The Three Global Orthopedic Giants | Johnson & Johnson, Stryker, and Zimmer Biomet All Achieve Stable Growth in Their Latest 2024 Financial Reports

So far, the three giants of orthopedics have announced their 2024 performance, with Johnson & Johnson and Stryker both achieving sales of $9.1 billion, neck and neck, while Zimmer Biomet also reached $7.7 billion. Trauma products account for a high proportion, with Zimmer Biomet leading in knee joints. International orthopedic giants are responding to the challenges of centralized procurement, achieving stable growth.

So far, the three giants of orthopedics have announced their 2024 performance, with Johnson & Johnson and Stryker both achieving sales of $9.1 billion, neck and neck, while Zimmer Biomet also reached $7.7 billion. Trauma products account for a high proportion, with Zimmer Biomet leading in knee joints. International orthopedic giants are responding to the challenges of centralized procurement, achieving stable growth.

In January, Johnson & Johnson announced its 2024 performance, with total annual revenue of $88.821 billion, up from $85.159 billion last year, representing a 4.3% year-over-year increase. The full-year net profit was $14.066 billion, up from $13.326 billion last year, representing a 5.6% year-over-year increase. Johnson & Johnson's two core business segments - innovative pharmaceuticals and medical technology - achieved revenues of $56.964 billion (+4.0%) and $31.857 billion (+4.8%), respectively.

In January, Johnson & Johnson announced its 2024 performance, with total annual revenue of $88.821 billion, up from $85.159 billion last year, representing a 4.3% year-over-year increase. The full-year net profit was $14.066 billion, up from $13.326 billion last year, representing a 5.6% year-over-year increase. Johnson & Johnson's two core business segments - innovative pharmaceuticals and medical technology - achieved revenues of $56.964 billion (+4.0%) and $31.857 billion (+4.8%), respectively.Johnson & Johnson's Medical Technology segment achieved sales of $31.86 billion in 2024, an increase of 4.8%, with orthopedic business sales reaching $9.158 billion, accounting for 28.7%.

Johnson & Johnson's Medical Technology segment achieved sales of $31.86 billion in 2024, an increase of 4.8%, with orthopedic business sales reaching $9.158 billion, accounting for 28.7%.In orthopedic products, trauma-related items are the most numerous, with sales exceeding $3 billion, accounting for one-third of the total. This is followed by spine, sports, and other categories, which also account for nearly one-third of the total. In 2025, Johnson & Johnson is expected to see an increase of 2.5% to 3.5%, with total revenue projected to reach between $90.9 billion and $91.7 billion.

In 2025, Johnson & Johnson is expected to see an increase of 2.5% to 3.5%, with total revenue projected to reach between $90.9 billion and $91.7 billion.

In 2025, Johnson & Johnson is expected to see an increase of 2.5% to 3.5%, with total revenue projected to reach between $90.9 billion and $91.7 billion.

In 2025, Johnson & Johnson is expected to see an increase of 2.5% to 3.5%, with total revenue projected to reach between $90.9 billion and $91.7 billion.

Details of the Financial Report

Details of the Financial ReportNet sales for 2024 were $22.6 billion, with an organic growth in net sales of 10.2%;

Net sales for 2024 were $22.6 billion, with an organic growth in net sales of 10.2%;The operating profit margin was 16.3%. The adjusted operating profit margin increased by 110 bps to 25.3%;

The operating profit margin was 16.3%. The adjusted operating profit margin increased by 110 bps to 25.3%;The US and international markets both performed exceptionally well, with the US market continuing to show strong double-digit growth at 11%, and the international market also achieving a 9.8% growth at a fixed exchange rate.

The medical devices and neurotechnology business: net sales were $13.5 billion, with organic net sales growth of 11.2%.

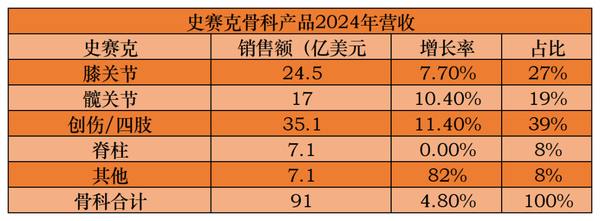

Orthopedics business: net sales were $9.1 billion, with an organic net sales growth of 8.7%, accounting for 40% of the annual sales. Among orthopedic products, trauma and extremities were the highest, reaching $3.5 billion, accounting for nearly 40% of the orthopedics business, and the growth rate exceeded 11%. Knee and hip joints also achieved stable growth. Data source: Pharmaceutical and Medical Device River Record

Data source: Pharmaceutical and Medical Device River Record

2025 Outlook

Based on the strong development momentum in 2024, Stryker estimates that the organic net sales growth rate for 2025 will be between 8.0% and 9.0%, with adjusted diluted net earnings per share expected to be between $13.45 and $13.70.

With the strong development momentum in 2024, Stryker estimates that the organic net sales growth rate for 2025 will be between 8.0% and 9.0%, with adjusted diluted net earnings per share expected to be $13.45 to $13.70.Stryker has completed its acquisition of Inari Medical, which is expected to contribute $590 million in sales in 2025.

Stryker has completed its acquisition of Inari Medical, which is expected to contribute $590 million in sales in 2025.

Zimmer Biomet Holdings announced its full-year 2024 results, with annual net sales of $7.679 billion, up from $7.394 billion the previous year. The full-year operating profit was $1.286 billion, compared to $1.278 billion the previous year. The full-year net income attributable to the company was $904 million, down from $1.024 billion the previous year.

Zimmer Biomet Holdings announced its full-year 2024 results, with annual net sales of $7.679 billion, up from $7.394 billion the previous year. The full-year operating profit was $1.286 billion, compared to $1.278 billion the previous year. The full-year net income attributable to the company was $904 million, down from $1.024 billion the previous year.The company achieved sales of $7.678 billion in 2024, a year-on-year increase of 3.8%, with the knee business being the largest, reaching $3.173 billion, accounting for 41% of the company's total sales.

Knee: Zimmer Biomet had the highest sales at $3.173 billion, accounting for 41% of the company's total, Stryker at $2.45 billion, and Johnson & Johnson the least, at $1.545 billion.

Knee: Zimmer Biomet had the highest sales at $3.173 billion, accounting for 41% of the company's total, Stryker at $2.45 billion, and Johnson & Johnson the least, at $1.545 billion.Hip: Zimmer Biomet also led with $2 billion, while Johnson & Johnson and Stryker were not far apart, at $1.638 billion and $1.7 billion, respectively.

Hip: Zimmer Biomet also led with $2 billion, while Johnson & Johnson and Stryker were not far apart, at $1.638 billion and $1.7 billion, respectively.In other products, Stryker's trauma and extremities segment reached $3.51 billion, and Johnson & Johnson's trauma was the highest at $3 billion.

In other products, Stryker's trauma and extremities segment reached $3.51 billion, and Johnson & Johnson's trauma was the highest at $3 billion.The domestic orthopedic consumables centralized procurement has impacted the industry structure, but the three international orthopedic giants have achieved stable growth through various strategies.

The domestic orthopedic consumables centralized procurement has impacted the industry structure, but the three international orthopedic giants have achieved stable growth through various strategies.Zimmer Biomet is optimistic about its full-year financial performance for 2025 and provided the following guidance:

Zimmer Biomet is optimistic about its full-year financial performance for 2025 and provided the following guidance:1. Expected revenue growth: 1.0% to 3.5% as reported, and 3.0% to 5.0% on a constant currency basis.

1. Expected revenue growth: 1.0% to 3.5% as reported, and 3.0% to 5.0% on a constant currency basis.2. Adjusted diluted earnings per share: expected to be between $8.15 and $8.35.

2. Adjusted diluted earnings per share: expected to be between $8.15 and $8.35.【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track