[today’s plastics market] weak fluctuation! pmma drops by 200, pa6 rises slightly

Summary: Summary of prices and forecasts for general-purpose and engineering plastics markets on July 29. General-purpose materials experienced weak fluctuations; PE market prices were mixed; PP was weak, down 4-16; PVC declined during trading, down 40-60; ABS transactions were average, with a local drop of 20; EVA transactions were hindered, with some dropping by 50; PS remained stable. Engineering plastics were stable to slightly declining, PET was weak with fluctuations, some dropping by 10-30; PMMA's focus shifted downwards, some dropping by 200; PA6 market was on the rise, some increasing by 50; PC, POM, PBT, and PA66 remained stable for now.

General material

PE: Macro support remains, prices show both rises and falls.

1. Today's Summary

The United States and the European Union have reached a new trade agreement, and the U.S. will shorten the deadline for new sanctions against Russia, leading to a rise in international oil prices. NYMEX crude oil futures for the September contract increased by $1.55 per barrel to $66.71, a rise of 2.38% from the previous period; ICE Brent crude futures for the September contract increased by $1.60 per barrel to $70.04, a rise of 2.34% from the previous period.

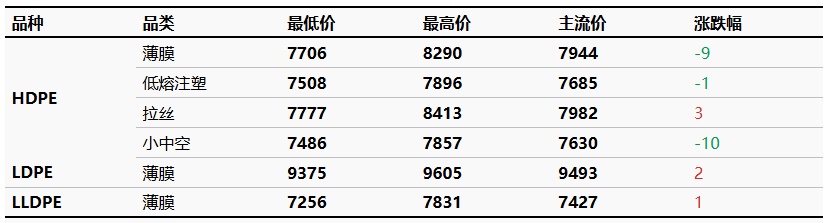

②. The HDPE market price fluctuated by -10 to -3 RMB/ton, the LDPE market price increased by 2 RMB/ton, and the LLDPE market price increased by 1 RMB/ton.

2. Spot Overview

Table 1 Summary Table of Domestic Polyethylene Closing Prices (Unit: RMB/ton)

From the current cost perspective, the support from crude oil costs is acceptable. From the supply and demand perspective, as maintenance units gradually start up and new units are put into production, supply pressure continues to increase. From the demand side, downstream demand is gradually recovering, and some companies are replenishing their inventories. Although the macroeconomic support is strong, the marginal improvement in supply and demand is limited. The price change range for the HDPE market is -10 to 3 yuan/ton, for the LDPE market is +2 yuan/ton, and for the LLDPE market is +1 yuan/ton.

3. Price Forecast

Short-term Overall demand remains weak, and downstream purchasing volume is not large, maintaining just essential needs. In the short term, the market may be influenced by news, leading to a slight price recovery and an improvement in market sentiment. Therefore Tomorrow Polyethylene market price Oscillation Mainly.

PP: Macroeconomic and Supply-Demand Game - Polypropylene Market in Weak Fluctuation

1 Today's Summary

① Sinopec North China made individual adjustments, and Yanshan Petrochemical 4912 was reduced by 200 to 9,250 yuan.

Today, the domestic polypropylene shutdown impact increased by 0.41% from yesterday to 16.73%. The daily production proportion of raffia decreased by 0.73% from yesterday to 28.25%, while the daily production proportion of low melt copolymer increased by 0.08% from yesterday to 6.56%.

③(20250718-0724) The supply and demand balance in this period remains in a state of supply exceeding demand. , The supply-demand gap remains positive but has slightly narrowed, alleviating some of the negative impact on market sentiment. In the next period, the surplus in the supply-demand balance is expected to significantly expand, which is anticipated to further intensify the negative impact on prices.

2 Spot Overview

Table 1 Summary of Domestic Polypropylene Prices (Unit: Yuan/Ton)

|

Market |

7 28th day of the month |

7 29th day of the month |

Change in value |

Change rate |

|

Nationwide |

7149 |

7137 |

-12 |

-0.17% |

|

East China |

7131 |

7117 |

-14 |

-0.20% |

|

North China |

7137 |

7125 |

-12 |

-0.17% |

|

Southern China |

7261 |

7245 |

-16 |

-0.22% |

|

Central China |

7090 |

7085 |

-5 |

-0.07% |

|

Southwest |

7157 |

7148 |

-9 |

-0.13% |

|

Northwest |

7028 |

7024 |

-4 |

-0.06% |

|

Key downstream |

||||

|

BOPP |

8100 |

8100 |

0 |

0.00% |

Data Source: Longzhong Information

Based on the East China region, today's polypropylene raffia closed at 7,117 yuan/ton, down 14 yuan/ton from yesterday. The national average price for raffia is 7,137 yuan/ton, down 12 yuan/ton from yesterday, which is in line with the morning forecast. Today, futures experienced narrow fluctuations and consolidation, with some market prices declining. The end-user purchasing enthusiasm was limited, which dragged down mainstream market transactions. Traders made concessions in their offers to promote deals. It is expected that the market will slightly soften from high levels and return to rational pricing in the near future. As of midday, the mainstream price for East China wire drawing is between 7,100-7,180 RMB/ton.

3 Price Forecast

The speculative atmosphere at the macro policy level has weakened, and enterprises are simultaneously undergoing maintenance and resuming operations. The benefits of maintenance and concerns about capacity expansion are offsetting each other, leading to weak support for spot prices from the demand side. Affected by the macro and supply-demand dynamics, the short-term market needs to balance between high costs and weak demand. Based on a comprehensive analysis of the pros and cons, it is expected that the short-term market will fluctuate around 7080-7180 yuan/ton to verify transactions.

PVC: Supply and demand are flat, PVC declines intraday.

1. Today's Summary

Domestic PVC manufacturers have reduced the ex-factory price of the carbide method by 20-50 yuan/ton, while the ethylene method has increased by 50-100 yuan/ton.

The Ordos Phase I and Zhongyan maintenance will be completed over the weekend.

The national childcare subsidy plan has been released: 3,600 yuan per child per year before the age of 3. Local governments can appropriately increase the standard based on their financial capacity.

2 Spot Overview

Table 1 Summary of Domestic PVC Spot Prices (Yuan/Ton)

| Market Name | 2025/07/29 | Change in value | Change in Value | ||||

| PVC | SG-5 | 5020 | -60 | -1.18% | yuan/ton | ||

| PVC | SG-5 | 5040 | -40 | -0.79% | CNY/ton | ||

| PVC | SG-5 | 5060 | 0 | 0% | CNY/ton | ||

| PVC | SG-5 | 4900 | -60 | -1.21% | CNY/ton | ||

| PVC | SG-5 | 4930 | 0 | 0% | Yuan/ton | ||

| PVC | SG-5 | 4920 | 0 | 0% | CNY/ton |

Taking the East China Changzhou market as a benchmark, today's cash-and-carry price of carbide-based Type V in East China is 5020 yuan/ton, a decrease of 60 yuan/ton compared to the previous trading day. 。

The domestic PVC spot market has seen sluggish transactions, with spot market quotations remaining steady and prices fluctuating downwards during trading. Industry policy expectations are weak, and the fundamental supply-demand contradiction persists in the spot market. End-users are cautious and watching closely. In the East China region, the cash price for calcium carbide method Type 5 is between 4980-5120 yuan/ton, while the ethylene method is between 5000-5200 yuan/ton.

3、Price forecast

Affected by rumors related to the meeting, the market fluctuated at a low level during the day before recovering. However, many in the market expect that there is little chance of exceeding expectations. In the current environment, several policies have already been anticipated, and considering the current industrial supply and demand fundamentals, the market remains weak on both supply and demand sides. There is no favorable outlook for exports, and cost support is weak. In the short term, prices are expected to remain weak with expectations for East China acetylene-based PVC Type V at 4950-5100 yuan/ton on a cash basis, warehouse pickup.

PS: Cost support weakened, and the market followed with a slight decline.

1 Today's Summary

The GPPS in East China today remained stable at 7,850 yuan/ton.

On Tuesday, the East China styrene market dropped by 15 to 7,355 yuan/ton, South China dropped by 25 to 7,430 yuan/ton, and Shandong dropped by 70 to 7,205 yuan/ton.

2 Spot Overview

Table 1 Summary of Domestic PS Prices (Unit: Yuan/Ton)

|

Market |

Specifications |

Today's Price |

Change in value |

Change in value |

|

Ningbo |

East China GPPS - Green Anqingfeng |

7850 |

0 |

0% |

|

Yuyao |

East China HIPS-Saibailong |

8700 |

0 |

0% |

|

Shantou |

South China GPPS-Renxin |

7550 |

0 |

0% |

|

Shantou |

South China HIPS - Star Glory |

8470 |

0 |

0% |

According to Longzhong Information, the GPPS price in East China today remained steady at 7,850 yuan/ton.The upstream styrene has weakened recently, leading to a weakened cost support and a tightening of market risk appetite. Industry supply has slightly recovered, but downstream demand has not improved, resulting in average market transactions.

3 Price Prediction

The raw material styrene is weakly consolidated, with general cost support, leading to a tightening of market risk appetite. Industry production is slightly recovering from low levels, and overall downstream demand is average. In the short term, the PS market may be slightly weak overall. It is expected that the East China market for GPPS/hips will be around 7,800-8,700 yuan/ton.

ABS: Raw materials continue to decline, today's market transactions are average.

1 Today's Summary:

①. There is little change in the prices in the East China market today; prices in the South China market have slightly decreased in some areas, with market transactions driven by just-in-demand needs.

②. The ABS monthly production in July is expected to increase month-on-month.

2 Spot Overview Table 1 Summary of Domestic ABS Prices (Unit: Yuan/Ton)

|

Market |

Specifications |

7 28th of the month |

7 29th of the month |

Change in Value |

Change in price percentage |

|

Yuyao |

15E1 |

10400 |

10400 |

0 |

0% |

|

750A |

No price |

No price |

No price |

No price |

|

|

HI-121H |

10150 |

10150 |

0 |

0% |

|

|

DG417 |

10100 |

10100 |

0 |

0% |

|

|

PA-757K |

10400 |

10400 |

0 |

0% |

|

|

0215A |

10000 |

10000 |

0 |

0% |

|

|

Dongguan |

15E1 |

9600 |

9580 |

-20 |

-0.21% |

|

750A |

No price |

No price |

No price |

No price |

|

|

121H |

9200 |

9200 |

0 |

0% |

|

|

KF730 |

9450 |

9450 |

0 |

0% |

|

|

DG417 |

9400 |

9380 |

-20 |

-0.21% |

|

|

PA-757K |

No price |

No price |

No price |

No price |

|

|

0215A |

9050 |

9050 |

0 |

0% |

|

|

Data source: Longzhong Information |

|||||

Based on Yuyao and Dongguan regions, there is little change in the East China market prices, while the South China market prices have slightly declined. Today's market transactions are mainly driven by rigid demand, with the prices of the three major raw materials declining. ABS transactions are average, and prices maintain a slight local decrease.

3 Price Prediction:

Based on the regions of Yuyao and Dongguan, there is not much change in the prices in the East China market, while there are slight local declines in the South China market. Today's market transactions remain primarily driven by just-in-demand needs. The raw material prices slightly decreased today, and most transactions within the market are based on just-in-demand needs. It is expected that ABS prices will continue to fluctuate within a narrow range tomorrow.

EVA: Partial Petrochemical Foaming Increases, High Market Prices Face Resistance

1 Today's Summary

This week, the ex-factory price of EVA petrochemicals remains stable, with no auction sources available. Some soft materials are still in short supply.

This week, EVA petrochemical units are mostly operating stably.

Table 1: Domestic EVA Price Summary (Unit: Yuan/Ton)

|

Market |

Grade |

7 28th of the month |

7 The 29th day of the month |

Change in value |

Change in Price Percentage |

|

Xiamen |

Gulei USI-629 |

10000 |

10000 |

0 |

0.00% |

|

Xiamen |

Rainbow View 6020M |

9950 |

9900 |

-50 |

-0.51% |

|

Xiamen |

Yangba 5110J |

10300 |

10300 |

0 |

0.00 % |

|

Jiangsu |

Yangba 5110J |

10200 |

10200 |

0 |

0.00 % |

|

Jiangsu |

Hongjing 6020M |

9950 |

9900 |

-50 |

-0.51% |

|

Jiangsu |

Photovoltaic 28-25 |

9400-9700 |

9400-9700 |

0 |

0.00% |

|

Data Source: Longzhong Information |

|||||

Today, the domestic EVA market is stable with some adjustments. Some petrochemical companies have increased their supply, while downstream foam factories are resistant to high-priced sources. After transactions were hindered, holders have slightly lowered their offers, and the overall market trading atmosphere is average. 。 Mainstream prices: Soft material reference 9900-10500 yuan/ton, hard material reference 9550-10300 yuan/ton.

4 Price prediction

In the short term, EVA petrochemical manufacturers do not face inventory pressure for photovoltaic products, and the transaction situation is acceptable. The production plans for foam products are increasing, and there will be continuous replenishment in the future. Before the market sees an increase in the availability of foam soft materials, supply and demand remain tight. Therefore, before the end of the month, The EVA market is expected to continue a relatively strong consolidation trend.

Engineering materials

PC: The market is difficult to recover from a low position.

1 Today's Summary

Monday International Crude Oil Increase , ICE Brent Crude Futures September contract at $70.04, up $1.60 per barrel.

②、 The closing price of BPA in the East China market is 7900. Yuan/ton, stable compared to the previous period.

This week, the latest ex-factory prices of domestic PC factories have been reduced by 100-200 RMB/ton.

2 Spot Overview

Table 1: Summary of Domestic PC Prices (Unit: RMB/ton)

Today, the domestic PC market remained in a low-level weak consolidation. As of the afternoon closing, the mainstream negotiation reference for low-end materials in East China injection molding grades was 10,300-13,800 yuan/ton, while medium to high-end materials were negotiated at 14,600-15,300 yuan/ton, with the overall focus remaining stable compared to yesterday. This week, many domestic PC factories have lowered their latest ex-factory prices by 100-200 yuan/ton. Zhejiang Petrochemical's auction opened flat for three rounds of transactions, down 100 yuan/ton from last week. In the spot market, both East China and South China maintained a stalemate with a weak consolidation pattern. Super low prices failed to form a bottoming expectation, and the bearish pressure on fundamentals remains high. Market participants' sentiment is weak and hard to revive. They are actively negotiating sales with the market, but downstream purchasing demand is insufficient, and transactions remain sluggish.

3 Price Prediction

This week, the ex-factory prices of domestic PC have been further reduced. However, in the context of high industry integration and high capacity utilization, there is no expectation of reduced supply from the PC sector in the near future. The ample supply of domestic materials will continue, while short-term improvement in downstream rigid demand is unlikely. Market transactions remain sluggish, and the outlook remains pessimistic, with continued bearish sentiment. It is expected that tomorrow the domestic PC market will continue its weak consolidation pattern.

PMMA: The focus of the PMMA market has shifted downward.

1 Today's Summary

①、 The focus of today's PMMA particle market has shifted downward.

②. Today, the domestic utilization rate of PMMA particles remains at 64%.

2 Spot Overview

Table 1 Summary of Domestic PMMA Particle Prices (Unit: Yuan/Ton)

In the East China region, PMMA particles closed at 13,000 yuan/ton today, down 200 yuan/ton from the previous working day, in line with the morning forecast. The domestic PMMA particle market is shifting downward. Downstream buyers are cautious, and the buying interest remains weak and difficult to revive. Suppliers continue to deplete their inventories, leading to continuous declines in offer prices. However, in the context of weak raw material MMA, industry participants lack support in their mindset, and a bearish atmosphere pervades the market.

3 Price Prediction

The cost side continues to be stalemated during the day, with some support still existing for the cost of PMMA pellet manufacturers. The probability of price stabilization is relatively high in the future, and the inclination to quote lower prices is limited. However, the demand side remains weak, and the end market is unlikely to see significant improvement due to the usual off-season, resulting in slow circulation of spot goods in the market. The possibility of holders quoting lower prices to deplete inventory cannot be ruled out. Traders are mostly observing the situation, with a low willingness to hold positions.

PET: Polyester bottle chip market fluctuates weakly

1 Today's Summary

Some factory prices have been reduced by 20-50, while others remain stable. (Unit: CNY/ton)

The domestic polyester bottle chip capacity utilization rate reached 70.12% today.

2 Current Spot Overview

Table 1: Domestic Polyester Bottle Chip Price Summary (Unit: Yuan/Ton)

|

Market |

Specifications |

7 28th day of the month |

7 29th of the month |

Change in value |

Change in value percentage |

|

East China |

Aquarius class |

6010 |

6000 |

-10 |

-0.17% |

|

South China |

Aquarius class |

6090 |

6060 |

-30 |

-0.49% |

|

North China |

Aquarius class |

5990 |

5990 |

0 |

0% |

The spot price of polyester bottle-grade chips in the East China region closed at 6,000 today, down 10 from the previous working day, in line with the morning forecast.

Raw material support is weak, some polyester bottle chip factories have lowered prices by 20-50, with actual transactions for August sources around 6030, while some remain stable. The market focus is on weak fluctuations, with downstream demand for replenishment. It is heard that... The supply for July-August was traded at 5920-6060 or the futures contract 2509 at a discount of 50 to a premium of 40. The reported bid-ask spread was large, and the trading activity was light. ==(Unit: RMB/ton)

3. Price Prediction

International oil prices have rebounded, providing some support for costs. The supply side remains stable, with holders being cautious about releasing goods, while downstream maintains just-in-time replenishment, resulting in relatively stagnant trading. However, sentiment within the industry is relatively pessimistic, and the polyester bottle chip market is expected to fluctuate weakly, with the East China market spot prices anticipated to be between 5920-6050 Yuan/ton. Attention is needed on raw material changes.

POM: Transaction Demand, Market Relatively Strong

1. Today's Summary

Domestic material supply is tightening.

②. The low market offers are gradually being absorbed.

2 Spot Overview

Table 1 Summary of Domestic POM Prices (Unit: Yuan/Ton)

|

Market |

Specification |

July 28th |

July 29th |

Change in Value |

Change in value |

|

Yuyao |

Yuntianhua M90 |

10800 |

10800 |

0 |

0.00% |

|

Dongguan |

Yuntianhua M90 |

9900 |

9900 |

0 |

-1.00% |

|

North China |

Yuntianhua M90 |

11000 |

11000 |

0 |

0.00% |

|

Data source: Longzhong Information |

|||||

Based on the Yuyao region, the current price of Yun Tian Hua M90 is 10,800 yuan/ton, stable compared to the previous period.Today's POM market performance varied, with the East China market operating steadily. Low-price offers are gradually being absorbed, and traders have a strong inclination to hold prices firm, resulting in relatively firm mainstream offers. The South China market is primarily focused on inventory digestion, with cautious sentiment among operators, limited price fluctuation, and end-users proceeding with on-demand procurement, leading to continued negotiated transactions. Longzhong predicts that in the short term, the domestic POM market will tend to consolidate on the stronger side.

3. Price Prediction

At the beginning of the week, there is limited guidance information from various regions, and petrochemical plants are not under inventory pressure. The fundamentals are relatively stable, and market participants have some support in their mindset. Some market offers remain stable, but downstream factories have limited inventory digestion capacity, leading to relatively flat transactions. Longzhong expects that the domestic POM market will undergo a strong consolidation in the short term.

PBT: Cost aspect continues to be bearish, PBT market information is chaotic.

1 Today's Summary

① PBT manufacturers' quotations remain stable.

There is less maintenance of PBT units this week.

In this period, PBT production was 23,100 tons, an increase of 1,800 tons compared to the previous period, with a growth rate of 8.45%. The capacity utilization rate was 54.46%, an increase of 4.24% compared to the previous period.The average domestic PBT gross profit this week is -504 yuan/ton, down 116 yuan/ton from the previous week. 。

2 Spot Overview

Table 1 Summary of Domestic PBT Prices (Unit: Yuan/Ton)

|

Market |

Specification |

2025/07/28 |

2025/07/29 |

Change in value |

Change in Price Percentage |

|

East China |

Medium-low viscosity pure resin |

7800-8300 |

7800-8300 |

0/ 0 |

0%/ 0% |

|

Key upstream |

|||||

|

East China |

PTA |

4845 |

4830 |

-15 |

-0.31% |

|

East China |

BDO (Sprinkling) |

8200-8400 |

8200-8300 |

0/ -100 |

0%/ -1.19% |

|

Data Source: Longzhong Information |

|||||

The mainstream price of medium and low viscosity PBT resin in the East China region is between 7,800-8,300 RMB/ton today, remaining stable compared to the previous working day.Today, the PBT market operated steadily, the PTA market was under pressure and moved downward, and the BDO market saw a decline in focus. Raw materials continued to fall, leading to a pessimistic sentiment in the PBT market. Offerings were relatively disorganized, and the market focus fluctuated within a range. According to Longzhong Information statistics, the price of low-viscosity PBT pure resin in the East China market is 7,800-8,300 yuan/ton.

3 Price prediction

The PBT market is expected to remain weak and in a wait-and-see mode. On the raw material side, the supply of PTA is slightly reduced, the inventory accumulation pace has slowed down in the balance sheet, and there is a lack of substantial benefits downstream. Seasonal purchasing is hindered, and there is a lack of new drivers externally, maintaining a volatile pattern in the short-term PTA spot market. The supply of BDO is abundant, while downstream demand is relatively weak, and supply-demand pressure persists, negatively affecting market sentiment. Holders are offering narrow discounts to promote sales, and the market is fluctuating downward. There is little expectation for cost improvement, and the PBT market may follow this downward trend, with the market expected to fluctuate weakly. Therefore, Longzhong forecasts that tomorrow's East China market price for low-to-medium viscosity PBT resin is expected to be between 7,800-8,200 yuan/ton.

PA6: Increasing cost pressure, PA6 market rises

1 Today's Summary

①. Sinopec's high-end caprolactam settlement price for July 2025 is 9,060 RMB/ton (liquid premium grade, six-month acceptance, self-pickup), down 660 RMB/ton compared to the June settlement price.

②. The price of Sinopec's pure benzene in East China and South China refineries has increased by 100 yuan/ton, now executed at 6050 yuan/ton, effective from July 29th.

2 Spot Overview

Table 1 Domestic Polyamide 6 Price Summary (Unit: RMB/ton)

Today, the price of polyamide 6 in the market has risen, upstreamPure benzene priceThe increase in raw material caprolactam costs exerts significant pressure, leading to higher market negotiation prices.Aggregated companies increase the ex-factory price of wafers.The downstream is selectively replenishing at lower prices, and the market transaction atmosphere is acceptable. In East China, the regular spinning PA6 is priced at 9,250-9,550 RMB/ton with short-distance cash delivery, while high-speed spinning spot goods are delivered at 9,600-9,900 RMB/ton on acceptance. In Chaohu, the cash self-pickup price is 8,600-8,700 RMB/ton.

3 Price prediction

From a cost perspective, the caprolactam market may remain firm, and the cost pressure from losses in the chip sector is increasing. From the supply and demand perspective, the stable operating rate of domestic polymerization enterprises ensures sufficient supply, while downstream players restock at lower prices. Polymerization enterprises may maintain firm quotations, and the PA6 market is expected to show a slight upward trend in the near term.

PA66: Downstream follows demand, market operates steadily.

1 Today's Summary

On July 28th, the United States and the European Union reached a new trade agreement, and the U.S. will shorten the deadline for new sanctions against Russia, leading to a rise in international oil prices. NYMEX crude oil futures for the September contract rose by $1.55 per barrel to $66.71, a 2.38% increase compared to the previous period; ICE Brent crude futures for the September contract rose by $1.60 per barrel to $70.04, a 2.34% increase compared to the previous period. China's INE crude oil futures main contract 2509 fell by 3.1 to 505.5 yuan per barrel, and rose by 10.4 to 515.9 yuan per barrel in the night session.

The current domestic PA66 capacity utilization rate is 60%, with a daily output of approximately 2,300 tons. Despite the pressure from costs and demand, the capacity utilization rate of domestic PA66 companies remains stable. However, demand from the downstream sector is average, and the domestic PA66 industry has a sufficient supply of goods.

2 Spot Overview

Table 1 Summary of Domestic PA66 Prices (Unit: Yuan/Ton)

|

Market |

Specifications |

7 28th of the month |

July 29th |

Change in value |

Price Change Percentage |

|

Huadong |

EPR27 |

15600 |

15600 |

0 |

0% |

|

Key upstream |

|||||

|

East China |

Adipic acid |

7000 |

7100 |

+100 |

+1.43% |

|

Data source: Longzhong Information |

|||||

Based on the East China Yuyao market, today's EPR27 market price is referenced at 15,500-15,700 RMB/ton, stable compared to yesterday's price. 。 The raw material adipic acid fluctuated and rose, with continued cost pressure. Downstream buyers mostly purchase as needed, and the market supply is sufficient, maintaining a steady operation.

3 Price prediction

The cost pressure remains unchanged, downstream purchasing is based on demand, and the market supply is sufficient. It is expected that the domestic PA66 market will stabilize in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track