[This Week in the Plastics Market] All Green! ABS Prices Fall Across the Board, Dropping Up to 250; PE, PS, PC, PA Slightly Down

Summary: Weekly Market Summary and Forecast for General and Engineering Plastics from August 29 to September 4! This week, the market continued to be weak, showing a general decline. In terms of general materials, the PE market experienced slight fluctuations, with some prices rising or falling by 5-24; PP slightly declined, with some prices dropping by 72; the PS market declined, with individual prices falling by 100; ABS saw an overall decline with a range of 40-250; and EVA maintained stable prices. In terms of engineering plastics, PC slightly declined; PMMA saw individual decreases of 20; PET partially decreased by 70; the PA market was slightly weak, with some prices falling by 10-90; POM declined by 50-200; and PBT remained stable and consolidated.

General material

PE: Spot prices in the polyethylene market show mixed fluctuations.

1. Summary of the market situation this week

This week, international oil prices have fallen due to increased risks of oversupply, and the traditional peak season for fuel consumption in the United States is coming to an end, collectively putting pressure on the oil market.

This week, the trading atmosphere in the PE packaging film market has slightly improved, with some packaging products starting to stock up.

The polyethylene output for this period is 632,500 tons, an increase of 14,600 tons compared to the previous period. The total output for the next period is expected to reach 652,600 tons, an increase of 20,100 tons compared to this period.

2. Review of the Polyethylene Market Trends This Week

This week, domestic polyethylene spot market prices were mixed, with fluctuations ranging from 5 to 24 yuan/ton (weekly average). Market speculation cooled down, coupled with a weaker linear futures market, a decline in market sentiment, and a slow improvement in downstream orders, resulting in a softening of polyethylene prices. The price of HDPE film was 8,006 yuan/ton, up 12 yuan/ton compared with last week; the price of LDPE film was 9,683 yuan/ton, up 7 yuan/ton compared with last week; the price of LLDPE film was 7,473 yuan/ton, down 26 yuan/ton compared with last week.

3. Polyethylene Market Outlook and Forecast

The price of polyethylene is expected to fluctuate mainly downward in the next period. Key points to watch: 1. Cost aspect. It is anticipated that the cost support from oil-based production will weaken, while the cost support from coal-based production will remain largely unchanged. 2. Supply side. Market supply involves planned restarts of units at Maoming Petrochemical, Shanghai Petrochemical, and Daqing Petrochemical, with additions from planned maintenance at Sino-British Petrochemical, Sino-Korean Petrochemical, and Yangzi Petrochemical, overall expected to increase. The total production for the next period is expected to be 652,600 tons, an increase of 20,100 tons compared to the current period. 3. Demand side. The overall operating rate of downstream PE industries is expected to increase by 1.43% next week, with demand gradually improving. The market trading atmosphere is slightly improving, with some packaging materials starting to stock up, and the agricultural film market entering a reserve cycle. Enterprise orders are in the process of gradually accumulating, and production levels are expected to improve. Overall, the fundamentals indicate a state of dual increase in supply and demand, but the market trading atmosphere has somewhat weakened, and prices are likely to fluctuate downward, with a range of 5-40 yuan/ton.

PP: The market focus slightly declined this week and is expected to continue a weak trend next week.

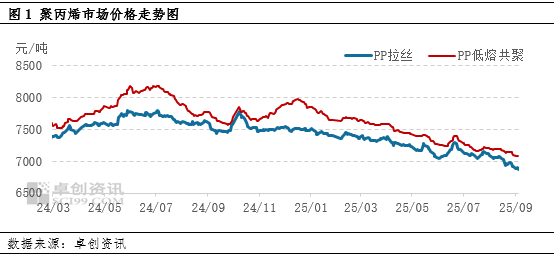

1Market Review: This week, the domestic PP market showed a weak trend, with the price focus continuing to decline.

This week, the domestic PP market was weakly consolidated, with price levels continuing to decline.As of this Thursday, the weekly average price of East China drawing wire was 6,890 RMB/ton, down 72 RMB/ton from the previous week, a decline of 1.03%. The regional price difference for drawing wire remained largely unchanged. In terms of varieties, the production level of low-melting copolymer continued to decline during the week. Traders maintained some price support intentions, resulting in a smaller price drop compared to drawing wire. The price gap between drawing wire and low-melting copolymer continued to widen.

2. Market Outlook: The supply and demand fundamentals are weakly supportive, and the market is expected to trend weakly next week.

The PP market is expected to remain weak next week.Taking East China as an example, the wire drawing price is expected to operate in the range of 6,750-6,950 yuan/ton next week, and the low-melt copolymer price is expected to operate in the range of 6,950-7,150 yuan/ton, with the average price expected to be around 7,070 yuan/ton. On the cost side, crude oil prices are expected to fluctuate, providing limited guidance for PP costs. On the supply side, some facilities are scheduled for maintenance next week, with the intensity of maintenance expected to increase, leading to a slight reduction in supply. On the demand side, most downstream sectors have limited follow-up on new orders. Although some enterprises have new orders, profits are slim, resulting in weak procurement enthusiasm downstream and overall weak demand performance. In summary, although supply-side pressure may ease somewhat next week, demand remains weak, restricting market upward movement. Coupled with limited cost-side guidance, the PP market is expected to maintain a weak trend next week.

PS: The market has slightly declined; selling at low levels is still acceptable.

1. This Week's Hot Topics

During this period, the domestic PS market declined slightly, with a decrease of around 100 yuan/ton.

This week, China's PS industry produced 96,000 tons, an increase of 2,000 tons compared to last week. The industry operating rate was 61%, up 1.1% from last week.

This week, China's PS finished product inventory was 89,000 tons, stable compared to last week.

2. Weekly Market Review

Figure 1: PS for 2023-2025DailyEast China Market Price Trend Chart (Unit: Yuan/Ton)

![[PS周评]:成本连续下行 市场小幅下跌(20250822-0828) [PS周评]:成本连续下行 市场小幅下跌(20250822-0828)](https://oss.plastmatch.com/zx/image/04c41c800b3a4f3f85860842d682990d.png)

During this period, the domestic PS market experienced a slight decline of around 100 yuan/ton. On the cost side, the weakening of benzene and high inventory levels of styrene, coupled with a bearish sentiment among investors, led to a fluctuating downward trend in styrene prices. On the supply and demand front, the continued production increase from Huizhou and Xinpu plants resulted in industry supply growth; however, market shipments at low prices remained acceptable, inventory fluctuations were minimal, and the recovery in demand was relatively limited. According to Longzhong Information, on September 4, 2025, the East China market saw pure benzene drop by 90 yuan to close at 7,580 yuan/ton, and modified benzene drop by 100 yuan to close at 8,400 yuan/ton.

3. Market Forecast for Next Week

The PS market is expected to remain range-bound in the next period. On the cost side, with some styrene units experiencing short-term and planned shutdowns, there is an anticipated increase in demand, which may lead to a slight rebound in prices. On the supply and demand side, Renxin's production capacity is increasing, and the industry's overall supply continues to rise. However, the recovery in downstream demand is limited, resulting in an overall loose supply-demand balance. The market is likely to fluctuate within a narrow range.

ABS: ABS lacks positive support; prices continue to decline this week.

1. This Week's Hot Topics:

1) The market prices fell this week.

2) Industry output declined this week

3) This week, the inventory of the petrochemical plant has increased.

2. This week's ABS market trends:

During this period (August 28, 2025 - September 4, 2025), ABS prices declined across the board. At the beginning of the week, manufacturers lowered the listed prices, and market transactions were very weak. There was a predominance of negative factors within the market, causing traders to cut prices to clear inventory. Home appliance manufacturers maintained generally moderate purchasing, mostly staying calm and observing. The supply of ABS clearly exceeded demand. Manufacturers’ profits approached the cost line this week, and external raw material procurement enterprises were on the brink of losses. Some manufacturers continued to operate at reduced capacity. Currently, manufacturers in the industry face significant cost pressures. It is expected that the room for further price declines is limited, but due to the limited reduction in losses, industry supply pressure remains high, and there is certain resistance to price increases. Prices are fluctuating at a low level with a downward trend. Market prices show that domestic material ranges between 8,900 and 9,600 RMB/ton, while imported materials range between 9,800 and 10,350 RMB/ton.

Current Week Domestic ABS Market Price Comparison Table

3. Market Outlook: The next phase of ABS supply and demand is expected to remain in surplus, with overall transactions driven by rigid demand. Key points of concern: 1. Supply side: Tianjin Dagu is expected to increase its operating rate next week, and the overall industry supply is projected to rise. 2. Demand side: The ABS market is still in the off-season for procurement, with weakened demand expectations. 3. Cost side: Prices of styrene and butadiene are fluctuating within a narrow range, while acrylonitrile remains relatively weak. It is expected that cost-side support will be moderate next week. Market sentiment: With expectations of new capacity releases and continued off-season consumption, pessimism dominates the market. It is anticipated that ABS market prices will remain in a narrow consolidation range, with possible localized slight declines in the near term.

EVA: Petrochemical prices remain firm, with the market steady to slightly stronger.

1. Analysis of the EVA Market Trends This Week

![[EVA周评]:石化强势补涨 市场涨后整理运行(20250822-20250828) [EVA周评]:石化强势补涨 市场涨后整理运行(20250822-20250828)](https://oss.plastmatch.com/zx/image/233a192ea3a0484fb92e20bd518f0525.png)

Source: Longzhong Information

This week, the domestic EVA market operated steadily. At the beginning of the week, influenced by the continued increase in EVA petrochemical ex-factory prices and settlement prices, market traders raised their offers. However, downstream foam factories resisted high-priced sources. Some factories and profitable traders actively sold goods, and with a mindset of securing profits, some engaged in concession sales, causing the market trading focus to decline slightly. As of this Thursday, mainstream prices closed at: soft material reference at 10,900-11,300 yuan/ton, remaining stable compared to last week. The reference price for hard materials is 10,200-11,100 yuan/ton, remaining unchanged from last week. Photovoltaic price Negotiations are mainly referenced at 10,300-10,400 yuan/ton, up by 100-200 yuan/ton compared to the previous period.

Domestic Regional Price Change Comparison Table

2. Market forecast for next week

Next week, the supply side will still be dominated by inventory confidence supporting the market, with ex-factory and settlement prices likely to continue rising. Production units remain stable and normal, with some operating rates expected to increase, leading to added supply. On the demand side, photovoltaic demand is expected to maintain a good purchasing rhythm, while foaming demand may resist high prices, maintaining only rigid demand for follow-up purchases. Holders remain cautious, focusing on stable operations, and willingness for arbitrage sales has increased. The market’s room for further price increases in quotations is likely limited. Overall, it is expected that the domestic EVA market prices will fluctuate sideways next week.

Engineering materials

PC: Price narrow weak consolidation

1. Review of the Domestic PC Market: Market Slightly Declined

This week, the domestic PC market experienced a narrow decline. As of September 4, taking the Covestro 2805 in the East China market with foreign capital sources as an example, the closing price was between 14,000-14,100 yuan/ton, with an average price of 14,110 yuan/ton this week, a decrease of 1.26% compared to the previous week. For domestic sources in the East China market, such as Luxi 1609, the closing price was between 11,000-11,000 yuan/ton, with an average price of 11,000 yuan/ton this week, a decrease of 0.09% compared to the previous week.

2. Analysis of Driving Factors: Downstream peak season is not strong, rigid demand procurement

This week, the domestic PC market experienced a slight decline, mainly due to downstream rigid demand supporting the market. Most factories kept their offers stable, with a few factories slightly lowering prices, and traders’ quotations fluctuated marginally. The traditional peak season is not as strong as expected, with limited demand recovery, resulting in a stalemate in PC market transactions. Some actual orders saw slight price concessions. During the week, the price of upstream raw material bisphenol A increased, leading to greater cost pressure for the PC market; however, due to the deadlock between supply and demand, the market found it difficult to follow the upward trend.

3. Market Outlook: The market may fluctuate within a narrow range at low levels.

The domestic PC market is expected to remain weak and consolidate next week. Recent price changes in the PC market are mainly driven by supply and demand factors. Downstream demand appears less robust than expected for the peak season, and the market is primarily supported by rigid demand. The overall supply of PC is relatively abundant, and sellers maintain an active selling attitude. It is expected that market prices will slightly weaken in negotiations next week. However, there is still some upward potential for the raw material bisphenol A, and the cost pressure on PC is significant, so the decline in the PC market is expected to be limited. In the short term, the price of domestically produced goods in East China is expected to range between 10,500 and 11,000 yuan per ton.

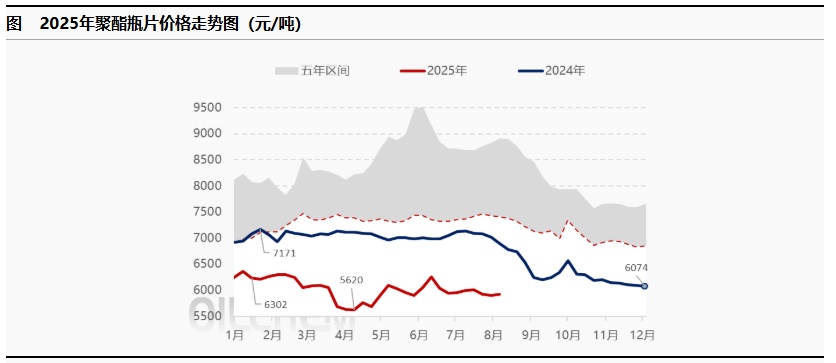

PET: The polyester bottle chip market is on a weaker trend.

This week Market Focus:

Production: Capacity utilization rate is 72.08%.

Raw materials: PTA industry startThe work rate is 69.48%.

2. Market Analysis

During this period (August 29 to September 4, 2025), polyester bottle chip prices declined. Thursday, September 4 East China Market PET Bottle Grade Spot The price is 5,790 yuan/ton, down 70 yuan/ton from last week, a decrease of 1.19%. In detail, the East China polyester bottle market has been fluctuating strongly this period, with price fluctuations ranging from 5,740 to 6,030 yuan/ton. Demand is relatively weak, with just-needed replenishment at low prices. The cost-side support is gradually weakening, but fortunately, several supply-side device anomalies support the market's price retention mentality. However, the macro and crude oil bearish factors at the end of the period affected the market.Cost collapse: polyester bottle flakes sharply decline with costs, the drop exceeds market expectations. This, in turn, prompted concentrated buying on dips.

3. Future Forecast:

Supply Side: There are no changes in production facilities, supply is stable, and the availability of goods is gradually increasing.

Demand side: It is the peak season for terminal demand, with downstream soft drink industry operating rates stable at around 85-95%, and oil plant operating rates likely to remain at about 64%; PET sheet industry operating rates are at 65-75%.

Cost Perspective: Crude oil is expected to decline, but the main raw material PTA has support due to tight supply and demand. The tight supply of PX is slightly easing. Overall, the cost side of polyester is expected to fluctuate strongly.

Next week's forecast: Demand is primarily rigid when it dips, mainly digesting previously stocked raw materials. There is weak rebound support in polyester raw materials, combined with the expectation of reduced supply. Overall, it is expected that the polyester bottle chip market price in East China will show a strong oscillating trend next period, with spot water bottle material priced at 5750-5950 yuan/ton.

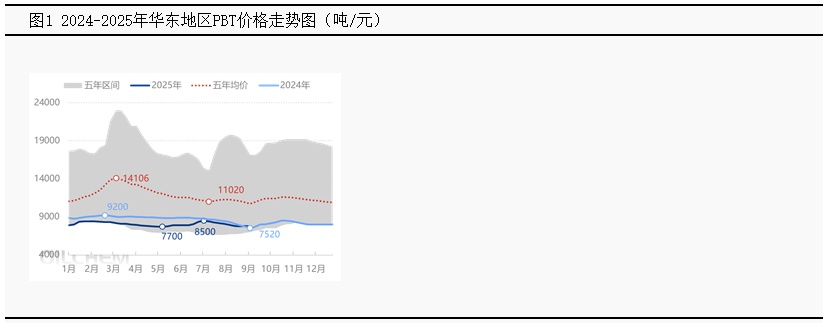

PBT: Supply and demand both increase, and the PBT market stabilizes and consolidates.

1. Review of Market Trends This Week

This week, the East China PBT market stabilized and consolidated, with mainstream prices for low to medium viscosity PBT resin in East China closing at 7,650-7,900 yuan/ton. On the supply side, the Lanshan Tunhe PBT facility has completed maintenance, leading to an overall increase in supply. On the raw materials side, the BDO market remained stagnant after a decline this week, while the PTA market mainly weakened with fluctuations. This week, the cost support was relatively stable, with supply increasing and demand gradually recovering, as downstream and end users continued to follow up on just-in-time needs. The overall market atmosphere was relatively calm, with growth on both the supply and demand sides, and the ongoing tug-of-war between the two, resulting in a stable market operation.

2. Market Forecast for Next Week

The PBT market is expected to be relatively strong and observant in the next period, with little change in raw materials and supply-demand dynamics. The PBT market is expected to operate on a relatively strong note. Key focuses include: 1. Supply side. Previous PBT maintenance facilities have all been operational, and the supply volume is expected to be stable with a potential increase. 2. Demand side. Demand is entering the traditional peak season in September, with overall demand recovering slowly. PTA The market is expected to have a weak rebound; the negotiation and game of BDO continue, keeping the market in a stalemate, with the overall support for PBT market prices remaining stable.

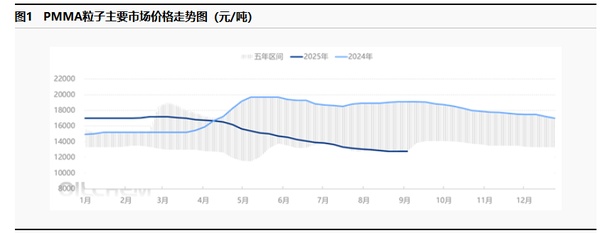

PMMA: PMMA market consolidates sideways

1.This Week's Market Focus

The raw material MMA fluctuates within a narrow range, providing limited cost support.

PMMA operations remain stable, with a capacity utilization rate of 62%.

Downstream enterprises mainly consume inventory, with insufficient enthusiasm for entering the market.

2. Market Analysis for This Week

In this period, the domestic PMMA particle market has been operating sideways, with price fluctuations ranging from 12,600 to 13,800 yuan/ton. Recently, the volatility on the raw material side has slowed down, providing limited stimulus to the market from a cost perspective. Suppliers have not yet made clear releases, focusing mainly on selling, and holders are following the market trends, with quotation ranges stabilizing compared to the previous period. The demand side is progressing slowly, mainly digesting inventory, with just-in-time purchases leading to flexible procurement, and large orders being rarely heard.

3. Market Forecast for Next Week

The PMMA particles are expected to remain stable to slightly weak in the next period. On the cost side, the domestic MMA market is expected to be slightly weak next week, with reduced cost-driven growth. On the supply side, production changes in operating enterprises are expected to be minimal, but the possibility of some units increasing their load cannot be ruled out. On the demand side, end-user factories are purchasing based on rigid demand, but overall transactions are unlikely to increase significantly.

POM: Maintenance Support Limits Market Decline

1. Market Focus This Week

1) The operating load of the petrochemical plant has decreased.

2) The market is in a strong wait-and-see mood. ;

3) The mentality of end users taking over is not very positive. 。

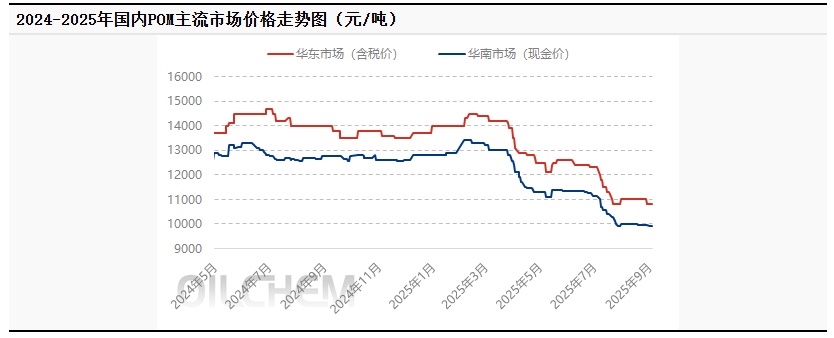

2. Market Analysis for This Week

Weekly Price Fluctuation Table of Domestic POM Market

The POM market has been operating weakly this period. This week, supply-side support has increased as Tangshan Zhonghao's POM plant temporarily shut down and Xinlianxin's POM plant underwent maintenance, leading to a tightening of overall supply. However, sales across various regions have not improved, and traders are lacking motivation to operate, with some offering increased discounts ranging from 50 to 400 yuan/ton. Some offers remain stable due to tight supply, but considering that end factories have sufficient stock and are resistant to current prices, users are mostly adopting a cautious and wait-and-see attitude, negotiating on a case-by-case basis.

3. Market Impact Factors Analysis

1) This week, the POM market declined weakly, with mainstream grades dropping by 200 yuan/ton compared to last week.

2) This week, the capacity utilization rate of China's POM industry is 83.63%, a decrease of 5.74% compared to last week's operation rate.

3) This week's average domestic POM gross profit is 106 yuan/ton, a decrease of 166 yuan/ton compared to last week.

4. Market Forecast for Next Week

The POM price is expected to remain largely stable with a slight decline in the next period. Key points to watch: 1. Supply side: The Xinlianxin POM plant will be shut down for maintenance next period, while the Tangshan Zhonghao POM plant is planned to resume operation. The loss from maintenance will increase, strengthening supply support. 2. Demand side: Terminal factories' inventory digestion will be slow next period, with some users still holding resistance, resulting in limited short-term purchasing interest and relatively limited active trading. 3. Cost side: Upstream raw material methanol is fluctuating slightly downward. Given the continuous shrinking profit margins of POM, support is relatively limited. 4. Macro environment: It is reported that low-priced import offers will increase in the future market, leading to relatively intense price competition and greater pressure on transactions.

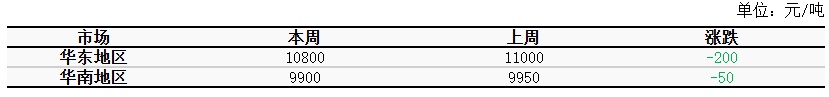

PA6: Both bullish and bearish sentiments coexist in the market, with the PA6 market showing a slight weakening trend.

1. Market Focus This Week

Sinopec has reduced the prices of pure benzene at its East China and South China refineries by 100 yuan/ton, implementing a new price of 5,900 yuan/ton, effective from September 4. The monthly settlement price for Sinopec caprolactam is 9,330 yuan/ton, while Shenyuan's weekly listed price is 9,200 yuan/ton. The spot price of caprolactam in East China is 8,650 yuan/ton. (Unit: yuan/ton)

2) For conventional PA6 spinning chips in East and Central China, some are priced at 9,200-9,550 RMB/ton for spot delivery with immediate payment, and some high-end chips are at 9,300-9,600 RMB/ton for cash pick-up. For PA6 high-speed spinning regular chips, prices are 9,100-9,300 RMB/ton ex-works with immediate payment, and premium chips are 9,600-9,900 RMB/ton delivered with acceptance.

3) Supply and demand situation: According to Longzhong statistics, the production of caprolactam this week was 131,100 tons, and the production of polyamide 6 chips was 125,600 tons. The operating rate of nylon filament was 78%. This week, the operating rate of the domestic weaving industry was 62.42%, up by 0.44% compared to last week.

2. This Week's Market Analysis

During this period, the PA6 chip market operated slightly weaker, with mainstream prices at 9,375-9,400 yuan/ton (cash, short delivery). From the cost side, raw material caprolactam prices declined, polymerization enterprises continued to suffer losses, and cost pressure persisted. However, downstream demand was average, with limited terminal orders restraining downstream procurement, so replenishment was mainly based on rigid demand. Some enterprises with lower-priced chips maintained stable quotations for the time being, while slightly higher-priced chips saw limited negotiations and sales, resulting in mediocre market transactions. This period, the PA6 high-speed spinning chip market trended downward, with mainstream prices at 9,750-9,900 yuan/ton (cash, short delivery). Raw material prices fell, coupled with average downstream demand. Polymerization enterprises saw slow sales and had to negotiate shipments. Multiple negative factors from both cost and demand led to a decline in market transaction prices.

3. Next week's forecast:

The PA6 market is expected to experience slight adjustments in the coming week, with mainstream prices for conventional spinning chips likely to remain in the range of 9,300-9,350 RMB/ton for cash and short delivery. Mainstream prices for high-speed spinning chips of premium quality are expected to be in the range of 9,650-9,750 RMB/ton for acceptance and delivery. 。 Key Focus: 1. Supply side. The overall supply is expected to increase next period, mainly due to the load increase in Luxi during this cycle, leading to a rise in overall supply. 2. Demand side. Orders from downstream manufacturers are limited, with raw material purchases primarily based on phased, just-in-time restocking. 3. Cost side. The caprolactam market is expected to undergo slight consolidation next period, with slice losses and cost pressures still present. Going forward, attention should be paid to the impact of costs and supply-demand dynamics on market sentiment.

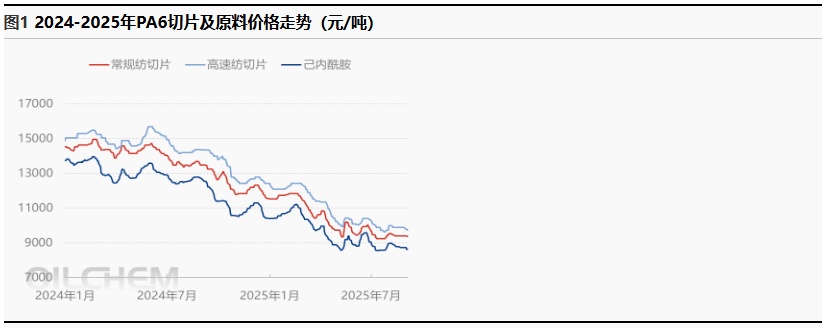

PA66: Downstream demand remains weak; the market is weak and consolidating.

1. Market Focus This Week

1) Production:This period's PA66 production was 16,500 tons, with a capacity utilization rate of 60%, slightly lower than last week.

2) Demand: Terminal market demand is generally moderate, and downstream buyers mostly purchase according to their needs.

2. This Week's Market Analysis

The current East China PA66 market spot prices are weak, with a weekly average price of 15,150 yuan/ton, down approximately 0.46% compared to last week. During the week, raw material prices fluctuated, and cost pressures remained. Although some companies have halted production and capacity utilization rates have declined, spot supply in the market remains ample. The industry sentiment is cautious, and the market continues to consolidate weakly.

3. Analysis of Market Influencing Factors

① The operation of raw materials adipic acid and hexamethylene diamine is organized, with relatively high pressure on the cost side.

② Terminal market demand is generally moderate, and downstream buyers mostly purchase based on actual needs.

The operating rate of the aggregate 66 enterprises has declined, but the spot supply in the market remains sufficient.

4. Market Forecast for Next Week

The PA66 spot market is expected to have an oversupply in the next period, with significant cost pressures and a weak market stalemate. Key points to focus on: 1. Supply side. The capacity utilization rate of polymerization enterprises is expected to remain relatively stable, with ample spot market supply. 2. Demand side. There is no significant recovery in end-user demand, and downstream procurement is expected to continue on a just-in-need basis. 3. Cost side. The raw material market is operating steadily, with cost pressures remaining unabated.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track