[Today's Plastics Market] Demand falls short of expectations, PE and PP see minor fluctuations, PS, PET, and PBT drop by up to 150

Abstract: Summary of prices and forecasts for general-purpose and engineering plastics in the plastic market on March 4th. General-purpose plastics showed mixed increases and decreases, with an increasing trend in supply. PE and PP saw minor fluctuations, PVC decreased by 20, PS fell across the board by 30-100, and ABS fluctuated by 20-60. Engineering plastics were generally stable with some declines, PC fluctuated by 50, PET was fully adjusted down by 100, PBT decreased by 50-150, and PA6 fell by 50. PMMA, POM, and PA66 remained unchanged in price.

General Purpose Plastics

General Purpose PlasticsGeneral Purpose PlasticsPE:

PE:PE:1, Today's Summary

11, Today's Summary, Today's Summary①, 3/3: Concerns over US tariff hikes dragging down the global economy and demand, along with uncertainty about whether OPEC+ will delay production increases, led to a decline in international oil prices. The NYMEX crude oil futures contract for April 2023 closed at $68.37, down $1.39 per barrel, a decrease of -1.99%; the ICE Brent crude oil futures contract for May 2023 closed at $71.62, down $1.19 per barrel, a decrease of -1.63%. China's INE crude oil futures main contract 2504 fell by 3.3 to 539.2 yuan per barrel, and further dropped by 12.7 to 526.5 yuan per barrel during the night session.

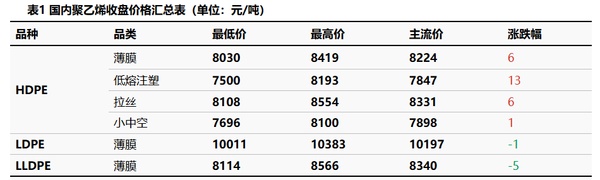

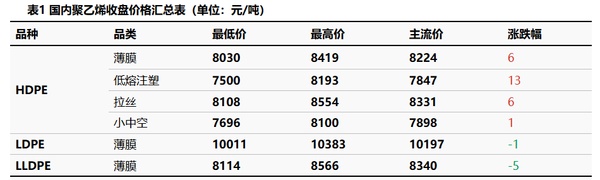

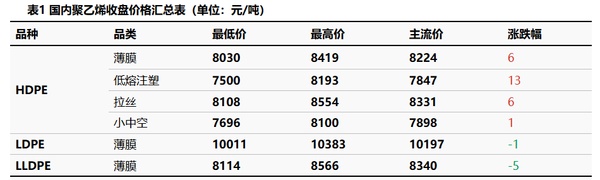

②, Today, HDPE market prices increased by 1-13 yuan per ton; LDPE market prices slightly decreased by 1 yuan per ton; LLDPE market prices slightly decreased by 5 yuan per ton.

2, Spot Overview

22, Spot Overview, Spot Overview

Today, the spot market prices for polyethylene in China showed mixed trends. HDPE spot market prices were adjusted by 1-13 yuan/ton. Affected by news of maintenance and production shifts, market quotations have risen, but the increase is limited. LDPE spot market prices fell slightly by 1 yuan/ton. There was a reduction in some lower-end resources in the market, but traders' enthusiasm for purchasing was average, leading to minor fluctuations in overall market prices. LLDPE spot market prices decreased slightly by 5 yuan/ton. In the short term, there is no new supply pressure, but the spot remains relatively abundant. The macro environment has released bearish signals, resulting in more transactions at lower prices.

Today, the spot market prices for polyethylene in China showed mixed trends. HDPE spot market prices were adjusted by 1-13 yuan/ton. Affected by news of maintenance and production shifts, market quotations have risen, but the increase is limited. LDPE spot market prices fell slightly by 1 yuan/ton. There was a reduction in some lower-end resources in the market, but traders' enthusiasm for purchasing was average, leading to minor fluctuations in overall market prices. LLDPE spot market prices decreased slightly by 5 yuan/ton. In the short term, there is no new supply pressure, but the spot remains relatively abundant. The macro environment has released bearish signals, resulting in more transactions at lower prices.The domestic polyethylene spot market prices showed a mixed trend today. HDPE spot market prices were adjusted by 1-13 yuan/ton, influenced by news of maintenance and production shifts, leading to a slight increase in quotations, although the rise was limited. LDPE spot market prices slightly decreased by 1 yuan/ton, with some reduction in lower-end resources in the market, but traders' enthusiasm for procurement remained moderate, causing overall market prices to fluctuate slightly. LLDPE spot market prices also saw a minor drop of 5 yuan/ton; there is no new supply pressure in the short term, yet spot supplies remain relatively abundant. With bearish signals from the macroeconomic front, most transactions occurred at lower prices.3、Price Forecast

3、Price Forecast Price ForecastIn the short term, despite the continuous increase in downstream demand and a tendency among producers to maintain prices, after mid-month, with the full-scale commissioning of new capacities at Shandong Xinshidai and Inner Mongolia Baofeng, the supply volume is expected to increase, which may have a negative impact on price increases. At that time, it is predicted that market prices will exhibit a narrow range of fluctuations.

In the short term, despite the continuous increase in downstream demand and a tendency among producers to maintain prices, after mid-month, with the full-scale commissioning of new capacities at Shandong Xinshidai and Inner Mongolia Baofeng, the supply volume is expected to increase, which may have a negative impact on price increases. At that time, it is predicted that market prices will exhibit a narrow range of fluctuations.

PP:

PP: PP:1. Today's Summary

1. Today's Summary 1. Today's Summary① On March 4th, the inventory of polyolefins from the two major oil companies was 845,000 tons in the morning, a decrease of 15,000 tons compared to yesterday.

① On March 4th, the inventory of polyolefins from the two major oil companies was 845,000 tons in the morning, a decrease of 15,000 tons compared to yesterday.② The impact of domestic polypropylene plant shutdowns today remained steady at 12.81%, with no changes in domestic PP maintenance facilities. The daily production ratio of drawing materials decreased by 1.95% to 30.81% compared to yesterday, while the daily production ratio of low-melt copolymers increased by 0.84% to 12.90%.

② The impact of domestic polypropylene plant shutdowns today remained steady at 12.81%, with no changes in domestic PP maintenance facilities. The daily production ratio of drawing materials decreased by 1.95% to 30.81% compared to yesterday, while the daily production ratio of low-melt copolymers increased by 0.84% to 12.90%.③ This week (February 22-28, 2025), the supply-demand difference was 77,020 tons. As downstream demand continues to recover, inventories are being slowly consumed, but the supply still shows a growth trend, maintaining a slight surplus in the supply-demand balance.

③ This week (February 22-28, 2025), the supply-demand difference was 77,020 tons. As downstream demand continues to recover, inventories are being slowly consumed, but the supply still shows a growth trend, maintaining a slight surplus in the supply-demand balance.2. Spot Overview

2. Spot Overview 2. Spot Overview

Using the East China region as a benchmark, today's polypropylene fiber closed at 7393 yuan/ton, down 4 yuan/ton from yesterday, in line with the morning expectations.

Using the East China region as a benchmark, today's polypropylene fiber closed at 7393 yuan/ton, down 4 yuan/ton from yesterday, in line with the morning expectations.The futures market was weak and fluctuating today. Downstream demand did not show any significant change, maintaining only the necessary purchases, with limited order increments. Operators followed the market trend, and the trading atmosphere within the market was lukewarm, with no major fluctuations in spot prices. As of midday, the mainstream price for East China fiber was between 7340-7450 yuan/ton.

The futures market was weak and fluctuating today. Downstream demand did not show any significant change, maintaining only the necessary purchases, with limited order increments. Operators followed the market trend, and the trading atmosphere within the market was lukewarm, with no major fluctuations in spot prices. As of midday, the mainstream price for East China fiber was between 7340-7450 yuan/ton.3、Price Forecast

3、3、Price ForecastPrice ForecastAt the beginning of the month, most upstream petrochemical enterprises maintained their prices for sales. Traders adjusted their offers according to the market and made shipments, with a lukewarm trading atmosphere in the market. Spot prices fluctuated narrowly, and the circulation of goods in the market was slow, with factories maintaining consumption to deplete the inventory along the industrial chain. It is expected that the polypropylene market will continue to fluctuate within the range of 7350-7450 yuan/ton tomorrow. Special attention should be paid to changes in demand and inventory. With the arrival of the peak season in March, orders may slightly increase, and there are expectations for improved trading conditions in the market.

PVC:

PVC:PVC:1. Today's Summary

1. Today's Summary1. Today's Summary① The ex-factory prices of domestic calcium carbide-based PVC producers are mainly stable;

① The ex-factory prices of domestic calcium carbide-based PVC producers are mainly stable;② Suzhou Huasu resumed operations on the 5th, with no new maintenance schedules added;

② Suzhou Huasu resumed operations on the 5th, with no new maintenance schedules added;③ The US announced an additional 10% tariff on products exported from China to the US starting from March 4th.

③ The US announced an additional 10% tariff on products exported from China to the US starting from March 4th.2. Spot Overview

22. Spot Overview. Spot Overview

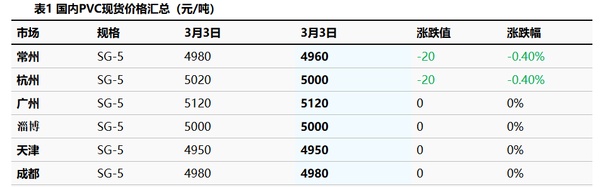

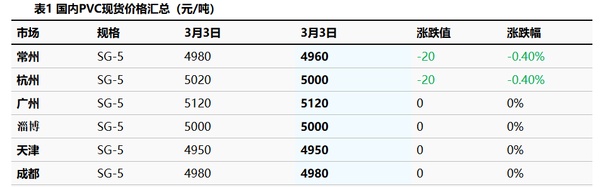

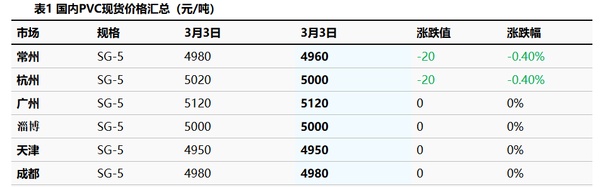

Using the Changzhou market in East China as a benchmark, the cash-on-delivery warehouse price for Type V calcium carbide method PVC in the East China region today is 4960 RMB/ton, a decrease of 20 RMB/ton from the previous period.

Using the Changzhou market in East China as a benchmark, the cash-on-delivery warehouse price for Type V calcium carbide method PVC in the East China region today is 4960 RMB/ton, a decrease of 20 RMB/ton from the previous period.This week, the price of calcium carbide, the upstream raw material for PVC, continued to rise, while the price of ethylene remained firm. The cost support is relatively strong, coupled with positive macro expectations, and the intraday prices of commodities such as petrochemicals have risen, leading to firm and high-looking spot quotes for PVC. Intraday prices generally increased, with the cash-on-delivery warehouse price for Type V calcium carbide method PVC in the East China region ranging from 4950-5080 RMB/ton, and the ethylene method ranging from 5100-5400 RMB/ton.

This week, the price of calcium carbide, the upstream raw material for PVC, continued to rise, while the price of ethylene remained firm. The cost support is relatively strong, coupled with positive macro expectations, and the intraday prices of commodities such as petrochemicals have risen, leading to firm and high-looking spot quotes for PVC. Intraday prices generally increased, with the cash-on-delivery warehouse price for Type V calcium carbide method PVC in the East China region ranging from 4950-5080 RMB/ton, and the ethylene method ranging from 5100-5400 RMB/ton.3. Price Forecast

3. Price ForecastThe supply and demand fundamentals of PVC show a dual increase. As maintenance losses decrease, market supply increases, and downstream operations have returned to pre-holiday levels, increasing rigid demand purchases. The cost support is firm, and the bottom support of the market is improving. However, there are significant fluctuations in external macro expectations, and domestic policy support and changes in foreign trade policies still have a large impact on the market. There are doubts about long-term demand expectations, and it is expected that prices will maintain a slight fluctuation in the near term, with the cash-on-delivery price for Type V calcium carbide method PVC in the East China region fluctuating between 4900-5100 RMB/ton.

The supply and demand fundamentals of PVC show a dual increase. As maintenance losses decrease, market supply increases, and downstream operations have returned to pre-holiday levels, increasing rigid demand purchases. The cost support is firm, and the bottom support of the market is improving. However, there are significant fluctuations in external macro expectations, and domestic policy support and changes in foreign trade policies still have a large impact on the market. There are doubts about long-term demand expectations, and it is expected that prices will maintain a slight fluctuation in the near term, with the cash-on-delivery price for Type V calcium carbide method PVC in the East China region fluctuating between 4900-5100 RMB/ton.

PS:

PS:PS:1. Today's Summary

1. Today's Summary①、Today, the price of GPPS in East China fell by 50 to 8,800 yuan/ton, meeting the early morning expectations.

①、Today, the price of GPPS in East China fell by 50 to 8,800 yuan/ton, meeting the early morning expectations.②、On Tuesday, the styrene market in East China fell by 125 to 8,325 yuan/ton, South China fell by 110 to 8,465 yuan/ton, and Shandong fell by 50 to 8,400 yuan/ton.

②、On Tuesday, the styrene market in East China fell by 125 to 8,325 yuan/ton, South China fell by 110 to 8,465 yuan/ton, and Shandong fell by 50 to 8,400 yuan/ton.2, Overview of Spot Market

22, Overview of Spot Market, Overview of Spot Market

According to statistics, today the price of GPPS in East China fell by 50 to 8,800 yuan/ton, meeting the early morning expectations. The upstream styrene market was slightly weak, with a strong sentiment of waiting and seeing in the market. The industry supply continued to recover, and the pick-up speed at downstream factories slightly improved, but the industry still remains in a state of high inventory, leading to a reduction in prices for sales.

According to statistics, today the price of GPPS in East China fell by 50 to 8,800 yuan/ton, meeting the early morning expectations. The upstream styrene market was slightly weak, with a strong sentiment of waiting and seeing in the market. The industry supply continued to recover, and the pick-up speed at downstream factories slightly improved, but the industry still remains in a state of high inventory, leading to a reduction in prices for sales.According to statistics, today's GPPS in East China fell by 50 to 8,800 yuan/ton, meeting the early morning expectations. Upstream styrene was slightly weak, with a strong market sentiment of waiting and seeing. Industry supply continues to recover, and the speed of downstream factories picking up goods has slightly recovered, but the industry is still in a state of high inventory, with the market reducing prices for sales.3、Price Prediction

3、3、Price Prediction Price PredictionThe cost of raw material styrene continues to decline, dragging down the market. The recovery speed of small and medium-sized downstream factories is not as fast as the supply, and the pressure on the industry to sell off remains, so in the short term, the PS market may turn to price reduction for sales. It is expected that the transparent modified benzene in the East China market will be between 8,700-10,300 yuan/ton.

The cost of raw material styrene continues to decline, dragging down the market. The recovery speed of small and medium-sized downstream factories is not as fast as the supply, and the pressure on the industry to sell off remains, so in the short term, the PS market may turn to price reduction for sales. It is expected that the transparent modified benzene in the East China market will be between 8,700-10,300 yuan/ton.

ABS:

ABS:ABS:1、Today's Summary:

11、Today's Summary:、Today's Summary:①、Today, the market price in South China operated strongly, while there wasn't much change in the East China market price.

①、Today, the market price in South China operated strongly, while there wasn't much change in the East China market price.②、The monthly production of ABS in March is expected to increase.

②、The monthly production of ABS in March is expected to increase.2、Spot Overview

22、Spot Overview、Spot Overview

With Yuyao and Dongguan as the benchmarks, market prices have decreased. Today, some parts of the Dongguan market saw a rise in prices, with transactions mainly driven by rigid demand. The East China market has seen minor adjustments, with overall changes being insignificant.

With Yuyao and Dongguan as the benchmarks, market prices have decreased. Today, some parts of the Dongguan market saw a rise in prices, with transactions mainly driven by rigid demand. The East China market has seen minor adjustments, with overall changes being insignificant.With Yuyao and Dongguan as the benchmarks, market prices have decreased. Today, some parts of the Dongguan market saw a rise in prices, with transactions mainly driven by rigid demand. The East China market has seen minor adjustments, with overall changes being insignificant.3、Price Forecast: Today, some parts of the South China market experienced an increase in prices, while the East China market showed little change. Transactions were primarily driven by rigid demand. With raw material prices declining and more negative factors within the market, cost support is relatively weak. It is expected that domestic ABS market prices will continue to maintain a narrow range tomorrow.

33、、Price Forecast: Price Forecast: Today, some parts of the South China market experienced an increase in prices, while the East China market showed little change. Transactions were primarily driven by rigid demand. With raw material prices declining and more negative factors within the market, cost support is relatively weak. It is expected that domestic ABS market prices will continue to maintain a narrow range tomorrow.

EVA:

EVA:EVA:

Engineering Plastics

Engineering PlasticsEngineering PlasticsPC:

PC:PC:1、Today's Summary

11、Today's Summary、Today's Summary①、On Monday, international crude oil prices fell, with the ICE Brent oil futures contract for May delivery closing at $71.62, down $1.19 per barrel.

①、On Monday, international crude oil prices fell, with the ICE Brent oil futures contract for May delivery closing at $71.62, down $1.19 per barrel.②、The closing price of Bisphenol A in the East China market was 9400 yuan/ton, remaining stable compared to the previous period.

②、The closing price of Bisphenol A in the East China market was 9400 yuan/ton, remaining stable compared to the previous period.③、A PC plant in Southwest China has reduced its operating load.

③、A PC plant in Southwest China has reduced its operating load.2、Spot Market Overview

22、Spot Market Overview、Spot Market Overview

The domestic PC market continues to show a weak trend today. As of the close of trading in the afternoon, the mainstream negotiation price for low-end injection molding grade materials in East China was 12,200-15,900 yuan/ton, and for mid-to-high-end materials, it was 15,250-16,500 yuan/ton, with some prices dropping by 50 yuan/ton compared to yesterday. This week, the latest factory prices from domestic PC manufacturers remained largely stable, with individual adjustments down by 100 yuan/ton. Zhejiang Petrochemical's auction opened low in three rounds, decreasing by 200 yuan/ton compared to last week. Looking at the spot market, both East China and South China maintained a weak consolidation, with no significant positive factors in the fundamentals. The sentiment among industry players remains cautiously bearish, leading to active negotiations and sales. However, downstream demand is insufficient, resulting in mainly small-scale transactions within the market.

The weak trend in the domestic PC market continues today. As of the afternoon close, the main negotiation price for low-end injection molding materials in East China is 12,200-15,900 RMB/ton, and for mid-to-high-end materials, it's 15,250-16,500 RMB/ton, with some prices down by 50 RMB/ton compared to yesterday. This week, the latest ex-factory prices from domestic PC manufacturers are mainly stable, with a few reduced by 100 RMB/ton; Zhejiang Petrochemical's auction started low and was concluded in three rounds, falling 200 RMB/ton from last week. In terms of the spot market, both East China and South China remain weak, with little positive news on the fundamentals. The sentiment among industry players remains bearish, leading to active negotiations for sales, but there is insufficient demand from downstream buyers, with small-volume transactions dominating the market.3、Price Forecast

33、、Price Forecast Price ForecastThis week, the raw material bisphenol A has been consolidating at a low level, with the price difference with PC basically within 3,000 RMB/ton. As some ex-factory prices continue to decline, the cost pressure on the PC industry is increasing. However, considering that the current capacity utilization rate is still around 85%, domestic supply is highly abundant, while downstream rigid demand remains insufficient. The negative factors of supply and demand dominate, and it is expected that the domestic PC market will maintain a weak trend.

This week, the raw material bisphenol A has been consolidating at a low level, with the price difference with PC basically within 3,000 RMB/ton. As some ex-factory prices continue to decline, the cost pressure on the PC industry is increasing. However, considering that the current capacity utilization rate is still around 85%, domestic supply is highly abundant, while downstream rigid demand remains insufficient. The negative factors of supply and demand dominate, and it is expected that the domestic PC market will maintain a weak trend.

PET:

PET:PET:1、Today's Summary

11、Today's Summary、Today's Summary①, Tenglong's quotation remains stable, while other factories have lowered their quotations by 50-120 (unit: RMB/ton)

①, Tenglong's quotation remains stable, while other factories have lowered their quotations by 50-120 (unit: RMB/ton)②, Today, the capacity utilization rate of domestic polyester bottle chips is 69.05%.

②, Today, the capacity utilization rate of domestic polyester bottle chips is 69.05%.2、Spot Overview

22、Spot Overview、Spot Overview

Based on the East China region, the spot price of water bottle grade polyester chips closed at 6150 yuan/ton today, a decrease of 110 from the previous working day, in line with early expectations.

Based on the East China region, the spot price of water bottle grade polyester chips closed at 6150 yuan/ton today, a decrease of 110 from the previous working day, in line with early expectations.Based on the East China region, the spot price of water bottle grade polyester chips closed at 6150 yuan/ton today, a decrease of 110 from the previous working day, in line with early expectations.Tariff news continues to disturb the commodity market, and under the influence of crude oil, the prices of polyester raw materials and polyester chip markets have significantly declined. Factory quotations have been reduced by 50-120, with actual orders for April goods ranging from 6180-6250; the selling prices of holders have dropped, with March goods trading between 6130-6200 or futures contract 2505 at a discount of 10 to 20. No high-priced goods were heard to have actually traded. Some traders are covering short positions, purchasing as needed at lower prices. A few large factories have seen increased transaction volumes, but overall market transactions are moderate. (Unit: yuan/ton)

Tariff news continues to disrupt the commodity market, with crude oil leading the way, the prices of polyester raw materials and polyester bottle chips have significantly declined. Factory quotations have been reduced by 50-120, with actual orders for April goods ranging from 6180-6250; the selling prices of inventory holders have dropped, March goods are traded at 6130-6200 or futures contract 2505 at a discount of 10 to 20. High-priced goods have not heard of any actual transactions, some traders are covering shorts, and rigid demand is restocking at low points. Some large factories have seen an increase in order fulfillment, but overall market transactions are average. (Unit: RMB/ton)3、Price Forecast

3、3、Price Forecast Price ForecastThe news of additional tariffs continues to ferment, potentially suppressing the ongoing weakness in chemical products. The industry's restocking mentality is cautious, and the end-users maintain just-in-time restocking. In the short term, the supply side remains stable, while the downstream insists on restocking at low points, with a low willingness to stockpile. Under pressure from the raw material end, the polyester bottle chip market finds it difficult to reverse its downturn, and the basis strengthens. Attention should be paid to macroeconomic news.

The news of additional tariffs continues to ferment, potentially suppressing the ongoing weakness in chemical products. The industry's restocking mentality is cautious, and the end-users maintain just-in-time restocking. In the short term, the supply side remains stable, while the downstream insists on restocking at low points, with a low willingness to stockpile. Under pressure from the raw material end, the polyester bottle chip market finds it difficult to reverse its downturn, and the basis strengthens. Attention should be paid to macroeconomic news.

PMMA:

PMMA:PMMA:1、Today's Summary

11、Today's Summary、Today's Summary①、Today, factory quotation focus remains stable.

①、Today, factory quotation focus remains stable.②、Today, the domestic PMMA particle utilization rate is 59%.

②、Today, the domestic PMMA particle utilization rate is 59%.2、Spot Overview

22、Spot Overview、Spot Overview

Using East China as the benchmark, today's PMMA granules closed at 17,200 yuan/ton, unchanged from yesterday, in line with the morning expectations. Using East China as the benchmark, today's PMMA granules closed at 17,200 yuan/ton, unchanged from yesterday, in line with the morning expectations. The PMMA granule market today was operating steadily, with supply and demand remaining stable. Upstream and downstream players continued to negotiate, but there were no significant changes in the PMMA granule market. Merchants held a steady attitude towards quotations, negotiating orders as they came, and overall trading atmosphere was average. In the short term, attention will continue to be paid to the dynamics of offer and bid.

Using East China as the benchmark, today's PMMA granules closed at 17,200 yuan/ton, unchanged from yesterday, in line with the morning expectations. Using East China as the benchmark, today's PMMA granules closed at 17,200 yuan/ton, unchanged from yesterday, in line with the morning expectations. The PMMA granule market today was operating steadily, with supply and demand remaining stable. Upstream and downstream players continued to negotiate, but there were no significant changes in the PMMA granule market. Merchants held a steady attitude towards quotations, negotiating orders as they came, and overall trading atmosphere was average. In the short term, attention will continue to be paid to the dynamics of offer and bid.3, Price Forecast

33,, Price ForecastPrice ForecastIn the short term, the PMMA granule market is expected to remain in a stalemate, with suppliers mainly maintaining stable prices. It is anticipated that there will be limited changes in quotations. Due to weak demand, downstream buyers are only purchasing based on necessity, and there has been no significant increase in transactions. In summary, the trading atmosphere remains lukewarm, and it may continue to operate in a stalemate. It is predicted that the PMMA granule market will maintain a stable trend in the short term, and further updates on trading activities will be closely monitored.

In the short term, the PMMA granule market is expected to remain in a stalemate, with suppliers mainly maintaining stable prices. It is anticipated that there will be limited changes in quotations. Due to weak demand, downstream buyers are only purchasing based on necessity, and there has been no significant increase in transactions. In summary, the trading atmosphere remains lukewarm, and it may continue to operate in a stalemate. It is predicted that the PMMA granule market will maintain a stable trend in the short term, and further updates on trading activities will be closely monitored.

POM:

POM:POM:1. Today's Summary

1. Today's Summary1. Today's Summary①, POM petrochemical plant inventories are gradually accumulating.

①, POM petrochemical plant inventories are gradually accumulating.②, The market is more cautious, and the quotation trend shows limited fluctuations.

②, The market is more cautious, and the quotation trend shows limited fluctuations.2, Spot Market Overview

22, Spot Market Overview, Spot Market Overview

Using Yuyao region as a benchmark, today's Yun Tianhua M90 closed at 14,400 yuan/ton, with limited price fluctuation. Today's POM market remains stable and watchful. With limited support from POM fundamentals, trading atmosphere in various regions is light, and traders are becoming more cautious. Main quotations show no significant changes, and downstream users are mainly purchasing based on rigid demand. Overall, transaction volumes are moderate. The main quotation range is 10,600 to 14,700 yuan/ton.

Based on the Yuyao region, today's Yun Tianhua M90 is priced at 14,400 yuan/ton, with limited price fluctuation. The POM market is currently stable and in a wait-and-see mode. With limited fundamental support for POM, the trading atmosphere in various regions is light, and traders are becoming more cautious, with no significant changes in mainstream offers. Downstream users are mainly purchasing based on rigid demand, and overall transaction volumes are average. The main offer range is 10,600-14,700 yuan/ton. Based on the Yuyao region, today's Yun Tianhua M90 is priced at 14,400 yuan/ton, with limited price fluctuation. The POM market is currently stable and in a wait-and-see mode. With limited fundamental support for POM, the trading atmosphere in various regions is light, and traders are becoming more cautious, with no significant changes in mainstream offers. Downstream users are mainly purchasing based on rigid demand, and overall transaction volumes are average. The main offer range is 10,600-14,700 yuan/ton.3、Price Forecast

33、、Price ForecastPrice ForecastThere is no clear guidance from POM petrochemical plants, and given the slow movement of goods in the market, the trading atmosphere will not improve. Traders are cautious and lack enthusiasm, and there is still room for concessions in mainstream offers. Terminal users are making sporadic small orders, and the transaction situation is unlikely to be optimistic. Longzhong expects that the domestic POM market will operate weakly and stably in the short term.

There is no clear guidance from POM petrochemical plants, and given the slow movement of goods in the market, the trading atmosphere will not improve. Traders are cautious and lack enthusiasm, and there is still room for concessions in mainstream offers. Terminal users are making sporadic small orders, and the transaction situation is unlikely to be optimistic. Longzhong expects that the domestic POM market will operate weakly and stably in the short term.

PBT:

PBT:PBT:1、Today's Summary

11、Today's Summary、Today's Summary①Some PBT manufacturers have lowered their quotes.

①Some PBT manufacturers have lowered their quotes.②This week, PBT production facilities are operating normally.

②This week, PBT production facilities are operating normally.③This week, China's PBT industry output reached 19,915 tons, with a capacity utilization rate of 47.65%, showing little change from last week. The average gross profit margin for domestic PBT this week is -403 yuan/ton, an increase of 87 yuan/ton compared to last week.

③This week, China's PBT industry output reached 19,915 tons, with a capacity utilization rate of 47.65%, showing little change from last week. The average gross profit margin for domestic PBT this week is -403 yuan/ton, an increase of 87 yuan/ton compared to last week.

With the East China region as the benchmark, today's mainstream price of medium to low viscosity PBT resin is 8000-8300 yuan/ton, a decrease from yesterday. The PBT market is weak and declining today, with the PTA market under pressure and falling sharply, and the BDO market fluctuating within a range. The weakening cost support continues to negatively impact the PBT market sentiment, with an increase in lower-priced goods within the market, leading to a generally weak and declining trend. According to Longzhong Information, the price of pure PBT resin with medium to low viscosity in the East China market is 8000-8300 yuan/ton.

With the East China region as the benchmark, today's mainstream price of medium to low viscosity PBT resin is 8000-8300 yuan/ton, a decrease from yesterday. The PBT market is weak and declining today, with the PTA market under pressure and falling sharply, and the BDO market fluctuating within a range. The weakening cost support continues to negatively impact the PBT market sentiment, with an increase in lower-priced goods within the market, leading to a generally weak and declining trend. According to Longzhong Information, the price of pure PBT resin with medium to low viscosity in the East China market is 8000-8300 yuan/ton.2. Price Forecast

2. Price ForecastIt is expected that the PBT market will be weak and watchful. In terms of cost, the domestic supply of PTA has significantly decreased, maintaining a tight supply-demand pattern, with continuous inventory reduction in the balance sheet. However, due to frequent policy interventions, commodity sentiment remains low, coupled with a weak crude oil trend, the short-term domestic PTA spot market is expected to continue its weak pattern; BDO's recent downstream load has decreased, reducing the consumption of raw materials, and there is a strong desire to negotiate raw material prices, but suppliers are intent on holding prices, and traders are cautious, resulting in little change in the market focus. The cost side finds it difficult to provide support, leading to a growing pessimistic sentiment in the PBT market, which is filled with bearish factors. It is expected that the market focus will experience weak fluctuations. Therefore, Longzhong predicts that tomorrow's East China market for medium to low viscosity PBT resin will be in the range of 8000-8300 yuan/ton.

PA6:

PA6:1. Today's Summary

1. Today's Summary①. Sinopec's weekly settlement price for caprolactam is 11190 yuan/ton (six months interest-free acceptance), down 420 yuan/ton from last week.

②. Sinopec's benzene prices in East China and South China have been reduced by 150 yuan/ton, now at 7400 yuan/ton, effective from March 4th.

2. Spot Overview

2. Spot Overview

The polyamide 6 chip market is operating weakly today, with a significant decline in the upstream markets for pure benzene and caprolactam. Market sentiment is cautious, and downstream demand for replenishment at appropriate prices is limited overall. Polymer enterprises are mainly negotiating sales, and market transactions are moderate. In East China, the cash price for regular spinning PA6 is 11150-11550 yuan/ton for short delivery, while the spot price for high-speed spinning is 12000-12500 yuan/ton with acceptance delivery. The self-pickup cash price in Chaohu is 1035-10450 yuan/ton.

The polyamide 6 chip market is operating weakly today, with a significant decline in the upstream markets for pure benzene and caprolactam. Market sentiment is cautious, and downstream demand for replenishment at appropriate prices is limited overall. Polymer enterprises are mainly negotiating sales, and market transactions are moderate. In East China, the cash price for regular spinning PA6 is 11150-11550 yuan/ton for short delivery, while the spot price for high-speed spinning is 12000-12500 yuan/ton with acceptance delivery. The self-pickup cash price in Chaohu is 1035-10450 yuan/ton.The polyamide 6 chip market is operating weakly today, with a significant decline in the upstream markets for pure benzene and caprolactam. Market sentiment is cautious, and downstream demand for replenishment at appropriate prices is limited overall. Polymer enterprises are mainly negotiating sales, and market transactions are moderate. In East China, the cash price for regular spinning PA6 is 11150-11550 yuan/ton for short delivery, while the spot price for high-speed spinning is 12000-12500 yuan/ton with acceptance delivery. The self-pickup cash price in Chaohu is 1035-10450 yuan/ton.3,Price Forecast

33,,Price ForecastPrice ForecastFrom a cost perspective, the decline in the upstream markets for pure benzene and caprolactam has weakened cost support. From the supply and demand side, downstream demand is below expectations, and most of the inventory is being consumed, leading to limited overall demand. Polymer enterprises have a large inventory and are negotiating sales. It is expected that the polyamide 6 market will continue to operate weakly in the near term. Closely monitor downstream demand and price adjustment dynamics from manufacturers.

From a cost perspective, the decline in the upstream pure benzene and caprolactam markets has weakened cost support; from the supply and demand perspective, due to lower-than-expected downstream demand, mainly consuming inventory, overall demand is limited. Polymer enterprises have more inventory and are negotiating shipments. It is expected that the PA6 market will operate weakly in the near future. Closely monitor the dynamics of downstream demand and manufacturer price adjustments.

PA66:

PA66:PA66:1、Summary of Today

11、Summary of Today、Summary of Today①、3/3: Concerns about U.S. tariffs dragging down the global economy and demand, coupled with uncertainty over whether OPEC+ will postpone its production increase plan, led to a decline in international oil prices. The NYMEX crude oil futures 04 contract fell by $1.39 to $68.37 per barrel, a decrease of -1.99% month-over-month; the ICE Brent oil futures 05 contract (rollover) fell by $1.19 to $71.62 per barrel, a decrease of -1.63% month-over-month. China's INE crude oil futures main contract 2504 fell by 3.3 to 539.2 yuan per barrel, and the night session fell by 12.7 to 526.5 yuan per barrel.

①、3/3: Concerns about U.S. tariffs dragging down the global economy and demand, coupled with uncertainty over whether OPEC+ will postpone its production increase plan, led to a decline in international oil prices. The NYMEX crude oil futures 04 contract fell by $1.39 to $68.37 per barrel, a decrease of -1.99% month-over-month; the ICE Brent oil futures 05 contract (rollover) fell by $1.19 to $71.62 per barrel, a decrease of -1.63% month-over-month. China's INE crude oil futures main contract 2504 fell by 3.3 to 539.2 yuan per barrel, and the night session fell by 12.7 to 526.5 yuan per barrel.②、Today, the domestic PA66 capacity utilization rate is 58%, with a daily output of about 2,200 tons. Under cost and demand pressures, domestic PA66 polymer enterprises maintain low-load production. After the holiday, downstream enterprises gradually resume work, and the supply of goods in the domestic PA66 industry is relatively stable.

②、Today, the domestic PA66 capacity utilization rate is 58%, with a daily output of about 2,200 tons. Under cost and demand pressures, domestic PA66 polymer enterprises maintain low-load production. After the holiday, downstream enterprises gradually resume work, and the supply of goods in the domestic PA66 industry is relatively stable.③、Invista (China) Investment Co., Ltd. announced that starting from 7:00 on March 1, 2025, the spot trading price of hexamethylenediamine will be set at 21,300 RMB per ton, an increase of 300 RMB per ton compared to the February price.

③、Invista (China) Investment Co., Ltd. announced that starting from 7:00 on March 1, 2025, the spot trading price of hexamethylenediamine will be set at 21,300 RMB per ton, an increase of 300 RMB per ton compared to the February price.2、Overview of Spot Market

22、Overview of Spot Market、Overview of Spot Market

Using the Yuyao market in East China as a benchmark, today's EPR27 market price is around 17,300 to 17,400 yuan per ton, remaining stable compared to yesterday. The raw material adipic acid is showing a weak fluctuation, while hexamethylenediamine (HMDA) is showing a stronger fluctuation. The cost support remains stable, with moderate downstream demand and relatively stable supply of goods, resulting in a light market transaction.

Using the Yuyao market in East China as a benchmark, today's EPR27 market price is around 17,300 to 17,400 yuan per ton, remaining stable compared to yesterday. The raw material adipic acid is showing a weak fluctuation, while hexamethylenediamine (HMDA) is showing a stronger fluctuation. The cost support remains stable, with moderate downstream demand and relatively stable supply of goods, resulting in a light market transaction.Using the Yuyao market in East China as a benchmark, today's EPR27 market price is around 17,300 to 17,400 yuan per ton, remaining stable compared to yesterday. The raw material adipic acid is showing a weak fluctuation, while hexamethylenediamine (HMDA) is showing a stronger fluctuation. The cost support remains stable, with moderate downstream demand and relatively stable supply of goods, resulting in a light market transaction.3,Price Forecast

33,,Price ForecastPrice ForecastOn the cost side, hexamethylenediamine is fluctuating, and adipic acid is consolidating weakly. The raw material prices are stably supported, with downstream purchases made according to demand. The market supply of goods is stable, and it is expected that in the short term, domestic PA66 will consolidate within a narrow range.

On the cost side, hexamethylenediamine is fluctuating, and adipic acid is consolidating weakly. The raw material prices are stably supported, with downstream purchases made according to demand. The market supply of goods is stable, and it is expected that in the short term, domestic PA66 will consolidate within a narrow range.【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track