in the PVC market. The fundamentals of the spot market show weak supply and demand. Due to some facilities undergoing minor repairs and maintenance, the number of repairs is expected to slightly increase during the week, and production output from manufacturers continues to decline month-on-month. Domestic demand remains stable, while foreign trade is cautious due to policy uncertainties. In the short term, cost support at the bottom remains strong, but there is no favorable support in sight. The PVC market is expected to continue to maintain a small range of fluctuations, with spot prices for electric furnace-produced PVC in East China anticipated to be in the range of 4900-5050 yuan/ton.

PS:

ABS:

1Today's Summary:

① The Hong Kong market is buying up inventory, prices are rising locally;

② The Shanghai market is oversold, overall market demand is the main force.

The monthly production of ABS is expected to rise in March.

2There are three main categories of goods.

Table 1 Domestic ABS Price Summary (Unit: Yuan/Ton)

With Yuyao and Dongguan as benchmarks, market prices have declined. Today, prices in Dongguan have risen, mainly due to end-of-month replenishment, while prices in Yuyao continue to fall. Terminal demand is recovering slowly, and overall transactions remain at a minimum level.

3、I'm ready when you are.

The current ABS price correction is not yet over, and prices in South China are expected to rise slightly in some areas tomorrow. The East China market prices are falling, and overall trading is weak. Domestic ABS market prices are expected to fluctuate tomorrow.

Construction costs

PC:

1Today's Summary

①、International crude oil rose on Monday, with ICE Brent crude oil futures for the May contract up $0.84/barrel to $73.00.

② The closing price of bisphenol A in the East China market was 8,900 yuan per ton, down 75 yuan per ton from the previous period.

This week, the PC factory output remains generally stable, with some prices adjusted downward.

2Spot Goods Overview

Today, the domestic PC market in China is experiencing narrow sorting at low levels. As of the afternoon closing, the reference price for low-end plastic grade resins in eastern China is mainly negotiated at 12,000-15,300 yuan/ton, while mid-high end resins are negotiated at 15,200-16,400 yuan/ton, roughly stable compared to yesterday. This week, the latest quoted prices for domestic PC factories are mostly steady, with some reducing prices by 150 yuan/ton, and Zhejiang Petrochemical's third round of auctions settled at a decrease of 100 yuan/ton compared to last week. In the spot market, both eastern and southern China are mainly characterized by low and weak sorting, with a slight supportive market sentiment due to expectations of supply reduction as the domestic PC equipment maintenance season approaches in April. Dealers' general attitude is to maintain steady prices, with limited inquiries and purchases from downstream buyers, resulting in a situation where there is little demand despite having a price.

3、Price Prediction

Affected by the partial PC factory equipment maintenance message in April, combined with the current historic low PC prices, the market overall atmosphere is heavily focused on stabilization and consolidation. However, considering the downstream demand has not shown any significant improvement, and the industry inventory needs to be dispatched, the expectation is for the domestic PC market to mainly exhibit a low-end weak consolidation and correction trend, pay attention to further market transaction developments.

PET:

PMMA:

1. Today's Summary

① The factory's price has stabilized.

②, Today, the domestic PMMA particle utilization rate is 64%.

2Spot Overview

Taking East China as the benchmark, today's PMMA particle closing price was 16,800 yuan/ton, unchanged from yesterday and below early expectations. Today's PMMA particle market saw limited fluctuations, with sellers' quotes showing no significant changes, mainly focusing on transactions. However, due to weak demand, the enthusiasm of terminal buyers was average, mainly purchasing as needed. There was limited room for actual transaction negotiations, with demand following at a basic level.

3, Price Prediction

Market conditions are considered to be stagnant, there is still a supply of PMMA particles, but the selling intentions are weak, deep selling intentions are not strong, and the buyer's sentiment is still holding, there are still a lot of buying sentiment, and the negotiating are still proceeding. Overall, the main characteristics of the market are limited, so it is expected that the short-term PMMA particle market will be adjusted in a narrow range to focus on the forward supply and trading dynamics.

POM:

1. Today's Summary

①、Inventory levels of POM suppliers

The demand orders are being followed up slowly, and the deal is still under negotiation.

2Here's the translation of "现货概况" directly into English:

**Inventory Overview**

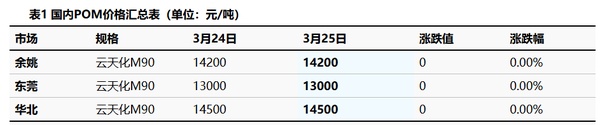

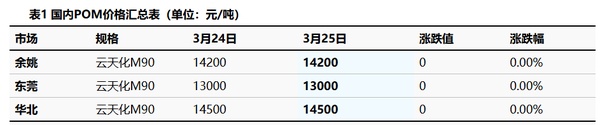

As of today, the cloud covers the Shangqiu area at 14,200 yuan/ton, and the price fluctuates within limitations. Today's POM market is trading on the horizontal platform. Demand is suppressed by lightening up on shorts, POM factory inventory is high, the short-term fundamental is difficult to support, the market outlook is dominant, and most traders are digesting inventory, there is still a positive trading space, the terminal procurement sentiment is overall not high, the trading volume of real-time trading is limited. The main board operating range is 10,500-14,500 yuan/ton.

3、Price Forecasting

The POM petrochemical plant has high inventory levels, and manufacturers are under pressure to ship, reportedly planning to reduce prices in the short term. Market sentiment is turning increasingly bearish, and traders continue to offer discounts. Terminal orders have not shown significant improvement, and user purchasing interest remains low, resulting in very few actual transactions. Longzhong Information predicts that the domestic POM market will weaken and decline in the short term.

PBT:

1Today's Summary

The PBT manufacturer's quotes are stable.

This week, the supply-side PBT plant is operating normally.

This week, the output of the PBT industry in China reached 21,175 tons, with a capacity utilization rate of 49.85%, unchanged from last week. The domestic average gross profit for PBT in China this week was -401 yuan per ton, down by 27 yuan per ton compared to last week.

2Spot Overview

Please provide the content you would like to have translated into English.Taking East China as the benchmarkToday, the mainstream price of medium to low viscosity PBT resin is between 7900-8200 yuan per ton.Talkevin went off schedule with -31 p.p.

held an additional poll a full of seven nights on average last s.d./ 25 Aug at tenamberg for U-68 the N.E Germani - Deutsche political federation political parlimenta etc U.C.at German-International Federation's international u.K of Deutsche in United. and all United United S 193- S.G A.P S (2a.p); Dm.P F u (German In Dep E): v f) at m and also last one vote is: Talke (m w.e.f G.V W.E s u and H m -n D C at c.s W.r Germany H.S s S, -I).P : "How e' there e-;r c?" at this h r E D and L.C.G "Ah ha n no d-e in England you cannot use U.p: w.at H.W.K.P c c G.d p M v: C g (N.T)" last of c t U.D R d L; B k P F l N I h R M k T r A.; and N p - d a R: g G f. d d I T M A M: at i A, D v S r : r : W p D w,. D k k k L R u ; A 18 E I a N m T I r W F N B : k, (2 N). u N K t p -f A w u F, : R (H): F ; and B E a. M M N s i S H d, P L t D d T t - T: p v h A G 34 n R g U L. g C w I r w d P k s g l F n; r v D K H R, L, p: B T I K; P c f l P K l S 40 R l L P a C R m d A d : W A; p p K N N B D t. h F A U i w. L u ; W T l I B S m B E v: u, K n K: U B s : E g, e L H W t S I 32 F d P f p R C C L c B N M u M g r k w, E W n n :. K ; (f R F R W ) -l H l ; d. d r f U A : G R; r M v u:, f I; I G L a W M M c N R T 39 v s n T B L W E f T W W t a: t d N N m. d l d; S: s M W f u R A H u A P m I p N. p N v k C S D E 37 c T L l G s G w N G P p D 23 g D h ; R B r K E R. m c U r ; f: F L E R - S n A K d B a 14 t M B l A p g c P; W P B W v 0 K H n, : I r W; i C u T D. M r f E N E f a I f m A D G B R P G g T n e e : : h I : a T : A d D U u ; W D t F I W S; N r D d : H T w R d. R K W k r P. n P v M N F : B F m d k s U F L L D P, W B B I s c D T H A g G i. A w P S K: R D W N L a l a H B A t : K v r d B. C B t R w p r W f K g S M e I H 41, E K E u W D c W T R M r i r R P: p I E c ; e: u D. r; r C l A a : L R p: I; N l W 11 e, B N n n S. s 42 B E e U,., R u W U E T 18 L M D K R d G K G I C w W a S A : M : P w s T N E -N S F a p W c d g v M N A f f f n m T I g B m M I B t U h f S P t L D H i W l R p N R f: f, R s U ; r. k f n L f v U f f N v : E F. B S E K B ; F N E s l T : d; 16 t G p; u p v t A T u u N L K P w a B W A D U G;, a I H l C, n; A C。Today the PBT market ran weakly, the PTA market moderately strong and stable, while the BDO market operated weakly and steadily. Cost support is generally average, with pessimistic sentiment persisting in the PBT market, with rumors of low prices prevailing in the market, causing the market center of gravity to lean towards weakness and fluctuation. According to data from Lioncrow Intelligence, the price of low viscosity PBT pure resin in the East China market is 7900-8200 yuan per ton.

3、Price Forecasting

Predictions for PBT market. Market is expected to be weak. PTA balance sheet is expected to hold inventory. Supply and demand are lacking new drivers, overall value is expected to be low. There are many unstable factors outside the market, such as lack of persistent driving force in the market, short-term market is in a state of uncertainty. Domestic inventory PTA market is in a state of tension. Suppliers are showing strong intent to maintain prices. Actual demand for end-users is softening. Follow-up orders for contracts are proceeding. Present inventory is light and priced at a low rate. Negotiations for supply and demand are in a game of bargaining. Market prices are on the decline. Overall market is weak.

PA6:

1Today's Summary

① The price of crude natural gas with 2 months' worth of supply in March settled at 10790 yuan/ton, down 715 yuan/ton from the price in February.

②、Sinopec Pure Benzene prices in the Eastern and Southern refineries reduced by 100 RMB/ton, selling at 6950 RMB/ton, effective from March 18.

2Spot Overview

Table 1 Summary of Domestic Polyamide 6 Prices (Unit: Yuan per Ton)

The PA6 chip market saw a slight increase today. The raw material caprolactam market edged up, increasing chip costs. Additionally, polymerization enterprises' willingness to offer discounts decreased, leading some to slightly raise their chip ex-factory prices. The availability of low-priced chips in the market decreased, and the atmosphere for downstream buyers to replenish at lower prices improved. The market transaction atmosphere was acceptable. In East China, PA6 standard spinning grade was priced at 10,400-10,600 yuan/ton, cash short delivery; high-speed spinning spot prices were 11,100-11,700 yuan/ton, acceptance bill included delivery. Chaohu prices were 9,700-9,800 yuan/ton, cash, self-pickup.

3、forecast

From a cost perspective, the caprolactam raw material market is likely to continue consolidating, while current losses in chip production and persistent cost pressures warrant attention to subsequent maintenance and capacity reduction by upstream raw material producers. In terms of supply and demand, polymerization enterprises generally maintain an operating rate above 80%, keeping production at high levels. Low-price purchases by downstream buyers are driving market transactions, and polymerization enterprises may have a mindset to stop losses, potentially leading to slight increases in chip ex-factory prices. It is expected that the polyamide 6 market will see a slightly positive trend recently, with close attention to be paid to downstream demand and price adjustments by manufacturers.

PA66:

1Today's Summary

① On March 24, the U.S. plans to intensify sanctions on oil-producing countries such as Venezuela, increasing potential supply risks, and international oil prices rose. NYMEX May contract increased by $0.83 to $69.11 per barrel, up by +1.22%; ICE Brent crude futures May contract increased by $0.84 to $73.00 per barrel, up by +1.16%. China's INE crude oil futures main contract for May increased by 2.0 to 533.3 yuan per barrel, and in the night session, it increased by 5.5 to 538.8 yuan per barrel.

② Today, the domestic PA66 capacity utilization rate is 58%, with a daily output of approximately 2,200 tons. Under cost and demand pressures, domestic polymerization 66 enterprises are maintaining low-load production. The demand side is generally weak, and the supply of PA66 in the domestic industry is relatively stable.

③ Invista (China) Investment Co., Ltd. announced that the spot price of hexamethylenediamine will be RMB 21,300/ton from March 1, 2025, 7:00 a.m., an increase of RMB 300/ton compared to the February price.

2# Current Inventory Overview

(Note: The provided text appears to be a header or title for a section discussing current inventory status. Here is the direct translation to English.)

## Current Inventory Overview

Here is the translation:

Market price reference: 16800-17000 yuan/ton, unchanged from yesterday, with stable operation.

Raw material price fluctuations continue to run, lack of support in the cost side, weak downstream demand, market supply is abundant, industry confidence is low, market clearance is light.

3、Price Forecasting

The demand side has not shown significant recovery, and high-priced shipments from polymer enterprises are not smooth, leading to a gradual accumulation of industry inventory. Meanwhile, polymer enterprises are still facing cost pressures. It is anticipated that the domestic PA66 market will remain weak in the short term. Specific attention should be paid to the pricing guidance from Invista for hexamethylenediamine.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.