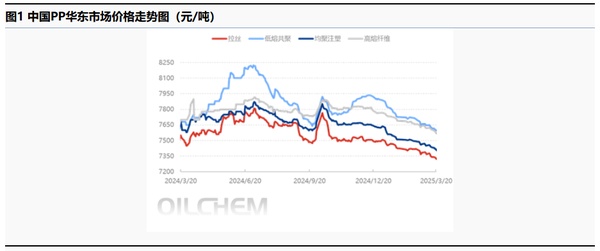

The supply and demand game continues, and the upward momentum for polypropylene spot prices is insufficient.

Introduction: Recently, there has been a集中检修 of polypropylene units, which is counterbalanced by new production capacity, leading to manageable supply-side pressure. On the demand side, however, product manufacturers are facing insufficient orders, and end-users are struggling to support the market, resulting in ongoing contradictions in the supply-demand situation and increasing resistance to the upward movement of polypropylene prices.

Since entering the peak season, the overall operation of the demand side still appears weak, with insufficient follow-up on new orders. Although downstream production has slightly increased, it is difficult to provide strong support for the spot market. On the supply side, many new installations have been delayed and maintenance is high, leading to low capacity utilization rates. The supply and demand game still exists, and the market lacks clear signals for guidance. The polypropylene market is unlikely to find direction in the short term and may maintain a narrow fluctuation trend.

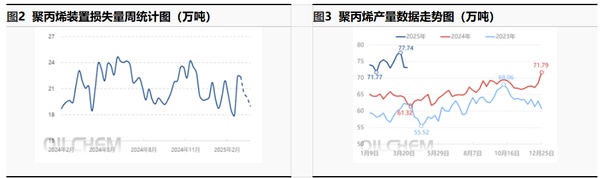

Recently, Jineng Chemical has taken offline several secondary units, Yulong Petrochemical has shut down five units, and Hengli Petrochemical has halted STPP lines for maintenance. Although the restart of previous units has caused a slight decrease in output loss, overall it remains at a high level. As of the 27th, the maintenance loss was 156,120 tons, a decrease of 2.33% compared to last week. During the week, polypropylene production was 732,000 tons, a decrease of 600 tons from last week's 732,600 tons, reflecting a drop of 0.08%, which is still significantly higher than the same period last year.

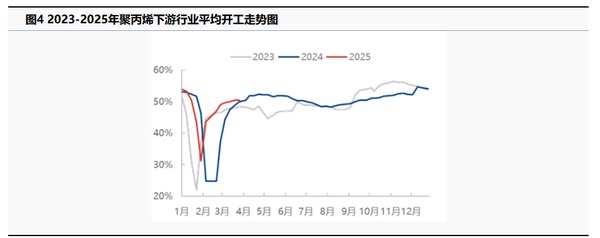

Currently, downstream operations are relatively stable, with an average operating rate of 50.43% in the downstream industries for the week. The raw material end of the PP market has not changed much, providing limited cost support for products. On the demand side, with the temperature rising in spring, residents are increasing their daily travel, which boosts consumption in areas such as food, beverages, disposable hygiene products, and daily necessities. Policies like trade-in subsidies are driving some downstream demand, but export orders are constrained by the expectation of increased tariffs overseas, limiting demand from some downstream manufacturers. Overall, the demand side offers limited support for the polypropylene market.

Overall, the current spot market for polypropylene is showing a cautious trend. The supply side is in a production lull, and with many maintenance shutdowns scheduled for April, the pressure from supply increases has been alleviated to some extent. However, the demand recovery during the peak season has not shown significant improvement and is unlikely to sustain, compounded by factories' low acceptance of high-priced sources, which may suppress the upward price potential on the demand side. It is expected that the polypropylene market will maintain a fluctuating trend in the short term, with an upward expectation in the future.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track