[Today’s Plastic Market] General Material Transactions Poor, All Down; PC and PMMA Prices Surge by 300-400

Summary: Summary of prices and forecasts for general and engineering plastics on September 29.General MaterialBefore the holiday, PP and PE continued to maintain a stalemate; PVC and PS markets sold at low levels, with individual drops of 10-20; ABS transactions turned weak, with some dropping 30-80; EVA was steady to declining, with individual drops of 50.Engineering materialsPC continues to rise, with some increasing by 50-300; PMMA increases by 400; PA6 is running weakly, with individual decreases of 100, while PET, PBT, POM, and PA66 remain stable.

General material

PE: Replenishment is nearing completion, and prices are relatively stable.

1. Today's Summary

The intensity of the Russia-Ukraine conflict has recently increased, raising market concerns about potential supply risks, leading to a rise in international oil prices. NYMEX crude oil futures for the November contract rose by $0.74 per barrel to $65.72, a month-on-month increase of 1.14%. ICE Brent oil futures for the November contract rose by $0.71 per barrel to $70.13, a month-on-month increase of 1.02%.

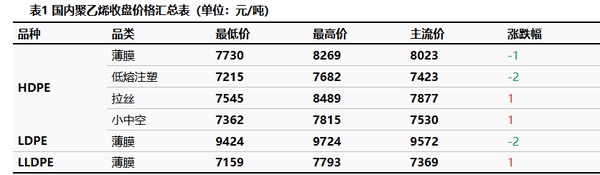

The price change range for the HDPE market is -2 to -1 yuan/ton, the LDPE market price is -2 yuan/ton, and the LLDPE market price is +1 yuan/ton.

2. Spot Overview

Today in the domestic polyethylene market, industry participants have low confidence in the future market. Downstream replenishment is nearing completion, and the market transaction atmosphere is limited. Due to the continuous price decline, market participants are cautious, and there is a strong sense of wait-and-see. The price change range for the HDPE market is -2 to -1 yuan/ton, the LDPE market price is -2 yuan/ton, and the LLDPE market price is +1 yuan/ton.

3. Price Prediction

In the short term, there is room for a decline in crude oil prices, weakening the cost support for polyethylene. On the supply side, maintenance facilities are gradually restarting, combined with the commissioning of new facilities, leading to a build-up in social inventory after the holiday, and the supply pressure continues to increase. On the demand side, downstream demand is limited, with most companies focusing on restocking at lower prices. In summary, it is expected that in the short term, polyethylene market prices may fluctuate weakly, with a range of 10-50 yuan/ton.

PP: Supply and Demand Variables Drive the Market, Stalemate Continues Before the Holiday

1. Today's Summary

① East China petrochemical polypropylene prices dropped by 100 at the beginning of the month, with Zhong'an T set at 6650 yuan/ton, Zhenlian T set at 6950 yuan/ton, M17 set at 6800 yuan/ton, F800EPS set at 8200 yuan/ton, and GM1600E set at 7900 yuan/ton.

Sinopec Central China's PP price adjustments at the beginning of the month: Zhongyuan raffia decreased by 200 yuan/ton, Luoyang thin-walled decreased by 50 yuan/ton, Changling decreased by 70 yuan/ton, transparent decreased by 100-150 yuan/ton, Korean low-melt copolymer increased by 30 yuan/ton, high-melt increased by 50 yuan/ton.

②. The domestic polypropylene shutdown impact today has decreased by 1.34% compared to last week, reaching 18.31%. Hengli Petrochemical's STPP unit with a capacity of 200,000 tons per year and Huizhou Lituo's 150,000 tons per year unit have started production, with an expected daily supply increase of 1,050 tons. The daily production proportion for raffia has increased by 2.97% compared to last week to reach 30.94%, mainly due to the switch to raffia production at Beihai Refining's 200,000 tons per year unit, Gulei Petrochemical's 350,000 tons per year unit, and Jinneng Chemical's 900,000 tons per year unit, with an expected increase in raffia production of 4,350 tons per day.

③、(20250919-0925) The supply and demand balance in this period remains in a tight equilibrium. , However, the gap between supply and demand has narrowed, providing continued support for market sentiment. In the next period, the supply-demand balance gap is expected to narrow due to increased supply, which is likely to weaken the price support.

2. Spot Overview

Based on the East China region, today's polypropylene filament price is 6762 yuan/ton, a decrease of 2 yuan/ton compared to yesterday. The national average price for filament also dropped by 2 yuan/ton compared to yesterday, and decreased by 0.03% compared to last week, in line with morning expectations.

Today, the futures opened lower and fluctuated. In the morning, the market reported a stable main range with a slight downward adjustment of 10-20 yuan/ton. At the end of the month, the pace of inventory reduction in the industry has accelerated, and downstream purchasing ahead of the festival is mainly based on demand. Market trading has entered a slowing rhythm. The supply and demand fundamentals are in a stalemate and negotiation state, and the market is expected to maintain a narrow range of fluctuations in the near term. By midday, the mainstream price for wire rod in East China was 6750-6850 yuan/ton.

3. Price Forecast

The National Day holiday impact has accelerated the pre-holiday destocking process of the industrial chain. Due to the long-term oversupply conflict of polypropylene becoming prominent, upstream production enterprises have conducted maintenance and reduced load to avoid market risks. On the demand side, there is weak pre-holiday restocking intention, and post-holiday procurement will be on a demand basis, keeping the market in a weakly fluctuating situation. With limited variables in the supply and demand side recently, the short-term market is expected to fluctuate weakly around 6750-6850 yuan/ton.

PVC: Spot market remains stagnant and stable, with fundamentals under pressure.

1. Today's Summary

Domestic PVC production enterprises are mostly maintaining stable ex-factory prices, with some minor adjustments.

②, Yili is scheduled for maintenance tomorrow, and with the increase in new production capacity, market supply will continue to grow.

The "anti-involution" policy is intensified. Analysts expect the cement industry to reduce clinker production capacity by 10% within the year.

2 Spot Overview

Based on the East China Changzhou market, the spot warehouse price for calcium carbide-based Type V in East China is 4,730 yuan/ton today, down 10 yuan/ton compared to the previous trading day. 。

Today's Review: The domestic PVC market maintained slight range fluctuations before the holiday, with a continued increase in spot supply. Terminal stocking demand is generally moderate, and market sales are mainly stable. It is expected that inventory in the industry will continue to accumulate before and after the holiday, with weak cost performance putting pressure on the spot market. However, the overall trend of bulk commodities remains strong, providing good support for the futures market. Short-term price adjustments are limited. In East China, the cash price for calcium carbide method PVC is between 4650-4800 yuan/ton, while for ethylene method it is between 4800-5100 yuan/ton.

3. Price Prediction

The domestic PVC spot market is experiencing a standoff between supply and demand before the holiday. With the release of new production capacity and a reduction in maintenance, supply expectations remain high before the holiday. Demand for downstream stocking is underperforming, leading to increased inventory accumulation under supply-demand pressure in the industry. The cost of taking delivery supports market prices to remain stable. After the holiday, the market faces downward pressure on costs, which weakens the support for market bottoms. However, considering the expected support from related sectors, the market is anticipated to remain stable before the holiday, with the spot price for calcium carbide method PVC expected to be in the range of 4650-4780 yuan/ton.

PS: The market is at a low point, and the transactions are average.

1 Today's summary

Today, the price of GPPS in East China dropped by 20 to 7,330 RMB/ton.

② 、 On Monday, styrene in the East China market dropped by 35 to 6,915 yuan/ton, in South China it fell by 45 to 6,960 yuan/ton, and in Shandong it decreased by 40 to 6,695 yuan/ton.

2 Spot Overview

According to According to Longzhong Information, today the GPPS in East China fell by 20 and is priced at 7330 yuan/ton.Raw material styrene is fluctuating, with cost pressures remaining low, and the market is still experiencing price reductions for sales. The high production in the industry has led to a relatively ample supply of goods, and buyers have already stocked up to a certain extent, resulting in low current purchasing intentions and average transaction volumes.

3 Price Prediction

The raw material styrene is fluctuating and consolidating, but the cost center remains relatively low. The industry supply is relatively ample, and with the approach of the National Day holiday, downstream purchasing pace has slowed down. In the short term, the PS market may show weak consolidation. It is estimated that the East China market for transparent modified polystyrene will be around 7,300-8,400 RMB/ton.

ABS: As the National Day holiday approaches, market transactions gradually cool down.

1 Today's summary:

①. Today, there is little change in the prices of the East China market; in the South China market, prices have slightly declined in some areas, with market transactions driven by just-needed demand.

The monthly production of ABS in October is expected to increase compared to the previous month.

2 Spot overview Table 1 Domestic ABS Price Summary (Unit: RMB/ton)

Taking Yuyao and Dongguan as the benchmark, price fluctuations in the East China market are limited, while prices in the South China market are gradually declining. Today's market transactions remain focused on just-in-need demand. As the National Day holiday approaches, logistics are gradually halting operations, leading to a decrease in market transactions. It is expected that the domestic ABS market prices will maintain a narrow consolidation trend tomorrow.

3 Price Prediction:

Based on the Yuyao and Dongguan areas, the price changes in the East China market are not significant, while the prices in the South China market are declining. Today's market price fluctuations are minimal, supply remains high, and as the National Day holiday approaches, demand is gradually decreasing, and logistics have ceased operations. It is expected that tomorrow's ABS prices will continue to show a slight downward trend in certain areas.

EVA: Market offers are stable to slightly lower, transactions are not good.

1 Today's Summary

This week, the ex-factory price of EVA petrochemicals remains stable.

This week, the EVA petrochemical facilities: all are operating stably except for the long-stopped facilities at Yanshan Petrochemical.

2. Spot Overview

Today, the domestic EVA market is relatively quiet, as downstream stocking is nearing completion ahead of the holiday. Transactions in the market are focused on just-in-time needs, and some holders lack confidence in the market outlook, primarily focusing on selling. As a result, there is an increase in negotiation space among actual transactions, leading to weaker sales. Mainstream prices: soft grade is referenced at 11,000-11,400 RMB/ton, and hard grade is referenced at 10,600-11,500 RMB/ton.

3 Price prediction

During the holiday period, the domestic EVA market saw weakened trading activity, with less news available. The market is expected to have a light trading demand. After the holiday, the market is anticipated to become more balanced in terms of supply and demand. Prices on the supply side may stabilize initially, while downstream demand for spot goods may slightly decrease. The overall transaction pace is slow, and the market is expected to remain weak and stable. Pay attention to the latest price adjustments by EVA manufacturers and changes in market sentiment during the long holiday. 。

Construction materials

The market continues to rise.

1 Today's Summary

Last Friday International crude oil Rise , ICE Brent crude futures for November contract at 70.13, up by 0.71 USD/barrel.

②、 Raw material bisphenol A closed at 7850 in the East China market. Yuan/ton, unchanged month-on-month.

This week, the ex-factory prices of domestic PC are stable or increased by 100 yuan/ton.

2 Spot Overview

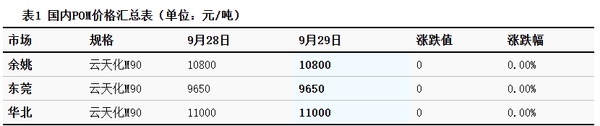

Table 1 Domestic PC Price Summary (Unit: Yuan/Ton)

Today, the domestic PC market continues to rise. As of the afternoon close, the mainstream negotiation reference for low-end injection molding materials in East China is 10,250-13,400 yuan/ton, while negotiations for mid-to-high-end materials are between 14,000-14,800 yuan/ton. The focus on domestic products has generally continued to rise by around 100 yuan/ton compared to yesterday. In the last two trading days before the holiday, domestic PC factories are continuing to hold prices firm, with some factory prices stable or raised by 100 yuan/ton. In the spot market, the supply-side favorable expectations continue to support market sentiment, with the focus on domestic materials generally rising compared to yesterday. Pre-holiday procurement and stocking by downstream players is nearing completion, and actual transactions are limited. Market participants are mostly paying attention to the further development of the market after the holiday.

3 Price Prediction

The expectation of favorable supply prospects continues to boost market sentiment, with domestic PC spot prices mostly continuing to rise, while the market atmosphere remains cautiously moderate. Tomorrow is the last trading day before the long double festival holiday, and there are no significant fluctuations in the fundamentals. It is expected that the domestic PC market will continue to observe and maintain strong pricing. Attention should be paid to changes in market sentiment and the downstream response to high-priced PCs.

POM: Sporadic purchases by operators, transactions based on demand.

1. Today's Summary

Xinjiang Xīnliánxīn POM plant is operating at full capacity.

The Tianjin Bohua POM unit was shut down for maintenance on July 7, and the startup time is yet to be determined.

2 Spot Overview

Based on the Yuyao region, today the price of Yun Tian Hua M90 is 10,800 yuan/ton, which remains stable compared to the previous period.Today, the POM market is stable and observing. Before the holiday, trading activity in various places has weakened. , The inventory of petrochemical plants has been somewhat released, and there is currently no short-term pressure to ship goods. The market is in a strong wait-and-see atmosphere, with traders mainly following market trends in their operations and conducting real-time negotiations. By the close of trading, the domestic POM (Polyoxymethylene) price in the Yuyao market was 8,100-11,100 yuan/ton including tax, while the cash price in the Dongguan market was 7,300-10,400 yuan/ton.

3. Price Prediction

The National Day holiday is approaching, and there is limited guidance information from POM across various regions. Petrochemical plants have a strong intention to maintain stable prices, with no significant fluctuations in supply. Before the holiday, operators' interest in trading has waned, and mainstream offers are expected to remain relatively stable. End users are gradually completing their stocking, and factories will successively cease operations for the holiday, resulting in sparse actual transactions.Longzhong expects the domestic POM market to mainly consolidate in the short term.

PET: Polyester bottle chip market is in a deadlock

1 Today's Summary

1. Taibao, Tamron, Haoyuan, Yisheng, and Sanfangxiang have stable prices, while other factories have reduced prices by 10-80. Unit: Yuan/ton

②. Today, the domestic polyester bottle chip capacity utilization rate is 68.49%.

2 Spot Overview

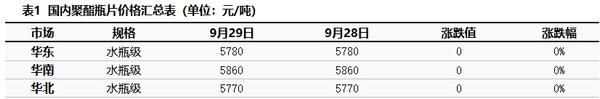

As of today, the spot price for polyester bottle-grade chips in the East China region is 5,780, unchanged from the previous working day and basically in line with the morning expectations.

Raw material prices are fluctuating weakly, with insufficient support. However, the supply of polyester bottle flakes is tightening, and the sentiment among factories and stockholders is relatively positive, leading to firmer quotations compared to raw materials. As the National Day holiday approaches, downstream and traders show low market sentiment, resulting in relatively stagnant trading, mainly focused on arranging shipments. It is reported that the transaction prices for September-October materials are between 5710-5860 or futures contracts are at a discount of 10 to a premium of 30 against 2511. (Unit: yuan/ton)

3. Price Prediction

As the National Day holiday approaches, there are many uncertainties, and factories and stockholders are primarily focused on arranging shipments, resulting in a subdued shipping mentality. The Zhuhai China Resources facility has restarted, and with the weakening of typhoon impacts, the supply of goods in South China may trend towards loosening. However, due to concentrated shipments and previous logistics impacts, local supplies still remain relatively tight, with general supply pressure. Before the holiday, influenced by raw materials, the polyester bottle chip market may experience weak fluctuations and adjustments, with spot prices for polyester bottle chip materials in East China expected to range between 5700-5850 yuan/ton.

PBT: The PBT market is running quietly as the National Day holiday approaches.

1 Today's Summary

This week, the PBT manufacturers' quotations remained stable overall.

② There were fewer PBT unit maintenance activities this week.

③ The PBT production for this period is 22,600 tons.The capacity utilization rate is 53.14%, remaining steady compared to the previous period. This week, the average gross profit of domestic PBT is -266 yuan/ton, an increase of 42 yuan/ton from the previous period. 。

2 Spot Overview

Table 1 Summary of Domestic PBT Prices (Unit: Yuan/Ton)

The mainstream price of medium and low viscosity PBT resin in the East China region is between 7,600-7,900 yuan/ton today, remaining stable compared to the previous working day. Today, the PBT market is operating quietly, with insufficient buying interest in the PTA market and fluctuating ranges in the BDO market. As the holiday approaches, there are few changes in the fundamentals of PBT. The market atmosphere is relatively quiet. The market's focus is stabilizing and consolidating. According to statistics from Longzhong Information, the price of low-viscosity PBT pure resin in the East China market is 7600-7900 yuan/ton.

3 Price Forecast

The PBT market is expected to continue observing a wait-and-see approach. The supply and demand for the raw material PTA have not changed significantly, and there is a lack of external drivers. The market is becoming calm before the holiday, with fewer actual orders and offers. Before the holiday, the PTA spot market maintains a volatile pattern. As the National Day holiday approaches, actual trading activity for BDO is subdued, and the market overall shows weak fluctuations. As the holiday nears, the PBT market may continue to operate with limited transactions, and actual trading may be limited. Therefore, Longzhong expects that tomorrow the East China market will see low to medium viscosity PBT resin priced at 7600-7900 yuan/ton.

PMMA: PMMA particle prices are rising

1 Today's Summary

①、 Today PMMA particles Market price increase 。

Today's domestic PMMA pellet utilization rate remains at 65%.

2 Spot Overview

In the East China region, PMMA particles closed at 13,200 RMB/ton today, an increase of 400 RMB/ton compared to the previous working day, in line with the morning forecast. 。 As the low-priced market sources continue to be consumed and the raw material MMA remains strong, holders are adjusting their prices upwards, which has led to a slight increase in the trading focus. Downstream terminals are maintaining a demand for small orders, and transactions are primarily based on essential needs.

3 Price prediction

The production factory quotes remain firm, and the willingness of holders to sell at low prices has weakened, with the focus of offers shifting towards the high end. Downstream terminal factories mostly maintain a wait-and-see approach, and market transactions are concentrated on interactions between traders, with high-priced transaction volumes yet to be released. The short-term PMMA particle market is expected to maintain a strong operation, with localized low prices continuing to rise.

PA6: Downstream Prepares for Low-price Stocking, PA6 Market Weakly Consolidates

1 Today's summary

①、 Sinopec's high-end caprolactam settlement price for September 2025 is 9,080 yuan/ton (liquid superior grade, six-month acceptance for self-pickup), down 250 yuan/ton from the August settlement price.

②、 Sinopec has lowered the price of pure benzene by 100 yuan/ton at its refineries in East China and South China, now set at 5,900 yuan/ton, effective from September 4th.

2 Spot Overview

Today, the nylon 6 market is undergoing a weak consolidation, with raw material markets also weakly consolidating, and cost pressures still present. However, as downstream procurement of raw materials approaches the end before the holiday, the focus is on stocking up based on low and suitable needs. In the sliced product market, discussions on prices are trending lower, and actual transactions are being negotiated. East PA6 regular spinning ordinary 8900-9300 yuan/ton cash short delivery, high-speed spinning spot 9300-9700 yuan/ton acceptance delivery. Chaohu 8400-8500 yuan/ton cash self-pickup price.

3 Price Prediction

From a cost perspective, the caprolactam market has a loose supply, which is bearish for the market and may lead to a weak performance. From the supply and demand perspective, the supply is relatively stable, but downstream procurement of raw materials ahead of the festival may gradually be completed, resulting in limited demand. It is expected that the PA6 market will run slightly in a in the near term.

PA66: Downstream on-demand procurement, market operates steadily.

1 Today's Summary

①, 9/26: The intensity of the Russia-Ukraine conflict has recently increased, raising market concerns about potential supply risks, leading to a rise in international oil prices. NYMEX crude oil futures for the November contract increased by $0.74 to $65.72 per barrel, a 1.14% increase compared to the previous period; ICE Brent crude futures for the November contract rose by $0.71 to $70.13 per barrel, a 1.02% increase compared to the previous period. China's INE crude oil futures for the 2511 contract increased by 0.2 to 489.1 yuan per barrel, and rose by 5.9 to 495 yuan per barrel during the night session.

As of today, the domestic PA66 capacity utilization rate is 61%, with a daily output of approximately 2,400 tons. Under cost and demand pressures, domestic polymer 66 enterprises are making slight adjustments to their capacity utilization rates. Downstream demand is moderate, and new capacities are being gradually released, resulting in a sufficient supply of goods in the domestic PA66 industry.

2 Spot Overview

Based on the East China Yuyao market, today's EPR27 market price is referenced at 14,800-15,000 RMB/ton, stable compared to yesterday's price. 。 The raw material hexanedioic acid is experiencing a weak consolidation, with cost support being soft. However, there is significant pressure on polymerization, and downstream buyers are cautious about following high prices. The market is operating within a narrow range of fluctuations.

3 Price prediction

The demand side is generally stable, the market spot supply is stable, raw material prices are fluctuating, and the overall market fundamentals are stabilizing. It is expected that the domestic PA66 market will fluctuate in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track