[This Week's Plastics Market] Fluctuations with a Downward Trend! PE and ABS saw the highest weekly decline of 300, while PA66 dropped by 200.

Abstract: Weekly market summary and forecast for general materials and engineering plastics from March 14 to March 20! Most general materials declined, with weak demand weighing down, PP market showed a weak fluctuation; PE, ABS saw the highest weekly decline of 300; PS continued to fall by 50-150 due to cost reduction and inventory pressure. Engineering plastics operated weakly, PET slightly rebounded; PBT market observed after a decline; PA66 saw the highest weekly decline of 200; PMMA, POM spot markets remained stable and watchful.

general material

PP: Weak Demand Hinders Polypropylene Market, Leading to Weak and Fluctuating Prices

1. This week's market focus

Production: This week, domestic polypropylene production was 732,600 tons, a decrease of 44,800 tons from last week's 777,400 tons, a decline of 5.76%. Compared to the same period last year, which was 642,500 tons, it increased by 90,100 tons, an increase of 14.02%.

2) Demand: The raw material inventory days of large enterprises in the plastic weaving sample increased by 2.60% compared to last week; the raw material inventory days of BOPP sample enterprises decreased by 5.39% compared to last week. The raw material inventory days for modified PP increased by 0.79% compared to last week.

3) According to statistics, this week China's polypropylene commercial inventory decreased by 0.84% compared to the previous period, while the total inventory of production enterprises increased by 0.66%; the inventory of sample traders increased by 3.23%, and the inventory of sample port warehouses increased by 2.70%. In terms of inventory by grade, the inventory of drawing grade increased by 0.95%, and the inventory of fiber grade decreased by 3.05%.

2.weekly market analysis

This week, the polypropylene market has not changed much. Due to unstable geopolitical situations, potential supply risks have increased, and oil prices have stopped falling and rebounded, leading to a recovery in the overall market sentiment. Fundamentally, with multiple plants undergoing temporary shutdowns, the operating rate of polypropylene production capacity has dropped to a relatively low level. The pressure from new capacity expansions and maintenance outages offset each other, temporarily easing supply pressures; demand remains stable, with domestic demand still under pressure while export opportunities continue. Overall, as concerns over crude oil diminish and the fundamental situation improves, polypropylene is entering a short-term consolidation phase under a pattern of reduced supply and steady demand. As of the 20th, the national average price for fiber-grade polypropylene was 7,325 yuan/ton, down 20 yuan/ton from last week, a decrease of 0.27%.

3.next week market forecast

Supply forecast: It is expected that there will be a trend of reduced supply, mainly due to the concentrated maintenance of facilities such as the second line of Pu Jin Neng Chemical, the second line of Maoming Petrochemical, and others, leading to a situation of reduced future supply. Recently, companies undergoing maintenance are concentrated in Pucheng Clean Energy, Anqing Baiju, Zhongjing Petrochemical Phase II Line 1/Line 2, and Yulong Petrochemical.

Demand forecast: mainly driven by downstream rigid demand procurement. Due to the impact of a weak global economy and overseas tariffs on some downstream export orders, under the dual pressure of reduced domestic and foreign orders, the willingness of downstream raw material procurement for restocking is low. According to plastic weaving data, the raw material inventory days of large enterprises in the plastic weaving sample increased by 2.60% compared to last week; the raw material inventory days of BOPP sample enterprises decreased by 5.39% compared to last week. The raw material inventory days for modified PP increased by 0.79% compared to last week.

Cost forecast: Cost support still exists, although there is an expectation of easing in international oil prices, as recent geopolitical benefits have led to a rise from recent lows in international oil prices; propane follows the trend of international oil prices with recent downstream market entry supporting prices; propylene has limited high-level transmission recently and is mainly stable in the short term.

Overall, the continuous expansion and increase in supply contrast sharply with the weak response from the demand side. The imposition of additional tariffs overseas has curbed downstream export orders, coupled with a slow increase in domestic demand, dragging down mainstream market transactions. The bottom support for the market lies in the relatively stable cost end and ongoing maintenance benefits, alleviating downward pressure on the market. In the short term, the market will revolve around the confrontation and game between supply and demand and the cost end. It is expected that the market will fluctuate weakly within the range of 7250-7450 yuan/ton in the short term, with close attention to changes in additional tariffs overseas, progress in social inventory reduction, and the status of demand-side variables.

PE: Polyethylene market spot prices mainly declined

This week's polyethylene factory price trend fluctuation

This week, the factory prices of polyethylene showed a mixed trend, with fluctuations ranging from 50 to 300 yuan per ton. By type, the factory prices of HDPE showed a mixed trend, with fluctuations ranging from 50 to 200 yuan per ton; among them, the factory price of 100-grade pipe material increased due to tight supply. The factory price of LDPE decreased, with a range of 150 to 300 yuan per ton. The factory price of LLDPE also decreased, with a range of 50 to 200 yuan per ton.

2. This weekmarket review

This week, the domestic polyethylene spot market prices mainly declined, with a range of 20-400 yuan/ton. The imbalance between supply and demand in the market continued this week, with a slow recovery in demand, making it difficult to effectively absorb the pressure from the supply side. Some production enterprises lowered their ex-factory prices, further weakening market confidence. Merchants generally faced pressure and reduced prices to sell, leading to a decline in market prices. Currently, the mainstream price of oil-based linear products in North China is 7900 yuan/ton, down 170 yuan/ton from last week; in East China, the mainstream price is 8100 yuan/ton, down 50 yuan/ton from last week; in South China, the mainstream price is 8050 yuan/ton, down 100 yuan/ton from last week.

3. Polyethylene market forecast

Looking at the raw material end trend for next week, it is expected that the cost support of oil-based production will strengthen, while the cost support of coal-based production will remain largely unchanged; it is estimated that the overall operating rate of various downstream industries of PE will increase by 0.88%. The downstream demand for polyethylene will follow up slightly, and at the same time, due to the regular finished product inventory needs of large-scale enterprises, there is still a possibility of an increase in operations. Considering the supply situation, maintenance units of Wanhua Chemical, Yanshan Petrochemical, Guangdong Petrochemical, and Yangzi Petrochemical are scheduled to restart, with additional short-term planned maintenance units including Zhongan United and Shanghai Petrochemical. It is estimated that the impact of maintenance on production volume next week will be 68,600 tons, a decrease of 44,000 tons from this week. The total estimated output for next week is 586,300 tons, a reduction of 16,400 tons from this week. Overall, although the growth rate of supply is lower than expected, the recovery of downstream demand is slow, and inventory digestion is sluggish. It is predicted that the price of polyethylene may show a weak fluctuation next week, with a fluctuation range of 50-100 yuan per ton.

PS: Cost reduction and inventory pressure lead to continued market decline

This week's hot topics

current periodThe center of gravity has fallen, with a range of 50-150 yuan/ton, mainly due to the decline in styrene and the impact of market price reductions for sales.

2) This week, China's PS industry production was 103,000 tons, with a capacity utilization rate of 67.4%, an increase of 1.9% from last week.

3) This week, China's PS finished goods inventory is 118,000 tons, an increase of 6,000 tons from last week, with a growth rate of 5.4%.

2. Review of this week's market conditions

In this period, the domestic PS market focus has declined, with a range of 50-150 yuan/ton. The market was mainly affected by the decline in styrene and price reductions for sales. On the cost side, the continued decline in pure benzene and high inventory levels have led to a weaker trend in styrene. In terms of supply and demand, the restart of some production facilities in Guangxi, Shandong, and Anhui has led to continued growth in industry output. However, the overall recovery of downstream sectors has not met expectations, and inventories continue to accumulate. According toThe data shows that on March 20, 2025, the price of transparent benzene in the East China market fell by 100 to 8550 yuan/ton, and the price of modified benzene fell by 50 to 9850 yuan/ton.

3. Next week's market forecast

It is expected that the PS market may undergo a weak consolidation in the short term. In terms of cost, under the influence of the gradual balance between supply and demand for styrene, the price may tend to fluctuate within a narrow range, weakening its guidance on the PS price. Regarding supply and demand, the industry's supply recovery rate is faster than demand, with the fundamentals trending towards a more relaxed situation, still facing inventory pressure. Affected by this, there is a possibility of a softening in PS prices, with profits likely to be compressed, and the price difference with styrene is expected to continue narrowing.

ABS: Market transactions are extremely weak, and prices continue to fall this week.

This week's hot topics:

This week's market prices have fallen

2) This week's industry output decreased

3) The inventory of the petrochemical plant increased this week

2. This week's ABS market trend:

This period (20250313-0320) saw a comprehensive decline in market prices, with very weak market transactions. On Monday, all petrochemical plants lowered their ex-factory quotations, and market prices followed the decline, with the price drop for this week ranging from 100 to 200 yuan per ton. Recently, the output of the ABS industry has increased, continuing the situation of oversupply, leading to a continuous weakening of market prices. The market is filled with negative factors, and traders are selling at lower prices to make deals, resulting in an overall bearish sentiment in the market.

3. Market forecast:

It is expected that the ABS market price trend will be weak next week. Some manufacturers will start their facilities, and it is estimated that production will increase slightly. However, terminal demand continues to be weak, and the situation of oversupply still persists, leading to a bearish price expectation.

engineering material

PET: polyester chip market shows strong fluctuation

this weekMarket Focus:

Production: Capacity utilization 70.63%.

Raw material: PTA industry operating at 79.08%.

2. Market Analysis

In this period (20250314-0320), the polyester chip market showed a strong fluctuation, with the weekly average price of water bottle material in the East China region at 6090 yuan/ton, an increase of 14 yuan/ton from last week, a rise of 0.23%. Geopolitical factors led to a rebound from a low position. However, the overall commodity sentiment was bearish, and the support from the raw material end was weak, leading to a strong wait-and-see attitude within the industry, resulting in a weak rebound in polyester chip prices. The downstream mainly focused on inventory digestion, with transactions being stagnant. Yesterday, the first delivery of the 03 contract took place, and there was a concentration of foreign trade shipments, leading to tight supply for some goods. Approaching the end of this month, some local supplies were sold off at a low fixed price. At the close, the spot price of polyester chip water bottle material in the East China region was 6070 yuan/ton, an increase of 20 yuan/ton from the same period last week, a rise of 0.33%.

3. later prediction:

Supply forecast: A major line at a factory in East China with a capacity of 500,000 tons plans to restart, and Hainan Yisheng's 250,000-ton plan is also scheduled to restart. The output of polyester chips may increase to 304,500 tons next week.

Demand forecast: Considering the end of the month, the operating rate of the soft drink industry is expected to decline to around 75%, while the operating rate of the PET sheet industry will be maintained at about 60%, with some areas running at full capacity or low load. The downstream terminals are mainly focused on digesting inventory, with a small amount of restocking.

Next week forecast: As maintenance units gradually restart, the supply-side pressure increases. However, after recent deliveries, foreign trade shipments are concentrated, and with large downstream factories picking up goods, some supplies are in tight circulation. Terminal demand has not shown significant improvement, and the polyester chip market may come under pressure, operating within a range. It is expected that next week, the spot price of water bottle material in the East China region will be 6000-6100 yuan/ton.

PMMA: PMMA market consolidation operation

1. This week's market focus

1) Production: This week's PMMA capacity utilization rate is 64%.

2) Raw materials: The domestic MMA market has slightly risen, methyl acrylate has fallen, and costs have increased.

2. Weekly Market Analysis

This week, the domestic PMMA particle market remained stable. As of March 20th, the price of domestically sourced materials was between 16,700 and 17,400 yuan per ton; the price of imported materials was also between 16,700 and 17,400 yuan per ton.

From the perspective of raw materials, the raw materials saw a slight increase within the week. As of March 20th, the mainstream price in the secondary market in East China was 11,200 yuan/ton, the mainstream price of methyl acrylate in the East China market was 11,600 yuan/ton, and the theoretical cost of PMMA was 12,996 yuan/ton.

From the supply side, the capacity utilization rate of the PMMA particle industry this week was at 64%, with some facilities in East China increasing their load.

From the demand side, downstream adopts a buy-as-you-go approach, with a predominantly wait-and-see attitude.

From the perspective of mentality, more observation, the atmosphere is light.

In summary, the PMMA East China particle market has transitioned smoothly, with inventory holders showing average sales, lackluster buying interest from end-users, a light trading atmosphere, and insufficient follow-up on actual transactions.

3. next week's market forecast

It is expected that the domestic MMA market will consolidate in the short term. Sellers are not strongly inclined to lower prices, while downstream players mainly execute contracts, showing insufficient enthusiasm for spot transactions, leading to a somewhat stagnant atmosphere. The trading game continues, with the market remaining firm in the short term. Attention should be paid to Panjin Sanli and Quanzhou Petrochemical.device dynamics。

2) Supply forecast: low capacity utilization, normal shipment.

3) Demand Forecast: Demand is average, discuss as needed.

4) Mental state analysis: poor mental state, limited trading.

It is expected that the short-term PMMA particle market will remain stable, with limited changes in supply and demand. The PMMA particle market is mainly in a wait-and-see mode, with slightly stagnant trading, and actual transaction follow-ups are needed. It is estimated that the overall market will not change much.

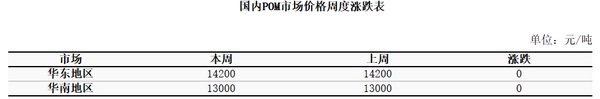

POM: Demand performance is lukewarm, actual trading is negotiated based on demand

This week's market focus

The total inventory of POM manufacturers continues to rise;

2) The market sentiment becomes more bearish;

3) The downstream sector mostly holds a cautious and wait-and-see attitude.

2. This week's market analysis

This week, the domestic POM market has risen steadily. As of the close on March 20th, the mainstream negotiation price for domestically produced POM in the Yuyao market was 10,500-14,500 yuan/ton, remaining stable compared to last week; in the Dongguan market, the cash price for domestically produced POM closed at 9,700-13,400 yuan/ton, also stabilizing from last week. This week, shipments across various regions continued to be weak, with POM petrochemical plants facing pressure in their sales. The overall performance of the fundamentals was poor, and the bearish sentiment in the market intensified. Traders mainly followed the market trend in their sales, while terminal factories had limited capacity for inventory digestion, and overall purchasing sentiment among users was lackluster, with a focus on negotiations.

3. next week market forecast

Supply forecast, the POM facilities of domestic manufacturers will operate stably next week, with no short-term maintenance plans, so the total POM supply will slightly increase. Demand forecast, the operating load of end-user factories is insufficient next week, and the purchasing intention of users is weak, indicating that the overall POM demand is expected to be poor. Overall, market fluctuations in various regions will be limited next week. Given the continuous increase in the total inventory of POM petrochemical plants, there is little fundamental support, coupled with slow follow-up of demand orders, traders' enthusiasm for operations is not high, and the pressure to sell in the short term remains significant. Downstream users mostly maintain a cautious wait-and-see attitude, with real transactions continuing to be negotiated. It is expected that the domestic POM market will be weakly adjusted next week.

PBT: PBT market falls and watches, cost support weakens

1. This week's market review

In this cycle, the PBT East China market declined and then entered a wait-and-see phase, with cost support weakening. As of the close on March 20th, the mainstream price of medium to low viscosity PBT resin in the East China region was between 7900-8200 yuan/ton. On the supply side, there were limited changes in the facilities. Regarding raw materials, this weekinterval declineWeak rebound. This week, the price of raw material BDO continued to weaken, PBT market quotations loosened, negotiation focus was on a weak fluctuation, downstream and terminal markets were mainly observing, adopting a strategy of purchasing as needed, and the pessimistic sentiment in the market persisted.

2, Market Impact Factors Analysis

-0.37%: The domestic PBT weekly average price is 8050 yuan/ton, a decrease of 0.37% from last week.

2) 0%: PBT industry operation this week is 49.85%, unchanged from last week.

3) -5.25%: This week, the average gross profit of domestic PBT was -401 yuan/ton, a decrease of 5.25% compared to last week.

3, next week market forecast

Next week, the PBT market may see a weak and slight decline. On the supply side, Changchun Chemical's PBT facility maintenance is expected to end, and production may slightly increase; on the demand side, the willingness to enter the market may increase, with transactions focusing on rigid demand. The downstream and terminal markets for PBT next week may see an increase in price suppression sentiment, leading to a psychological game in the market. Supply-side operations that trade volume for price may increase, and market prices may continue to weaken and decline. Longzhong expects that next week, the price of medium and low viscosity PBT resin in the East China market will be around 7900-8100 yuan/ton.

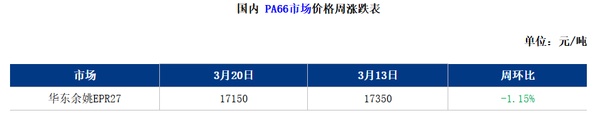

PA66: Weak demand, market operating weakly

1. This week's market focus

Production: According to statistics, the average weekly capacity utilization rate of domestic polymers this week is about 58%, remaining stable from last week, with a capacity base of 1.271 million tons.

2) Demand: The terminal market demand is average, and the procurement enthusiasm of downstream buyers is lacking.

2. weekly market analysis

This week, the domestic PA66 market operated weakly. As of March 20th, the market price of EPR27 in Yuyao, East China, was around 17,000 to 17,300 yuan/ton, a decrease of about 1.15% compared to last week. The raw material adipic acid showed a weakening trend, while hexamethylenediamine remained stable. The cost side lacked support points, and downstream demand was weak. The capacity utilization rate of polymer enterprises remained stable, with ample market supply, and the market transaction focus slightly weakened.

3. Next week's market forecast

From the cost perspective, raw materials have slightly weakened, and hexamethylenediamine is operating in a consolidation phase, lacking strong support points on the cost side. From the supply and demand perspective, there is no significant recovery in terminal market demand, with downstream sectors mostly purchasing according to need. Polymer enterprises are maintaining low production loads, and due to weak demand, the market supply is ample. The fundamentals are expected to remain stable, and the domestic PA66 market may continue to operate in a consolidation phase in the short term. Attention can be paid to Invista's April hexamethylenediamine listing price guidance.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track