The third round of titanium dioxide price hikes, coupled with tariff barriers, targets the Southeast Asian export market.

Due to the continuous rise in raw material costs, after Longqi Enterprise issued a price increase notice on March 21st, other titanium manufacturers also followed by raising their prices, leading to the "third round" of price increases in the titanium dioxide industry. However, there has been no noticeable improvement in downstream demand. Despite it being the traditional peak season of “golden March and silver April,” buyer sentiment for signing orders is not as high as expected. There is a situation where demand from previous orders has been over-consumed, and currently, buyers are mainly placing orders for essential needs. The situation of manufacturers is polarized, with some still in a state of processing and shipping orders, while others have increased inventory and generally adopt a wait-and-see attitude. Under this situation, some manufacturers are primarily focused on fulfilling earlier orders, and they are relatively cautious about receiving new orders and large orders. The execution of new order prices remains to be confirmed. Currently, the market is still in a观望state, maintaining a wait-and-see attitude.

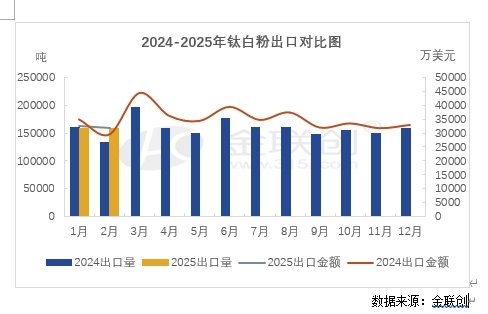

The global economic recovery has driven an increase in international market demand. Simultaneously, the results of anti-dumping investigations by major importing countries have been successively implemented, leading foreign customers to stockpile 1-2 months of inventory in advance. This demand frontloading has caused a rise in China's titanium dioxide exports in the first quarter. However, export growth has slowed due to international trade frictions and exchange rate fluctuations.

According to customs data, from January to February 2025, the cumulative export of titanium dioxide reached 315,900 tons, increasing by 7.68% year-on-year. The export volume of sulfuric acid process titanium dioxide was 257,600 tons, with the top three export destinations being India, Turkey, and the United Arab Emirates, accounting for 20.57%, 6.88%, and 5.56% of the total export volume, respectively. About 58,400 tons of chlorinated process titanium dioxide were exported, with the top three export destinations being India, Egypt, and South Korea, which accounted for 18.17%, 8.75%, and 7.33% of the total chlorinated process export volume, respectively. The export data from the first two months of this year shows that the economic growth of emerging developing countries such as India, Turkey, and the United Arab Emirates, along with the development of infrastructure and real estate, has led to strong demand in downstream industries such as coatings and plastics. On the other hand, the reduction caused by EU anti-dumping measures has forced domestic titanium dioxide enterprises to accelerate the development of markets in Southeast Asia due to the impact of anti-dumping measures in the EU and India.

Due to the dual impact of rising raw material costs and declining market demand, it is expected that titanium dioxide prices will decrease in the second quarter following the off-peak and peak season cycle. On the supply side, limited new capacity release is influenced by industry profits, but the market oversupply situation remains difficult to alleviate. With the continuous advancement of environmental policies and accelerated industry consolidation, the titanium dioxide industry will move towards scale and intensification, and the market share of leading companies will further expand. It is expected that the mainstream market price of sulfuric acid process rutile titanium dioxide in the second quarter will be 14,200-15,900 yuan/ton, with a negotiation price fluctuation range of about 300-500 yuan/ton. The actual transaction price will be determined on a case-by-case basis depending on order volume and manufacturer inventory levels.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track