Third Quarter Ocean Freight Rates Drop, But Polyolefin Export Market Remains Weak

Introduction:

Export freight rates:

As of the week ending September 26, the demand for China's export container shipping has weakened, ocean route market freight rates continued to adjust, and the composite index continued to decline.

The European route has seen weak economic data recently, leading to a lack of momentum in transportation market demand growth. This week, the supply and demand fundamentals are weak, and spot market booking prices continue to decline. On September 26, the freight rate (including sea freight and surcharges) from Shanghai Port to major European ports was $971/TEU, down 7.7% compared to the previous period. The Mediterranean route is similar to the European market, with freight rates continuing to adjust. On September 26, the freight rate (including sea freight and surcharges) from Shanghai Port to major Mediterranean ports was $1485/TEU, down 9.3% compared to the previous period.

The transportation demand on the Persian Gulf route remains weak, and spot market freight rates have undergone a significant adjustment, with a slightly smaller decline compared to the previous period. On September 26, the market freight rate (ocean freight and surcharges) from Shanghai Port to the main ports in the Persian Gulf was $843/TEU, a decrease of 14.9% compared to the previous period.

The South American shipping route is experiencing weak growth in the transportation market, with supply and demand maintaining a weak balance. Spot market booking prices continue to decline. As of September 26, the market freight rate (including shipping and surcharges) from Shanghai Port to major ports in South America is $2,133 per TEU, down 14.6% from the previous period.

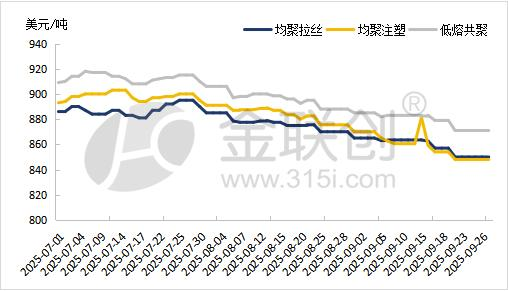

Regarding the export prices of polyolefins:

LLDPE Export Price Trends at FOB Tianjin Port from July to September 2025

Data source: Jin Lian Chuang

FOB Tianjin Port PP export price trend from July to September 2025

Data Source: JLC (Jinlianchuang)

In September, China's export container index saw a slight decline due to continuously falling domestic prices and a weak performance in the export market. Quotes decreased compared to August, with actual transactions experiencing discounts of varying amounts up to $10 per ton. The weakness in overseas markets has also intensified competition among exporters.

In the third quarter, although sea freight rates showed a downward trend, it did not improve the current situation of sluggish exports. Export prices continue to be adjusted downward due to weak demand and intensified competition, compressing export profits. It is still the seasonal off-peak period for exports, and exporters are still waiting for a possible window period in the fourth quarter.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track