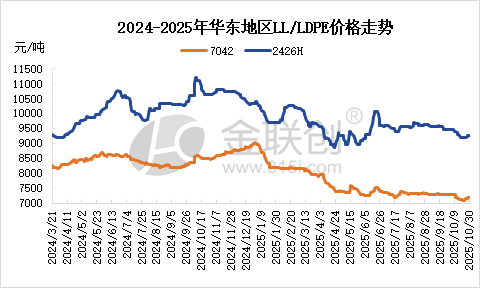

"Golden October" Weak, Polyethylene Prices Hit New Low of the Year in October

Data Source: JLC Network Technology

With the "Golden September and Silver October" peak demand season nearing its end, the market performance has fallen short of expectations. In October, the average price of oil-based linear low-density polyethylene in the Hangzhou market was 7,197 yuan/ton, a decrease of 1.44% compared to September. Even during the traditional peak season, the market still faces sluggish pressure, with polyethylene continuing to exhibit a weak and fluctuating pattern throughout October, and prices persistently declining. As of recently, prices have gradually stopped falling, with some low-end prices seeing a slight increase.

In October, the domestic polyethylene market in China saw an accelerated decline, with prices hitting new lows for the year. After the National Day holiday, petrochemical companies experienced a significant increase in inventory, leading to a strong willingness among businesses and traders to lower prices for sales. At the same time, the renewed escalation of trade tensions between China and the U.S., along with the easing of geopolitical risks in the Middle East, exerted downward pressure on the global oil market, further weakening market support. Regarding demand, although it is the peak season for polyethylene consumption and some industries, such as agricultural film and packaging, have increased their operating rates, the limited follow-up of new orders has led to a generally cautious attitude among end users, who primarily focus on essential purchases. By the end of October, with the introduction of the 14th Five-Year Plan, industry confidence rebounded somewhat, leading to a low-level rebound in plastic futures prices, with spot prices experiencing slight increases.

Looking ahead to November, in terms of domestic polyethylene facilities, the number of planned maintenance units is decreasing, with only some facilities such as Maoming Petrochemical, Lanzhou Petrochemical, and Shanghai Petrochemical having maintenance plans. At the same time, some facilities that were previously under maintenance are scheduled to restart. The Phase 2, No. 2 full-density and No. 3 low-density units of Zhenhai Refining & Chemical are planned to restart on November 2nd, Lianyungang Petrochemical's first-phase low-pressure unit is scheduled to restart, and Fushun Petrochemical is also planning to restart soon. Therefore, supply pressure is expected to remain unchanged in November. On the demand side, as November marks the onset of winter, temperatures in the north decrease significantly, leading to a decline in demand for agricultural and greenhouse films, while demand in sectors such as pipe materials and injection-molded products also decreases with the temperature drop. In summary, November is expected to see an increase in supply and a decrease in demand, suggesting that the polyethylene market will continue to face pressure, and the weak trend will be difficult to change in the short term. Although e-commerce promotions like Double 11 may bring some packaging demand, their impact on the overall market is limited. In conclusion, market prices in November are expected to fluctuate slightly at current levels but are likely to remain weak.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Brazil Imposes Five-Year Anti-Dumping Duty of Up to $1,267.74 Per Ton on Titanium Dioxide From China

-

Kingfa Sci & Tech Q3 Net Profit Attributable to Shareholders Rises 58.0% YoY to 479 Million Yuan

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

China-U.S. Summit in Busan Tomorrow! Syensqo Launches New PAEK Material; Ascend Debuts at Medical Summit

-

MOFCOM Spokesperson Answers Questions from Reporters on China-U.S. Kuala Lumpur Trade Consultations Joint Arrangement