The unshakable model y, the bleeding tesla

"Everyone wants to kill Model Y, but what happened in the end?"

Recently, with the release of the August retail data, the Model Y secured the runner-up position in China's car market for single models with an output of 39,413 units. The opening sentence of the article became a heartfelt exclamation for me.

Since achieving domestication, this mid-sized pure electric SUV has faced round after round of attacks from independent brands. Yet, even when trapped in the fiercely competitive mire, it remains unyielding.

Last month, the Model Y L, primarily targeting the six-seater market, made a sudden entry. Based on current feedback, although its overall experience is not as good as competitors like the Li Xiang i8 and Le Dao L90, it has still managed to gain the approval and favor of end consumers, garnering a substantial number of orders.

Honestly, you have to admire it.

The fundamental reason behind this is, on one hand, definitely due to relatively balanced product capabilities. For instance, even though it still uses a 400V platform, the overall energy consumption and range performance of the Model Y remain top-notch among its peers. In comparison, a larger proportion is attributed to the brand. Many users who choose to order this mid-sized pure electric SUV are entirely drawn to the "Tesla" brand name.

This is precisely the moat it currently relies on the most. However, to speak rationally and objectively, although this barrier is enviable, it is not impenetrable.

As the article title suggests, the unshakable position of the Model Y cannot hide Tesla's continued losses in the global market this year.

01"Sooner or later, a piece of flesh will be torn off."

"If the LeDao L60 could carry the Tesla logo, how many units do you think could be sold in a month?"

At the beginning of this month, NIO released its second-quarter financial report. In an interview the next day, Li Bin mentioned the leading position of the Model Y and couldn't help but ask everyone present.

In my opinion, what he really wants to express is that the product strength of the LeDao L60 is excellent and even significantly cheaper, but it lacks in terms of visibility. Tesla's influence, including Musk's personal aura, adds too much to the Model Y, making most of its competitors unable to catch up.

This feeling indeed leaves one helpless, yet it is the eternal survival rule of the automotive industry: "In the end, selling cars comes down to the brand."

In the current era of smart electric vehicles, where actual experiences are becoming increasingly homogenized and the Matthew effect is intensifying, similar phenomena are particularly prominent. The difficulty in shaking the dominance of the Model Y is also such a case.

For many challengers, the existence of a huge cognitive gap has to be accepted, whether they like it or not.

From the perspective of users, there is a significant group of potential customers in the Chinese car market who "only consider Tesla," similar to those consumers who "only choose Apple." No matter what kind of strategies domestic brands employ, this group remains unmoved.

When they purchase a car, their mindset is more like choosing nothing but a Model Y. After all, it's definitely a safe choice, with high retention and resale value, low explanation costs, and it saves a lot of unnecessary trouble.

Even so, when examining the retail data of this mid-sized electric SUV over the past 12 months, it is still evident that since entering this year, fluctuations of a certain magnitude remain in China due to the transition to a refreshed version. The facts prove that "hard to shake does not mean forever."

The same principle applies: we have reason to believe that with the relentless onslaught of domestic brands, the Model Y will eventually be significantly challenged. The current situation of BBA in China serves as a cautionary tale. Although the moat created by the brand is formidable, it is not without flaws and vulnerabilities.

This inevitably raises the question, who is Model Y's most formidable opponent? The answer points directly to Huawei and Xiaomi. In fact, the fierce competition between them is already gradually unfolding.

Taking the example of the YU7, which secured 200,000 pre-orders overnight, its sales in August have rapidly climbed to 16,548 units. If nothing goes wrong and the manufacturing side performs well, it's almost certain to exceed 20,000 units in September.

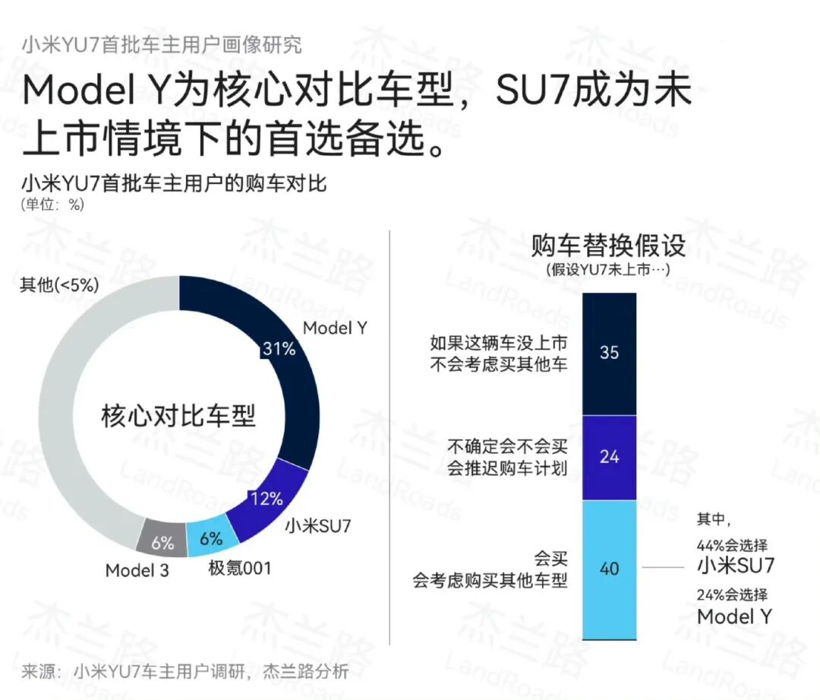

According to the first batch of owner profile research reports for the YU7 released by Jalan Road, the Model Y unsurprisingly became the most comparable core model.

Approximately 35% of users stated that if the YU7 is not launched, they would not choose other products, while 24% said they would postpone their car purchasing decision.

Xiaomi's appeal, including Lei Jun's personal aura, is putting the Model Y up against its toughest battle since entering China.

In contrast, the HarmonyOS Intelligent Driving, which is "even more so," undoubtedly adds fuel to the burning flames. The immediate entry of the Shangjie H5 and Wenjie M7 will also be an extreme stress test against the Model Y from both above and below.

Next year, based on related leaks, the number of products available from HarmonyOS Smart Mobility is expected to exceed 17 models, with new cars launching in all "five domains." Do you think they will further challenge Tesla's territory?

Moreover, it should be noted that although it is temporarily unable to compete at the brand level, the new players led by "NIO, Xpeng, and Li Auto" are also experiencing a major breakthrough on the supply side. The price range of 200,000 to 300,000 yuan has clearly become the main battlefield where everyone is heavily investing.

With the rapid pace of new product launches akin to making dumplings, it's likely enough to give Tesla a run for its money. During this process, how long can the unshakeable Model Y maintain its dominant position? Perhaps the declining sales curve of the Model 3 in China is a cautionary tale.

02"The front yard's beauty cannot cover up the fire in the backyard."

Tesla's current global situation can be summed up in one sentence: "The European market is sluggish, the U.S. market is uncertain, and the Chinese market is full of strong competitors."

In August, there was a brief moment of solace in China.

Specifically, including exports, a total of 84,159 new cars were sold, representing a year-on-year increase of 9.3% and a significant month-on-month increase of 31%, marking a substantial rebound from the sales low point in July.

Once the perspective is broadened, the front yard's scenery cannot conceal the fire in the backyard. Tesla, situated in other sectors, continues to experience ongoing losses.

In the case of the European market, according to relevant data from France, the number of new car registrations in August decreased by 47.3% compared to the same period last year. Ironically, the overall car market sales increased by nearly 2.2%.

In Sweden, while the overall sales of electric vehicles remained flat and the total car market grew by 6%, Tesla's registrations plummeted by 84%. Similarly, in Denmark, Tesla's registrations in August also fell by 42%; in the Dutch market, there was a 50% decline.

In comparison, although Tesla's sales in Norway and Spain have increased, the growth rate is far less than that of BYD, which is also aggressively expanding in Europe this year.

In Norway, where Tesla has consistently invested significant efforts, almost all newly sold cars are electric vehicles. In August, Tesla's registration volume in Norway increased by 21.3%, while BYD's registration volume surged by 218%.

In Spain, due to a subsidy of up to 7,000 euros for electric vehicles, Tesla's sales in August increased from 549 units in the same period last year to 1,435 units, an increase of 161%. In contrast, BYD's sales grew by over 400%, reaching 1,827 units.

Since the beginning of the year, BYD's cumulative sales in Spain have surged to 14,181 units, an increase of 675%, while Tesla's sales in the region amounted to only 9,303 units, with an increase of just 11.6%.

In summary, considering various signs, its "fall" in Europe this year is already a foregone conclusion. The lack of diversity in products, Musk's remarks, and the pressure from Chinese car companies are all fatal "fuses" behind this situation.

What makes matters worse is undoubtedly the collapse of Tesla in its domestic market.

At its peak, its market share of the pure electric market once reached an astonishing 80%. However, this past August, it dropped to only 38%. It is reported that this is the first time it has fallen below the 40% mark since the mass production of the Model 3 began in October 2017.

According to research from relevant organizations, more and more domestic consumers in the United States are beginning to choose new products from competitors rather than Tesla's older models.

In other words, the disappearance of the "novelty" is the main culprit for the significant decline in its pure electric market share.

However, as Tesla shifts its strategic focus, autonomous taxis and humanoid robots are being placed in increasingly important positions. Recently, Musk reiterated that the scaling up of FSD and Optimus will be the highest priority for the entire company.

"In the future, 80% of the market value will be supported by these two."

Last Friday, the Tesla board proposed an unprecedented compensation plan: "If the company's market value rises to $8.5 trillion within ten years, Musk could receive additional stock incentives worth a trillion dollars."

Such a lucrative opportunity instantly sparked widespread discussion.

In everyone's view, the most concerning issue is: "The dream of poetry and distant places that Tesla tirelessly promotes is certainly beautiful, but how exactly do we get through this difficult period right now?"

After all, at its core, it is still a car company. If the foundation is unstable, no amount of plans will stand. I always feel that today's protagonist in the article still needs a blockbuster vehicle to reclaim lost ground. I'm increasingly curious, will the rumored "affordable car" actually be released this year?

As for how long Tesla will have to endure this difficult "down cycle," honestly, up to now, no strong points or signals for a breakthrough and breakout have been found.

In the last four months, the European market has been sluggish, and the American market is in turmoil, seemingly still difficult to change. Relying solely on the struggling support of the Chinese market, it will eventually face the day of gradual exhaustion.

I have always firmly believed that the entire vehicle business is the absolute support for the continuous advancement of its various new businesses.

Nowadays, the stagnation or even regression of this line makes it difficult for Tesla to enter the previously anticipated virtuous cycle, always giving the outside world a sense of trying to cover one thing and losing sight of another.

Interestingly, just yesterday, according to the latest news, Musk purchased an additional 2.5 million shares, with a total value of approximately $1 billion.

The helmsman appears to be full of confidence about the company's future. As for the outcome, let's wait and see...

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track