Can't Hold On! Daomo Chemical Germany Company Files for Bankruptcy, Why Is the European Chemical Industry Heading Towards Despair?

On December 31, Zhuan Su Shijie learned that three German subsidiaries of Domo Chemical Group have officially filed for bankruptcy protection. These subsidiaries are Domo Chemicals GmbH, Domo Caproleuna GmbH, and Domo Engineering Plastics GmbH. This bankruptcy will directly affect approximately 585 employees.

This event not only affects the employment fate of 585 employees but also clearly reflects the structural survival dilemma faced by European chemical companies under the triple pressures of energy costs, global competition, and industry demand. It also sends a strong signal of the restructuring of the global plastic industry landscape.

Event summary: Key facts regarding the bankruptcy of Daimler's German subsidiary.

DOMO Chemicals, as a global leader in high-performance polyamide materials, primarily offers a product line that includes Polyamide 6 (Nylon 6), Polyamide 66 (Nylon 66), specialty plastics, and intermediate chemicals. These products are widely used in automotive, electronics, electrical, consumer goods, and industrial sectors. Globally, DOMO Chemicals has production bases in Europe, America, and Asia, including a new factory opening in April 2024 in Haiyan, Jiaxing, Zhejiang, with an initial TECHNYL® polyamide production capacity of 25,000 tonnes, planning to gradually increase to 50,000 tonnes. On May 8th this year, its factory in Mumbai, India completed the second phase of expansion, broadening its engineering materials product portfolio based on polyamide and other resins.

Due to the bankruptcy proceedings of its three German subsidiaries, Domer Chemical has clearly stated that the continued weak demand in the European chemical industry and competitive pressure from imports of polyamide resin from non-EU countries, especially China, are the main reasons. It is reported that Domer Chemical initiated restructuring efforts in early 2024, attempting to address market challenges through internal adjustments. However, the recent breakdown of negotiations for additional short-term financing became the last straw, directly forcing its German subsidiaries to seek court protection from bankruptcy.

From a business operations perspective, the daily production and customer delivery at the current two production bases have not yet been interrupted. DOMO has set up the production of key chemical intermediates such as cumene, phenol, acetone, cyclohexanone, caprolactam, as well as core plasticizing products like nylon 6 resin and engineering plastics at these two bases. The continuity of its business has a certain impact on the downstream industrial chain.

Interim insolvency administrator Flöther also acknowledged that Dowmer has a team of highly capable employees and a strong and reputable customer base, but the current operating environment in the chemical industry has become so severe that it is difficult for the company to continue functioning.

Shutdown Wave Sweeps: European Chemical Giants Retrench

The year 2025 will be a "shutdown year" for European chemical companies, with several chemical giants announcing capacity adjustment plans in Europe.

On October 2, Dow Chemical announced that it will permanently close its polyether polyol (55,000 tons/year) plant in Belgium by the end of the first quarter of 2026. This move will affect 37 employees and 8 contractors. Additionally, Dow Chemical plans to close an ethylene cracker unit in Böhlen, Germany (ethylene 510,000 tons/year, propylene 250,000 tons/year) and chlorine and vinyl assets in Schkopau, Germany (chlorine 250,000 tons/year, caustic soda 275,000 tons/year) by the end of 2027; and to close a basic silicones plant in Barry, UK by mid-2026.

In July of this year, Celanese decided to indefinitely shut down its vinyl acetate monomer plant located in Frankfurt, Germany. The facility was temporarily idled in 2024, and this decision marks its official retirement. The reason cited is the "continued weakness in the European VAM market and high costs."

Ineos plans to shut down its 650,000 tonnes per annum phenol/acetone plant in Gladbeck, Germany in July 2025; the 350,000 tonnes per annum ethylene unit in Grangemouth, UK (planned to be completed by the end of 2026); and the 500,000 tonnes per annum olefin unit in Lavéra, France. Additionally, in January 2025, it will close the last synthetic ethanol plant in the UK.

In July of this year, Arkema announced that it will restructure its French plant, shutting down the production of chlorine, soda, chloromethane, and technical fluids.

BASF announced between June and July this year that it would close or sell multiple production lines at its integrated site in Ludwigshafen, Germany. The listed facilities include adipic acid, cyclododecanone, cyclopentanone, caprolactam, synthetic ammonia, and TDI.

In June this year, Xihu Company announced the closure of its bisphenol A and liquid epoxy resin units at the Pernis plant in the Netherlands, and it will not restart the allyl chloride and epichlorohydrin units that were shut down in July 2024. The entire plant will be closed in 2025.

In June this year, Trinseo confirmed that its 160,000-ton/year polycarbonate plant in Stade, Germany, would be permanently shut down. The company stated that declining demand in Europe and the price differential between energy and raw materials have led to "long-term losses" at the site.

In the second quarter of this year, LANXESS announced that it will bring forward the closure plan of its caprolactam plant at the Krefeld-Uerdingen site in Germany to the end of the second quarter of 2025.

In May of this year, after evaluation, Huntsman decided to close the maleic anhydride plant in Moers, Germany, by the end of the second quarter. Additionally, the PU plant in Otterup has also been announced to be shut down.

In February this year, Chemours announced its European strategic adjustment, shelving the expansion plan for its French plant and deciding to exit the Surface Protection Solutions business.

.......

Daumer Chemical is neither the first nor the last European chemical company to encounter difficulties. Previously, Fibrant announced on October 21 its plan to permanently close its caprolactam plant in the Netherlands. This series of shutdowns reflects the systemic challenges facing the European chemical industry.

Deep tracing:

The Triple Predicament of European Chemical Industry's Decline

The decline of European chemical companies is not accidental, but rather the result of multiple factors combined.

Dilemma 1: High energy and compliance costs squeeze profit margins.

The energy-intensive nature is a typical attribute of the chemical industry, and European chemical companies are facing energy cost pressures far exceeding those in other regions worldwide. The rise in energy prices, particularly natural gas, in Europe has increased the cost of chemical production. Taking Germany as an example, industrial electricity prices in 2022 increased by nearly 40% compared to 2021. Although energy prices have somewhat declined from their peak in 2022 since 2024, natural gas and electricity costs remain significantly higher than levels before 2022. Data from CERA, a subsidiary of S&P Global Energy, indicates that the production cost of phenol in Europe is approximately 41% higher than in Southeast Asia and 45% higher than in the Middle East. The main reason is the persistently high costs of energy and raw materials, compounded by the widespread aging of European phenol facilities and their relatively low energy efficiency.

At the same time, the stringent environmental policies and compliance requirements of the European Union have further increased the burden on enterprises. In 2021, the European Commission released a climate change package proposal, requiring the EU's net greenhouse gas emissions by 2030 to be reduced by 55% compared to 1990 levels, renewable energy to account for 40% of EU energy consumption by 2030, and zero greenhouse gas emissions for new cars by 2035. The proposal also introduced the first related trade measure—the EU Carbon Border Adjustment Mechanism (CBAM). Europe's demands for environmental protection and sustainable development are becoming increasingly strict, forcing traditional chemical companies to invest more funds in technological upgrades and environmental modifications.

Dilemma Two: Global Competition Imbalance, Intensified Impact of Asian Production Capacity

In the context of the restructuring of global chemical production capacity, European chemical companies are facing intense competition from Asian and Middle Eastern enterprises. Middle Eastern companies have built a cost advantage in the field of basic chemicals by leveraging inexpensive natural gas resources, while China, as the world's largest chemical producer, has been continuously expanding its capacity in core products such as polyamide. By relying on large-scale production and cost advantages, China is adopting a low-price strategy to capture global market share.

Taking the nylon market as an example, although European products still have a quality advantage, the price advantage of Chinese imports has formed a significant impact. Data shows that from March 2024 to December 2025, European spot prices for phenol and acetone dropped by approximately 49% and 61.5%, respectively, with market supply continuing to be excessive. This is a direct reflection of global capacity imbalance and import impact. More noteworthy is the increasingly evident trend of the global industrial center shifting eastward. According to data from the European Chemical Industry Council (Cefic), the EU's share of global chemical sales decreased from 17% to 14% between 2012 and 2022. Meanwhile, in 2024, Asia's share of global plastic production reached 57.2%, with China alone accounting for 34.5%, nearly three times that of the EU.

Predicament Three: Weak Demand and Continued Contraction of the Downstream Market

Economic uncertainty in Europe has led to continued sluggish demand in the downstream chemical industry. High inflation and rising interest rates have dampened the production willingness of manufacturing sectors such as automotive and construction. In 2023, EU chemical production fell by 8.7% year-on-year, and although there is a slight recovery in 2024, it has not yet returned to pre-pandemic levels, with order volumes continuing to shrink. The weakness in demand has further exacerbated the market surplus, squeezing corporate profit margins.

Pattern Reconstruction:

European Capacity Adjustments Trigger Global Restructuring of the Plastics Industry Chain

The wave of shutdowns in Europe and other regions is leading to a restructuring of global chemical production capacity. On one hand, European companies are focusing more on the research and production of high value-added, environmentally friendly products to meet increasingly stringent environmental requirements and market demand. On the other hand, the Asia-Pacific region, due to cost advantages and rapidly growing market demand, has become the focal point for global chemical product production and capacity growth.

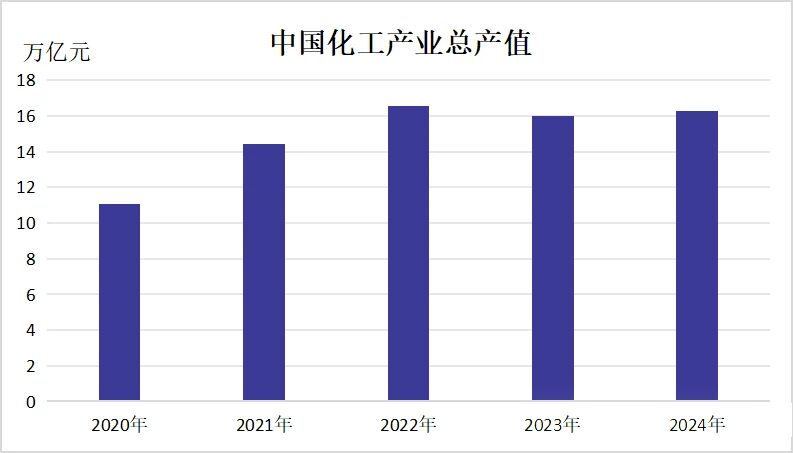

In 2025, the total output value of China's chemical industry has exceeded 19 trillion yuan, accounting for 17.8% of the global market share. With a vast domestic market, complete industrial chain support, and continuous technological advancement, its output value growth rate is far faster than that of Europe and the United States, forming intense competition with European chemical giants in many bulk chemicals and high-end materials fields.

In recent years, companies such as BASF and Saudi Aramco have been increasing their investments in China. The advancement of major projects like BASF's integrated base in Zhanjiang and ExxonMobil's ethylene project in Huizhou signifies that the focus of the global chemical industry is rapidly shifting eastward. For Chinese plastic and chemical enterprises, this presents an opportunity to absorb global capacity transfer and expand their international market share, while also indicating that industry competition will further intensify. Therefore, continuous efforts are needed in technological upgrades and green transformation to enhance core competitiveness.

In the future, the global chemical industry will gradually form a new pattern where Europe focuses on high-end specialty chemicals, while Asia-Pacific and the Middle East dominate the production of basic chemicals. Identifying the right position within this pattern, reducing costs through technological innovation, enhancing product added value, and adapting to changes in global environmental policies will be core issues that all chemical companies will need to address.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

EVA Morning Prices on September 12: Most of the Market Holds Steady, Highest Rise of 50 Yuan

-

[PET Weekly Outlook] Polyester Bottle Chips Expected to Oscillate and Warm Up with Costs Today

-

Top Ten Personnel Changes in the Auto Industry: Insights into Industry Anxiety and Progress | Vision 2025

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Domo Chemicals Files for Bankruptcy Protection in Germany! B. Braun Launches New Supply Assurance Program