【Today's Plastic Market】More Rises Than Falls! PVC, PS, PC, PET, etc. Adjusted Upwards, POM Plummeted 700 Against the Trend

Summary: April 1st summary of prices and forecasts for general and engineering plastics in the plastic market. General plastics mostly rose with a few declines, as supply-side pressures eased; the PP market continued to fluctuate within a range; PE experienced a slight drop; PVC remained stable with slight increases, adjusting narrowly by 10-20; PS saw a small price increase, with a maximum rise of 50; ABS market prices moved upwards, with overall good trading volume; EVA market had no price adjustments. Engineering plastics showed mixed trends, with PC rising up to 150; PET increased by 20-30; PMMA partially fell by 100; POM lacked cost support, plummeting by up to 700; PA6 rose/fell by 50-100; PBT and PA66 spot markets showed no fluctuations.

General material

PP: Supply pressure eases, polypropylene market consolidates in range

1. Today's Summary

① CNPC Southwest PP prices partially decreased: Ternary CPP down 50, Dushanzi TF1007 to 8250; medium melt copolymer down 100, Lanzhou Petrochemical SP179 to 8000.

Today, the domestic polypropylene shutdown affected the price, which increased by 0.89% to 18.72% compared to yesterday. The main reasons are the maintenance shutdown of the PP unit at Yan'an Energy Chemical (300,000 tons/year), the maintenance shutdown of the first line PP unit at Dushanzi Petrochemical (70,000 tons/year), the maintenance shutdown of the second line PP unit at Luoyang Petrochemical (140,000 tons/year), and the maintenance shutdown of the first line PP unit at Inner Mongolia Baofeng (500,000 tons/year). The daily production of drawn wire decreased by 2.65% compared to yesterday, reaching 29.36%, while the daily production of low-melt copolymer decreased by 2.19% compared to yesterday, reaching 9.63%.

③. This week (20250321-0327), the supply-demand gap narrowed significantly to 35,100 tons, mainly due to increased plant maintenance leading to a noticeable decline in supply, coupled with demand still recovering slowly, resulting in an improved supply-demand gap.

2. Spot Overview

3. Price Prediction

Today, multiple units were shut down, further reducing the capacity utilization rate and alleviating supply-side pressure. In the short term, demand has not shown significant improvement, exerting downward pressure on polypropylene prices. Buyers remain cautious in procurement, with lackluster trading activity in the market. Currently, there is no clear driving force, making demand the primary factor influencing price fluctuations. Spot prices lack upward momentum, and the polypropylene market is expected to continue trading within a narrow range tomorrow.

PE: Downstream still resists high prices, polyethylene prices are mainly on the decline.

1Today's Summary

On March 31, the U.S. indicated that it does not rule out the option of taking military action against Iran, raising concerns about potential supply risks and boosting international oil prices. NYMEX crude oil futures for May delivery rose $2.12 to $71.48 per barrel, a 3.06% increase. ICE Brent crude oil futures for May delivery increased by $1.11 to $74.74 per barrel, a 1.51% rise. China's INE crude oil futures主力contract 2505 fell 4.3 to 537.4 yuan per barrel, while the night trading session saw a rise of 16.5 to 553.9 yuan per barrel.

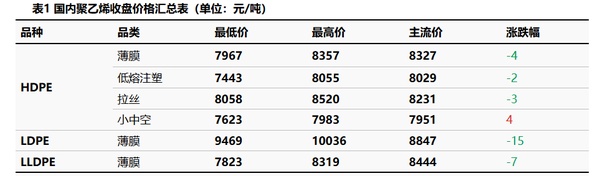

Today, the HDPE market price has adjusted, with a range of 2-4 yuan/ton; the LDPE market price has dropped by 15 yuan/ton; the LLDPE market price has slightly decreased by 7 yuan/ton.

2Spot Overview

3Price Prediction

In the short term, as the Qingming Festival holiday approaches, downstream factories will have restocking behavior, which will provide some support for demand. Looking at the supply side, with the improvement in market trading atmosphere today, it is expected that the production enterprise inventory will see a noticeable decline, reducing inventory pressure. All things considered, it is expected that the domestic polyethylene prices in China will mainly fluctuate upwards tomorrow.

PVC: The forward maintenance season is approaching, and PVC spot prices are stabilizing with a wait-and-see attitude.

1. Today's Summary

① Domestic PVC producers' ex-factory prices remain largely stable today;

Qinzhou Huayi plans to start operations soon, and the long-term maintenance dates will be announced successively.

③、Market concerns over potential supply risks intensify, driving up international oil prices and pushing up commodity futures.

2 Spot Market Overview

Based on the Changzhou market in East China, the current ex-warehouse cash price for calcium carbide method PVC (Type 5) in East China is 4900 yuan/ton, an increase of 10 yuan/ton compared to the previous trading day.。

Domestic PVC upstream production enterprises are about to undergo concentrated maintenance, leading to an expected reduction in market supply. Coupled with macroeconomic expectations for stimulus policies, bulk commodity futures are fluctuating and rising. The spot PVC market remains firm, with prices experiencing minor fluctuations during the session. In East China, the cash ex-warehouse price for calcium carbide-based PVC type five ranges from 4,870 to 5,020 yuan/ton, while ethylene-based PVC is priced between 5,000 and 5,150 yuan/ton.

Price ForecastTest

Domestic PVC producers have gradually announced their maintenance schedules, which is expected to reduce market supply. Domestic demand remains weak, but positive macroeconomic policies are expected to boost the short-term market sentiment. Spot costs are stabilizing, and the PVC spot market is anticipated to continue trading within a range. The Echean PVC market's cash price for electric furnace method Type V with immediate payment is expected to hover between 4800-5000 RMB/ton.

PS: Styrene oscillates slightly stronger, market stops falling and rises

1Today's Summary

Today, the price of GPPS in East China rose by 50 yuan to close at 8,400 yuan/ton, in line with the morning forecast.

② On Tuesday, the East China market for styrene increased by 90 to 8115 yuan per ton, the South China market increased by 65 to 8200 yuan per ton, and the Shandong market increased by 65 to 8000 yuan per ton.

2Spot Overview

3Price prediction

The raw material styrene fluctuated and rose, with cost support strengthening. However, supply remains high, and demand falls short of expectations. Market low-price shipments have improved, and short-term PS market prices may slightly firm up. It is expected that the East China market for transparent and modified benzene may range from 8,400 to 9,800 yuan/ton.

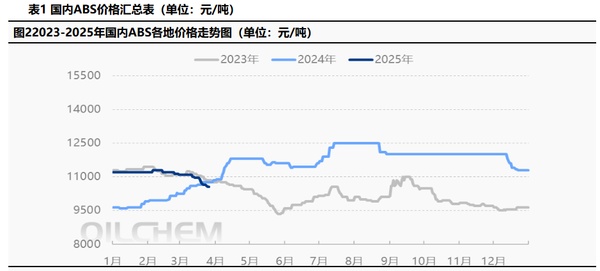

ABS: Market bottom-fishing at the start of the month drives prices up

1Today's Summary:

Today, the market in South China rose; the price in East China rose, and the overall trading was good.

The monthly production of ABS in April is expected to decline slightly month-on-month.

The market prices have increased in the Yuyao and Dongguan regions.Today, the prices in Dongguan increased, and the overall market transaction was relatively good. Terminal demand has shown signs of recovery. The prices in East China also went up, with a good market transaction situation.

2Spot Overview

3Price prediction:

Today, the prices in the South China market have risen, and the prices in the East China market have also increased. Terminal demand is relatively good, and overall transactions are booming. It is expected that tomorrow the market prices will maintain a narrow range consolidation trend.

EVA: Demand is weak, transactions are being discussed.

1Today's Summary

This week, the EVA petrochemical plant's ex-factory price remains stable.

This week, the EVA petrochemical unit is producing steadily.

2Spot Overview

3Price Forecast

In the short term, the domestic EVA market may oscillate weakly and consolidate. Demand from the photovoltaic sector provides some support, with EVA producers maintaining firm prices, and major distributors stabilizing their positions accordingly. Meanwhile, downstream foam demand follows suit out of necessity, but market trading activities remain sluggish. The supply and demand dynamics continue to be in play, and it is expected that the domestic EVA market will mainly consolidate weakly in the near term.

Engineering materials

PC: Market adopts a wait-and-see stance with firm prices

1Today's Summary

On Monday, international crude oil prices rose, with ICE Brent futures for the May contract increasing by $1.11 to $74.74 per barrel.

②、The closing price of raw material bisphenol A in the East China market was 8,850 yuan/ton, up 100 yuan/ton from the previous period.

③ Domestic PC factories maintained stable prices or increased them by 100-200 yuan/ton this week.

2Spot Overview

3Price prediction

Driven by factors such as reduced supply and rising prices of raw materials and related products, the domestic PC market this week has seen a strong price-supporting atmosphere. Factory prices have mostly increased, and spot prices have also tentatively followed suit. However, with fewer trading days this week and overall limited downstream purchasing volume, industry participants remain cautious. It is expected that the domestic PC market will experience moderate price support followed by narrow-range consolidation in the short term, with attention to further changes in market trading.

PET: Polyester bottle chip prices rise

1Today's Summary

1. Huarun and Baihong raised by 30, Haoyuan raised by 70, while other factories remained stable (unit: RMB/ton).

Today, the capacity utilization rate of polyester bottle chips in China has reached 73.12%.

2Spot Overview

3. Price Forecasting

With the imminent U.S. tariff hikes and the Qingming holiday, industry sentiment remains cautious. A new plant in East China has started production, yielding premium-grade products, and is currently ramping up its capacity, signaling expected supply-side growth. However, downstream demand remains lukewarm, with buyers focusing on low-priced supplies. The PET bottle chip market may trend weakly, with spot prices for water-grade materials projected to range between 6,000 and 6,150 yuan tomorrow.

PMMA: Insufficient buying interest, slight decline.

1. Today's summary

Today's factory quotes are stable.

Today, the domestic PMMA particle utilization rate is 64%.

2Spot Overview

3Price prediction

The short-term PMMA particle market is consolidating, with factory capacity utilization rates remaining stable and no significant inclination for deep declines. The trade market operates in line with market conditions, with limited room for negotiation. End-users are purchasing on-demand, showing moderate enthusiasm. In summary, supply-demand dynamics show little change, and the PMMA particle market is expected to experience limited fluctuations in the short term, with actual transaction volumes awaiting further follow-up.

POM: Domestic material prices fall, quotations continue to decline

1. Today's Summary

① Domestic material manufacturers have lowered their ex-factory prices.

Market sentiment is becoming more cautious, and traders are offering discounts to operate.

2Spot Overview

3. Price Prediction

Due to weak demand, the cost support for POM is lacking, and manufacturers continue to face shipping pressure. The trading atmosphere remains weak across various regions, and market participants are increasingly cautious. Traders' operating mentality is lackluster, and mainstream price quotes are expected to show no significant fluctuations. Downstream users have low purchasing enthusiasm, and the overall buying and selling atmosphere is unsatisfactory. It is expected that in the short term, the domestic POM market will mainly remain weak and stable.

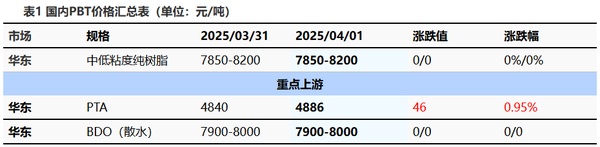

PBT: The PBT market continues to weaken.

1Today's Summary

The PBT manufacturer's quotation remains stable.

② PBT facilities are operating normally this week.

This week, the production volume of China's PBT industry reached 23,075 tons, with a capacity utilization rate of 54.32%, increasing by 4.47% compared to last week. The average gross profit margin of domestic PBT this week was -498 yuan/ton, decreasing by 97 yuan/ton compared to the previous week.

2Spot Overview

3Price prediction

The PBT market is expected to trade weakly. On the cost side, there is some expectation of reduced operating rates in PTA and polyester segments. Downstream procurement enthusiasm is not high. The supply and demand side lacks sustained momentum, and the overall industry chain valuation is low. Support from the cost side remains, and in the short term, the domestic PTA spot market is expected to maintain an oscillating pattern; BDO market supply is generally moderate, with support from the supply side, and suppliers have a stable market mentality. Downstream buyers follow as needed but bargain, resulting in continuous supply and demand博弈. The market focus remains steady. The PBT market center tends to weaken, with downstream and terminal buyers maintaining necessary transactions. Demand has not shown significant changes, so it is expected that tomorrow the price of medium to low viscosity PBT resin in the East China market will be between 7800-8100 RMB/ton.

PA6: Raw material prices have risen, and downstream buyers are opting for lower-priced restocking, leading to a slight improvement in the trading atmosphere.

1Today's Summary

Sinopec's caprolactam weekly settlement price is 10,280 yuan/ton (six-month interest-free acceptance), down 100 yuan/ton from last week.

Sinopec has raised the price of pure benzene at its East China and South China refineries by 150 yuan/ton, now set at 6,750 yuan/ton, effective from April 1st.

2Spot Overview

3Price prediction

From the cost perspective, the raw material caprolactam may face upward pressure due to cost increases, leading to higher polymerization costs. From the supply and demand side, Zhejiang Fangyuan and Fangming are undergoing maintenance shutdowns, resulting in reduced supply. Some enterprises are gradually alleviating inventory pressure, and downstream players are primarily restocking based on demand. It is expected that the nylon 6 market will operate slightly favorably in the near term, with close attention to downstream demand and manufacturers' pricing dynamics.

PA66: General demand on the consumer side, market operating in a consolidation phase.

1Today's Summary

① 3/31: The U.S. indicated that military action against Iran remains an option, raising market concerns over potential supply risks and driving up international oil prices. NYMEXCrude oil futuresThe May contract rose to $71.48, increasing by $2.12 per barrel, with a环比 of +3.06%; ICE Brent crude oil futures for May rose to $74.74, increasing by $1.11 per barrel, with a环比 of +1.51%. China INE.Crude oil futuresThe main contract for May 2025 fell by 4.3 to 537.4 yuan/barrel, while the night session rose by 16.5 to 553.9 yuan/barrel.

As of today, the domestic PA66 capacity utilization rate is 57%, with a daily output of approximately 2,200 tons. Under pressure from costs and demand, domestic polymer 66 enterprises have reduced their capacity utilization rate, and the demand side is generally weak, leading to a relatively ample supply of goods in the domestic PA66 industry.

③, Invista (China) Investment Co., Ltd. announced that starting from April 1, 2025 at 7:00 am, the spot transaction price for hexamethylenediamine will be executed at 21,300 RMB per ton, maintaining the same price as in March.

2Spot Overview

3Price prediction

The demand side shows no obvious signs of recovery, and downstream procurement is mostly based on needs. Aggregated enterprises, under cost pressure, plan to reduce production more concentratedly. It is expected that the domestic PA66 market will operate in a stable manner in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track