Through the Five Major Changes in China's Polypropylene Market, Observing the Industry Trend Evolution by 2025

Introduction:In 2025, China's polypropylene will still be on the fast track of capacity expansion, and the market supply and demand pattern will change rapidly, which may trigger a series of changes in the Chinese and even global markets. It is expected to revolve around five major changes: globalization, supply and demand rebalancing, high-end development, import and export reversal, and end-user consumption.

One,China's polypropylene globalization process is accelerating, transitioning from being large but not strong to being both large and strong.

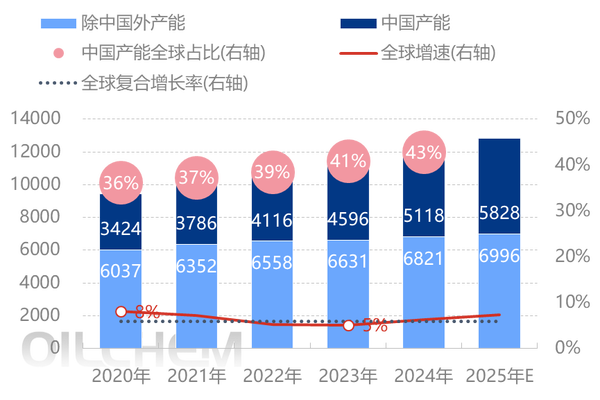

2020-2025 Global Polypropylene Annual Production Capacity Change Trend Chart (10,000 tons/year)

2024 Global polypropylene capacity was approximately 119.39 million tons per year in 2024, an increase of about 24.78 million tons per year compared to 2020, with a compound annual growth rate of 5.99%. The main driver of global polypropylene capacity growth is China, with China's capacity increasing to 43% of global capacity in 2024, up 7% from 2020. China's polypropylene globalization process is accelerating, but it still shows a characteristic of being large yet not strong, lacking globally competitive products.

II. China's polypropylene has entered a stage of structural overcapacity and may undergo a round of supply and demand rebalancing.

2020-2024 Annual Polypropylene Industry Chain Supply and Demand Balance Sheet (Unit: 10,000 Tons)

|

Project |

2020 Year |

2021 Year |

2022 Year |

2023 Year |

2024 Year |

Five-year compound annual growth rate |

|

Production capacity |

2882 |

3216 |

3496 |

3976 |

4461 |

12% ↑ |

|

Production |

2581.59 |

2926.89 |

2965.45 |

3193.59 |

3446.29 |

7% ↑ |

|

Capacity utilization rate |

90% |

91% |

85% |

80% |

77.25% |

-4% ↓ |

|

Import volume |

655.52 |

479.81 |

451.09 |

411.68 |

367.13 |

-13% ↓ |

|

Total Supply |

3237.11 |

3406.7 |

3416.54 |

3605.27 |

3813.42 |

4% ↑ |

|

Export volume |

42.51 |

139.11 |

127.24 |

131.22 |

240.66 |

54% ↑ |

|

Total consumption量 |

3226.48 |

3471.84 |

3544.29 |

3631.18 |

3806.53 |

4% ↑ |

|

Annual Supply and Demand Gap |

10.63 |

-65.14 |

-127.75 |

-25.91 |

6.89 |

-10% ↓ |

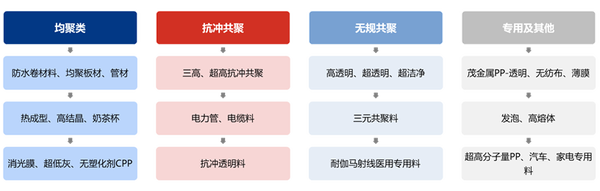

Three, The high-end R&D of China's polypropylene products has entered the "deep-water zone." , and began to move towards becoming a global brand.

With the accelerated transformation and upgrading of the domestic polypropylene consumption structure, the collision between traditional energy and new energy has sparked innovation, propelling the high-end, differentiated, and specialized development of polypropylene into the "deep water zone." The industry is witnessing a surge in the research and production of high-performance, high-efficiency products. This conference will focus on these hot areas: bio-based polypropylene, modified polypropylene, foamed polypropylene, and metallocene polypropylene, setting the benchmark for the industry's high-end development.

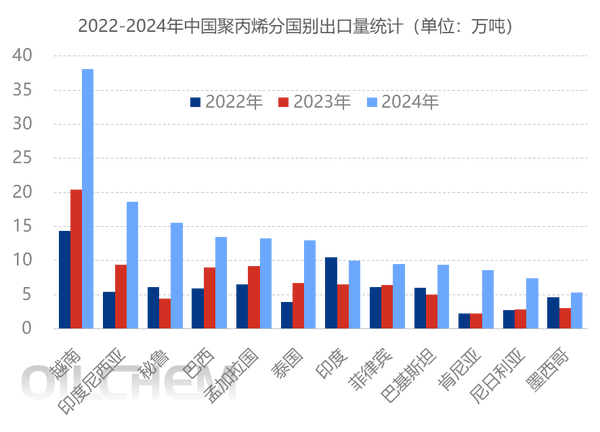

IV. China's Polypropylene Industry Ushers in a New Era of Export in 2024, with 2025 Marking the Pivotal Year of Transition from Net Importer to Net Exporter

In the just-passed year of 2024, China's polypropylene exports achieved impressive results, with export volume increasing from 1.31 million tons to 2.4 million tons, a year-on-year growth of 83.4%. In March, a notable turnaround from net imports to net exports was achieved. As Chinese companies more actively expand into overseas markets, diversifying their channels beyond Southeast Asia to regions such as South America, Africa, and Central Asia, 2025 may become the most critical year for China's polypropylene industry to transition from a net importer to a net exporter.

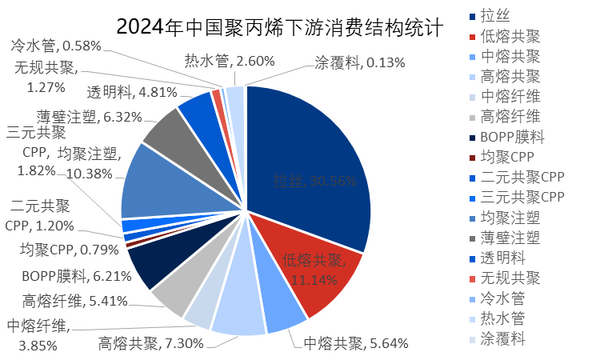

5. Polypropylene has a wide range of downstream applications and strong rigid demand, and traditional and emerging fields will collide with new sparks.

Although traditional plastic woven and non-woven sectors face slowing growth or even decline, there is no single area of polypropylene (PP) consumption that will be completely replaced due to its numerous applications. Moreover, China's new energy vehicle industry is developing rapidly, with PP accounting for 60% of the plastic consumption in this sector, driving an annual growth rate of over 10% in the co-polymer class of PP. Looking ahead, as China's competitive advantage in polypropylene product consumption continues to increase and national policies boost consumption layer by layer, after the peak period of capacity expansion, the supply-demand gap will return to normal.

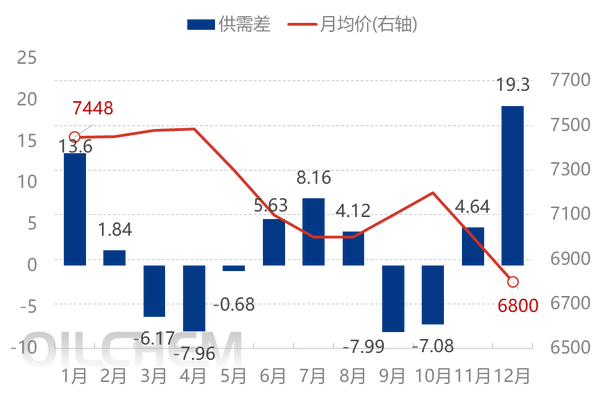

2025 Monthly Supply and Demand Balance and Price Linkage Forecast of Polypropylene in China for 2023 (10,000 tons, right axis: yuan/ton)

2025 In recent years, against the backdrop of high cost support, the supply-demand gap has become the main factor influencing market price fluctuations. As the supply-demand contradiction of polypropylene continues to deepen, especially with the off-season demand at the end of the fourth quarter overlapping with the concentrated release of new production capacity, the market supply-demand contradiction has intensified, putting pressure on price trends. After the decline in the second quarter, the likelihood of a price increase in the third quarter driven by demand has increased, with the price fluctuation range narrowing across different regions and categories.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track