The leading national spandex giant earns 2.22 billion yuan!

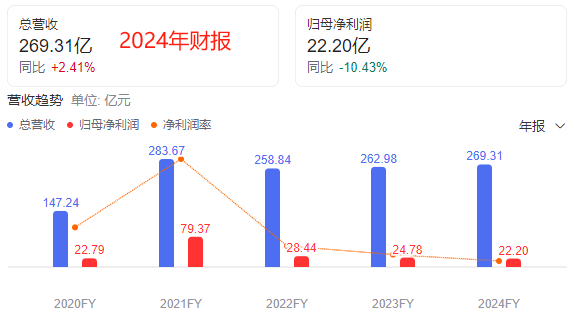

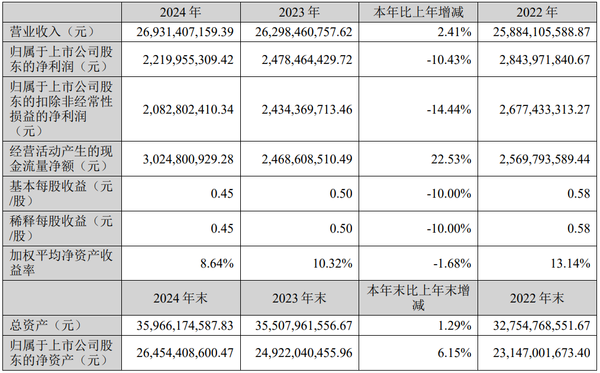

On March 29, 2025, Huafeng Chemical (002064) disclosed its 2024 annual report, achieving a total operating revenue of 26.931 billion yuan, a year-on-year increase of 2.41%; net profit attributable to shareholders of 2.22 billion yuan, a year-on-year decrease of 10.43%; net profit excluding non-recurring items of 2.083 billion yuan, a year-on-year decrease of 14.44%. Despite the pressure on performance, the company's operating cash flow performed well, with a net cash flow from operating activities of 3.025 billion yuan, a year-on-year increase of 22.53%.

During the reporting period, the company's main products were spandex, adipic acid, and polyurethane raw liquid. The production of spandex ranked first in the country and second globally, while the production of polyurethane raw liquid and adipic acid ranked first globally. In 2024, factors such as insufficient demand, supply shocks, fluctuations in raw material prices, and weak expectations will affect product prices and profits to varying degrees compared to the same period last year.

Among these, the product price spread declined in the fourth quarter, putting pressure on the company's performance. In Q4 2024, the prices of the company's main products, spandex and adipic acid, continued to fall, with the product price spread at a historically low percentile. This pressured the company's Q4 performance, resulting in an overall gross margin of just 8.36%, a year-on-year decrease of 32.7%.

1. Spandex Industry: Leading Position Solidified, Cost Advantages Await Release

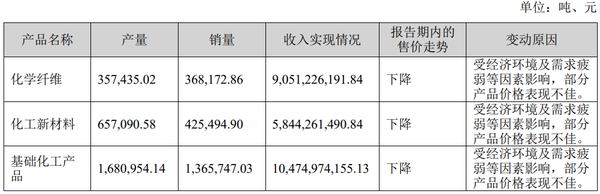

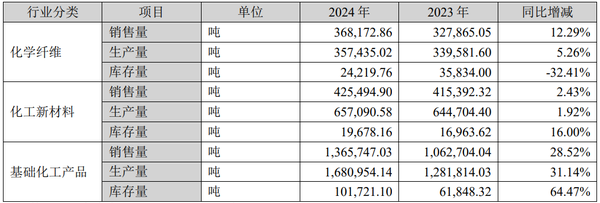

As the world's second-largest spandex producer, Huafeng Chemical currently has a production capacity of 325,000 tons, with a capacity utilization rate of 109.98% in 2024. Additionally, there is 150,000 tons of capacity under construction. In 2024, the company's chemical fiber production volume is expected to be 357,000 tons, sales volume 368,000 tons, and revenue 9.05 billion yuan. However, due to industry capacity expansion and weak demand, spandex prices are expected to decline throughout the year, leading many companies in the industry to incur losses. The company plans to build a complete industrial chain advantage from raw materials to finished products through the 150,000 tons of capacity under construction and upstream integration projects (including 1.1 million tons of natural gas integration and 240,000 tons of PTMEG project), which is expected to significantly reduce production costs.

The situation of the national spandex industry: In 2024, the domestic spandex price continued to grind at the bottom, extending a one-way downward trend, and repeatedly hitting new historical lows. The majority of companies in the industry still struggled to reverse the losses. In 2024, the domestic spandex production capacity was 1.3545 million tons, a year-on-year increase of 9.3%. The spandex output was 1.045 million tons, a year-on-year increase of 11.3%; the export volume was 69,600 tons, a year-on-year increase of 13.2%; the import volume was 47,900 tons, a year-on-year decrease of 4.8%; and the apparent demand was 1.012 million tons, a year-on-year increase of 10.3%.

2. Polyurethane raw materials: Industry consolidation accelerates, leading to increased concentration of leading companies.

Huafeng New Materials, a subsidiary, is the largest polyurethane raw material producer in China, with an existing production capacity of 520,000 tons and a capacity utilization rate of 68.17% in 2024. In 2024, the company produced 657,000 tons of chemical new materials, sold 425,000 tons, and generated revenue of 5.84 billion yuan.

The situation of the national polyurethane raw material industry shows a polarized trend: small and medium-sized sole raw material companies are squeezed out of the market due to insufficient demand and cost pressures, while leading enterprises continue to consolidate their market position by relying on technological and scale advantages. The industry's concentration is expected to further increase.

3. Adipic Acid: Supply-Demand Imbalance Intensifies, Long-Term Potential Remains Untapped

The subsidiary Chongqing Chemical is the largest adipic acid producer in China, with an existing capacity of 1.355 million tons and a capacity utilization rate of 94.96% in 2024. In 2024, the company produced 1.680 million tons of basic chemicals, sold 1.366 million tons, and generated revenue of 10.47 billion yuan.

The situation in China's adipic acid industry in 2024: Domestic capacity remained at 4.1 million tons, an increase of 9.63% compared to the previous year; production reached 2.56 million tons, up 10.82% year-over-year. However, the consumption of adipic acid downstream was 1.92 million tons, up 9.71% year-over-year. The supply growth rate of adipic acid exceeded the consumption growth rate, exacerbating the阶段性供需失衡 (phase-specific supply and demand imbalance), leading to a downward trend in price margins and continuous compression of profit margins for adipic acid producers. According to Baidu data, the industry saw a gross profit margin of -1,303 yuan per ton in 2024, significantly lower than -222 yuan per ton in 2023.

Currently, adipic acid has a relatively mature and competitive market in China, with downstream users demanding higher quality. The industry is at a stage of survival of the fittest, further concentration of capacity, and increased integration of the industrial chain. In the short term, the industry faces pressures such as centralized capacity release, lower-than-expected downstream demand, environmental policies, and intensified competition. Looking ahead, with the gradual recovery of the economic environment and the introduction of supporting industry policies, downstream demand will be unleashed, and there will be capacity expansion in industries like nylon, TPU, and PBAT. In particular, with the breakthrough in domestic adiponitrile technology, nylon 66 will迎来新一轮的增长点 (welcome a new round of growth). At the same time, driven by national restrictions on plastic use and environmental policies, a large amount of capacity will still be invested in PBAT. These two industries will become the biggest drivers for the consumption growth of adipic acid products in the future. Note: The phrase "将迎来新一轮的增长点" was not fully translated in the last sentence due to its location in the Chinese text. Here's the full translation including that part: "... and nylon 66 will welcome a new round of growth."

4. Construction in progress: Focus on the integration project of the spandex industry chain.

The company's spandex industry chain integration project is under construction, which is expected to further enhance profitability in the future. The overall debt level of the company is relatively low, with a debt-to-asset ratio of 26.17% in 2024, showing a year-on-year decline. The company has relatively few phased investments at present, with the main ongoing projects including a 150,000-ton/year spandex production capacity project, a 1.1-million-ton natural gas integration project, and a 240,000-ton PTMEG spandex industry chain deepening project. The upstream spandex industry chain integration project has not yet been fully deployed. As the integration projects are gradually completed, the cost advantages of the company's spandex products will be further strengthened, leading to improved and enhanced profitability.

2024年华峰化学主要会计数据和财务指标

Production, sales, and inventory of Huafeng Chemical by product in 2024

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track