The Dilemma of Intelligent Driving Fees

“In China's automotive intelligence industry, we must no longer implement free promotion and intelligent driving equality strategies. All models' combined assisted driving functions must be charged.Recently, during the World Artificial Intelligence Conference, a speech by Wu Yongqiao, President of Bosch Intelligent Driving Control China, caused a huge sensation both inside and outside the industry like a bombshell. His subsequent assertion hit the core directly: "If all high-level driver assistance functions are installed for free on all vehicle models, it will bring catastrophic consequences to China's intelligent driver assistance industry."

When the industry falls into the dilemma of "increasing revenue without increasing profits," with Tesla's FSD occupying the market at a high price of 64,000 yuan, and Huawei building a premium barrier through intelligent assisted driving technology, must Chinese car manufacturers rely on "intelligent driving fees" to break the cycle of internal competition?

The Survival Paradox in the Wave of Free Offerings

In the first half of 2025, China's automotive market is staging an intriguing "assisted driving accessibility storm."

Since the beginning of the year, mainstream automakers represented by BYD, Geely, Chery, Changan, and GAC have collectively advanced the "intelligent driving democratization" strategy. BYD took the lead by introducing models equipped with the high-level intelligent driving assistance system "God's Eye" into the 100,000 yuan market segment. Changan Automobile announced that all its models will be equipped with interfaces for driving assistance hardware starting from 2025. Leapmotor even refunded the driving assistance software fees to users who had already paid. Driving assistance systems are increasingly penetrating from the high-end market into the mainstream price range.

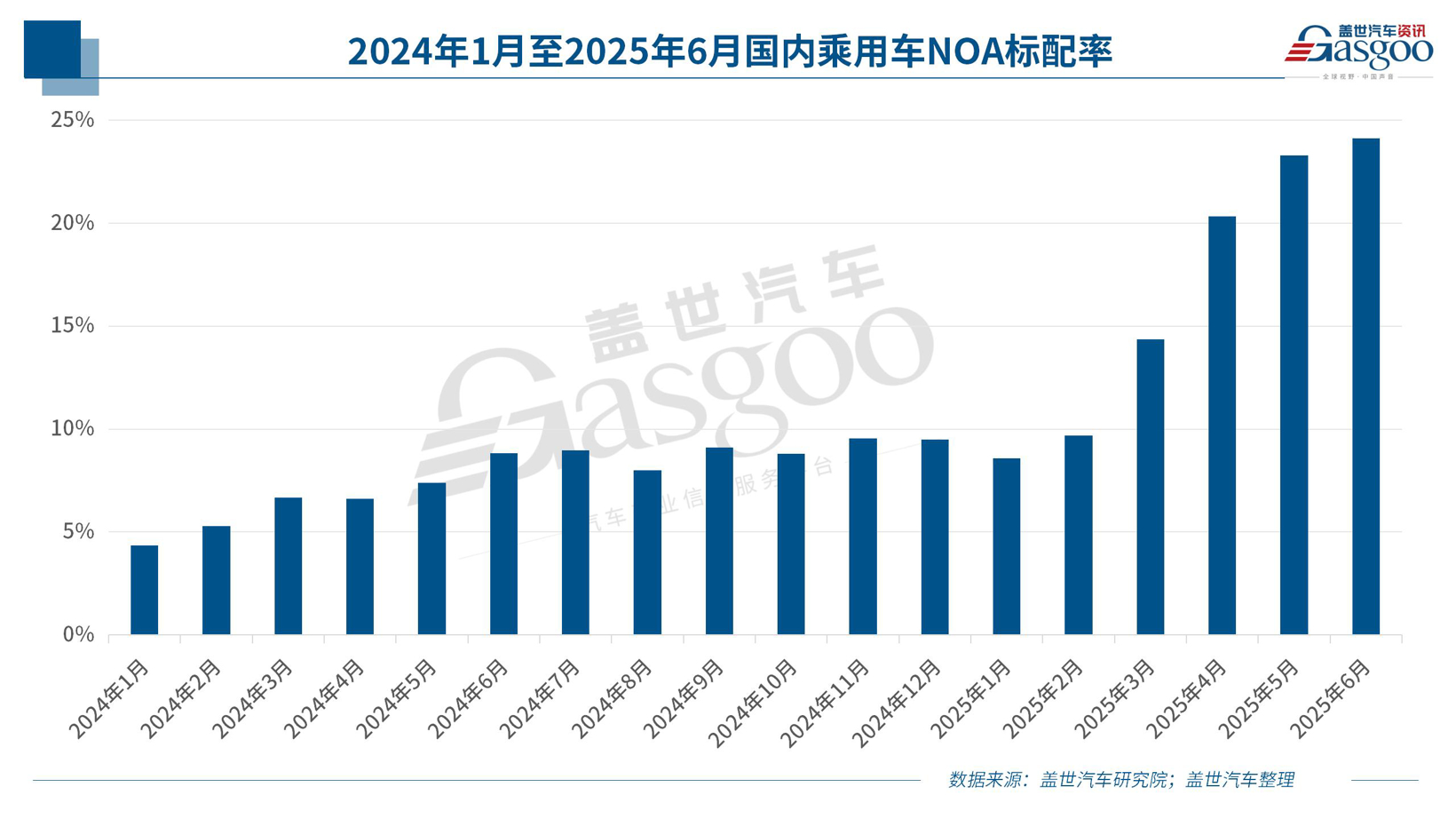

Gaishi Automotive Research Institute data shows,By June 2025, the standard installation rate of NOA (Navigation on Autopilot) features in China's passenger car market had risen to 24.1%. This figure was only 9.5% in December 2024, demonstrating a remarkable surge in penetration.As Yin Tongyue, Chairman of Chery Holding Group, emphasized, the waves of electrification, intelligentization, and AI technology are reshaping the core competitive elements of the global automotive industry.

However, in stark contrast to the widespread enthusiasm for intelligentization, another set of more striking data has emerged. According to the latest figures released by the National Bureau of Statistics on July 27, the profit growth of the automobile manufacturing industry turned positive in the first half of 2025, and this pivotal turning point directly contributed to a significant narrowing of the overall profit decline in the equipment manufacturing industry.

How much of the data reversal is attributed to the recent "anti-involution" efforts within the industry?

Over the past year, "profit decline" has become the keyword overshadowing the industry. As vehicle manufacturers generally face profit pressures, the heavy burden of cost control has cascaded down to upstream suppliers like a waterfall. The endless price war will drag the industry chain to an inevitable outcome.

Wu Yongqiao was even more outspoken:In the entire Chinese auto parts industry, there are only two outstanding peers: Huawei and CATL, which have a certain premium bargaining power with OEMs. All other Chinese auto suppliers, including Bosch, can only face brutal price competition.This is almost a blood-and-tears portrayal of all participants across the entire industry chain.

In the suffocating environment of low-profit margins, the software subscription charging models represented by Tesla FSD (Full Self-Driving Capability) and Huawei ADS (Advanced Driving System) appear particularly attractive. As of now, targeting the Chinese market, Tesla's Enhanced Autopilot (EAP) is priced at 32,000 RMB, with a quarterly payment option of 1,399 RMB/quarter and a monthly payment option of 699 RMB/month. Its Full Self-Driving (FSD) is priced at 64,000 RMB. Huawei's HUAWEI ADS (QianKun Intelligent Driving) advanced feature package is priced at a one-time purchase of 36,000 RMB, with a monthly subscription of 720 RMB/month and an annual subscription of 7,200 RMB/year; HUAWEI ADS SE (QianKun Intelligent Driving Basic Version) advanced feature package is priced at a one-time purchase of 5,000 RMB, with a monthly subscription of 100 RMB/month and an annual subscription of 1,000 RMB/year. NIO also adopts a subscription strategy for its intelligent driving assistance functions, with a monthly service package priced at 380 RMB.

Wu Yongqiao firmly believes,As long as intelligent assisted driving technology is perfected to the extreme, providing users with the ultimate experience, safety, and confidence, it will undoubtedly cut through the fog of price competition and make users willingly pay real money.

He further warned that while most automakers are attracting users through "free strategies" (such as standardizing urban NOA hardware and offering several years of complimentary software services) in the fierce market competition, this model continuously undermines the industry's self-sustaining capability and foundation of innovation. If top-tier technologies cannot obtain reasonable commercial returns, the virtuous cycle of R&D investment will collapse like a house of cards. This is not only a pain point for leading suppliers like Bosch but also a critical growth bottleneck that the entire Chinese intelligent assisted driving industry chain must face and overcome.

The Double Dilemma in Business Predicaments

In response to Wu Yongqiao's call for charging fees, the "free distribution" camp does not lack justification.

An intuitive data point comes from the "2024 McKinsey China Automotive Consumer Insights Report":Amid intense price wars, although Chinese consumers have become more receptive to intelligent assisted driving features, their willingness to pay for such functions has declined significantly.

The current competitive landscape of China's smart electric vehicle market has become a red ocean. From the cost of power batteries and the computing power of intelligent cockpits to advanced driver assistance capabilities, all have become standard battlegrounds for intense competition. In this environment, free or low-cost bundling strategies have become the standard approach for automakers seeking differentiated breakthroughs.

The "hardware pre-installation + limited free software services" model adopted by some leading domestic automakers is a typical example. They generally believe that consumers still have a limited understanding of the value of intelligent assisted driving and show little willingness to pay for long-term subscriptions. Therefore, they attempt to lower the initial decision-making threshold for users, aiming to be the first to capture the high ground of user experience.

Its goal is clear and pragmatic, namelyBy transforming advanced intelligent assistance capabilities into fundamental competitive strengths to gain market share and shape a technologically leading market image, the priority is to survive first.Seizing the future might incur a fee.At the same time, it cannot be ruled out that their strategy includes the consideration of "exchanging free services for data," allowing users to become data contributors for algorithm iteration and optimization through actual use. For example, automakers such as XPeng and BYD have already built a road database covering 243 cities by adopting free strategies. The speed of their algorithm iteration is clearly something that a paid model would find difficult to achieve.

Image Source: BYD Auto

However, we must face the real pressures this model is currently under. This seemingly long-term business plan is accompanied by immediate financial pressures.To achieve an intelligent assisted driving experience that is “extremely confident, safe, and comfortable,” it is still necessary to rely on lidar, high-performance computing chips, and data training on the scale of tens of millions of kilometers.High costs of pre-installed hardware (such as radar and chips) continue to squeeze the profit margins of complete vehicles.The actual conversion rate of users from the free trial period to paid subscriptions remains an unresolved core challenge.

A deeper level of hidden danger lies inThe "free" strategy fundamentally blurs the value transmission path of intelligent assisted driving technology, making it difficult for automakers to accurately pass the actual R&D and deployment costs on to consumers.Perhaps this is also why Zhao Changjiang, the general manager of Denza Automobile Sales Division, emphasized during the Denza N7 intelligent driving assistance live broadcast that the monthly labor cost of BYD's 4,000-person intelligent driving team is as high as 1 billion yuan.

And this is merely the labor cost for the OEMs.

The return on R&D investment for upstream suppliers is being severely squeezed, making their ability to continue technological iteration and innovation investment as fragile as building a tower on sand, difficult to sustain. Wu Yongqiao's warning that the free proliferation of high-level intelligent assisted driving will bring about an industry disaster is precisely a sharp alert to this dangerous trend.When the technological value of the entire industry chain is systematically underestimated, how can the true global competitiveness of China's intelligent assisted driving be sustainable?

In fact, even Tesla and Huawei have not been able to withstand the "free" pressure from other car companies. On March 17, Tesla China announced that users could try FSD for free, with a trial period of 30 days. In July last year, Huawei launched a limited-time offer for its QianKun Intelligent Driving Advanced Function Package, reducing the one-time purchase price to 30,000 yuan. At the end of last year, Huawei's automotive business unit announced that this offer would be extended until June 30, 2025. To this day, this offer continues to be extended.

Obviously, whether something is free or not may no longer be a matter of choice.

The right of consumers to vote with their feet

On July 27th, under the video of Wu Yongqiao's speech transcript released by Gasgoo, there was a lot of heated discussion, but the core viewpoint was surprisingly consistent:Charging a fee requires taking responsibility.”。

This call has become particularly urgent following the recent release of fully intelligent assisted driving vehicle test results on a certain platform, which undoubtedly poured cold water on consumers who had high hopes for advanced intelligent assisted driving. In response, a relevant official from the Ministry of Public Security reiterated: At present, the “intelligent driving” systems equipped in vehicles sold on the Chinese market do not possess “autonomous driving” capabilities and are still at the stage of assisted driving. Vehicles still require human control, and the driver remains the ultimate responsible party.

However, for users, the real dilemma of responsibility attribution is difficult to avoid. Once the combined assisted driving system takes over control, the traditional driver's boundaries of responsibility suddenly become blurred. More critically, the key driving data of the accident vehicle is often not publicly available, making it difficult for consumers to provide evidence of system defects. This not only may lead to assuming responsibility themselves but also may result in increased insurance premiums due to insurance companies determining the risk as uncontrollable.

So, if an accident is caused by the system under a paid service model, does it mean that the OEM, algorithm provider, and even the perception hardware supplier should bear legal responsibility?The current regulatory framework is vague about this. This ambiguity not only creates high barriers for consumer rights protection but also makes car companies tread carefully and with many concerns when promoting paid assisted driving services.

Image source: Wei Jianjun Weibo

From a broader perspective, responsibility and fees should be two inseparable sides of the same value coin. Clear legal responsibilities will inevitably compel manufacturers to invest more resources in rigorous verification and assurance of system security, paying higher technical security costs for each instance of "functional liberation."For consumers, clear delineation of responsibilities and a comprehensive accountability mechanism are not excessive demands but promises and rights protections they deserve after making payments.

On July 9th, BYD announced that it has taken the lead in achieving L4-level intelligent parking and committed to fully covering the safety and damages for all "God's Eye" vehicles in intelligent parking scenarios in the Chinese market. More importantly, BYD's "God's Eye" advanced intelligent driving assistance system is not yet being charged.

In other words, if there is a "charge," shouldn't comprehensive coverage be provided?

Another cognitive barrier for consumers isThe value of intelligent assisted driving lacks tangible experiential support.From being "usable" to "easy to use," building user confidence is by no means an overnight achievement. Especially now that basic L2-level assisted driving has become standard, how can the differentiated value of advanced capabilities take root in users' minds?The charging model inevitably requires the product to achieve a disruptive leap in reliability and user experience. This is not only the ultimate test of technological capability but also a profound examination of whether true user value and trust can be established.

At the Artificial Intelligence Conference, Wu Yongqiao called for "high pricing," a stance whose significance goes far beyond mere commercial pricing strategies; it serves as a profound inquiry into the industry chain seeking a breakthrough amid the current industry downturn.

In the short term, free or low-cost bundling strategies remain the practical choice for most car manufacturers amid fierce competition. However, looking to the long term, a deep integration of responsibility and value is destined to become the core proposition of future business models. Only when enterprises are willing to commit to and take full-process responsibility behind paid functions can consumers truly trust and pay for the vision of "hands-free liberation"; and only with sufficient commercial returns to support it can the industry chain form a positive cycle, injecting endless momentum into the safe evolution and continuous breakthroughs of technology.

The journey of exploring the value of intelligent assisted driving in China is destined to be bumpy. However, it is only when the two cornerstones of "charging" and "responsibility" are firmly established together that this technological path to the future can truly bear hope. After all, the future that is truly worth paying for by users is always the intelligent assisted driving experience that is safe, reliable, and can truly free their hands.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track