Summary: Weekly market summary and forecast for general materials and engineering materials from March 21 to March 27!In terms of general materials,PE prices showed mixed trends, with fluctuations between 30-150; the PP market saw a slight recovery, with prices rising modestly by 20-40; ABS prices continued to decline by 20-250; PS weakened and fell by 117-155; the EVA market remained stable with narrow fluctuations.Engineering materials aspectThe PC market is experiencing weak fluctuations, with a maximum weekly drop of 330; the PET bottle chip market shows a weak rebound; the pricing of POM and PMMA has decreased by 200-400; the PBT market is running weakly; PA6 and PA66 are operating under weak conditions, with a maximum weekly drop of 250.

Universal Material

PE: The spot prices of polyethylene in the market show mixed fluctuations, with changes ranging from 30 to 150.

1. This week's polyethylene ex-factory price fluctuations

This week, the ex-factory prices of polyethylene showed mixed trends, with fluctuations ranging from 30 to 200 yuan per ton. By product type, the ex-factory prices of HDPE varied, with changes between 50 and 200 yuan per ton; LDPE prices were adjusted downwards, with reductions of 100 to 200 yuan per ton; LLDPE prices mainly fell, with decreases of 30 to 150 yuan per ton. Notably, in the northwest region, prices saw an increase due to factors such as facility maintenance.

2. Weekly Review of the Polyethylene Market行情

This week, the domestic polyethylene spot market prices showed mixed trends, fluctuating between an increase and a decrease of 30 to 150 yuan per ton. Due to equipment maintenance and production changes, the supply of certain HDPE varieties has tightened slightly, leading to some price increases. However, overall market demand remains limited, and there is a noticeable resistance from end-users towards high-priced resources, which restricts further price increases. Meanwhile, new production capacities are gradually being released, resulting in a bearish market sentiment. Traders are maintaining an active sales strategy, but transactions remain weak. Currently, the mainstream price of oil-based linear low-density polyethylene in North China is 7,850 yuan per ton, down 50 yuan per ton from last week; in East China, it is 8,000 yuan per ton, down 100 yuan per ton from last week; and in South China, it is 8,050 yuan per ton, unchanged from last week.

3. Forecast for the polyethylene market

Looking at the raw material trends for next week, it is expected that the cost support from oil-based sources will weaken while the cost support from coal-based sources will remain relatively unchanged. It is anticipated that the overall operating rate of downstream industries for PE will decrease by 0.02% next week. Although the consumer market is driving some short-term new orders, the delivery of these short-term orders is gradually reducing the support for operating rates, indicating a potential decline. In terms of supply, next week will see the restart of maintenance units at Sinopec Jinling, Liaohe Petrochemical, Wanhua Chemical, and Yangzi Petrochemical, along with planned maintenance at Qilu Petrochemical. The expected impact of maintenance next week is 57,400 tons, a decrease of 47,700 tons compared to this week. Total production next week is expected to be 649,300 tons, an increase of 32,900 tons from this week. Overall, although there will be an increase in maintenance on the supply side next week, new projects are gradually returning to normal production, while the downstream sector maintains just-in-time inventory. It is expected that polyethylene prices will continue to fluctuate next week, with a range of 50-100 yuan/ton.

PP: The market has shown slight recovery this week, and is expected to stabilize with a bias towards warmth next week.

1、Market Review: This week, the market showed slight recovery, and the price focus moved up slightly.

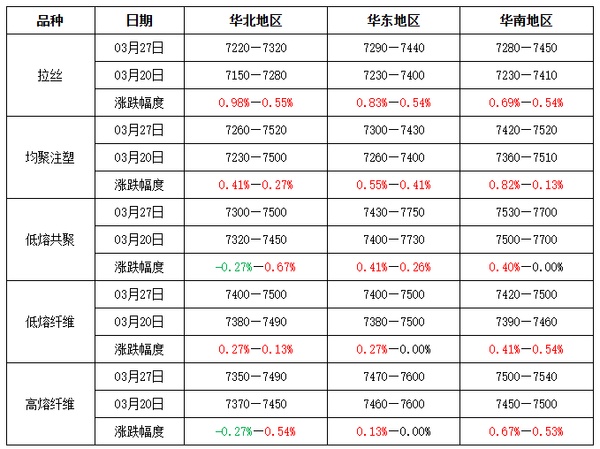

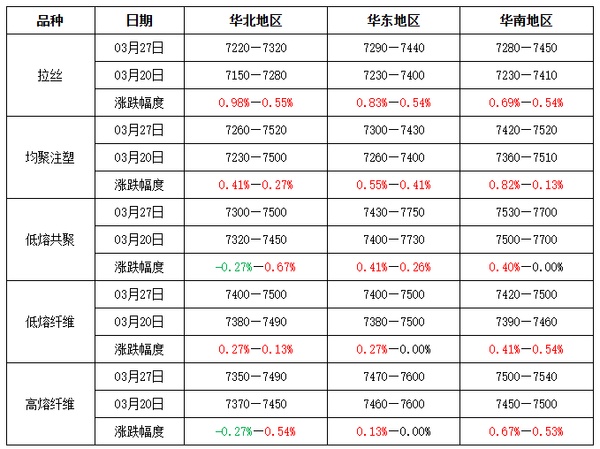

This week, the domestic PP market has seen a slight recovery, with price levels moving up slightly.As of this Thursday, the weekly average price of wire drawing in East China is 7,351 yuan/ton, an increase of 28 yuan/ton compared to the previous week, with a growth rate of 0.38%. Compared to last week, the price has stopped falling and started to rise. The price difference in the wire drawing region has changed little week-on-week. In terms of varieties, the price difference between wire drawing and low-melt copolymer has slightly narrowed. The high inventory pressure in the front market of low-melt copolymer places certain constraints on its price increase, resulting in a smaller rise this week compared to wire drawing, leading to a narrowing of the price difference between the two.

Table 1 Domestic Market Price Assessment of Polypropylene for This Week

2、Driving factors: Weakness in costs and fundamentals of supply and demand, market focus shifting downwards.

This week, there has been no significant improvement in new orders from downstream factories, and some factories still have not fully depleted their raw material inventory, leading to low enthusiasm for spot purchases, which is unlikely to boost the PP market. However, at the beginning of the week, the futures market showed a noticeable upward trend, providing strong support to the spot market. Meanwhile, the driving forces from both the supply and cost sides have increased. On the supply side, the launch of new production capacity has been delayed, and existing units are undergoing concentrated maintenance, resulting in manageable overall supply pressure on the PP market. On the cost side, recent international oil price trends have strengthened cost support for PP. Overall, the supply and demand fundamentals are not under significant pressure this week, coupled with enhanced cost support and the uplifting effect of futures, the domestic PP market has stopped falling and started to rise, although the upward space remains limited.

3Market Outlook: Supply and Demand Imbalance Not Strong, Expected to Maintain a Slightly Upward Trend Next Week.

The PP market is expected to stabilize with a slight upward trend next week.Taking East China as an example, it is expected that the wire drawing price will range between 7,250 and 7,450 RMB/ton next week, with an average price anticipated at 7,370 RMB/ton. The low melting co-polymer price is expected to range between 7,400 and 7,800 RMB/ton, with an average price projected at 7,600 RMB/ton. Next week, crude oil is expected to fluctuate weakly, which is likely to lessen the cost support for PP. On the supply side, there is currently a concentration of PP maintenance units, with a strong emphasis on maintenance, providing short-term support on the supply side. On the demand side, although downstream operations are gradually increasing, procurement remains cautious, and short-term demand is expected to be released steadily. Overall, although short-term cost support for PP is expected to weaken, the market's short-term supply and demand fundamentals show no significant contradictions, and the concentrated maintenance of supply-side units is expected to provide some phase-specific support to the market. Based on this, it is anticipated that the PP market will exhibit a slightly warm consolidation next week.

ABS: The pattern of supply exceeding demand is hard to change, and market prices continue to decline.

This week's hot topics:

This week's market prices have declined.

The industry's output increased this week.

This week, the inventory level of the petrochemical plant increased.

This week's ABS market trend:During this period (March 20-27, 2025), market prices fell across the board, and trading activity was very weak. On Monday, petrochemical plants lowered their ex-factory prices across the board, leading to a drop in market prices, which fell by 100-200 yuan/ton this week. Recently, the ABS industry has seen an increase in production, resulting in a situation of oversupply, and market prices continue to weaken. Negative sentiment is prevalent in the market, with traders offering low prices to clear inventory, leading to an overall bearish market outlook.

Domestic ABS Market Price Comparison Table for This Week

3. Market Forecast

It is expected that the ABS market prices will run weakly next week. In terms of supply, there are currently no manufacturers undergoing maintenance, and the industry's output remains high. However, terminal demand continues to show weakness, and the oversupply situation persists, leading to a bearish price outlook.

PS: Cost decline combined with supply-demand conflicts leads to a weak downward trend in the market.

1Market Review for This Week: Demand for Purchasing from Buyers, Difficulties in Increasing Transaction Volume

This week, the domestic PS market is showing a weak downward trend. The average price of ordinary-grade styrene in East China is 8,640 yuan/ton, down 155 yuan/ton from the previous period, with a week-on-week decline of 1.76%; the average price of modified styrene in East China is 9,650 yuan/ton, down 117 yuan/ton from the previous period, with a week-on-week decline of 1.20%.

2Driving Factors Analysis: Cost Decline Combined with Supply-Demand Contradictions, Market Weakness and Downward Trend

This week, the domestic PS market is weak and declining. The price of raw material styrene continues its downward trend. Although the main port has seen a decrease in inventory for three consecutive weeks, there is still pressure from social inventory. Coupled with the decline in the pure benzene market, the styrene market has further dropped, with PS being continuously guided by a bearish cost side. On the supply and demand side, there are still lines that have been shut down gradually resuming operations, which has further increased the average operating load of the PS industry to a high level. Although some companies have seen a decrease in inventory, some of the pressure has shifted to the intermediaries, leading to a higher willingness for holders to sell. Low prices have dragged the market down further. During the week, the buying intention from end-users for replenishment was moderate, leading to a temporary improvement in transactions, but the sustainability of this improvement is insufficient.

3Market Outlook for the Next Period: Supply and Demand Conflicts Persist, Market May Trend Weakly and Stagnate

Next week, the domestic PS market may trend weakly and remain stagnant. The ordinary GPPS is expected to operate in the range of 8300-8800 yuan/ton, with an average price forecasted at 8550 yuan/ton; the ordinary HIPS is expected to operate in the range of 9300-9800 yuan/ton, with an average price forecasted at 9550 yuan/ton. On the cost side, the raw material styrene may fluctuate weakly, leading to a bearish outlook for PS from the cost perspective. On the supply side, some petrochemical plants are scheduled for maintenance at the end of March and the beginning of April, which may result in a slight decrease in domestic PS supply next week; however, overall supply remains abundant. On the demand side, downstream operations are recovering slowly, with large end-user enterprises making essential purchases, while some small to medium-sized downstream operations have not fully resumed. New raw material procurement is insufficient, but as price levels continue to decline, purchasing willingness has slightly rebounded. Overall, lack of support from the cost side and persistent supply-demand pressure suggest that the PS market is unlikely to change its weak status.

EVA: Foam demand is sluggish, and the market is stabilizing with narrow fluctuations.

1. This Week's EVA Market Analysis

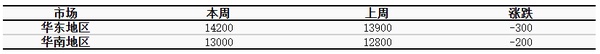

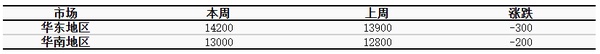

This week, the domestic EVA market continued to operate in a weak consolidation, with a sustained situation of weak supply and demand. At the end of the month, the number of spot orders from petrochemical companies was limited, and mainstream agents had few spot resources for foaming. EVA producers primarily focused on photovoltaic production, maintaining firm ex-factory prices to support the market. However, the downstream foaming terminal demand remained weak, which could not be changed, with demand mainly following just-in-time needs. Transactions were often negotiated on a case-by-case basis, mainly focused on low-priced resources, leading to a slight downward shift in some price centers. As of Thursday this week, mainstream prices closed as follows: soft material at 11,400-11,700 yuan/ton, down about 100 yuan/ton from last week; hard material at 11,200-11,600 yuan/ton, down about 50 yuan/ton from last week; and photovoltaic material around 11,600-11,800 yuan/ton, unchanged from last week.

Domestic Regional Price Variation Comparison Table

2. Market Influencing Factors Analysis

This week, the EVA petrochemical ex-factory prices remain stable.

This week, the estimated capacity utilization rate of China's EVA industry is 86.47%, a month-on-month increase of 3.52%.

This week, the average profit in the domestic EVA industry is 2263 yuan/ton, a decrease of 1.22% compared to the previous period.

3. Market Forecast for Next Week

Looking ahead to next week, the domestic EVA market is expected to continue its stable and subdued consolidation. On the supply side, domestic EVA plants are operating steadily overall, with many producing for previous photovoltaic orders. The supply of other types, such as foaming agents, remains limited. On the demand side, photovoltaic orders are satisfactory, but the foaming demand may become more pronounced in the post-Qingming Festival off-season. Demand is mainly driven by essential needs, and market sentiment among operators is cautious and wait-and-see, with mainstream prices following factory cost quotes. In summary, next week the EVA production side is expected to remain relatively stable, and the domestic EVA market is likely to experience a situation of indecision, with narrow fluctuations prevailing.

Engineering materials

PC: The market is slightly weak and fluctuating.

1.Domestic PC market review: market shows slight weakness.

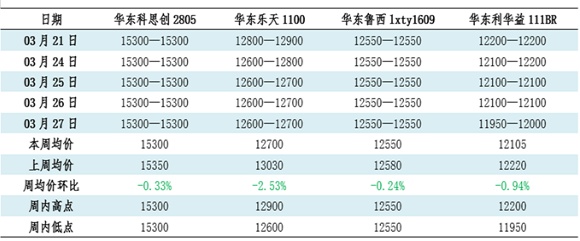

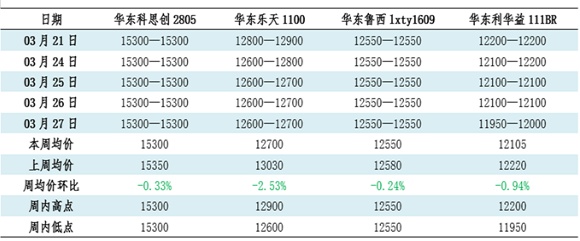

This week, the domestic PC market has been operating slightly weak. As of March 27, taking the foreign supply product Kestrel 2805 in the East China market as an example, the closing price was 15,300-15,300 RMB/ton, with an average price of 15,300 RMB/ton this week, a week-on-week decrease of 0.33%. Taking the domestic supply product Luxi 1609 in the East China market as an example, the closing price was 12,550-12,550 RMB/ton, with an average price of 12,550 RMB/ton this week, a week-on-week decrease of 0.24%.

2.Driving factors analysis: Downstream digestion raw material inventory, market transactions are sluggish.

This week, the domestic PC market showed a slight weakening and stagnation, mainly due to the lack of sustained purchasing enthusiasm from downstream buyers. Most factories reported stable prices this week, while a few factories experienced price declines. Overall, the prices reported by suppliers remained steady with minor fluctuations. Downstream markets have entered a raw material digestion period, resulting in a subdued trading atmosphere, with transactions limited to just a few essential orders. Some suppliers have slightly shifted their focus to weaker price negotiations, and the overall fluctuation range of the PC market has been limited. The price of bisphenol A has slightly decreased, creating a bearish sentiment in the PC market, and some industry players still maintain a bearish outlook.

3.Market Outlook:Market or low-level stalemate

It is expected that the domestic PC market will experience slight fluctuations at a low level next week. In the short term, the gross profit margin for PCs is limited, and sellers are cautious about shipping at low prices, resulting in a stable yet slightly fluctuating market. Meanwhile, downstream industries are in a raw material digestion phase, leading to a lackluster atmosphere for new orders, with supply and demand in a stalemate. It is anticipated that the price of domestic products in East China will range between 11,950 and 12,550 yuan per ton in the short term.

PET: Weak rebound in the polyester bottle chip market

This weekMarket focus:

Production: Capacity utilization rate is 75.02%.

Raw material: PTA industry operating rate is 80.48%.

2. Market Analysis

Table: Domestic Polyester Bottle Chip Market Price Change Comparison (Unit: Yuan/Ton)

During this period (March 21-27, 2025), the polyester bottle chip market saw a slight rebound, with the weekly average price of water bottle grade in East China at 6,102 yuan/ton, an increase of 12 yuan/ton from the previous week, representing a growth of 0.20%. Geopolitical factors influenced a rebound in low crude oil prices, driving the prices of polyester bottle chips upward. However, as the end of the month approaches, some suppliers are facing increased pressure to sell their inventory, leading to low-priced sales that weigh on the market's upward momentum. Additionally, end-user demand remains weak, with only minimal purchases for urgent needs, resulting in sluggish trading activity. By the close of trading, the spot price of polyester bottle chips water bottle grade in East China was 6,110 yuan/ton, up 40 yuan/ton from the same period last week, an increase of 1.15%.

3.Later forecast:

Supply Forecast: A certain factory in East China plans to restart a production line with a capacity of 500,000 tons by the end of the month, while a factory in Northeast China plans to restart with a capacity of 700,000 tons. The production of polyester bottle flakes may increase to 323,700 tons next week.

Demand Forecast: The beverage industry is expected to maintain an operating rate around 75%, the oil industry is expected to have an operating rate around 43%, and the PET sheet industry is stable. Domestic terminal demand is performing generally, mainly focused on inventory digestion.

Next week's forecast: The downstream will mainly focus on digesting previous inventory, with little change in deliveries. Next week, all maintenance units are expected to restart, so short-term supply pressure is manageable. As supply increases, it is anticipated that the industry processing fees will continue to be compressed. The polyester bottle chip market is expected to maintain a low-level fluctuation, with spot prices for water bottle materials in the East China region projected to be between 6050-6130 yuan/ton next week.

PMMA: The market price of PMMA has declined, dropping 200-400 this week.

1. Market Focus for This Week

1) Production: This week's PMMA capacity utilization rate is 64%.

2) Raw materials: The domestic MMA market is declining, while methyl acrylate is rising, leading to a decrease in costs.

This week's market analysis

This week, the domestic PMMA particle market has seen a downward shift. As of March 27, the price of domestic products is between 16,500 and 17,200 yuan/ton; the price of imported products is between 16,500 and 17,000 yuan/ton.

From the perspective of raw materials, the MMA market experienced a decline during the week. As of March 27, the mainstream price in the East China secondary market was 11,100 yuan/ton, while the mainstream price of methyl acrylate in the East China market was 11,800 yuan/ton. The theoretical cost of PMMA was 12,913 yuan/ton.

From the supply side, the capacity utilization rate of the PMMA particle industry this week is 64%, which is the same as the previous period.

From the demand side, downstream purchases are moderate, with no increase in volume.

From the perspective of mentality, the attitude is more about observation and practical discussions.

In summary, the PMMA particle market price in East China has declined, with insufficient buying interest. However, sellers still have the intention to sell, leading to lower offers. The market atmosphere is slightly weak, with transactions mainly driven by essential demand.

Table 1 PMMA Industry Chain Product Weekly Fluctuation Table (Unit: Yuan/Ton)

3. Next week's market forecast

1) The domestic MMA market is expected to be slightly weak in the short term. Sellers still have the intention to ship, and some downstream contracts are being executed at the beginning of the month, resulting in limited spot procurement volume. Negotiations may continue to decline, and the average weekly price is expected to drop. Continue to pay attention to Panjin Sanli and Quanzhou Petrochemical.Device Dynamics。

Supply Forecast: Capacity utilization is low, and short-term changes are limited.

3) Demand Forecasting: Demand is generally moderate and negotiated on a case-by-case basis.

4) Mindset Analysis: The mindset is neutral, maintaining just-demand.

In summary: It is expected that the short-term PMMA particle market will experience narrow fluctuations, with weak demand. The sellers in the PMMA particle market are making sales, but buying interest is lacking, and actual transaction activities will remain at a just-in-time basis.

POM: Factory prices lowered, quotation negotiations declined.

1. Market Focus for This Week

Domestic material manufacturers have lowered the ex-factory price by 500 yuan/ton.

Yankuang Phase II POM unit shutdown maintenance.

3) Traders continue to adopt a low-selling strategy.

Market Analysis for This Week

Domestic POM Market Price Weekly Fluctuation Table

This week, the domestic POM market has seen a downward trend. As of the close on March 27, the mainstream trading price for domestic POM in the Yuyao market was between 10,500 and 14,200 yuan/ton, a decrease of 2.11% compared to last week. In the Dongguan market, the cash price for domestic POM ranged from 9,600 to 13,300 yuan/ton, down 1.54% from the previous week. This week, weak demand has dampened trading sentiment across various regions, leading to pressure on shipments from POM petrochemical plants. Manufacturers collectively reduced their ex-factory prices by 500 yuan/ton, putting further pressure on market sentiment. Traders continued to adopt a low-selling strategy, with mainstream quoted prices declining by 200-300 yuan/ton. Downstream stocking behavior remained cautious, resulting in relatively limited actual transactions.

3. Market Forecast for Next Week

Supply forecast: Next week, the Yanzhou Mining Lu Hua Phase II POM unit will undergo maintenance, while other manufacturers' units are running stably. Therefore, the total POM supply will be slightly reduced. Demand forecast: Next week, the weak demand from end-users will constrain factory inventory digestion, making it difficult for the demand situation to improve. It is expected that the POM demand will be weak. Overall, there is limited support for the POM fundamentals next week, and some manufacturers may continue to lower their prices. The market atmosphere will be more cautious, with participants adopting a more prudent operation mentality. Mainstream offers may continue to decline, and with end-user factory operating rates being insufficient, user purchasing enthusiasm is generally low, resulting in a subdued trading atmosphere. It is expected that the domestic POM market will operate weakly next week.

PBT: The PBT market is experiencing weak fluctuations with increased pressure on the supply side.

1. Market Overview for This Week

In this period, the PBT market in East China is showing weak fluctuations, with increasing pressure from the supply side. As of the market close on March 27, the mainstream price of medium and low viscosity PBT resin in East China is between 7900-8200 yuan/ton. On the supply side, the maintenance of Changchun Chemical's PBT facility has ended, and normal production has resumed, while two production lines of Longhong Biochemical's PBT facility are operating. On the raw material side, the BDO market is in a weak wait-and-see state this week; the PTA market has seen price fluctuations and slight strengthening. This week, support from raw materials remains stable, but the support for the PBT market is limited, with increased pressure from the supply side. The market atmosphere is largely one of wait-and-see, with the market focus showing weak fluctuations and reports of low prices in the market. The improvement in terminal demand for PBT is limited, and the wait-and-see atmosphere in the market is strong, resulting in generally average spot trading.

2. Market Influencing Factors Analysis

-0.74%: The domestic PBT weekly average price is 8010 yuan/ton, a decrease of 0.74% compared to last week.

+4.47%: The industry's operating rate this week is 54.32%, which is an increase of 24.19% compared to last week.

-24.19%: This week's average PBT gross profit in the domestic market is -498 yuan/ton, a decrease of 24.19% compared to the previous week.

3. Market Forecast for Next Week

Next week, the PBT market is expected to experience range-bound fluctuations. On the supply side, PBT production facilities in Meizhou Bay, Fujian, have plans to resume operations, which may continue to increase output; on the demand side, there may be an increase in market participation willingness, with transactions centered around essential needs. Next week, some PBT facilities are preparing to restart, which may lead to an increase in supply, continuously affecting market sentiment negatively, but significant adjustments in price offers are unlikely. End users remain cautious, primarily replenishing inventory at lower prices, and the market is likely to continue its range-bound fluctuations. It is expected that next week, the price of medium and low viscosity PBT resin in the East China market will be around 7,800-8,100 yuan/ton.

PA6: This week's market prices fell first and then rose.

1.Market Review of the Week: The average market price has dropped this week.

This week, the domestic average price of PA6 has declined. As of Thursday's close, the mainstream selling price reference for PA6 conventional spinning medium viscosity in the light market is 10,600-11,000 yuan/ton, which is an increase of 0.47% compared to last Thursday's closing price. The low value of this week's closing price is the same as last Thursday's closing price, while the high value has increased by 100 yuan/ton compared to last Thursday's closing price. The weekly average price is 10,725 yuan/ton, down 1.24% from last week's average. As of Thursday's close, the mainstream negotiation focus for PA6 high-speed spinning semi-light spot is 11,100-11,550 yuan/ton delivered and accepted, which is a decrease of 0.88% compared to last Thursday's closing price. This week's average price is 11,365 yuan/ton, down 1.30% from last week's average. This week, raw material prices remain low, and there have been increasing reports of PA6 production cuts, leading to a slight increase in conventional spinning prices while high-speed spinning remains weak.

2.Driving Factors Analysis: Supply Forecast Decrease, PA6 Prices Slightly Rise After Hitting Bottom

This week, the caprolactam market has experienced a slight decline before stabilizing. As of Thursday's close, the trading center in the East China liquid caprolactam market was referenced at 9,700-9,800 RMB/ton, with an average price of 9,760 RMB/ton for the week, down 240 RMB/ton compared to last week’s average price, a decrease of 2.40% week-on-week. During the week, there was a slight improvement in the downstream PA6 shipments, which lifted the PA6 market prices slightly. Meanwhile, caprolactam factories continued to release information on maintenance and reduced production loads, leading to a decrease in supply, providing some support for price stability. However, with Sinopec further lowering the listing price of pure benzene by 350 RMB/ton to 6,600 RMB/ton, the cost support weakened, negatively impacting the confidence of downstream and terminal markets, causing market trading to turn sluggish. As the weekend approached, downstream replenishment was mostly completed, and all parties in the market adopted a cautious wait-and-see attitude toward future trends. Overall, the phase-wise reduction in supply and the slight improvement in downstream demand offset the negative factors brought by the weakened cost support, leading to a stabilization in the caprolactam market.

This week, the caprolactam market is operating at a low level, with the cost side of PA6 lacking positive support. There have been increasing reports of production cuts in the PA6 market, leading to price bottoms. Downstream purchasing sentiment has improved, and PA6 manufacturers are seeing better transaction conditions, with some manufacturers slightly raising their quotes and showing a reluctance to sell at low prices.

3.Market Outlook for Next Week: Limited Price Increase Expected for PA6

It is expected that the average price of PA6 in the market will see a slight increase next week. Some PA6 facilities are scheduled for maintenance next week, leading to a decrease in supply expectations, which will alleviate the supply-demand imbalance. Downstream orders may continue to follow demand, and the PA6 market will see transactions driven by just-in-time needs, while raw material prices may stabilize after falling. Overall, it is expected that the PA6 market price will rise next week, but the increase will be limited. The average price of conventional fiber medium-viscosity PA6 is around 10,825 yuan/ton, reflecting a slight increase compared to this week's average, with a trading range of 10,600-11,000 yuan/ton.

PA66: Weak downstream demand, market running weakly.

This week's market focus.

1) Production: According to Longzhong Information, the domestic average capacity utilization rate for polymer this week is approximately 58%, stable compared to last week, with a capacity base of 1.271 million tons.

Demand: The terminal market demand is generally low, and downstream purchasing enthusiasm is lacking.

2. Market Analysis for This Week

DomesticPA66 Market Price Weekly Change Table

This week, the domestic PA66 market is operating weakly. As of March 27, the market price for EPR27 in Yuyao, East China, is referenced at 16,800-17,000 yuan/ton, a decrease of about 1.96% compared to last week. The raw material adipic acid is fluctuating at low levels, and the April execution price for hexamethylenediamine from Invista remains stable at 21,300 yuan/ton. The raw material prices are not changing significantly, and polymer enterprises are still under cost pressure. However, due to weak demand, domestic PA66 shipments are hindered, resulting in continuous inventory accumulation in the industry and a slight decline in market transaction prices.

3. Next week's market forecast

From the cost perspective, the market for raw material adipic acid is fluctuating at a low level, and Invista's April price for hexamethylenediamine remains stable, with little fluctuation in raw material prices, leading to significant cost pressure for polymer enterprises. From the supply and demand perspective, there is no obvious recovery in terminal market demand, and downstream purchases are mainly based on needs. As a result, polymer enterprises are struggling to sell at high prices, and the overall inventory pressure in the industry is continuously increasing. However, some enterprises plan to reduce production in early April, and it is expected that the domestic supply of PA66 will decrease in April. With the expectations of reduced costs and supply, the domestic PA66 market may maintain narrow fluctuations in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.